Closing Bell: ASX dives below 8000, Nasdaq corrects, Bitcoin slips on Strategic Reserve news

The ASX slid below 8000 on Friday, with tariffs rattling the market, while Goodman, CBA, and tech stocks took a hit.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX drops below 8000 as tariffs send shockwaves

Goodman, CBA and tech stocks take a beating

Bitcoin drops back down under US$88k

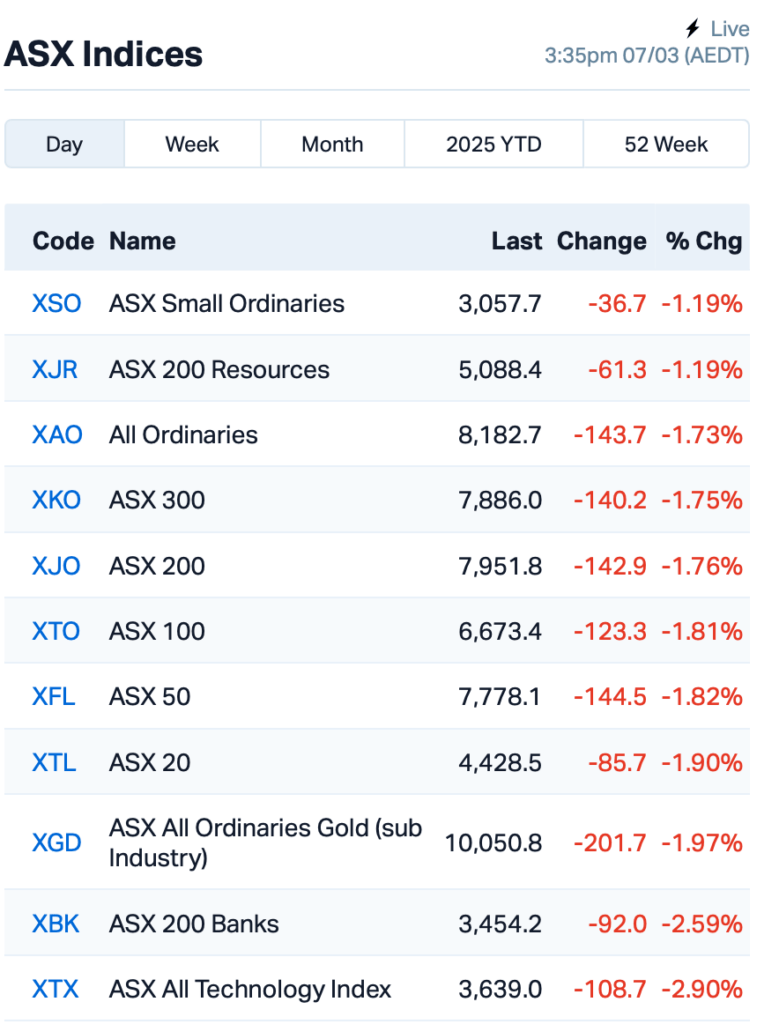

The ASX took a pretty heavy hit on Friday, sliding down by 1.8% to its lowest point since September. For the week, the benchmark ASX 200 index was down over 2.5%.

A few things stirred the pot, but the biggest culprit was tariffs – spooking investors left, right and centre.

Nasdaq was down by 2.6% last night and is officially in correction territory. The broad-based S&P 500 index also gave up its post-election gains.

Back home, the ASX slipped under the 8000 mark today, which is a crucial psychological level for investor sentiment.

This came after a number of blue chip names took a beating. Real estate giant Goodman Group (ASX:GMG), for example, sank by 4.5% today.

The financial sector wasn’t much better, with banks like Commonwealth Bank (ASX:CBA) losing 3%. Westpac (ASX:WBC) dropped 2.2% after its retail banking boss, Jason Yetton, jumped ship.

Elsewhere, tech stocks were also sold down heavily.

“I am not sure about 'buying the dip' in the tech stocks just yet,” said Moomo’s Jessica Amir.

