Does troubled Star have the leadership to fix its cultural mess?

Somewhere between contrition and the consultants lays an even bigger challenge for the fallen casino major as it fights to keep its licence.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Somewhere between contrition and the consultants’ advice that lays out the blueprint for Star Entertainment to keep its casino licence sits a big question.

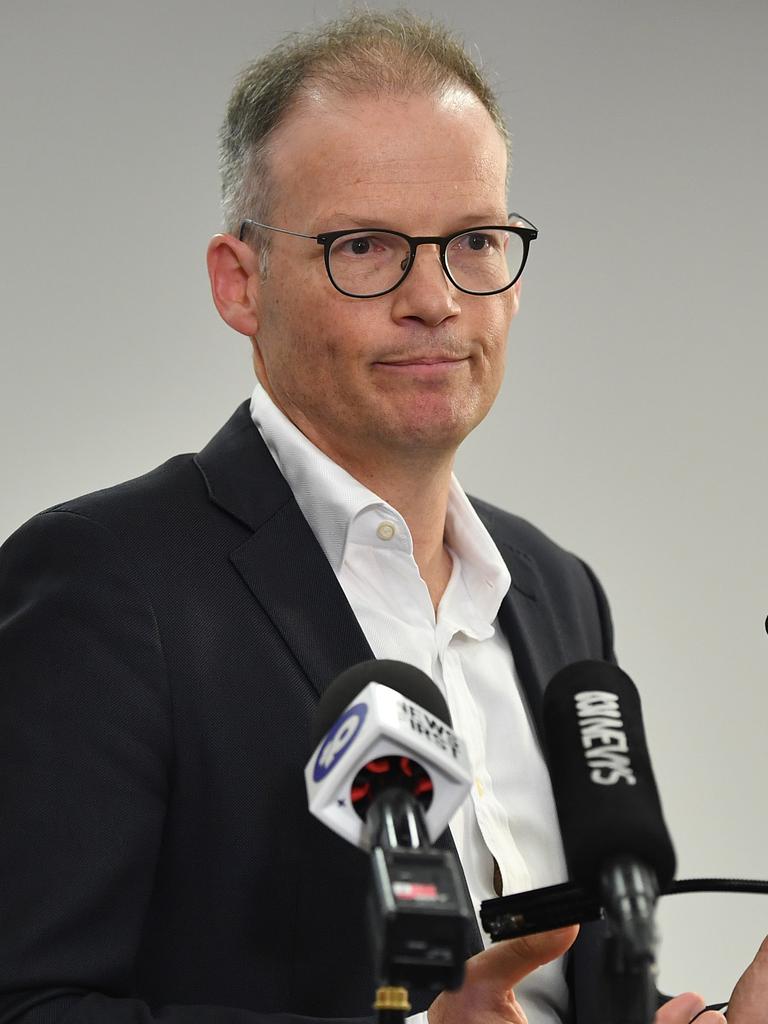

Is the former top UBS senior executive, venture capital founder and now Star executive chairman Ben Heap the best person to lead the casino out of its deep mess?

Heap was the newest member of the Star boardroom, joining in May 2018 but quickly became involved in the casino operator’s central board functions including audit, risk and compliance as well as a key committee overseeing culture.

Star’s culture has come under damning criticism in the Bell inquiry for fostering an environment of looking the other way when it came to potential criminal activity if it was good for the bottom line of the casino.

Heap took on the role of executive chairman following the resignation of long-serving Star chair John O’Neill in May.

And he remains the sole survivor of the former Star board regime and he is now in the process of rebuilding both the depleted director ranks and new management, including securing former Tatts and Tyro payments boss Robbie Cooke as chief executive.

There is no suggestion that Heap was aware of the wrongdoing inside Star and the Bell review said his character, honesty and integrity is not in question.

But it is still baffling to many outside why the Star board didn’t put more heat on its own management team around risk – particularly as rival Australian casino Crown Resorts was imploding amid allegations of money laundering while Commonwealth Bank and Westpac were also battling their own scandal, Star’s board was not asking the right questions.

Last month the NSW casino regulator issued Star with a “show cause notice” following the damning findings of the inquiry headed by Adam Bell SC into its operations which exposed multiple failings around money laundering.

Bankers and fund managers this column spoke with who have worked with Heap and have no connection to Star were firmly of the view that the former asset manager was right for the times.

Heap was former head of UBS Asset Management in Australia and also worked in senior global infrastructure roles with UBS in New York. He also founded H2 Ventures which has backed a number of smaller start-ups.

“I think what they’re (Star) is going through, having somebody like Ben with very high ethical and moral standards is someone who wants to get every part of it right,” one banker says.

The first version of the remediation plan submitted to the casino regulator on Tuesday sets out the road map for a painful two year overhaul. It also acknowledges that even now Star has been slow to respond to the NSW casino regulator. The plan includes 130 milestones and 48 specific workstreams from culture, governments, crime and technology.

