ASX February winners: Benchmark fell almost 4pc amid stormy weather

Australia’s S&P/ASX 200 fell 4% in February as global geopolitical and economic uncertainties rattled markets.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Australia’s S&P/ASX 200 fell 3.79% in February as global geopolitical and economic uncertainties rattled markets

Only four out of 11 S&P/ASX 200 sectors posted gains, primarily driven by defensive sectors

Kalgoorlie Gold Mining was the biggest winner in February, up 281% after a greenfields gold discovery

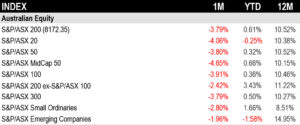

Australia’s S&P/ASX 200 fell by 3.79% in February, according to S&P Dow Jones Indices (S&P DJI) as global geopolitical and economic uncertainty played on markets.

Small caps faired the best in February's downturn, followed by large caps and mid caps.

VanEck Asia-Pacific CEO and managing director Arian Neiron told Stockhead nearly a third of the benchmark's decline (1.02%) was driven by the big four banks, which make up a sizeable portion (23.38%) of the index.

He said weak quarterly earnings from Westpac (ASX:WBC) and National Australia Bank (ASX:NAB) due to mounting margin pressure and higher impairments saw their prices decline by 5.7% and 12.1% respectively.

Despite stronger balance sheets, Commonwealth Bank (ASX:CBA) and Australia and New Zealand Banking Group (ASX:ANZ) were also punished, finishing -2.38% and -2.71% for the month respectively.

"International equities followed Australia by going backwards in February, based on the MSCI World ex Australia index, returning -0.36%," Neiron said.

The Trump factor

US President Donald Trump’s proposed sweeping new tariffs on America’s three biggest trading partners – Mexico, Canada, and China – continued to spook markets.

"Uncertainty surrounding the Trump administration’s trade tariffs saw US growth expectations fall and inflation expectations increase, adversely affecting US equities and the Mag 7 in particular," Neiron said.

"Investors rotated out to Europe and Japan, which have both recently surprised to the upside with stronger-than-expected GDP growth."

CEO of deVere Group Nigel Green described the proposed tariffs as a "colossal economic gamble" that could backfire spectacularly.

"This is an extraordinary escalation of protectionist policy, one that risks igniting a full-scale trade war at a time when markets are already on edge," he said.

"The impact could be severe – higher prices for American consumers, strained diplomatic relations, and retaliatory tariffs that could hammer US exports."

RBA rate cut fails to lift sentiment

Even a rate cut by the Reserve Bank of Australia (RBA) failed to lift Aussie investor sentiment in February. After holding the cash rate at 4.35% for months on end – the highest in 13 years – the RBA made a 0.25 percentage points cut in February bringing the rate to 4.1%.

The RBA said that it decided to finally cut rates because "inflationary pressures are easing a little more quickly than expected".

The Aussie dollar finished February lower at 62.09 US cents with the final week of the month its worst week since November 2023, wiping out gains from earlier in the month.

Bitcoin entered bear market territory towards the end of February, falling to US$85,000.

"A risk-off environment and clashes between Musk on behalf of DOGE and US regulators, contributed to the fall," Neiron said.

"However, Bitcoin has bounced back 9% in the first couple of days of March, after Trump tweeted about Bitcoin’s importance as part of a potential federal strategic reserve."

Defensive sectors up as tech drops 12%

Sector performance was mixed, as only four out of 11 S&P/ASX 200 sectors posted gains, which S&P DJI said was primarily driven by defensive sectors such as utilities, communication services and consumer staples.

In a reversal of fortunes the ASX's best performing sector for 2024 technology experienced a drop of 12%.

"The technology sector was dragged down by the decline in the US tech sector, while slowing iron ore demand from China has continued to put downward pressure on materials," Neiron said.

