SA parliament rushes through bill allowing government to move on GFG Alliance debts

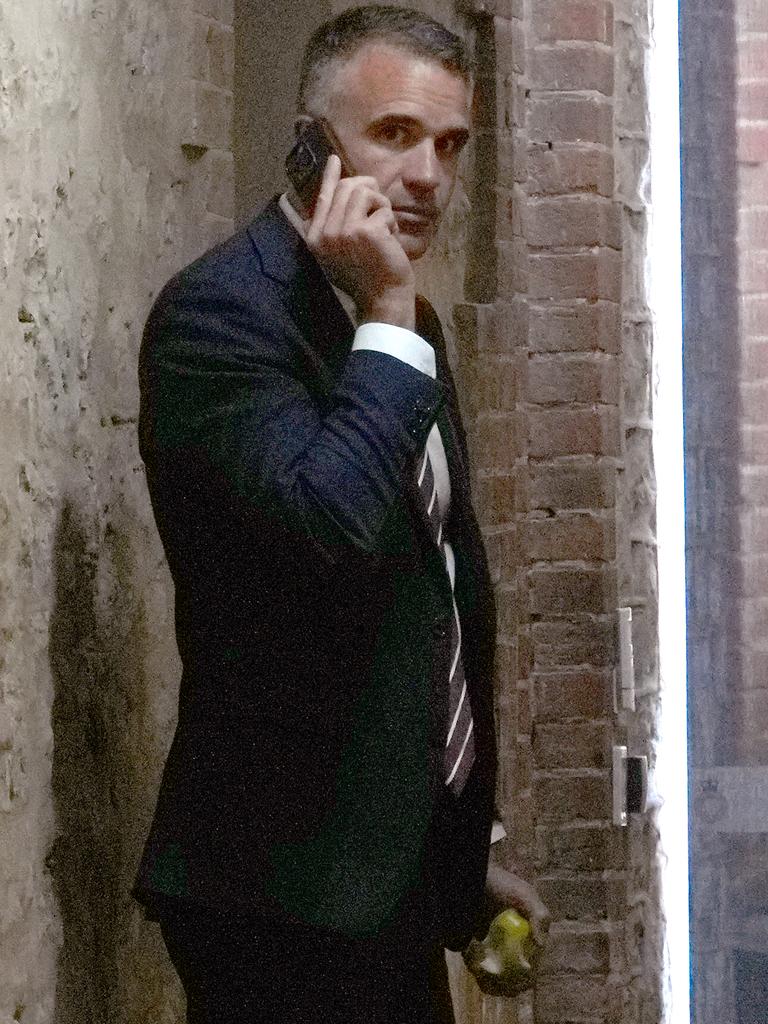

South Australian Premier Peter Malinauskas says putting the Whyalla steelworks into administration was about no less than saving sovereign steelmaking in Australia.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The South Australian government’s move to push the Whyalla steelworks into administration was about no less than preserving Australia’s sovereign steelmaking capacity, premier Peter Malinauskas said, adding that the operations were on a seemingly “irredeemable” path to failure under the ownership of British steel magnate Sanjeev Gupta.

The SA government on Wednesday morning convened an emergency sitting of parliament, where “surgical” amendments to the legislation governing the operations of the steelworks were passed.

The amendments have the effect of ensuring the government, which is owed “tens of millions” of dollars in royalties, and about $15m more via state water utility SA Water, would have security over both the steelworks and the land it sits on.

This then enabled the government to place the steelworks in administration.

High profile insolvency firm KordaMentha, which ran the steelworks under administration after Arrium failed in 2016 and eventually sold it to Mr Gupta’s GFG Alliance, will be installed as administrator, with Mr Malinauskas to fly to Whyalla on Wednesday night ahead of further announcements on Thursday.

Mr Malinauskus said the government had consulted widely, including with its own Steel Task Force, and came to the conclusion it had no choice but to act.

“We take this action very conscious of its significance, very conscious of the responsibility that is being bestowed upon us by taking this action,’’ Mr Malinauskas told a press conference.

“But we do so with absolute confidence and clarity that this is the right course of action to secure steelmaking in this country.

“It is unacceptable for such an important, critical piece of economic infrastructure for the nation to be in a situation where its ongoing operations are so severely compromised as we believe was the case prior to today.

“By putting OneSteel Manufacturing into administration it will allow for the administrator to stabilise the business, put it on a far surer footing in the immediate future, with a view to secure its long-term future, which is the objective that this government has always had.’’

Mr Malinauskas said the government’s hand was forced by what it saw as essentially an emergency situation.

