Savings and investment goals hit by living cost pain

Young adults are ditching investment plans in droves as they struggle to make ends meet, but it threatens to hit them twice.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Higher living costs have helped force more than four out of five Australians to change their savings and investment goals in the past year, research has found.

Younger generations in particular are ditching their money plans in droves in an effort to make ends meet, according a new study by financial advice and accounting group Findex.

This threatens to hit them them with a double-whammy from cost-of-living pain, today amid high inflation and in the future because their retirement nest egg will be smaller, Findex co-CEO Tony Roussos said.

“It’s the Generation Zs and Generation Ys who are de-prioritising their savings goals,” Mr Roussos said.

“Generation Zs and Millennials have significant student debts. You can say we have always had them, but we haven’t, actually.

“People are doing it tough right now, but if you don’t look at the long-term impacts it could come back and bite you twice.”

Findex’s research found 81 per cent of Australians had changed their investment and savings goals in the last 12 months, but the proportion was 90 per cent among Generation Z and 87 per cent among Millennials.

It also found that property is people’s favourite investment for building wealth, ahead of superannuation. However, only 13 per cent of Generation Z view super as a key investment while 40 per cent of Baby Boomers prioritise it.

Older Australians are feeling financial pressure too. JBS Financial Strategists CEO Jenny Brown said she was seeing a definite impact of living costs on people spending their nest eggs.

“We have found more people are increasing the amount they are withdrawing from their super,” she said.

“And there are more questions around ‘will my money last’ and ‘do I have the right investment strategy?’.

Mr Brown said investing earlier in life had a large positive impact later, because of the benefits of compound interest.

She said someone who invested $2400 a year ($46 a week) from age 25 to 35 and nothing after that could end up with $363,850 by age 65, but someone who did not start until 35 and invested $2400 annually for 30 years would only have $282,755 – a shortfall of $81,096 despite investing three times as much for three times as long.

Ms Brown said diversification into growth assets such as shares and property was vital, but only at a level where people were comfortable. “It’s no point putting it all in growth assets if you are not going to sleep at night,” she said.

“When you are young you want to make sure your money is going to grow, and when you are older you are still investing for the rest of your life.”

Findex’s Mr Roussos said the research found that 85 per cent of Australians diversified their investments, which allowed them to smooth out the ups and downs and protect their overall wealth.

“Diversification is critical because asset classes don’t always work the same way,” he said.

“If you start early and are consistent, even with small amounts, the compound effect of the interest means that you are not using as much of your money when in pre-retirement or retirement.”

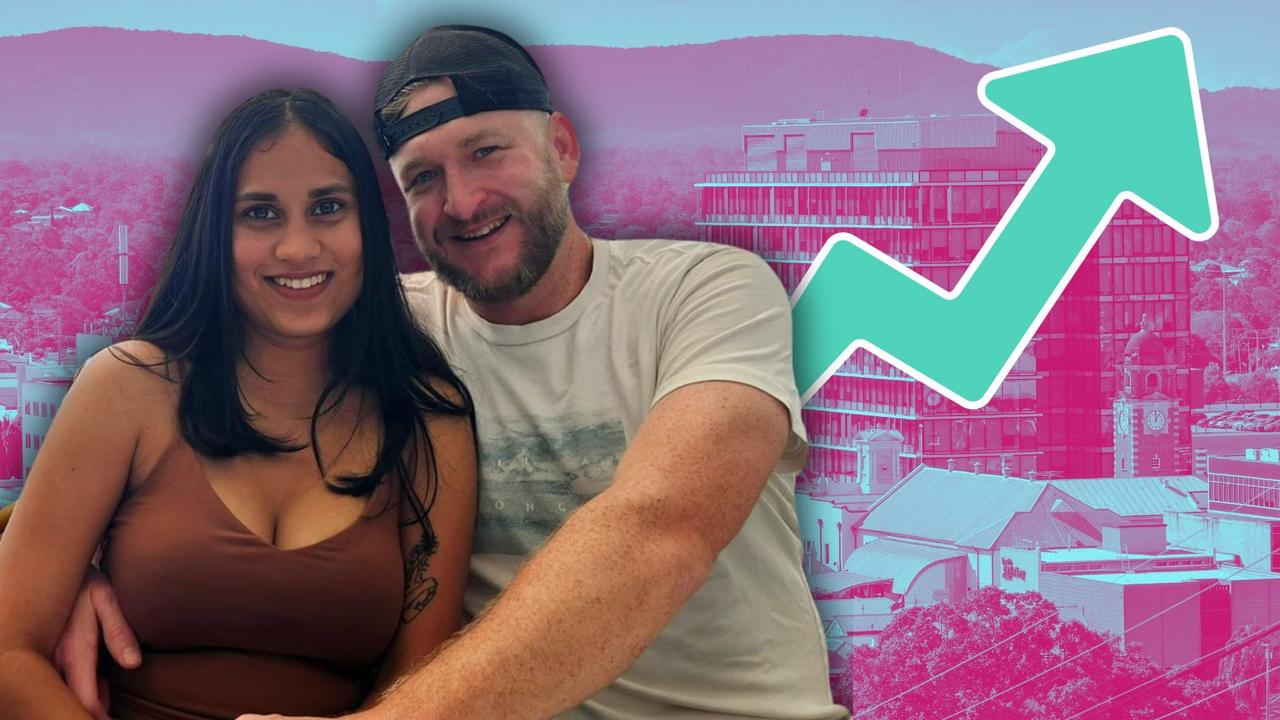

Wayne Humphries retired last year at 62 and his wife Ellen is set to retire at 60 next year, both well before the pension age of 67, thanks to the benefits of good financial advice, paying off their mortgage and pumping extra money into super through salary sacrifice and lump sums.

“You just need to keep chipping away … I tell you what, the last 40 years, I don’t know where they have gone,” Mr Humphries said.

“Retirement creeps up on you pretty quickly.”

More Coverage

Originally published as Savings and investment goals hit by living cost pain