ASX Small Caps Lunch Wrap: Honestly, Tuesday… is that the best you can do?

The ASX fell hard on Tuesday morning, and the giant FMG sell down didn’t help

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX 200 fell sharply at open after a weak lead in from Wall Street

Mega $1.9 billion sell down on Fortescue has left materials in a bad way

African Gold is the morning's Small Caps winner, after delivering a solid MRE

Local markets opened lower this morning, after a mixed result on Wall Street gave Aussie investors pause – and by pause, I mean “yet another reason to dump everything and run”.

The ASX 200 benchmark fell 76 points – 0.95% within the first 30 minutes of the session, but has since been putting on a bit of a rally, but it’s not looking all too hopeful that we’re going to end the day with a gain.

Yesterday’s early winners were taking the lion’s share of the early heat on Tuesday, with InfoTech and resources stocks falling hardest – and that’s partially due to Wall Street’s wan performance, and partly because of the usual panoply of things we like to blame when market sentiment is soured.

I was rather hoping for a quiet day today, too. Oh well… here’s what’s happening so far.

TO MARKETS

A quick look at the market’s sectors is telling a pretty grim tale on Tuesday morning, with all 11 of them into negative territory, and materials taking the worst of it.

I wasn’t sure why that was happening – and after checking that there’s nothing too far out of the ordinary happening among commodities at the minute, I meandered over to my trusty market tickers and… oh ...

Fortescue (ASX:FMG) … it’s down a more than measly ~9% this morning. Oh dear.

It turns out that someone decided yesterday to tip out of their investment in FMG, and it wasn’t a modest tranche of shares, either. JP Morgan, acting on behalf of a mystery vendor, basically walked into the middle of the room and dumped an enormous $1.9 billion worth of FMG shares on the table, stood back and said “righto… who wants ‘em?”

That sort of thing tends to knock a company’s share price around a bit and, despite its size, FMG is no different. The sell-off last night is the latest blow to the company, which has been on the nose with investors since it staged a clumsy retreat from its lofty green hydrogen ambitions earlier this month.

There’s no word on whose chunk of Fortescue it was, but there surely can’t be that many people hanging on to a $2 billion chunk of a $60 billion company – so the guessing game is on in earnest, for now.

For what it’s worth, BHP (ASX:BHP) and Rio Tinto (ASX:RIO) are also down, apparently out of sympathy, dropping 1.28% and 1.13% respectively before lunch – it’s also worth noting that BHP did announce that it’s about to sink ~US$2.1 billion into a JV with Lundin to buy Canada's Filo for 5.18 billion Canadian loonies.

Here’s how the sectors were looking at lunchtime today… spoiler alert – they're redder than the rear-end of an amorous baboon.

In a nutshell: Materials is lagging badly because of Fortescue, InfoTech is down because the move away from big tech stocks in the US is making local investors queasy, Energy shares have also taken a hit… and the best of the sectors, Consumer Staples, is still 0.25% in the red.

