ASX March Tech Winners: Tech sector gets smashed, but Opyl and Rocketboots hold strong

ASX tech took a hit with global chaos while Opyl, Yojee, and RocketBoots made moves, but big Wall Street names are struggling with AI.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX tech sector hit hard by global turmoil

Big names on Nasdaq struggle as AI investments raise doubts

ASX listed Opyl, Yojee, RocketBoots lead in March

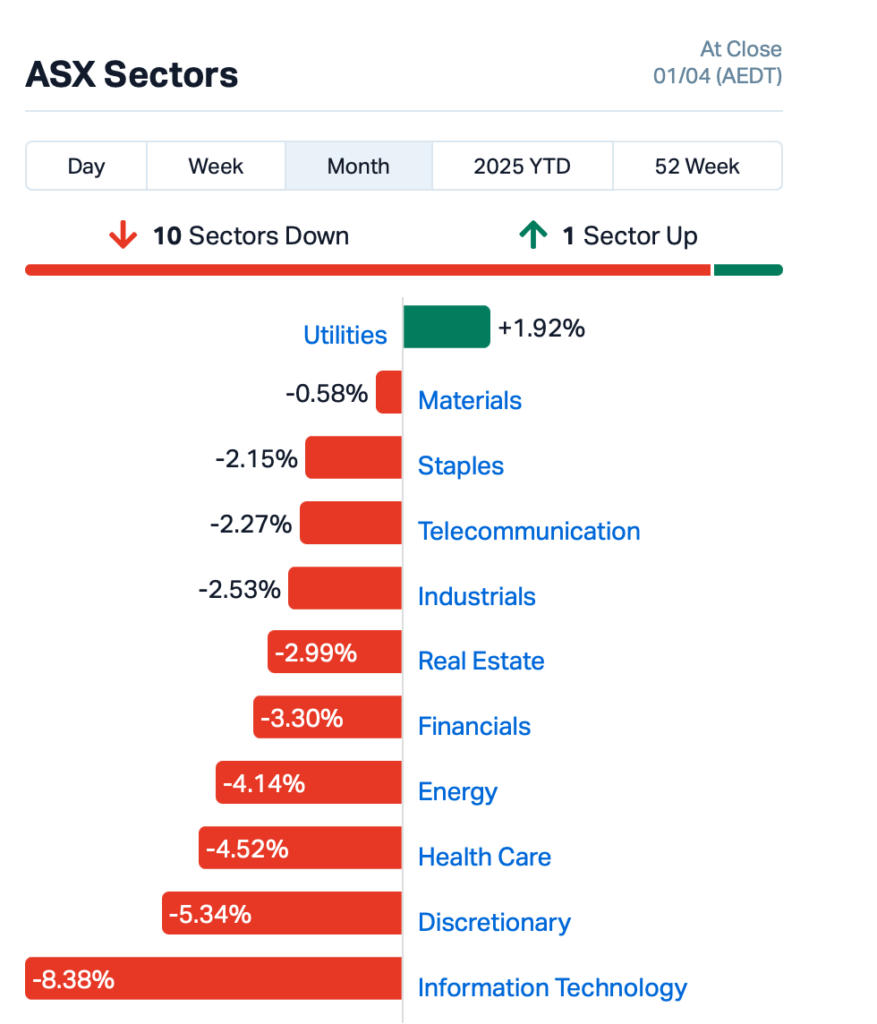

In March, the S&P/ASX 200 Information Technology sector (XIJ) took a big hit, making it the worst-performing sector on the ASX.

Several factors contributed to this downturn. First, there’s the ongoing global market turmoil.

The Nasdaq 100 has just wrapped up its worst quarter in nearly three years.

Big names like Nvidia, Broadcom, Microsoft, Amazon, Alphabet, and Meta, which were once the shining stars of the market, have all taken a big hit.

Nvidia’s stock alone has fallen by 28% since January, and Broadcom’s down 33% since its high in December.

Things took a turn for the worse when Trump’s tariffs added more pressure, causing the Nasdaq to tumble by as much as 2.5% in a single day.