The ultimate aim is to totally transform culture, and risk and compliance management practices of Star. It will get there by improving management transparency, breaking down silos and improving communication to the board. It also wants to invite “constructive challenge, raising issues, and having open, constructive and respectful relationships with regulators”.

It remains a consultants’ feast inside Star with Allen & Overy appointed as an independent monitor to provide oversight of the major remediation program. PwC and Deloitte meanwhile have been drafted to bolster financial crime, risk and compliance functions with dozens of staff added to this area.

Risk averse

The Bell report called out the high risk to the public interest involved in operating casinos. This includes risks of money laundering and criminal infiltration which means there must be a “risk averse culture” inside a casino, the Bell report found.

All of the former Star board members including Heap who came under questioning acknowledged it was the board that ultimately set the culture.

Indeed in an Australian Institute of Company Directors publication in 2020 Heap wrote that boards are “the guardians of ethical behaviour”.

During his evidence Heap says where there was a strong compliance culture in Star there is a much less sophisticated understanding of risk. This comes down to a tick the box mindset across the organisation.

Heap has acknowledged this is the heart of the problem recently telling investors Star needs to “fundamentally transform our culture”.

This includes better transparency, more stronger governance and greater accountability.

“We need to ask not only “Can we?”, but “Should we?”, and act swiftly where there is an issue,” he says.

One veteran bank director on Tuesday said there is “no end point” when it comes to fixing culture across big organisations. It’s clear this is going to be a long slow road ahead for Star and if Heap wants to see this through and give Star the best shot to keep its license, he will need a lot more than two years to fix it.

Optus in the cold

Former Westpac chief Gail Kelly and one time Freehills partner John Arthur are the two Australians in the hot seat inside the Singapore Telecommunications boardroom when it comes to fallout from the massive data breach at Optus.

These are some of the high-powered names advising SingTel about its now troubled Australian offshoot.

Optus represents the single biggest business for the $46bn SingTel and the breach could have major implications for the Asian telecom major. Apart from re-releasing Optus’ statement about the breach last Thursday night to the Singapore stock exchange, SingTel has remained silent.

It has a good reason to distance itself from Optus.

Financial fallout from the data hack hitting millions of current and former Australian customers will be felt for years, with the incident likely to raise doubts among Optus’ lucrative corporate clients around cyber security.

In the short term it couldn’t have come at a worse time with the release of the latest Apple iPhone this month and the new Samsung Z Fold 4 in August representing the most active period for all Australian telcos as they attempt to grab market share. The reputational hit stemming from the data breach is likely to see retail customers put Optus down the list of preferred carriers.

Optus’ Australian chief, Kelly Bayer Rosmarin, the former Commonwealth Bank executive, is the one in the firing line. And on Tuesday, she suggested the hack was a more sophisticated effort with measures in place to protect against data breaches. Bayer Rosmarin says the customer data was encrypted and there were “multiple layers” of protection.

As well as widespread political heat, federal Home Affairs Minister Claire O’Neil has said the current potential maximum fine of more than $2.2m for a breach on this scale was “totally inappropriate”.

Added to this, Optus now has the nation’s most powerful financial regulators – the Reserve Bank, APRA, Treasury and ASIC – monitoring the implications of the breach, along with the ACCC and the ATO. Banks have also been put on notice to review their cyber security planning and keep heightened monitoring of suspicious activity.

All this adds up to a big headache for long-time Optus-owner SingTel.

SingTel, which is 50 per cent owned by the Singapore Government’s investment arm, Temasek, is part way through a strategic reset program. A key part of this is doubling down on rolling out data centres for big corporate clients, including other telcos across Asia. It has facilities in Singapore, Indonesia and Thailand, and is looking to expand into Malaysia and Vietnam.

SingTel is positioning itself to become a regional tech services power, specialising on large business and government clients. As part of data warehouse services it is offering to manage IT systems and cyber security. Meanwhile, it operates consumer telco joint ventures in India and through Africa.

Gail Kelly, who retired from Westpac in 2015, is a member of the SingTel board and is chair of the Optus advisory committee. Arthur, another former top Westpac exec, also sits on the Optus advisory committee and is a board member. Both will be expected to update the entire SingTel board about details of the data breach.

It’s a high-powered committee with other Optus advisory members, including ANZ chairman Paul O’Sullivan, who is the Optus Australia chairman. Others on the SingTel advisory board are highly-connected director David Gonski and former ANZ chairman John Morschel.

Optus is seriously big business for SingTel. The Australian offshoot represents more than 54 per cent of group revenue and over 50 per cent of company-wide earnings based on the most recent earnings update.

Growth for Optus has been flat to low single digits after stripping out currency moves, and at least some of this momentum will take a hit in the coming quarter. That makes SingTel’s silence on the matter even more concerning.

johnstone@theaustralian.

com.au

Originally published as Does troubled Star have the leadership to fix its cultural mess?