‘Scary’ AI trick sees Aussie lose $130k

An Australian teacher is warning about the simple trick he fell for that broke up his entire family.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

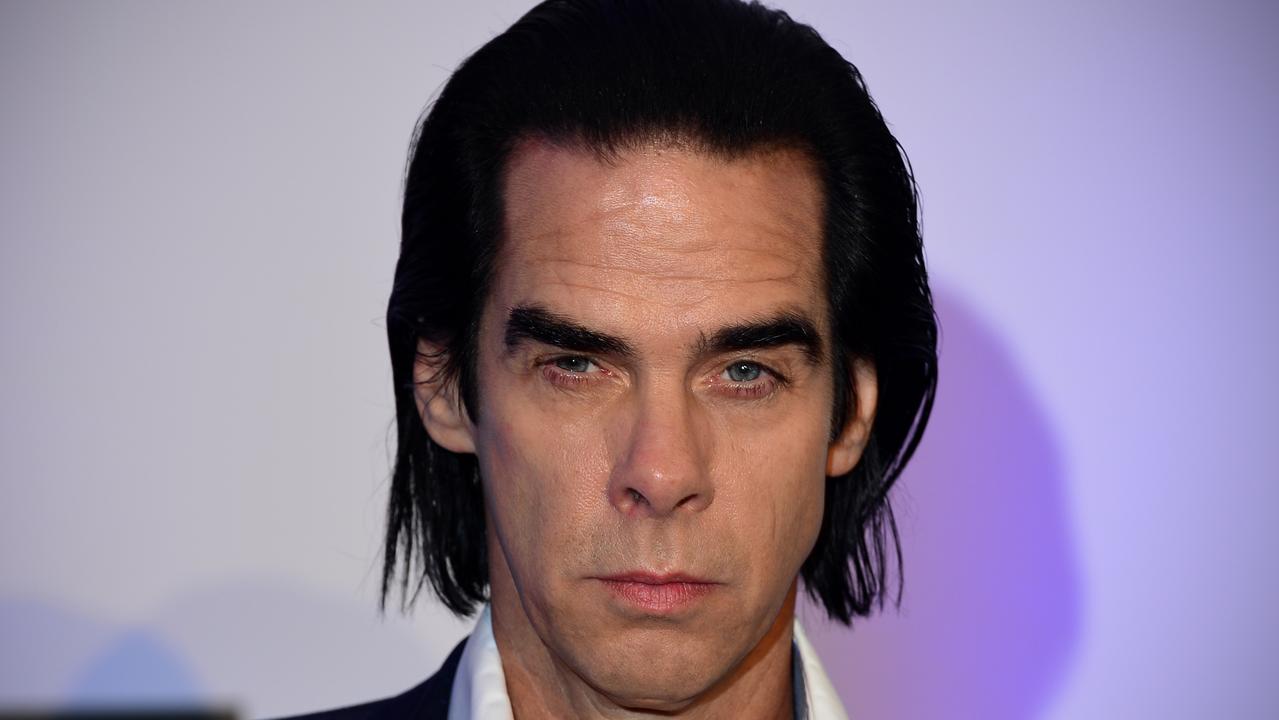

When Jake* was looking to make a bit of extra money and saw Australian singer Nick Cave speaking about an investment he thought it was the “icing on the cake” to dive in.

But instead it ended up with the Melbourne man being fleeced out of a whopping $130,000 last year – causing a rift in his family and him facing a long road to recover financially.

Jake admits he isn’t a “money person” but what he didn’t realise at the time was his favourite musician was a deepfake being used on Facebook to funnel Aussies into an investment scam.

He describes the experience as “pretty frightening”.

“I had a deepfake experience with Nick Cave and the video ends up with him saying he made a couple of extra thousands dollars in the bank by doing nothing,” he told news.com.au.

“I respect him greatly as an artist, so I’m of course thinking sh*t that’s put the icing on the cake.”

Chillingly, once he made contact to inquire about the investment scheme the floodgates opened.

“I was bombarded with a tsunami with different people trying to get a hold of me – it came from everywhere. I had people everywhere trying to get me on board,” he said.

“What actually happened in the end is I started talking to a young guy by the name of Max. It’s this case of right time, right place – absolute bullseye. There I was looking for something and he happened to be at the right place at the right time.

“He didn’t seem pushy and he seemed like someone I felt reasonably comfortable with.”

Max was also prepared to play the long game. He said he worked in London and on phone calls Jake said he could hear people in the background suggesting he was in an office environment.

Have you been the victim of a scam? Contact sarah.sharples@news.com.au

Centrefold for scammers

Jake invested $US250 ($A370) into a platform that would allow micro trading in cryptocurrency and then waited months.

Three to four months later, his account showed the amount had supposedly grown to $US45,000 ($A67,000).

“A normal person would look at that and say too good to be true, see you later and hang up the phone. I spoke to people, I spoke to friends, my own son who is 16 years old said this is bullsh*t,” he admitted.