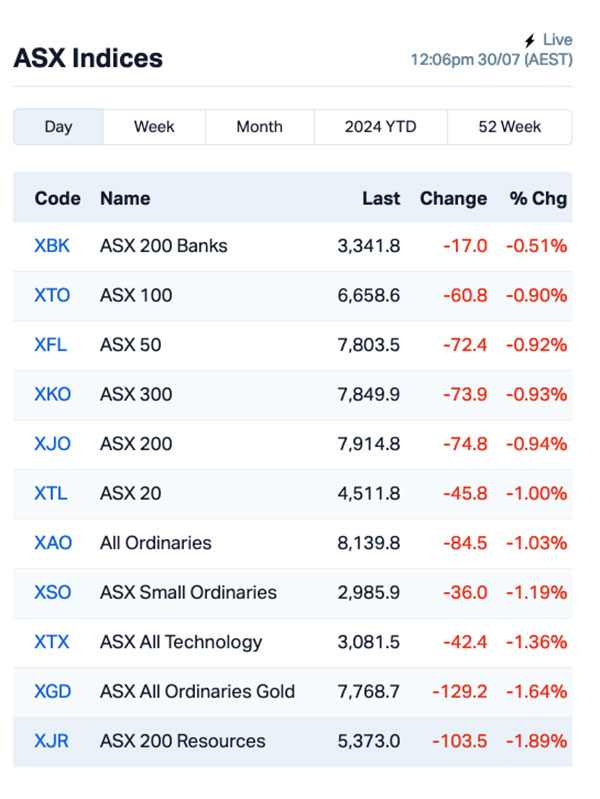

A look at the ASX indices reveals that it’s the banks that are having the best of the day… but it’s not a great day, so the best is a 0.5% fall. Resources and gold stocks are being hammered today – that’ll be FMG again – and the benchmark is down 0.94%.

Elsewhere, it appears that Australia is about to get yet another lesson in how to turn an airline into a trainwreck, with Regional Express (ASX:REX) in a trading halt ahead of what most people are assuming to be Bad News.

The company went into a trading halt yesterday, and we’re expecting that there will be some kind of announcement today, with some media outlets reporting that the airline is on the brink of financial collapse, and that Ernst & Young are likely to be called in as administrators.

This morning, Prime Minisier Anthony Albanese said out loud that the government would be keeping a close eye on Rex, and made vague offers to "help" – but whether that's help keeping it afloat, or help hiding the bodies, is anyone's guess.

Meanwhile, the rest of us are poised and waiting for inflation data to come out tomorrow, and there’s a non-zero probability that it’s not going to be pretty, especially for everyone who’s been hanging out for interest rate relief while watching their weekly grocery bill spiralling out of control.

Annnnd finally, the Commonwealth Bank (ASX:CBA) found itself on the wrong side of the law yesterday, fronting up in Melbourne Magistrates Court to plead guilty to short-changing some workers on their long service entitlements.

No doubt taking the guilty plea into consideration, Magistrate Kathryn Fawcett slapped the nation’s richest company with a fearsome $36,000 fine.

To put that into perspective, that’s less than a day’s pay for CBA’s CEO Matt Comyn, who pocketed $10.4 million in FY23.

That’ll learn ‘em.

NOT THE ASX

It was not exactly a day to remember for Wall Street yesterday, with US investors sticking to the sidelines ahead of some key data that’s due to land throughout the next 24-48 hours.

The S&P 500 finished the day 0.1% higher, the blue chips Dow Jones index fell by 0.12%, and the tech heavy Nasdaq was up by 0.07%.

Earlybird Eddy Sunarto reported this morning that around 300 stocks in the S&P 500 went up, and after a rotation that nearly pushed the Nasdaq 100 into a correction, major tech companies saw gains, while smaller companies fell.

Upcoming results later this week from Microsoft, Meta, Apple, and Amazon will be very crucial, especially after a disappointing start to the earnings season from Tesla and Alphabet.

Meanwhile, Fed Reserve officials are on the verge of lowering interest rates and chair Jerome Powell might reveal this on Wednesday at the post-FOMC meeting press conference.

“Investors may now be too dovish on US rates,” said Guy Stear, Head of Developed Markets Strategy at Amundi Investment.

“We expect a 25bp cut in September and another by year end, but the recent earnings disappointments in the US have pushed Fed funds rate expectations back to the early July troughs, implying a fifty percent chance of a third rate cut by December. This seems too aggressive in our view.”

Thank you, Eddy. That man is a superstar, and our lives are enriched by his presence.

On Asian markets today, it looks like they’re having a similar Tuesday to ours. Japan’s Nikkei is off by 0.98%, the Hang Seng is down 1.33% and Shanghai markets have faltered by 0.84% in early trade.