But the biggest reason for the tech selloff is that companies have been pouring huge amounts of cash into building the data centres and chips needed for AI.

Some experts now believe they might be building too fast.

Alibaba’s co-founder raised concerns about whether there’s really enough demand for all these new AI facilities.

Then, a report came out saying that Microsoft, which had committed US$80 billion to data centre projects this year, was pulling back from some of its plans in the US and Europe because there’s already too much supply.

On top of that, AI models from China are challenging the idea that US companies need to spend as much on resources to stay ahead.

“All of this adds up to too many dollars chasing too little computing centre demand,” said Kim Forrest at Bokeh Capital.

Michael Mullaney at Boston Partners told Bloomberg that these AI concerns are rising amid overall market uncertainty, especially when stocks were already priced to perfection.

“That makes them an extremely obvious place for investors who are broadly nervous to take profits,” he said.

Back home, Aussie tech stocks also mirrored this volatility.

Additionally, the quarterly rebalance of the S&P/ASX 200 Index in March led to adjustments in sector weightings, contributing to the sector's underwhelming performance.

ASX tech winners in March

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| OPL | Opyl Limited | 0.03 | 68% | $6,174,986 |

| SMP | Smartpay Holdings | 0.77 | 50% | $193,554,771 |

| YOJ | Yojee Limited | 0.18 | 25% | $53,168,155 |

| ROC | Rocketboots | 0.12 | 24% | $11,662,585 |

| IOD | Iodm Limited | 0.18 | 20% | $110,981,553 |

| EOS | Electro Optic Sys. | 1.31 | 19% | $270,132,939 |

| DRO | Droneshield Limited | 0.91 | 18% | $829,791,901 |

| FCL | Fineos Corp Hold PLC | 2.00 | 17% | $690,539,317 |

| KYP | Kinatico Ltd | 0.18 | 17% | $71,295,177 |

| ATV | Activeportgroupltd | 0.02 | 15% | $9,589,679 |

| PRO | Prophecy Internation | 0.52 | 14% | $38,339,046 |

| TAL | Talius Group Limited | 0.01 | 14% | $22,939,892 |

| VR1 | Vection Technologies | 0.03 | 13% | $41,104,533 |

| FL1 | First Lithium Ltd | 0.08 | 13% | $6,372,288 |

| HCL | Highcom Ltd | 0.22 | 13% | $22,076,774 |

| FLX | Felix Group | 0.22 | 13% | $43,967,438 |

| CGO | CPT Global Limited | 0.06 | 13% | $2,639,534 |

| BCC | Beam Communications | 0.09 | 12% | $7,950,817 |

| JCS | Jcurve Solutions | 0.03 | 12% | $8,919,273 |

| IRI | Integrated Research | 0.43 | 12% | $78,035,192 |

| BEO | Beonic Ltd | 0.20 | 11% | $14,172,202 |

| VIG | Victor Group Hldgs | 0.06 | 9% | $39,133,600 |

| SKO | Serko | 3.55 | 9% | $412,473,329 |

| NOR | Norwood Systems Ltd. | 0.03 | 8% | $12,660,574 |

| BTH | Bigtincan Hldgs Ltd | 0.22 | 7% | $176,660,326 |

| EOL | Energy One Limited | 11.04 | 7% | $343,067,694 |

| AMO | Ambertech Limited | 0.15 | 7% | $14,787,741 |

| NVX | Novonix Limited | 0.45 | 7% | $305,299,326 |

| AXE | Archer Materials | 0.32 | 7% | $76,454,104 |

| TZL | TZ Limited | 0.06 | 5% | $17,959,303 |

| RUL | Rpmglobal Hldgs Ltd | 2.85 | 4% | $635,302,076 |

| XF1 | Xref Limited | 0.14 | 4% | $29,688,753 |

| EVS | Envirosuite Ltd | 0.08 | 4% | $121,691,110 |

| IKE | Ikegps Group Ltd | 0.74 | 4% | $118,180,552 |

| CXZ | Connexion Mobility | 0.03 | 3% | $25,193,497 |

| CDA | Codan Limited | 15.59 | 2% | $2,916,027,723 |

| EIQ | Echoiq Ltd | 0.28 | 2% | $170,671,102 |

| IRE | IRESS Limited | 8.10 | 2% | $1,514,862,634 |

| ELS | Elsight Ltd | 0.36 | 1% | $64,269,630 |

| QHL | Quickstep Holdings | 0.57 | 1% | $40,525,311 |

Clinical trials focused tech firm, Opyl, reported a solid half-year.

