PwC’c chief braces for release of Senate report that’s expected to further damage firm’s brand

A Senate committee on Wednesday will table its report into the use of consultants by the government but it’s PwC and its misuse of confidential tax information which is likely to fare the worst.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A year into his reign, PwC Australia CEO Kevin Burrowes is bracing for impact, as the career consultant awaits the outcome of police investigations, regulatory probes, parliamentary reports and a firm on edge.

The British executive, parachuted in from Singapore to run PwC’s Australian operations in June last year, represents the face of an international tax scandal that has failed to subside.

On Wednesday, the Senate’s Finance and Public Administration committee will table its report into the use of consultants by the government, in what is expected to be another excoriation of PwC and its misuse of confidential tax information.

The Australian understands the report will take aim at PwC over the tax scandal as well as traversing other issues at rival firms Deloitte, KPMG, EY and Accenture.

The inquiry, notionally convened to scrutinise the spend on consultants, has instead seen a trio of senators go through the entrails of the tax scandal, forcing the Albanese government to act.

Committee chair Richard Colbeck said PwC “desperately wants to move on” from the tax scandal “but that’s not a reality”.

“They’ve got nine Tax Practitioners Board investigations in front of them, they’ve got Project Alesia,” Mr Colbeck said, referencing the Australian Federal Police investigation into the tax scandal.

“The suggestion they’re in a position to just move on has got a bit of a way to run yet.”

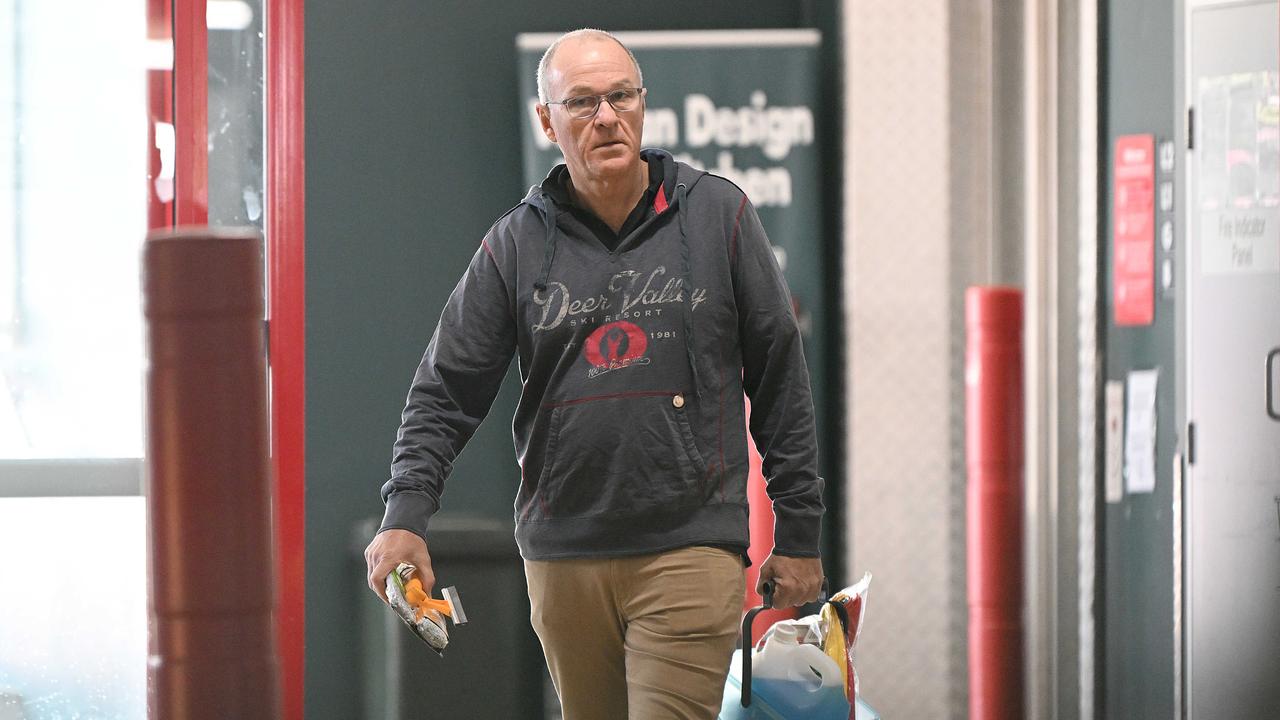

Mr Burrowes, who is paid $2.8m a year for the top job, has attempted to avoid the limelight with little engagement with the media, again declining requests on Tuesday.

The Australian attempted to approach Mr Burrowes with questions. However, he wagged his finger, furiously demanding his picture not be taken as he strolled the short walk to the firm’s headquarters from his luxurious apartment in Sydney’s One Barangaroo building.

Mr Burrowes has attempted to put the scandals around PwC to bed, but the company continues to grapple with the difficulty of quarantining fallout from the tax leaks.

PwC is also facing a growing pile of litigation, with several former staff actively looking to file against the firm over its handling of their exit.