I was going to report that in Morocco, the Casablanca Stock Exchange is closed for a holiday today… but frankly, my dears, I don’t give a damn.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for30 July :

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap APC Aust Potash Ltd 0.0015 50.0 517,856 $4,070,189 HLX Helix Resources 0.003 20.0 26,566,461 $8,160,484 A1G African Gold Ltd. 0.034 41.7 11,935,340 $5,741,177 CDT Castle Minerals 0.004 14.3 310,769 $4,647,392 DOU Douugh Limited 0.004 14.3 68,000 $3,787,241 IEC Intra Energy Corp 0.002 33.3 6,505,005 $2,536,172 APX Appen Limited 0.55 27.9 10,439,212 $95,890,706 R8R Regener8Resourcesnl 0.125 27.6 154,320 $3,087,245 AHN Athena Resources 0.005 25.0 8,714,381 $4,281,870 EEL Enrg Elements Ltd 0.0025 25.0 141,844 $2,019,930 NRZ Neurizer Ltd 0.005 25.0 900,000 $7,609,723 RLG Roolife Group Ltd 0.005 25.0 3,000,000 $3,176,585 RNE Renu Energy Ltd 0.005 11.1 422,143 $3,267,603 NGSDA NGS Ltd 0.035 20.7 23,142 $1,183,724 OEL Otto Energy Limited 0.012 20.0 2,857,066 $47,950,098 PRX Prodigy Gold NL 0.003 20.0 402,000 $5,294,436 AD1 AD1 Holdings Limited 0.007 16.7 322,263 $5,391,890 EPM Eclipse Metals 0.007 16.7 321,428 $13,505,133 DXN DXN Limited 0.086 16.2 328,451 $13,829,812 C1X Cosmosexploration 0.044 15.8 100,000 $2,712,180

African Gold (ASX:A1G) was flying quickly on Tuesday morning, on news of a maiden gold resource from the Blaffo Guetto prospect at the Didievi Project in Cote d’Ivoire, which has come in at an Inferred 4.93Mt for 452koz of gold at 2.9 g/t (1.0 g/t Au cut off). The company says that several key assays tell an exciting story, such as 10.0m at 123.0g/t gold from 66m including 2.0m at 613.0g/t gold, and 80.0m at 3.0g/t gold from surface, including 23.0m at 9.5g/t gold.

Small explorer Castle Minerals (ASX:CDT) delivered its quarterly, revealing that things are progressing much as you’d expect them to, with the company recently raising close to $600k in a placement to boost its warchest to around $1 million, while it continues its search for graphite and gold across three projects.

Appen (ASX:APX) also dropped its quarterly this morning, with mixed (but still mostly positive) news that revenue for Q2 FY24 was $55.0 million, down 16% on previous corresponding period – however, excluding Google revenue from the equation has the company’s revenue for Q2 FY24 grew 16% from $47.2 million in Q2 FY23.

Regener8 Resources (ASX:R8R) was up on news that the company has executed an agreement covering the acquisition of tenement application ELA6755, known to its friends as North Achilles, in the Cobar district of western NSW. Regener8’s purchase lies approximately 2km along strike from Australian Gold and Copper (ASX:AGC) recent Achilles discovery, which has returned drill intercepts up to 5m @ 16.9g/t Au, 1,667g/t Ag, 0.4% Cu and 15% Pb + Zn.

RooLife Group (ASX:RLG) delivered its quarterly, and while it’s not an at-a-glance smash hit, it was enough to get investors excited. The company has, by the looks of things, been trimming some of the fat from the expense side of the ledger this past quarter, and while revenue was down the company still has a handy million or so in cash reserves.

Otto Energy's (ASX:OEL) quarterly had some great news for shareholders, with the company reaffirming its decision to give as much money as it can back to investors. Otta says it had $60.8 million in cash balances at the end of the quarter – and after the proposed return of capital of up to $40 million, will still have at least $20.8 million of cash at bank – and will, from time to time, continue to look for ways to hand it out.

SaaS technology company AD1 Holdings (ASX:AD1) released its quarterly this morning, and investors were enjoying what it had to say. AD1 says that its North American business has grown by over 100%, a rebranding is well underway and the company has about 200 grand in the bank.

DXN (ASX:DXN) revealed in its quarterly report that total revenue for the quarter of $3.8 million was up 145% over this time last year, (4Q23: $1.6 million). FY24 revenue rose 41% to $10.9 million – up from $7.8 million in FY23, adding that sales growth has been driven by the deployment of new modular data centre sales across multiple clients.

