A fistful of divvies: The ASX tech stocks playing the dividend game

Big Tech is paying dividends on Wall Street and ASX tech stocks Dicker Data and Reckon, among others, are jumping on the bandwagon.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Wall Street’s Big Tech finally shares the wealth

ASX tech stocks join the dividend party

Dicker Data, Reckon lead the charge with dividends

Tech stocks have always been the darlings of growth investors – no dividends, just promises of future returns.

But guess what? Big Tech’s finally started handing out dividends, and it’s shaking things up.

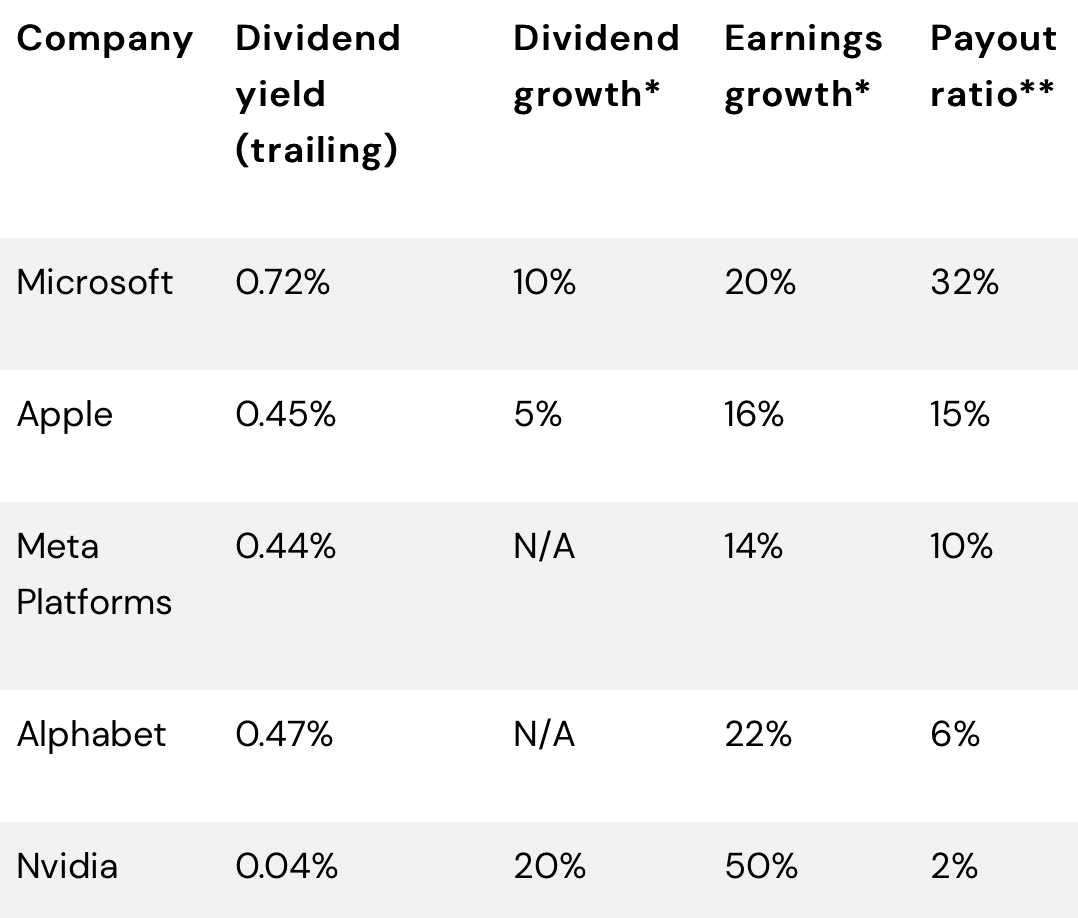

In 2024, the likes of Google and Meta have finally thrown their hats into the dividend ring, with Nvidia pushing its payout up by 150%.

The market's loving it – Meta’s stock jumped 20% after its first dividend announcement; while Alphabet saw a 10% surge when it followed suit.

Now, here's the big question for investors: Is this the end of growth, or just Big Tech getting smarter with its cash?

Turns out, it’s the latter.

"The trend we’re seeing in Big Tech is a shift towards capital discipline, with companies now in a position to balance rewarding shareholders and reinvesting for future growth,” said Annabelle Dickson from Betashares.

By the way, Microsoft and Apple have been paying dividends for years.

For Aussie investors looking for income from Wall Street, Big Tech’s payouts might not set your portfolio on fire… but it’s something.

Meanwhile back home, the ASX tech scene is still a bit behind the curve when it comes to generous payouts.

Most local tech companies are still firmly planted in the growth phase, reinvesting their earnings into expansion, research, and the like.

A lot of the biggest names – like Xero (ASX:XRO) and Appen (ASX:APX) – are sitting tight with their cash, opting not to pay out dividends (for now, at least).