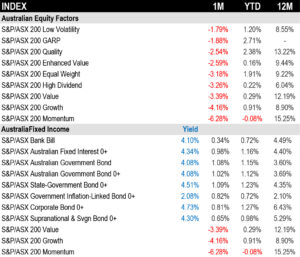

Not a good month for equity factors, fixed income advances

All reported Australian factor and thematic indices were in the red in February. Momentum, which was the best-performing factor in 2024, underwent the most substantial correction, while Low Volatility and GARP performed relatively better.

S&P DJI said the equity options market priced in heightened uncertainty. Known as the 'fear indices' the S&P/ASX 200 VIX and S&P 500's VIX increased to 11.8% and above 21% respectively.

Fixed income indices advanced across the board. The S&P/ASX Australian Fixed Interest 0+ Index rose by 1%, as the RBA joined its international peers in the global interest-rates easing cycle.

"Short-and long-dated government bonds fell and credit spreads tightened on the back of the RBA formalising the first rate cut in more than four years and heightened economic uncertainty," Neiron said, adding:

"US bond markets (Bloomberg US Aggregate Index returned 2.20%) mirrored Australia, with credit spreads tightening and long dated government bond yields falling."

The 50 best performing ASX stocks in February

| CODE | COMPANY | LAST SHARE PRICE | FEBRUARY RETURN % | MARKET CAP |

|---|---|---|---|---|

| KAL | Kalgoorlie Gold Mining | 0.061 | 281% | $20,755,557 |

| CRS | Caprice Resources | 0.058 | 190% | $25,711,472 |

| GRV | Greenvale Energy Ltd | 0.082 | 148% | $39,923,613 |

| AVE | Avecho Biotech Ltd | 0.007 | 133% | $22,185,079 |

| OZM | Ozaurum Resources | 0.068 | 127% | $13,428,427 |

| BSX | Blackstone Ltd | 0.061 | 126% | $36,879,897 |

| PEB | Pacific Edge | 0.115 | 121% | $44,655,379 |

| E79 | E79 Gold Mines | 0.042 | 121% | $5,363,538 |

| PKD | Parkd Ltd | 0.049 | 113% | $5,200,694 |

| CLU | Cluey Ltd | 0.105 | 110% | $40,574,731 |

| ASV | Asset Vision Co | 0.045 | 105% | $31,053,186 |

| ASO | Aston Minerals Ltd | 0.018 | 100% | $22,016,093 |

| EVR | EV Resources Ltd | 0.005 | 100% | $9,662,517 |

| FAU | First Au Ltd | 0.003 | 100% | $4,143,987 |

| NRZ | Neurizer Ltd | 0.003 | 100% | $6,716,008 |

| RR1 | Reach Resources Ltd | 0.014 | 100% | $12,242,039 |

| SFG | Seafarms Group Ltd | 0.002 | 100% | $9,673,198 |

| JAY | Jayride Group | 0.003 | 91% | $715,737 |

| FRS | Forrestania Resources | 0.019 | 90% | $4,724,180 |

| WWG | Wiseway Group | 0.19 | 90% | $35,144,171 |

| EPX | EPT Global Limited | 0.043 | 87% | $24,935,904 |

| PFT | Pure Foods Tas Ltd | 0.043 | 87% | $5,823,302 |

| C1X | Cosmos Exploration | 0.1 | 85% | $12,415,992 |

| RAS | Ragusa Minerals Ltd | 0.024 | 85% | $3,422,371 |

| AII | Almonty Industries | 1.95 | 81% | $50,994,838 |

| CAE | Cannindah Resources | 0.075 | 79% | $50,237,517 |

| REM | Remsense Technologies | 0.064 | 78% | $9,311,942 |

| SM1 | Synlait Milk Ltd | 0.775 | 76% | $467,478,526 |

| FIN | FIN Resources Ltd | 0.007 | 75% | $4,544,881 |

| GES | Genesis Resources | 0.007 | 75% | $5,479,889 |

| ORD | Ordell Minerals Ltd | 0.56 | 75% | $17,434,620 |

| TYX | Tyranna Res Ltd | 0.007 | 75% | $19,727,552 |

| NMR | Native Mineral Res | 0.075 | 74% | $53,500,465 |

| EVS | Envirosuite Ltd | 0.08 | 74% | $121,017,624 |