Elixinol Global (ASX:EXL) issued its quarterly, and it’s jam-packed with healthy news that’s tasty as well. Q2 Group revenue was up 118% to $3.7 million from $1.7M a year ago, and that represents the seventh consecutive quarter of revenue growth. Additionally, record Q2 sales of $3.2 million are a twofold increase over Q2 FY23, a 29% improvement on Q1’s $2.5 million and have handed Elixinol an unaudited H1 revenue that has almost doubled to $6.8 million from $3.5 million on PCP.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 30 July :

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ME1 Melodiol Glb Health 0.0025 -37.5 20,708,497 $2,430,946 88E 88 Energy Ltd 0.002 -33.3 7,185,029 $86,678,016 RCR Rincon 0.052 -32.5 31,335,489 $22,428,227 LM1 Leeuwin Metals Ltd 0.06 -28.6 37,120 $3,935,540 LNR Lanthanein Resources 0.003 -25.0 285,002 $9,774,545 PKO Peako Limited 0.003 -25.0 20,000 $2,108,339 SNT Syntara Limited 0.03 -25.0 6,017,187 $47,761,271 ERA Energy Resources 0.027 -22.9 3,148,534 $775,190,472 ALR Altairminerals 0.004 -20.0 4,868,867 $21,482,888 OVT Ovanti Limited 0.004 -20.0 3,898,553 $6,200,527 CTE Cryosite Limited 0.74 -19.6 24,771 $44,904,798 ASE Astute Metals NL 0.032 -17.9 100,000 $16,537,175 RAS Ragusa Minerals Ltd 0.014 -17.6 233,965 $2,424,179 PFE Panteraminerals 0.024 -17.2 177,491 $10,991,775 CBH Coolabah Metals Limi 0.06 -16.7 281,389 $8,669,252 NSM Northstaw 0.015 -16.7 354,680 $2,517,764 PLG Pearlgullironlimited 0.015 -16.7 1,850 $3,681,752 NNL Nordicnickellimited 0.065 -16.7 168,335 $10,130,940 PUR Pursuit Minerals 0.0025 -16.7 716,583 $10,906,200 WML Woomera Mining Ltd 0.0025 -16.7 258,526 $3,654,417

ICYMI – AM EDITION

Pure Hydrogen (ASX:PH2) expects to begin supplying its battery electric and hydrogen fuel cell commercial fleet from CY2025, subject to ARMS Group being satisfied with its due diligence.

Terra Metals (ASX:TM1) has restarted diamond drilling at its Dante Reefs copper-platinum group element sulphide discovery in WA.

The Phase 2 program totalling about 2200m will recover diamond core for preliminary metallurgical test work, obtain specific gravity data for mineral resource estimations, structural and mineralogical data, and extending mineralisation where reverse circulation drilling failed to reach target depth.

Additionally, the company plans to mobilise a RC rig to carry out further infill and extensional drilling at Reefs 1 and 2 before moving on to carry out reconnaissance drilling at priority sulphide targets across the project.

Victory Metals (ASX:VTM) has appointed internationally recognised and highly cited geoscientist Professor Ken Collerson, who had contributed to the company’s discovery of the North Stansmore REE project, as its technical director.

Collerson, who had served as a consultant to the company over the past two years, has a wealth of expertise in geochemistry and critical metals with a focus on the discovery of new ethically sourced supplies of critical minerals.

He has expert knowledge of rare earth and critical metal mineral systems as well as trace element and isotope analytical techniques.

In the 1980’s as a consultant to Union Oil, Collerson showed that the Mount Weld carbonatite, now being exploited by Lynas Rare Earths (ASX:LYC), was post-Archaean in age. He also provided key geochemical consultant services to Pacific Wildcat Resources Corporation for their Mrima Hill carbonatite regolith-hosted REE-Nd deposit in Kenya.

VTM also noted that non-executive chairman Trevor Matthews has resigned with current non-executive director James Bahen appointed in his place.

At Stockhead, we tell it like it is. While Pure Hydrogen, Terra Metals and Victory Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as ASX Small Caps Lunch Wrap: Honestly, Tuesday… is that the best you can do?