Qantas reputation on the line in defence of ‘ghost flight’ ACCC case

In choosing to fight or settle, Qantas will now take on the ACCC over what it claims is a fundamental test of the rules covering air travel.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

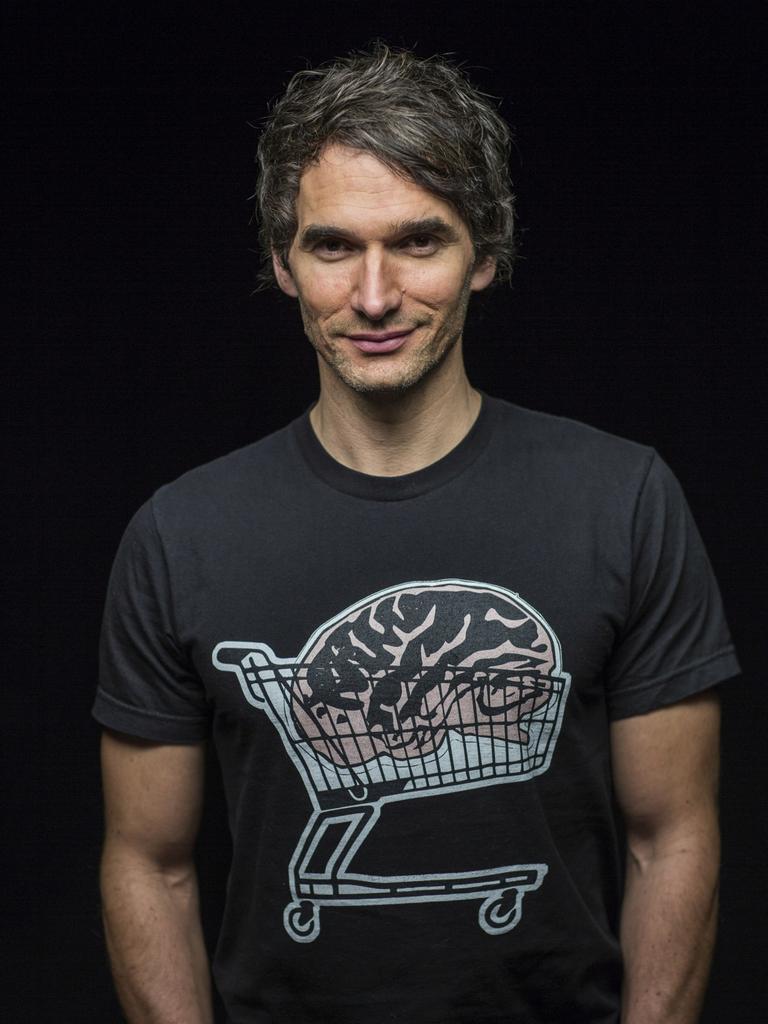

The heat on Qantas’s board is being turned even higher, with several US mega-funds declaring they plan to deliver a strike against the Richard Goyder-led board and vote down several directors – including former advertising boss Todd Sampson.

Even “anti-woke” Florida – home of Republican governor Ron DeSantis – has run out of patience with the Australian airline.

The $300bn state-backed Florida SBA will take aim at new Qantas chief executive Vanessa Hudson’s pay package in addition to lodging a protest vote against the remuneration report. However, Miami has kept its support behind the T-shirt-wearing Sampson.

And while Qantas’s annual meeting on Friday will attract much of the focus, coming days will show how Qantas is positioning itself in the post-Alan Joyce era.

Qantas’s law firm Johnson Winter & Slattery on Friday night lodged the long-awaited defence in the competition regulator’s landmark legal action that alleged the airline intentionally sold fares for “ghost flights”, or flights that had already been cancelled. And in the case of fight or flight, Qantas is digging in.

Qantas stands by its claim that said thousands of customers allegedly affected were still offered an alternative flight or a refund. It also argues the competition regulator is on shaky legal ground that guaranteeing a flight is impossible.

“While mistakes were made by Qantas, the ACCC’s legal case ignores the realities of the aviation industry – airlines can’t guarantee specific flight times,” Qantas said in a statement on Monday.

“The ACCC’s case ignores a fundamental reality and a key condition that applies when airlines sell a ticket. While all airlines work hard to operate flights at their scheduled times, no airline can guarantee that”.

“That’s because the nature of travel – when weather and operational issues mean delays and cancellations are inevitable and unavoidable – makes such a guarantee impossible”.

Qantas adds that 100 per cent of impacted domestic customers were offered flights within an hour and 98 per cent of international passengers were offered flights within a day.