“There are a number of elements which have led us to making the decision that we have done today, but none more so than the fact that state government has been in receipt of advice from our Steel Taskforce that the owner of the steelworks’ financial position wasn't just deteriorating, it was likely to continue deteriorating into the future, and more than that, it was compromising the very operations of the steelworks itself.

“That advice completely accords with all of the information that we are receiving on the ground from people who work within the steelworks.

“Given the state of the steelworks was going from bad to worse, and the finances of its owner were compromised, it ran the very real risk that as every week and month went by, where the owner of the steelworks was not able to invest in the operations appropriately, it was approaching a point where it would be irredeemable.

“That is unsatisfactory. That invites government intervention.’’

GFG Alliance edged out a South Korean consortium with a last minute, improved offer to buy the steelworks in 2017, and in 2018 Mr Gupta announced a huge investment program at Whyalla including a new steelmaking plant and huge amounts of renewable energy.

These plans multiplied over the following months and years to include multiple gigawatts worth of renewable energy projects, a bank, a potential new copper smelter, and even bringing car manufacturing back to Australia.

None of these plans eventuated, and the collapse of GFG’s financier Greensill in 2021 posed an existential threat to GFG, which was on the hook for about $US5bn to Greensill’s creditors at the time of its failure.

Mr Gupta has also faced several legal battles, with the UK’s Serious Fraud Office (SFO) continuing to investigate fraud, fraudulent trading and money laundering in relation to the group’s operations.

While the steelworks achieved profitability in the 2020 financial year, two major blast furnace outages over the past 12 months have plunged its finances into the red, and GFG has been dogged with complaints over non-payment of debts to suppliers big and small.

It also laid off about 50 white collar works last year and about another 100 workers at the iron ore mines in the Middleback Ranges.

Mr Gupta last week announced he had hammered out a global deal which he said, when finalised, would wipe the slate clean with regard to the Greensill debts, and also said he would put the Tahmoor coal mine which GFG owns, up for sale, with the circa-$800m to be raised to go towards keeping Whyalla operational.

He has also been trying to lock down another $US100m in emergency debt funding.

He said he was targeting bringing Whyalla back to break even by mid-year, with the operation now turning over $13m-$14m per week, but did not commit to a timetable for paying creditors.

Mr Malinauskas and his government have become increasingly wary of Mr Gupta’s promises however, culminating in Wednesday’s extraordinary action.

The premier said he recognised it was a “unique” and “unusual” thing to do, but the state had worked extremely hard to improve its economic fortunes in recent years.

“And we weren’t going to allow the owner of an economic asset of this significance, to compromise that for the future of the state.

“It’s just too important. We couldn’t have GFG holding back steelmaking in this country.

“We can’t have GFG holding back the future of the Upper Spencer Gulf and the economic future that surrounds it that is very much real.’’

Mr Malinauskas said the administrator was “fully funded” to run the steelworks while looking for a new owner, however did not elaborate on what fully-funded meant, saying more details would be released on Thursday.

“That means that bills get paid, work order are made, workers can roll up to work knowing that there is no question mark over their immediate future and the owner of the steelworks.’’

Mr Malinauskas said his heart broke for the company’s creditors, and he looked forward to speaking with them.

He said that on Thursday he would announce “one of the most comprehensive industry support packages that this nation has ever seen’’, and ruled out the government becoming the owner of the steelworks.

“There was an option that we could provide assistance to GFG and Mr Gupta. There was an option that we could have bailed out GFG, but we weren’t going to do that,’’ he said.

“This isn’t about GFG, this is about the critical economic infrastructure that is steelmaking production in this country.

“That is the future we’ve got to focus on, not any individual owner of the steelworks.’’

Mr Malinauskas said the last time the steelworks was in administration the process took 17 months, so people should not assume it would be a quick process.

He said he had not spoken with Mr Gupta on Wednesday but GFG had been served with the appropriate legal documents.

A GFG spokesperson said on Wednesday: “The South Australian Government has made an announcement regarding One Steel Manufacturing Pty Ltd (Whyalla Steelworks)’’.

“GFG is assessing what this means and is seeking advice on its options. Our concern is first and foremost the wellbeing and safety of our employees.

“InfraBuild is a separate company from One Steel Manufacturing Pty Ltd (Whyalla Steelworks). Its supply chain is resilient, in addition to its own domestic high quality production facilities it has regular supply from mature international suppliers.’’

Around 3000 staff work for GFG in South Australia, directly and indirectly.

Originally published as SA parliament rushes through bill allowing government to move on GFG Alliance debts