During the half, TrialKey, its flagship platform, passed a thorough review by X Firm during due diligence, confirming its reliability and ability to perform at scale.

The platform’s predictive analytics now boast an impressive 92% accuracy in predicting clinical trial outcomes.

Opyl also successfully used AI to create reports for NeuOrphan's drug candidates, and provided validation reports for cannabis product suppliers through Phenix Health.

Looking ahead, Opyl said it’s feeling optimistic about 2025.

The joint venture with X Firm and other partnerships position it well for growth, it said, especially with a focus on North America and EMEA, which are key markets for clinical trials.

The goal now is to secure capital and aggressively pursue clients in these regions, which could significantly boost revenue.

Payment tech firm, Smartpay, rose after receiving two non-binding, early-stage takeover offers during the month.

One was from Tyro Payments (ASX:TYR), who’s looking to buy 100% of Smartpay for NZ$1.00 (about $0.90) per share, mostly in Tyro shares and some cash.

The other offer comes from an un-named international party, also aiming to acquire 100% of Smartpay.

Both offers are still very early, and nothing’s set in stone yet.

Freight tech company, Yojee, was on the up after signing two major contracts in March.

First, it inked a deal with DSV in Australia to implement its Transport Carrier Management System (TCMS). This system helps businesses manage their transport operations by digitising land freight and reducing costs.

DSV will start using Yojee’s TCMS in Melbourne and Sydney, with plans to expand across Australia and New Zealand by the end of 2025.

Then, Yojee signed another deal with Röhlig Logistics for a four-month pilot of its TCMS in Singapore, set to go live by May 1st.

Röhlig will use Yojee’s system to optimise its transport movements with external carriers. By August, the system will be fully operational across Röhlig’s fleet in Singapore.

Banking and retail tech firm, Rocketboots, has renewed its contract with a major Australian retail bank, continuing a 6-year partnership.

The new deal is worth $214k annually, an increase of $52k, and runs for two years with a prepaid total value of $432k.

The company also said it’s scaling up its business to tap into the global retail, grocery, and banking markets, which are worth billions.

On top of that, RocketBoots has struck a partnership with Gebit Solutions, a global point-of-sale software provider.

This deal will see RocketBoots’ AI-powered loss prevention software integrated with Gebit’s POS systems.

Gebit operates in over 32 countries and serves some of the world’s largest retailers.

Account receivables tech company, IODM, has made big moves during the month by securing revenue share deals in North America with Convera, covering the education sectors in the US and Canada.

Starting in March, IODM will earn a share of the revenue Convera gets from educational institutions that adopt its IODM Connect platform.

The share depends on whether the institution is a new or existing client, with IODM earning 20% for existing clients and 30% for new ones.

The US and Canada are huge markets for IODM, with a combined potential market value of over $275 million, more than five times what’s on offer in the UK.

IODM is also in talks with other payment providers to expand even further in North America, so there could potentially be more to come.