“I'll revisit that next week after the US employment data is out and Australian business confidence has been released.”

But it wasn’t all bad news.

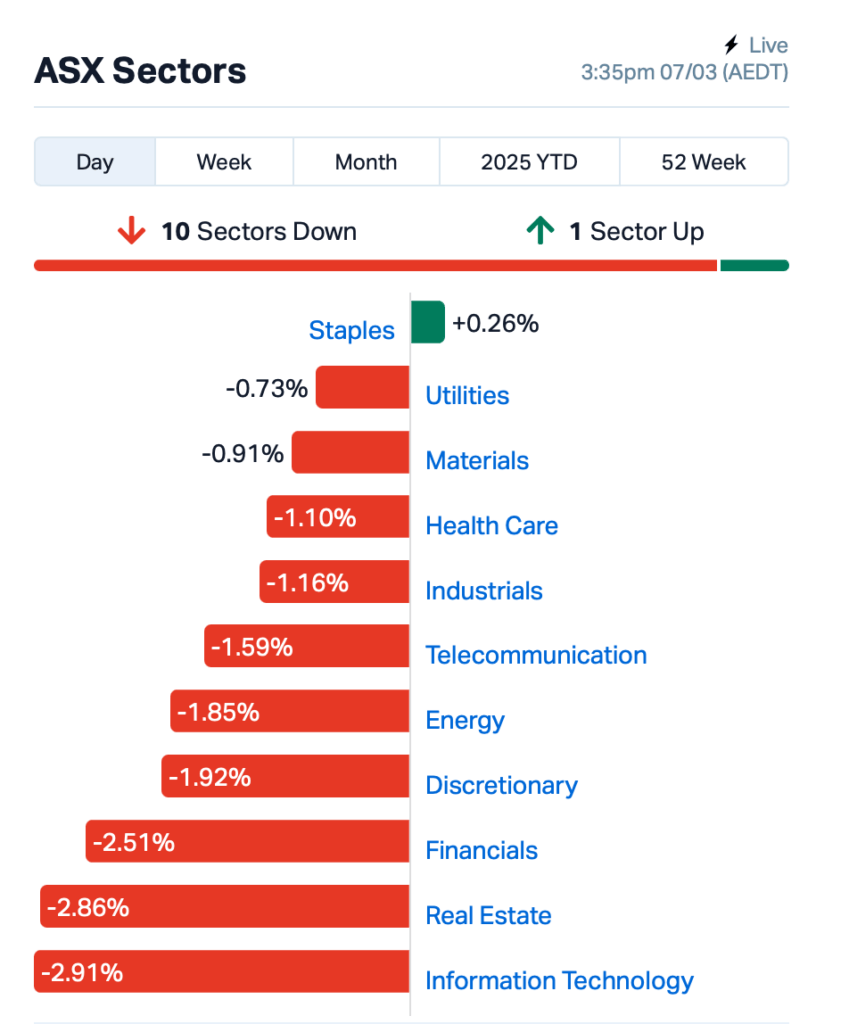

The consumer staples sector, the more defensive side of the market, had a good run, with Woolworths (ASX:WOW) and Treasury Wine Estates (ASX:TWE) ticking up.

This is where we stood leading up to Friday’s close:

In the large caps space, Insignia Financial (ASX:IFL)saw some serious action with a 10% jump. Private equity firms Bain and CC Capital have tossed in higher bids for the wealth manager, pushing the stock to new heights.

PolyNovo (ASX:PNV) found itself in hot water after a bullying scandal involving its chairman and CEO, sending its stock down by over 10%.

Meanwhile, Bitcoin has slipped to around the US$87,000 mark after the US government put the brakes on its plans to create a strategic reserve of Bitcoin.

This move disappointed many in the market who were hoping for some big government buy-ins. Ether, XRP, and Solana weren’t spared, all slipping as well.

It seems that Trump's executive order, promising to stockpile Bitcoin, is now being seen as less exciting after news broke that it would rely mainly on Bitcoin seized in civil and criminal cases, rather than new government purchases.

Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve.

The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings. This means it…

— David Sacks (@davidsacks47) March 7, 2025

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap JAY Jayride Group 0.003 50% 200,000 $477,158 EGN Engenco Limited 0.295 40% 1,441,332 $66,358,499 CTO Citigold Corp Ltd 0.004 33% 11,890,327 $9,000,000 MMR Mec Resources 0.004 33% 579,915 $5,549,298 SFG Seafarms Group Ltd 0.002 33% 771,020 $7,254,899 TOU Tlou Energy Ltd 0.016 33% 391,689 $15,583,012 GES Genesis Resources 0.012 33% 659,932 $7,045,572 NUC Nuchev Limited 0.190 31% 65,163 $21,219,199 LIO Lion Energy Limited 0.014 27% 563,188 $4,973,845 SKK Stakk Limited 0.007 27% 3,560,982 $11,412,938 AAJ Aruma Resources Ltd 0.010 25% 1,646,661 $1,776,465 RNX Renegade Exploration 0.005 25% 545,889 $5,136,014 TAS Tasman Resources Ltd 0.005 25% 107,930 $3,220,998 CRI Criticalim 0.018 20% 13,213,186 $40,326,729 ALM Alma Metals Ltd 0.006 20% 100,000 $7,931,727 HLX Helix Resources 0.003 20% 1,383,334 $8,410,484 IRX Inhalerx Limited 0.032 19% 138,750 $5,763,102 ZAG Zuleika Gold Ltd 0.013 18% 1,249,000 $8,160,679 STN Saturn Metals 0.235 18% 188,844 $61,776,977 ALY Alchemy Resource Ltd 0.007 17% 37,010 $7,068,458 APC APC Minerals 0.014 17% 522,156 $1,406,077 DTR Dateline Resources 0.004 17% 262,000 $7,696,706 MRQ Mrg Metals Limited 0.004 17% 246,419 $8,179,556 TMK TMK Energy Limited 0.004 17% 3,178,480 $27,976,695 RTG RTG Mining Inc. 0.029 16% 9,225,220 $27,091,138

Elph Investments, part of the Elphinstone Group, has made a cash offer to buy all shares in engineering company Engenco (ASX:EGN) for $0.305 per share, representing a significant premium of up to 63% above the recent share price. Elph already owns over 68% of Engenco and believes there’s strong potential for synergies by fully integrating Engenco into its operations.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ERG | Eneco Refresh Ltd | 0.009 | -36% | 980,000 | $3,813,017 |

| FAU | First Au Ltd | 0.002 | -33% | 6,571,416 | $6,215,980 |

| BP8 | Bph Global Ltd | 0.003 | -25% | 228,222 | $2,433,233 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 4,285,145 | $6,716,008 |

| PRM | Prominence Energy | 0.003 | -25% | 22,500 | $1,556,706 |

| SKN | Skin Elements Ltd | 0.003 | -25% | 673,500 | $3,424,611 |

| HPC | Thehydration | 0.008 | -20% | 864,624 | $3,049,131 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 112,982 | $11,683,736 |

| RWL | Rubicon Water | 0.225 | -20% | 5,119 | $67,394,627 |

| EMN | Euromanganese | 0.037 | -20% | 380,751 | $9,561,749 |

| ARI | Arika Resources | 0.024 | -17% | 8,466,278 | $18,371,751 |

| CMO | Cosmometalslimited | 0.015 | -17% | 50,177 | $2,357,872 |

| LOM | Lucapa Diamond Ltd | 0.015 | -17% | 2,564,977 | $8,286,696 |

| ASR | Asra Minerals Ltd | 0.003 | -17% | 170,000 | $7,119,380 |

| SER | Strategic Energy | 0.005 | -17% | 13 | $4,026,200 |

| YAR | Yari Minerals Ltd | 0.005 | -17% | 2,140,596 | $2,894,147 |

| BTC | BTC Health Ltd | 0.055 | -17% | 50,001 | $21,471,338 |

| GLH | Global Health Ltd | 0.110 | -15% | 58,977 | $7,546,440 |

| EME | Energy Metals Ltd | 0.066 | -14% | 50,607 | $16,145,615 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 12,645,321 | $22,185,079 |