Matter of reputation

As a rule of thumb, companies in the process of rebuilding damaged reputations want to avoid getting involved in court cases or risk having executives in a witness stand to face questioning under oath.

In this case, a settlement with the ACCC would be the surest way for Qantas to draw a line under the past and allow the airline to frame a narrative that it is moving on.

Importantly, it would also signal that the airline is taking a less combative approach to disputes involving reputation – especially when it comes to customer relations. However in this case Qantas believes it is test of the fundamental rules overseeing air travel – that is any can happen that could potentially impact safety be it weather or crew shortages that require flights to be cancelled.

The ACCC has also indicated it intends to seek the maximum penalty with Qantas, which is likely to run into the hundreds of millions of dollars.

Qantas is again generating big profits, but its balance sheet still needs repair before it can pay dividends again. A commitment to spending billions on new aircraft at the same time it has a $500m buyback under way means a big fine – if the case is found against it – will eat away at cashflows.

Even so, Qantas has some financial headroom. In recent weeks, it dropped a long-running $600m plan to buy charter airline Alliance Aviation. The acquisition had hit a stalemate after the ACCC formally opposed it, warning it would substantially hurt competition for corporate customers in Queensland and Western Australia for fly-in, fly-out mining operations.

Still, it is a humbled Goyder-led board that is now due to face the music with shareholders.

Just two months ago, former CEO Alan Joyce was planning this week’s annual meeting to be his swan song, where he could leave the airline on a high after 15 years as chief with a hefty exit package to see him through retirement. Instead, Joyce is now facing up to $14.4m of his remuneration being clawed back.

A string of cascading errors from Qantas means it is now an airline in defensive mode. This includes a botched High Court appeal on sacking ground staff while they were stood down; lobbying against rival Qatar Airways expanding in Australia; over-promising, but under-delivering coming out of Covid; and finally the ACCC legal action. Financial pain is also coming, with conflict in the Middle East pushing oil prices higher. New CEO Hudson now faces a massive rebuild of the airline’s reputation.

Three big proxy houses have already urged Australian institutional investors and super funds to vote down Qantas’s remuneration report, meaning it is all but certain the airline will cop a massive “strike” against its remuneration report.

The $210bn Future Fund has also signalled it is voting down Qantas and against Sampson having his term extended. A vote of 25 per cent or more against the remuneration report represents a strike, although the bar for directors is higher, with a majority vote needed to deliver change.

Californian teachers

Qantas chairman Richard Goyder has already tried to diffuse the anger, announcing his retirement in 12 months time, while two directors, Jacqueline Hey and Maxine Brenner, will retire in February. It remains to be seen whether this is enough.

The Californian stake-backed mega-funds CalPERS and CalSTRS each plan to vote down Qantas’s remuneration report and have also moved against Sampson.

The two US funds have gone a step further than Australian super funds by also signalling that they intend to vote against relatively new director Belinda Hutchinson, who is also seeking shareholder support to extend her term.

CalSTRS, the $US308bn ($486bn) fund that mostly counts teachers as members, is also taking aim at former long-serving American Airlines boss Doug Parker, who only joined the Qantas board in May.

Florida SBA, meanwhile, intends to vote down the remuneration report given the board has a “poor alignment” with a licence to operate. It also plans to vote down the awarding of up to 335,000 share rights to new CEO Hudson given lack of disclosure around targets.

Meanwhile, the New York fund that invests hundreds of billions of dollars on behalf of the city’s workers will issue its final voting position on Qantas in coming days.

The chances of support from New York City as well as the state’s retirement fund are slender: New York was one of a handful of big funds that delivered a protest vote against Qantas in each of the past two years.

Indeed, New York has been leading a small but growing band of investor dissent over the level of bonuses paid to Joyce as well as the Qantas board’s performance.

In each of the past two years, the Qantas protest vote had hit 9 per cent compared to about 3 per cent that the airline was attracting prior to the pandemic.

But New York’s cops and teachers could only do so much by themselves to change Qantas’s ways.

The overwhelming support from Australian investors and proxy houses for Qantas also needs to be put under scrutiny as part of the story of the airline’s reputational demise.

It’s these investors that shouldn’t claim to be caught by surprise by the position Qantas now finds itself in. After all, for years they’ve been giving the airline’s board and generous bonus schemes a pass in pursuit of profit at any cost.

johnstone@theaustralian.com.au

More Coverage

Originally published as Qantas reputation on the line in defence of ‘ghost flight’ ACCC case