ASX tech losers in March

| Code | Name | Price | Month % Change | Market Cap |

|---|---|---|---|---|

| SBW | Shekel Brainweigh | 0.00 | -100% | $4,789,286 |

| NUH | Nuheara Limited | 0.00 | -100% | $21,914,147 |

| LVH | Livehire Limited | 0.00 | -100% | $19,789,288 |

| FBR | FBR Ltd | 0.01 | -63% | $50,598,588 |

| 1TT | Thrive Tribe Tech | 0.00 | -40% | $2,031,723 |

| IFG | Infocusgroup Hldltd | 0.01 | -33% | $2,407,900 |

| XPN | Xpon Technologies | 0.01 | -33% | $2,899,532 |

| SNS | Sensen Networks Ltd | 0.02 | -29% | $18,239,862 |

| AI1 | Adisyn Ltd | 0.05 | -29% | $39,727,908 |

| VNL | Vinyl Group Ltd | 0.09 | -28% | $132,199,614 |

| DTI | DTI Group Ltd | 0.01 | -27% | $3,588,411 |

| ID8 | Identitii Limited | 0.01 | -27% | $6,193,708 |

| AD8 | Audinate Group Ltd | 6.21 | -27% | $536,822,905 |

| PIL | Peppermint Inv Ltd | 0.00 | -25% | $8,845,917 |

| W2V | Way2Vatltd | 0.01 | -22% | $6,538,001 |

| NVU | Nanoveu Limited | 0.04 | -21% | $31,182,070 |

| FND | Findi Limited | 4.00 | -21% | $245,062,567 |

| DUB | Dubber Corp Ltd | 0.03 | -20% | $91,725,164 |

| GTI | Gratifii | 0.10 | -20% | $32,523,783 |

| IS3 | I Synergy Group Ltd | 0.00 | -20% | $1,584,871 |

| 1CG | One Click Group Ltd | 0.01 | -20% | $10,600,919 |

| BLG | Bluglass Limited | 0.02 | -19% | $33,130,086 |

| CCR | Credit Clear | 0.23 | -18% | $97,669,188 |

| CML | Connected Minerals | 0.15 | -17% | $5,583,359 |

| NXL | Nuix Limited | 3.07 | -17% | $1,058,346,659 |

| EPX | Ept Global Limited | 0.04 | -16% | $25,690,706 |

| AR9 | Archtis Limited | 0.06 | -16% | $17,853,963 |

| OEC | Orbital Corp Limited | 0.09 | -16% | $14,459,791 |

| ESK | Etherstack PLC | 0.26 | -16% | $34,364,721 |

| XYZ | Block Inc | 86.47 | -16% | $4,984,409,936 |

| SMN | Structural Monitor. | 0.38 | -16% | $64,036,595 |

| JAN | Janison Edu Group | 0.17 | -15% | $44,181,003 |

| NXT | Nextdc Limited | 11.31 | -15% | $7,486,464,092 |

| FCT | Firstwave Cloud Tech | 0.02 | -15% | $29,129,818 |

| 360 | Life360 Inc. | 19.81 | -15% | $3,793,057,857 |

| NVQ | Noviqtech Limited | 0.05 | -14% | $11,822,218 |

| HYD | Hydrix Limited | 0.02 | -14% | $4,909,839 |

| SPZ | Smart Parking Ltd | 0.76 | -14% | $315,817,741 |

| DTZ | Dotz Nano Ltd | 0.07 | -14% | $37,943,925 |

| AVA | AVA Risk Group Ltd | 0.10 | -14% | $26,142,482 |

| QOR | Qoria Limited | 0.42 | -14% | $553,173,743 |

| MP1 | Megaport Limited | 9.63 | -13% | $1,613,924,809 |

| TYR | Tyro Payments | 0.77 | -13% | $406,579,271 |

| SPX | Spenda Limited | 0.01 | -13% | $32,306,508 |

| SLX | Silex Systems | 3.61 | -12% | $897,029,178 |

| CYB | Aucyber Limited | 0.10 | -12% | $15,211,392 |

| LIS | Lisenergylimited | 0.11 | -12% | $80,025,029 |

| ICE | Icetana Limited | 0.02 | -12% | $6,572,140 |

| BVS | Bravura Solution Ltd | 2.25 | -11% | $1,004,312,964 |

