American Salars bucks trend in building lithium brine portfolio

American Salars is so confident of a price recovery that it is forging ahead with a strategy to pick up brine projects across the Americas.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

American Salars M&A strategy is to pick up lithium projects while price stagnates

The company is particularly focused on brine projects in Argentina

Portfolio also includes projects in Canada and USA

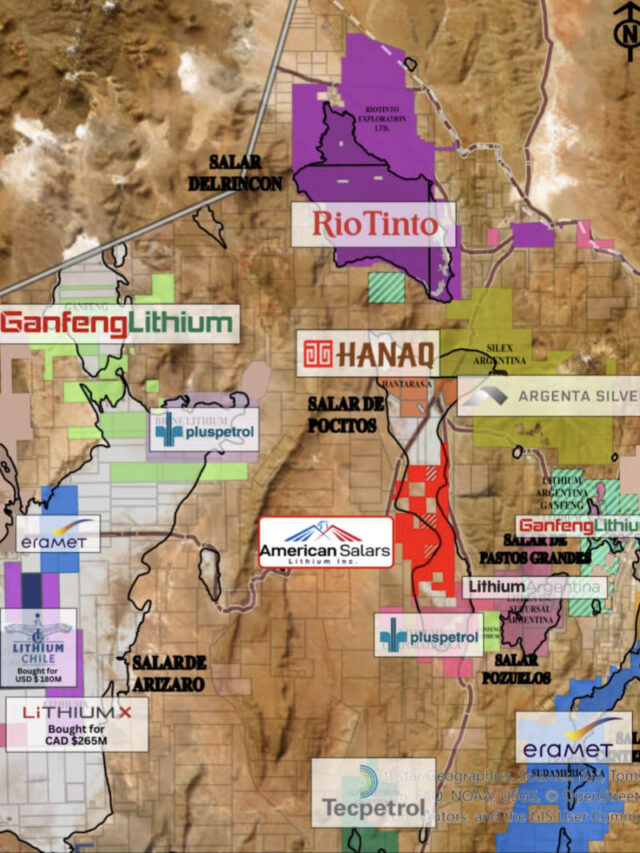

Special Report: Canadian-listed American Salars is bucking the lithium trend by buying large landholdings – particularly brine projects in Argentina – at a time when other lithium players are panicking and selling due to weak prices.

Lithium suffered so badly in 2023 that it was hard to see it getting much worse heading into 2024. It did, with oversupply resulting from the rapid growth of new mines in Africa and lepidolite in China helping battery makers keep a lid on prices.

6% Li2O spodumene concentrate, the benchmark price for hard rock mines in WA, fell as low as US$760/t at the nadir from more than US$8000/t in late 2022.

But American Salars (CSE:USLI) is confident of a price recovery. So much so that the company is active in M&A for strategic opportunities in the sector – particularly for brine projects as the current lithium carbonate price (~$10.383 spot) is attractive for brine projects and a real challenge for their hard rock competitors.

The company already holds the Black Rock South lithium brine project in Nevada, USA, where phase 1 exploration last year highlighted up to 180.5ppm lithium.

And earlier this month, American Salars signed a letter of intent to acquire up to 75% (and eventually 100%) of the Salar De Pocitos project in Argentina.

That brine project consists of 10 mineral tenements spanning around 13,080 hectares contiguous to the company’s 800 hectare flagship Pocitos project.

To break it down, that’s a property size increase of 1635% to a footprint combined total of 13,880 hectares on the Pocitos Salar, within the country’s prolific Lithium Triangle.

Historic drill holes will now be reviewed with the aim of updating the resource estimate and moving to scoping and feasibility studies with the ultimate aim of commercial production.

Best time to pick up projects

As lithium pricing sends investors into a tailspin and companies down the rabbit hole of reassessing projects, CEO Nick Horsley says it’s the best time to buy, with the company focused on large land packages, ideally standalone smaller salars.

“I think the long term outlook is bullish, with most M&A happening in Argentina,” he said.

However, the company is not putting all its eggs in one basket with a multi-jurisdictional suite of projects setting USLI up to buffer any geopolitical headwinds from the new US Trump Government’s tariffs coming into play.

Horsley is also keeping in mind that China could ban exports of lithium and other critical metals and Argentina is talking about a trade pact.

Diversification across different countries certainly seems the smart move. The company also picked up 100% of the Jaguaribe hard rock pegmatite project in Brazil in February this year, which includes rare earth elements.

Initial samples returned up to 3.72% Li2O, 2.15% Li2O and 1.58% Li2O as well as 554.5 ppm cesium, 135 ppm tantalum, 177 ppm oniobium and even >10,000ppm rubidium.

“We continue to add highly prospective assets to our portfolio of lithium projects in North and South America,” Horsley said at the time.

“Brazil has been one of the global epicentres for lithium production and American Salars’ Jaguaribe project is located in a known pegmatite district and contains high-grade lithium samples and significant rare earth elements values.”

Don’t forget North America

USLI also has a portfolio of hard rock projects in Quebec, Canada, kicking off exploration at the 3,958 acre Lac Simard project in November last year.

The focus is on the Lac Simard Nord block, directly contiguous to Sayona Mining’s (ASX:SYA) Tansim project which hosts the Viau-Dallaire and Viau Showings estimated by Sayona as having the potential to contain between 5 to 25 million tonnes of Li20 at 1.2-1.3%.

Notably, Sayona and Piedmont (NASDAQ: PLL) recently announced a merger to create a US$623m (C$870m) lithium giant after continued record production at the North American Lithium (NAL) operation in Quebec.

At the time Horsley said the recent merger of Sayona and Piedmont and acquisition by Rio Tinto of Arcadium showed there remained a strong appetite for M&A in the lithium space.

“We will continue to identify low-cost strategic acquisitions in the lithium space, with our long-term thesis remaining the development of our NI 43-101 lithium brine resources in Argentina,” he said.

This article was developed in collaboration with American Salars, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as American Salars bucks trend in building lithium brine portfolio