| GR8 | Great Dirt Resources | 0.120 | -14% | 10,927 | $4,109,176 |

| SPQ | Superior Resources | 0.006 | -14% | 111,111 | $15,189,047 |

| TYX | Tyranna Res Ltd | 0.006 | -14% | 715,112 | $23,015,477 |

| HE8 | Helios Energy Ltd | 0.013 | -13% | 581,012 | $39,060,742 |

BPH Global’s (ASX:BP8) seaweed research is showing promising results, with gold and copper found in the seaweed grown in clean, filtered seawater from Sentosa Island. Initial tests revealed gold levels up to 14.85 mg/kg and copper at 10.88 mg/kg, adding to previously identified cobalt and silver. The next phase of the research will test seaweed grown in polluted waters in Malaysia to see if it absorbs more minerals, like a “sponge” effect.

BPH is keen to explore this potential further. The idea behind finding gold, silver, and other metals in seaweed is based on the way certain types of seaweed can absorb metals from the surrounding water. This is called “bioaccumulation”.

Arika Resources (ASX:ARI) shares dipped despite its Pennyweight Point's gold discovery getting bigger, with step-out drilling extending the mineralised zone to over 350m long and 180m deep. The Phase 2 drilling program found thick gold zones, and confirmed the ore-hosting structure is still open in all directions.

IN CASE YOU MISSED IT

Hillgrove Resources (ASX:HGO) achieved a record monthly copper production of 1105t at its Kanmantoo mine in South Australia in February, processing 116,000 tonnes of ore at a grade of 1.01% copper and a 94.2% recovery rate. The company also recently raised $16 million to develop the Nugent deposit, which will boost production and reduce overall costs.

Pursuit Minerals (ASX:PUR) has successfully commissioned its 250tpa pilot plant and begun lithium carbonate production, marking a significant step toward scalable, commercial production at its Rio Grande Sur project in Argentina. With global lithium demand showing signs of recovery, Pursuit is well-placed to scale up production while benefiting from its counter-cyclical strategy, particularly as majors like Rio Tinto continue to invest in the region.

Petratherm (ASX:PTR) has secured $8.1 million to expedite exploration drilling at its Muckanippie titanium HMS project in South Australia. Phase 2 drilling will begin in mid-March, targeting extensions of high-grade mineralisation at the Rosewood prospect.

New World Resources (ASX:NWC) has received $14 million in firm commitments to advance its Antler copper project in Arizona towards a final investment decision. The funds will support federal and state permitting, exploration, and the definitive feasibility study, following promising pre-feasibility results.

Ora Banda (ASX:OBM) has strengthened its balance sheet with a $50 million syndicated revolving credit facility from ANZ and CBA for an initial two-year term. The company has also secured put options for 100,000 oz of gold in FY26 at $4400/oz, ensuring cash flow stability while retaining upside exposure.

Cannindah Resources (ASX:CAE) has appointed Cameron Switzer as technical advisor and exploration manager. With over 35 years in the industry and a strong track record in porphyry copper-gold systems, he’s set to play a key role in driving the Mt Cannindah project forward.

Medical device company ReNerve (ASX:RNV) has received an additional $139,537 in R&D tax incentive refund, bringing its total refund to $516,606. The company is advancing its portfolio of peripheral nerve repair solutions and is preparing to launch its next product, the NervAlign Nerve Conduit, while also developing a full suite of nerve repair and replacement technologies.

At Stockhead, we tell it like it is. While Hillgrove Resources, Pursuit Minerals, Petratherm, New World Resources, Ora Banda Mining, Cannindah Resources and ReNerve are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX dives below 8000, Nasdaq corrects, Bitcoin slips on Strategic Reserve news