That said, we are starting to see some promising moves.

Large companies like WiseTech Global (ASX:WTC), Dicker Data (ASX:DDR) and Technology One (ASX:TNE) have been paying modest dividends.

Smaller players are getting in on the action, too. Here’s a rundown of ASX tech stocks that are already paying dividends…

ASX tech stocks that pay dividends

| Code | Name | Div. Yield | Current Div. | Div. Payout Ratio | Franking | Market Cap |

|---|---|---|---|---|---|---|

| DDR | Dicker Data | 5.30% | $0.11 | 98% | 100% | $1,514,820,088 |

| RKN | Reckon | 4.40% | $0.03 | 49% | 0% | $66,843,951 |

| DTL | Data#3 | 3.30% | $0.13 | 91% | 100% | $986,766,081 |

| IFM | Infomedia | 3.10% | $0.02 | 72% | 100% | $518,586,060 |

| COS | Cosol | 2.40% | $0.01 | 51% | 100% | $183,808,684 |

| PPS | Praemium | 1.70% | $0.01 | 39% | 100% | $332,012,046 |

| CDA | Codan | 1.50% | $0.12 | 50% | 100% | $2,893,992,917 |

| HSN | Hansen Tech | 1.20% | $0.05 | 77% | 42% | $1,067,381,995 |

| OCL | Objective Corp | 0.90% | $0.09 | 52% | 47% | $1,527,282,656 |

| TNE | TechnologyOne | 0.80% | $0.17 | 62% | 65% | $9,935,635,219 |

| WTC | WiseTech Global | 0.20% | $0.09 | 21% | 100% | $41,982,624,192 |

… and a handful that stand out for yield percentage and more:

Dicker Data (ASX:DDR)

Dicker Data is an Aussie tech powerhouse, specialising in distributing IT hardware, software, and cloud solutions.

It’s the go-to distributor for big names like Microsoft, Nvidia, and VMware, supplying everything from computers to AI-driven tools across the ANZ.

The company paid out interim dividends in H1 despite some market hiccups. This was due to its solid grip on its cash and an 8.3% growth is Q2 sales.

What’s more, Dicker Data managed to improve its gross profit margins during the half, with gross profit reaching $155 million, up by 2.9%.

The margin boost came mainly from better performance in New Zealand and improvements in backend margin programs, which helped it squeeze more profit from each sale.

With a cash-generating core business in distribution and exclusive deals with power players like Microsoft and Nvidia, Dicker could be well-placed to keep sharing the wealth with its investors.

Reckon (ASX:RKN)

Reckon is a tech company that provides cloud-based accounting, payroll, and legal software, mainly for small businesses.

Despite some challenges in the market, Reckon has been on a roll, growing its cloud revenues by 8% in H1 and keeping a steady hand on cash flow.

With $4.3 million in operating cash flow, solid profit margins, and a strong cloud customer base of over 109,000 users, the company’s in a good financial spot.

This steady cash generation allowed Reckon to pay out an interim fully franked interim dividend in the half, keeping its tradition of rewarding shareholders.

As Reckon continues investing in its cloud solutions and expanding into global markets like the US and UK, it’s positioning itself for ongoing growth, and those dividends could be a reliable bonus for investors.

Data#3 (ASX:DTL)

DTL delivers everything from cloud solutions to network infrastructure for industries like healthcare and education.

Despite a tough economic year, the company grew full year revenue to a record $2.8 billion, with strong gains in software and managed services.

This was backed by big IT projects like those for the Sydney Football Stadium (Allianz Stadium) – enabling it to pay out a fully franked dividend, up 16.4% from last year.

With a diverse portfolio and cash flow, Data#3 could be set to keep sharing the wealth.

Infomedia (ASX:IFM)

Infomedia, an Aussie tech company delivering SaaS and DaaS solutions to the auto industry, saw impressive growth in FY24.

Revenue hit $140.8m, up 8%, while earnings per share (EPS) grew by 33%.

The company’s strategy of expanding globally, focusing on recurring revenue, and improving margins paid off big-time.

With a solid cash position of $70m, no debt, and a 26% jump in NPAT, Infomedia was in a strong spot to boost its dividend.

It’s a prime example of how a focused, profitable growth strategy can keep the cash flowing back to shareholders.

Cosol (ASX:COS)

Cosol, a leader in asset management software and services, had a stellar FY24, with revenue surging 35.7% to $101.9m and underlying EBITDA jumping 33%.

Strong cash flow and robust demand for its AMaaS (Asset Management as a Service) solution, boosted by strategic acquisitions, set Cosol up in 2024.

Even with some extra debt and acquisition costs, the company delivered solid profits and declared a dividend, sticking to its 50% NPAT payout ratio.

With a record pipeline and strategic acquisitions now fully integrated, Cosol has said it’s positioned for even more growth in FY25.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Originally published as A fistful of divvies: The ASX tech stocks playing the dividend game