| HTM | High-Tech Metals Ltd | 0.26 | 73% | $8,045,802 |

| TOR | Torque Met | 0.1 | 72% | $26,696,729 |

| WOA | Wide Open Agricultur | 0.012 | 71% | $7,471,613 |

| ENL | Enlitic Inc | 0.095 | 70% | $53,531,664 |

| NAE | New Age Exploration | 0.005 | 67% | $8,625,596 |

| PNT | Panther Metals | 0.015 | 67% | $3,722,561 |

| QXR | QX Resources Limited | 0.005 | 67% | $6,550,389 |

| RGL | Rivers Gold | 0.005 | 67% | $8,418,563 |

| YAR | Yari Minerals Ltd | 0.005 | 67% | $2,894,147 |

| SPA | Spacetalk Ltd | 0.24 | 66% | $13,393,036 |

| WYX | Western Yilgarn NL | 0.038 | 65% | $4,704,763 |

| EDU | EDU Holdings Limited | 0.18 | 64% | $24,841,312 |

| OKJ | Oakajee Corp Ltd | 0.013 | 63% | $1,188,798 |

| HVY | Heavy Minerals | 0.295 | 62% | $17,096,116 |

| MVP | Medical Developments | 0.67 | 61% | $75,481,077 |

| MYX | Mayne Pharma Ltd | 7.22 | 61% | $585,782,413 |

Kalgoorlie Gold Mining (ASX:KAL) was the biggest winner in February, up 281% after a greenfields gold discovery. Drilling at the prospect on the company’s Pinjin site – to be renamed Lighthorse – in Western Australia’s Eastern Goldfields region returned thick intersections of extensive gold mineralisation including a top result of 17m grading 4.81g/t gold that includes a higher grade intersection of 8m at 9.21g/t.

Altogether, Lighthorse has a larger footprint than either the company’s Kirgella Gift or Providence deposits with the company fast-tracking a priority follow-up drill program for March 2025 to help define the system’s full extent.

OzAurum Resources (ASX:OZM) rose 127% in February after achieving several milestones including the delivery of aircore drilling results which confirmed the high-grade nature of the New Cross Fault discovery at Mulgabbie North.

The company extended the discovery by 400m in strike length and believes the New Cross Fault enhances the overall prospectivity of Mulgabbie.

Blackstone Minerals (ASX:BSX) rose 126% in February after announcing it had inked a merger deal with IDM International to acquire the Mankayan copper-gold project in the Philippines. Mankayan features a large mineralised system with a high-grade core and orebody that remains open to the north, south and at depth which provide opportunities for resource growth.

BSX managing director Scott Williamson described Mankayan ‘as one of the largest high-grade undeveloped porphyry projects globally’.

Pacific Edge (ASX:PEB) rose 121% in Feburary after announcing the American Urological Association (AUA) has included the company's Cxbladder Triage as the standard of care in an amendment to its clinical guideline for the management of patients presenting with microhematuria (blood in the urine) and at risk of bladder cancer.

Pacific Edge said in a major amendment to the 2020 AUA microhematuria guideline, Cxbladder Triage was mentioned as the only urine-based biomarker test that has ‘Grade A’ evidence from a randomised controlled trial (the STRATA Study) in support of this recommendation.

As a consequence of the new guideline, Pacific Edge anticipates an uplift in demand for Cxbladder tests.