“But when you have this weird carrot dangled in front of you at the right time in the right space, you don’t listen.

“I’ve heard stories from intelligent people, they see the flags but for some unknown reason they don’t want to listen. It’s an interesting part of the psychology of the whole thing – it’s quite scary.”

When Jake questioned Max on whether the investment was too good to be true, he was assured that crypto had gone “ballistic” and unfamiliar with this financial product, he fell for it.

“I think these scammers when they pick up on that and that you are not really a crypto person they love that,” he added.

“There’s a hey hang on we have ourselves a real beauty here – we’ve got exactly what we need. This person is looking for an extra bit of money for their family. I was the centrefold – if they ever make a magazine called Scammers — I will be the pull out centrefold. I’m Mr Perfect for them.”

‘Vicious circle’

The emergency relief teacher said the scam deepened when he tried to pull money out.

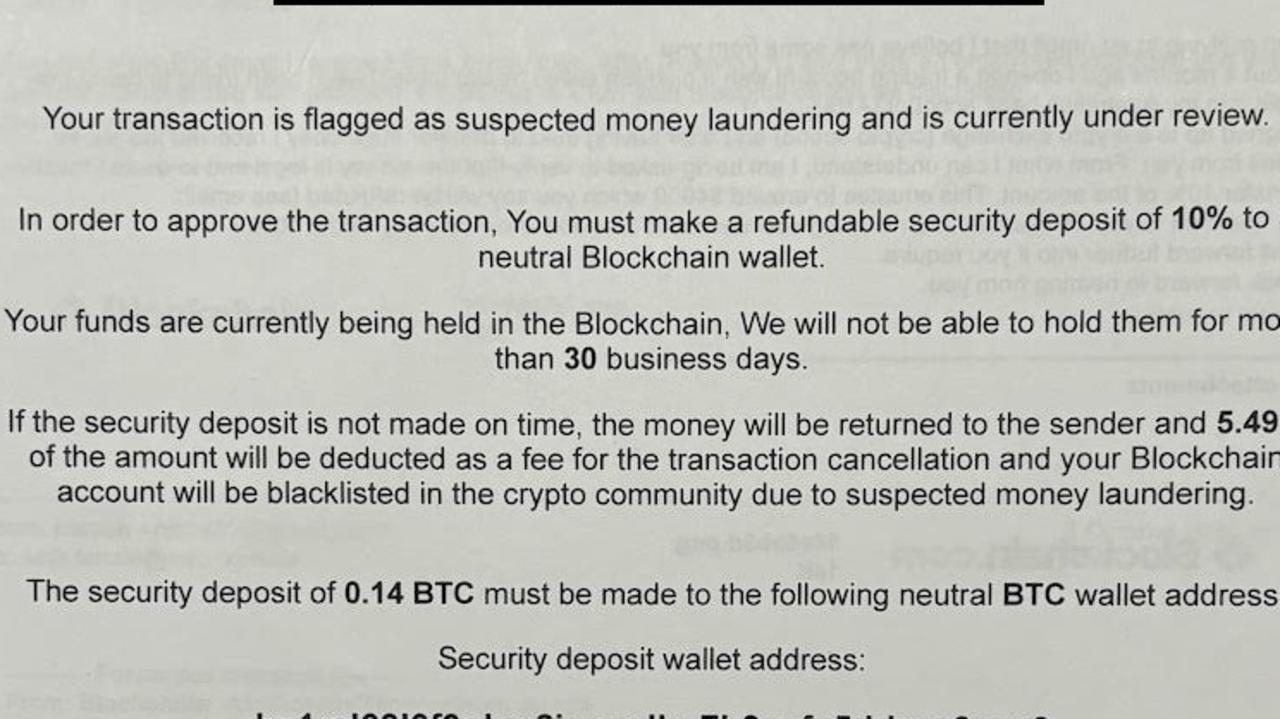

He received an email claiming his account had been flagged for possible money laundering and he had to forward a percentage of the payment as a deposit to prove he was legitimate.

From there things spiralled as he kept “running up against hurdles” to access his money.

“As you put in more money, the debt you are chasing grows and you end up a in a vicious circle,” he said.

“And you get to a point where it is not funny anymore, you are trying to chase more money. For us it got to the point where were trying to chase upwards of $90,000. It becomes frightening.”

Over a month, he lost $130,000. He deposited multiple amounts ranging between $4900 and $18,500.