| WHK | Whitehawk Limited | 0.01 | -11% | $5,195,168 |

| OLL | Openlearning | 0.02 | -11% | $8,205,469 |

| CF1 | Complii Fintech Ltd | 0.03 | -10% | $14,856,235 |

| DWG | Dataworks Group | 0.01 | -10% | $16,335,887 |

| NOV | Novatti Group Ltd | 0.03 | -10% | $15,147,695 |

| XRO | Xero Ltd | 154.75 | -9% | $23,862,901,192 |

| WBT | Weebit Nano Ltd | 1.92 | -9% | $425,920,968 |

| WTC | Wisetech Global Ltd | 81.23 | -9% | $26,774,291,480 |

| RDY | Readytech Holdings | 2.60 | -9% | $315,121,394 |

| BDT | Birddog | 0.03 | -9% | $5,167,553 |

| ACE | Acusensus Limited | 1.07 | -9% | $154,728,578 |

| ERD | Eroad Limited | 0.87 | -8% | $163,984,303 |

| ATA | Atturralimited | 0.83 | -8% | $311,059,483 |

| COS | Cosol Limited | 0.80 | -8% | $145,591,037 |

| DXN | DXN Limited | 0.04 | -8% | $10,454,627 |

| ASV | Assetvisonco | 0.04 | -8% | $28,095,739 |

| PPK | PPK Group Limited | 0.34 | -7% | $29,059,999 |

| SP3 | Specturltd | 0.01 | -7% | $4,314,102 |

| EXT | Excite Technology | 0.01 | -7% | $25,484,783 |

| MX1 | Micro-X Limited | 0.06 | -6% | $40,514,571 |

| OAK | Oakridge | 0.06 | -6% | $1,619,874 |

| DTL | Data#3 Limited | 7.25 | -6% | $1,110,692,748 |

| AJX | Alexium Int Group | 0.01 | -6% | $12,691,429 |

| AT1 | Atomo Diagnostics | 0.02 | -6% | $10,866,439 |

| TNE | Technology One | 27.84 | -6% | $9,333,277,104 |

| DUG | DUG Tech | 1.12 | -6% | $150,143,225 |

| CAT | Catapult Grp Int Ltd | 3.46 | -5% | $955,412,924 |

| XRG | Xreality Group Ltd | 0.04 | -5% | $19,984,380 |

| CAG | Caperangeltd | 0.09 | -5% | $8,541,747 |

| SOR | Strategic Elements | 0.04 | -5% | $17,345,912 |

| RCL | Readcloud | 0.10 | -5% | $15,259,936 |

| CPU | Computershare Ltd | 39.13 | -5% | $23,546,500,798 |

| SEN | Senetas Corporation | 0.02 | -4% | $38,076,939 |

| 8CO | 8Common Limited | 0.02 | -4% | $4,705,993 |

| SPA | Spacetalk Ltd | 0.23 | -4% | $14,668,563 |

| LVE | Love Group Global | 0.12 | -4% | $4,864,100 |

| PHX | Pharmx Technologies | 0.08 | -4% | $46,085,023 |

| RWL | Rubicon Water | 0.28 | -4% | $67,394,627 |

| 4DS | 4Ds Memory Limited | 0.03 | -3% | $62,072,030 |

| RKN | Reckon Limited | 0.49 | -3% | $55,514,468 |

| KNO | Knosys Limited | 0.04 | -3% | $7,997,132 |

| BRN | Brainchip Ltd | 0.21 | -2% | $435,534,473 |

| IFM | Infomedia Ltd | 1.33 | -2% | $513,090,277 |

| OCL | Objective Corp | 15.09 | -2% | $1,456,732,865 |

| ASB | Austal Limited | 4.19 | -1% | $1,755,169,259 |

| HSN | Hansen Technologies | 5.00 | -1% | $1,004,892,337 |

| PPS | Praemium Limited | 0.71 | -1% | $348,732,077 |

| DDR | Dicker Data Limited | 8.36 | -1% | $1,522,681,083 |

| DSE | Dropsuite Ltd | 5.76 | -1% | $403,991,510 |

| EML | EML Payments Ltd | 0.97 | -1% | $378,071,674 |

Originally published as ASX March Tech Winners: Tech sector gets smashed, but Opyl and Rocketboots hold strong