Auctus Advisors flags growth for ADX from shallow gas drilling in Austria and new offshore Sicily gas permit

Auctus Advisors has maintained a 30c price target for ADX Energy as it prepares for shallow gas drilling in Austria.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Special Report: UK-based equity markets advisory Auctus Advisors has maintained its 30c price target for ADX Energy – well above its current share price of 2.3c – as the company prepares to resume active oil and gas drilling in Q4 2025.

- Auctus Advisors maintains 30c price target for ADX Energy as it prepares to go hard on drilling in Q4 2025

- ADX’s initial focus will be to test shallow, low-risk gas prospects that can quickly boost production

- Company plans to drill an Anshof near field appraisal well and define gas resources for its new Sicily Channel gas permit

In its report, Auctus noted that while the company’s net production in the first quarter of 2025 was in line with expectations at 246 barrels of oil equivalent per day, its focus was on increasing production in Austria.

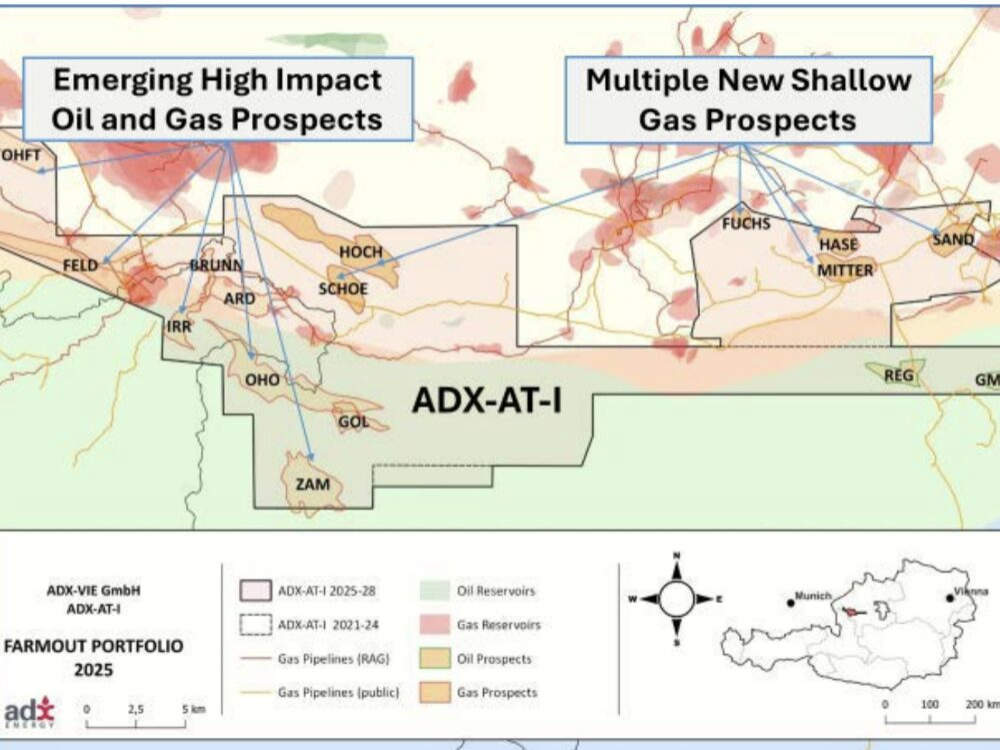

Highlighting this, ADX Energy (ASX:ADX) plans to advance up to 12 shallow gas prospects across the ADX-AT-I and ADX-AT-II licences in Upper Austria where it has varied its exploration acreage to maximise exposure to a previously proven gas play which ADX has further advanced with a combination of AI and analysis of 3D seismic characteristics indicative of gas and permiable.

It will look to secure a partner to help fund drilling of the first cluster of three prospects in Q3, 2025, with two of the wells likely to be drilled during the fourth quarter.

While each of these prospects is relatively modest with estimated resources of between 4-6 billion cubic feet each, Auctus notes they also carry very little geological risk with initial gas production rates for typical wells estimated at between 10 million and 15 million cubic feet per day.

These wells can also be brought into production quickly as they are close to open access pipelines.

Each shallow gas prospect carries unrisked value of about 4c per share assuming a 60% working interest or 3Bcf net to the company.

Oil and Italy

Auctus added that while it expected production at the Anshof oil field to remain flat due to the company’s focus shifting to appraisal and low risk exploration drilling, it planned to drill a new oil appraisal well in the Anshof area in Q4 2025.

To date, the company has defined seven oil targets with 3D seismic that are in close proximity to its recently installed oil processing and transportation facilities. These have best estimate prospective resources that range from 1.3-9.3 million barrels of oil.

ADX is also awaiting a decision from the Austrian government in relation to restarting testing of the Welchau prospect within the ADX-AT-II licence.

There is potential for Welchau to host more resources in deeper reservoirs.

Auctus also expects ADX to provide updates of prospective resources estimates in the Sicily Channel, offshore Italy.

ADX has advised that it expects to be formally awarded the Sicily Channel exploration permit in May, which will allow it to acquire more seismic and further define resources already identified from existing high quality seismic and historic oil wells drilled in the 80’s which encountered gas in shallower reservoirs.

ADX has high hopes for this permit due to it is proximity to other gas projects with analogous, productive reservoirs and nearby gas infrastructure.

This permit could provide another complimentary growth path based on gas which is highly prized in Italy and Europe.

Watch: Grande gas in the seismic Sicilian channel

This article was developed in collaboration with ADX Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Auctus Advisors flags growth for ADX from shallow gas drilling in Austria and new offshore Sicily gas permit