Staff are also incensed at Mr Burrowes’ $12.85m accommodation at Crown’s One Barangaroo, which sources indicated would cost the CEO about $2500 a week, while presiding over repeated rounds of staff cuts and belt tightening.

Mr Burrowes has cut more than 700 staff from PwC, taking an axe to the almost 8000-strong workforce, soon after completing a deal in which the firm offloaded its government consulting practice in a $1 deal.

That deal with private equity players Allegro Funds resulted in PwC dumping almost 30 per cent of its business, since rebranded Scyne Advisory, amid a near-ban by the government in the wake of the tax scandal and against the backdrop of a pullback in government spending on consultants.

Still, PwC has so far come off lightly from the tax scandal.

The firm has not faced tax promoter penalty proceedings or received any sizeable hit from the government, which notably made a move to massively increase the penalties for the very conduct PwC stands accused of.

In September last year Jim Chalmers unveiled new laws increasing the maximum penalty for advisers and firms promoting tax avoidance schemes from $7.8m to $780m, alongside a suite of new powers for regulators.

Mr Burrowes, who took on the running of PwC Australia in July last year, is now the face of scandals not of his own making, but one that has increasingly been marked by his handling of public criticism and inquiries.

The fire has been raging since PwC’s former head of international tax, Peter Collins, was banned in October 2022 and the firm reprimanded after being revealed to have repeatedly misused confidential government tax information.

Mr Collins had signed on to consult with Treasury in 2013, as the government considered major tax reforms, culminating in the 2016 Multinational Anti-Avoidance Law aimed at forcing major companies to pay tax rather than offshoring cash despite writing billions of dollars in contracts here.

PwC sought to open 2023 with journalists on side, convening a dinner in Sydney in February to gather those who might cover the firm in the year ahead as the tax scandal smouldered, with several senior figures including those who have since left the firm presenting to the small gathering.

Appearing a month later, PwC’s then-CEO Tom Seymour sought to downplay the event, telling a business summit the confidentiality breaches didn’t meet the firm’s “standards” but repeating there had been “no findings” about the 30 or so partners and staff identified by regulators who had received confidential information.

Mr Seymour initially sought to downplay the issue further in March, telling onlookers the firm was facing a “perception issue”.

But two months later the PwC boss was gone.

Mr Seymour sought to hold on to the top job after the scandal was turbocharged after the Senate tabled hundreds of emails revealing staff at the firm brazenly sharing and discussing the government secrets.

Mr Seymour, who did not respond to requests for comment, has repeatedly threatened legal action over attempts to link him to the tax scandal, in one message telling The Australian he had “not received any emails detailing confidential information”.

Mr Collins has also been quiet since exiting PwC in late 2022 just prior to his ban by the Tax Practitioners Board. The Melbourne-based tax partner was missing from his Melbourne home in the city’s comfortable southeastern suburbs, retreating inside the renovated Californian bungalow when confronted by The Australian in August last year.

More recently Australian Taxation Office second commissioner Jeremy Hirschhorn revealed he had put PwC’s former CEO Luke Sayers on notice over concerns the firm was engaging in further egregious conduct, coaching clients on how to mislead the ATO and the Foreign Investment Review Board.

Greens senator Barbara Pocock said “PwC’s misdemeanours extended well beyond the monetisation and misuse of confidential tax information”.

“These new revelations from the ATO suggest that PwC was warned to get its house in order on a number of serious issues,” she said.

But Mr Burrowes is making his best efforts to bury the tax scandal, with a near total clean-out at the top of PwC after the firm published an investigation into its culture – and the tax scandal – from corporate veteran Ziggy Switkowski.

Dr Switkowski found PwC had a “whatever it takes” culture, which had seen partners do “the wrong thing”, but failed to point the finger at any key figures.

A separate review by global law firm Linklaters found at least six partners of the firm outside Australia “should have raised questions as to whether the information was confidential”.

In August last year, before PwC had even released its findings of the Switkowski Review or the Linklaters inquiry, Mr Burrowes was telling partners at the firm “virtually no one has been found of any wrongdoing in any international firm outside of Australia”,

But he noted “there may be one or two small instances”.

PwC has declined to publish the report or name any of the global staff nor the 63 local staff and partners named on a list handed to parliament in June last year.

Mr Burrowes has pointed the finger at PwC International as blocking his requests for the information, attempting to characterise the global operation as being beyond his reach.

This is despite the international leadership intervening to put him in charge of the firm and Mr Burrowes previously holding a seat on the firm’s global board.

PwC declined to comment when questioned if Mr Burrowes was in receipt of any benefits from the global firm.

PwC Australia assurance partner Paddy Carney currently holds a seat on the global board.

Labor senator Deb O’Neill said Mr Burrowes was playing a “dead bat” to the Linklaters report, saying the PwC boss was “attempting to minimise” the scandal.

Senator O’Neill, who chairs another parliamentary inquiry examining the issue, said PwC had acted against the national interest and the firm “remain a risk to the proper functioning of the markets”.

Additional reporting: Liam Mendes

Originally published as PwC’c chief braces for release of Senate report that’s expected to further damage firm’s brand