‘Brains exploded’

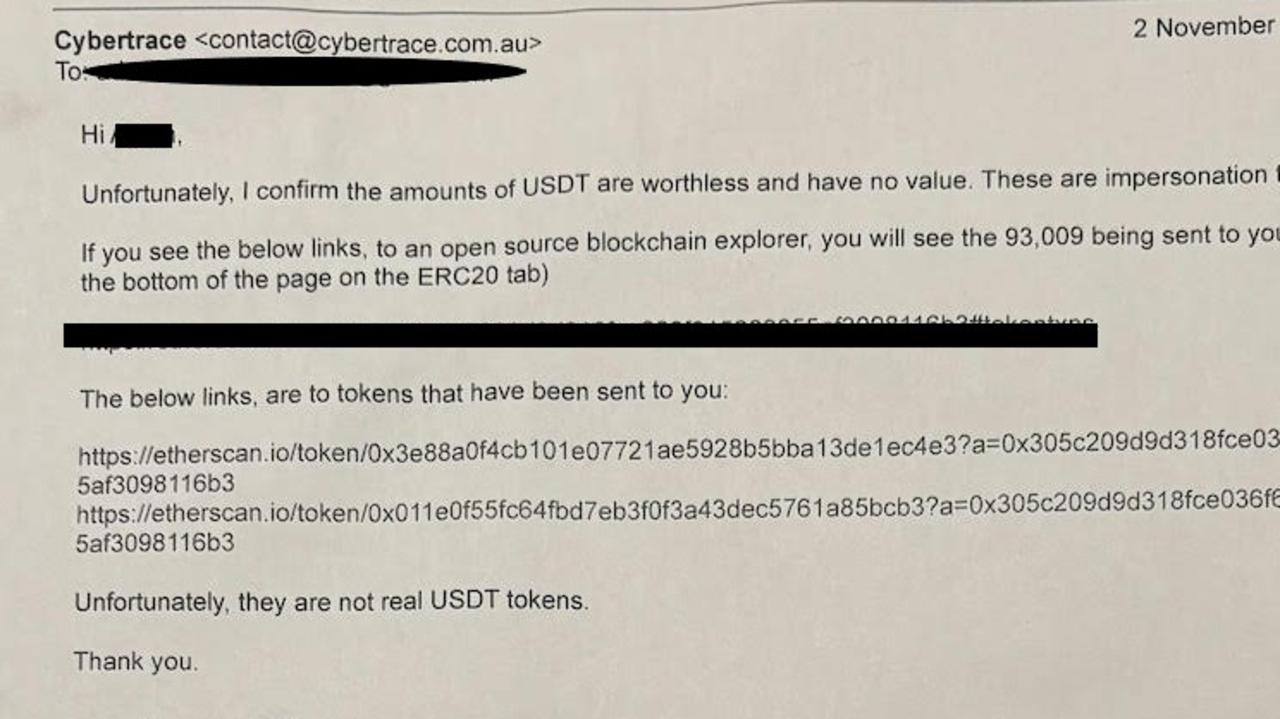

Fed up, Jake reached out to a Sydney company to help him untangle the web but he was devastated by what he learned.

“They told me unfortunately you have fake coins, they are worthless and at that point I knew I had lost $130,000 and my stomach hit the floor and my brains exploded,” he said.

“I was in a situation where I didn’t know what to do.”

Jake said he wants to raise awareness as he thinks there is a lot of information about stolen identity or hacking scams but warns people like Max would have a long list of people he is fleecing.

“Investment scams are using deep fakes and using extremely professional companies that take you on a ride which is all deceit,” he noted.

The 61-year-old said he was deeply embarrassed by the situation – leaving him feeling like a fool – which has seen him lose his life savings. He has reported the scam to the police.

“They will tell you are a victim of criminal activity. I look at it now as digital burglary,” he said.

“You get two different kinds of people – people who put their arms around you and say ‘This is the worst thing in your life and is there anything I can do?” And others who say ‘You are pretty f**king stupid aren’t you’?”

Jake said it’s “broken my family up” with his mum and sisters particularly scathing of his actions.

“I just want to try and warn people that if its too good to be true, then get the hell out,” he said.

Thousands of reported losses on social media

Scams have been a growing problem on social media platforms with a reported $43.4 million in losses in the first eight months of the year, with almost $30 million relating to fake investment scams, according to Scamwatch.

Meta has said its tackling deepfake images of celebrities after it introduced a new initiative for banks to share information on scams. As a result, there have been 8000 pages and 9000 celebrity scams blocked in its first six months of operation, according to Meta.

Yet, Scamwatch said there were 1600 reported losses from scams on social media in August alone.

Deepfake images of well known Australians that are appearing on the likes of Meta include David Koch, Gina Rinehart, Anthony Albanese, Larry Emdur and Guy Sebastian.

Meanwhile mining magnate Andrew Forest is suing Meta over the company’s alleged failure to tackle scams using his image.

Meta’s new initiative comes as the Australian Government looks to introduce new mandatory industry codes that will force social media companies and banks to fight scammers.

However, consumer groups have raised the alarm that the new government framework would mean an almost 30-step process that takes between 18 months and two years – with no guarantee of getting any money back at the end.

Amid growing backlash of the way Aussies would be treated under the framework – they are calling for scam victims to be reimbursed within 10 days unless there was gross negligence.

*Name changed

sarah.sharples@news.com.au

Originally published as ‘Scary’ AI trick sees Aussie lose $130k