The 50 worst performing ASX stocks in February

| CODE | COMPANY | LAST SHARE PRICE | FEBRUARY RETURN % | MARKET CAP |

|---|---|---|---|---|

| BSA | BSA Limited | 0.086 | -92% | $8,258,318 |

| BIT | Biotron Limited | 0.005 | -69% | $8,121,445 |

| OCT | Octava Minerals | 0.036 | -66% | $2,440,372 |

| NIM | Nimy Resources | 0.06 | -59% | $12,290,438 |

| 5EA | 5Eadvanced | 0.805 | -56% | $12,671,100 |

| AVW | Avira Resources Ltd | 0.009 | -55% | $1,616,337 |

| MGU | Magnum Mining & Exp | 0.006 | -54% | $4,856,168 |

| OVT | Ovanti Limited | 0.008 | -53% | $16,320,835 |

| FBR | FBR Ltd | 0.019 | -53% | $106,257,034 |

| DTM | Dart Mining NL | 0.005 | -52% | $2,990,278 |

| I88 | Infini Resources | 0.35 | -50% | $18,406,627 |

| AUH | Austchina Holdings | 0.001 | -50% | $2,420,384 |

| MOM | Moab Minerals Ltd | 0.001 | -50% | $1,566,999 |

| SIT | Site Group Int Ltd | 0.001 | -50% | $3,257,490 |

| CLG | Close Loop | 0.1 | -49% | $55,844,236 |

| TFL | Tasfoods Ltd | 0.009 | -47% | $4,370,955 |

| APX | Appen Limited | 1.305 | -47% | $429,602,701 |

| SOC | Soco Corporation | 0.067 | -46% | $9,754,856 |

| BRN | Brainchip Ltd | 0.21 | -46% | $507,910,504 |

| ALA | Arovella Therapeutic | 0.11 | -45% | $133,019,193 |

| LYN | Lycaon Resources | 0.135 | -45% | $7,417,875 |

| BEZ | Besra Gold Inc | 0.041 | -45% | $17,035,047 |

| NVQ | Noviqtech Limited | 0.056 | -44% | $15,846,803 |

| AMN | Agrimin Ltd | 0.088 | -43% | $32,266,701 |

| PEN | Peninsula Energy Ltd | 0.87 | -43% | $143,672,576 |

| RDN | Raiden Resources Ltd | 0.004 | -43% | $17,254,457 |

| VR1 | Vection Technologies | 0.023 | -43% | $36,537,363 |

| BDG | Black Dragon Gold | 0.039 | -42% | $12,148,642 |

| GLL | Galilee Energy Ltd | 0.007 | -42% | $3,900,350 |

| AI1 | Adisyn Ltd | 0.07 | -42% | $59,953,024 |

| OD6 | Od6Metalsltd | 0.038 | -42% | $6,051,338 |

| 1AE | Aurora Energy Metals | 0.036 | -41% | $6,267,231 |

| SUM | Summit Miinerals | 0.074 | -41% | $6,534,599 |

| PLY | Playside Studios | 0.22 | -41% | $87,982,759 |

| IFG | Infocus Group | 0.015 | -40% | $2,920,253 |

| NGS | NGS Ltd | 0.024 | -40% | $4,064,485 |

| CYC | Cyclopharm Limited | 1.425 | -40% | $167,816,644 |

| XF1 | Xref Limited | 0.13 | -40% | $24,958,732 |

| PEK | Peak Rare Earths Ltd | 0.097 | -39% | $38,730,352 |

| LDX | Lumos Diagnostics | 0.026 | -38% | $20,958,645 |

| BEL | Bentley Capital Ltd | 0.01 | -38% | $761,279 |

| SLX | Silex Systems | 4.11 | -37% | $959,430,407 |

| AMD | Arrow Minerals | 0.034 | -37% | $28,726,586 |

| MIO | Macarthur Minerals | 0.031 | -37% | $6,189,631 |

| PNV | Polynovo Limited | 1.43 | -36% | $1,018,993,412 |

| IPT | Impact Minerals | 0.007 | -36% | $27,534,903 |

| AM5 | Antares Metals | 0.008 | -36% | $4,083,847 |

| 4DX | 4Dmedical Limited | 0.385 | -36% | $175,101,208 |

| CXL | Calix Limited | 0.43 | -36% | $99,810,674 |

| BDT | Birddog | 0.036 | -36% | $5,813,497 |

At Stockhead, we tell it like it is. While OzAurum Resources is a Stockhead advertiser, it did not sponsor this article.

Originally published as ASX February winners: Benchmark fell almost 4pc amid stormy weather