No turning back as Origin Energy deal puts green energy in play

The challenge for Brookfield is to convince Origin’s customers it can deliver low cost and reliable electricity in the midst of an energy crisis.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Brookfield is seizing on the massive disruption underway in the energy market and is betting its long-term financial muscle will make it become a major force in Australia’s $500bn shift to green energy.

That’s play behind the monster $18.4bn takeover and carve-up of Origin Energy with the nation’s biggest electricity retailer already giving its early blessing to the Brookfield-led bid.

The Canadian fund giant has ambitions to fast-track the shift to green energy through Origin and has committed to an additional $20bn spending plan in coming years to power-up renewable generation and storage across Australia. The move comes just months after Brookfield teamed up tech billionaire Mike Cannon-Brookes for the since shelved bid for AGL.

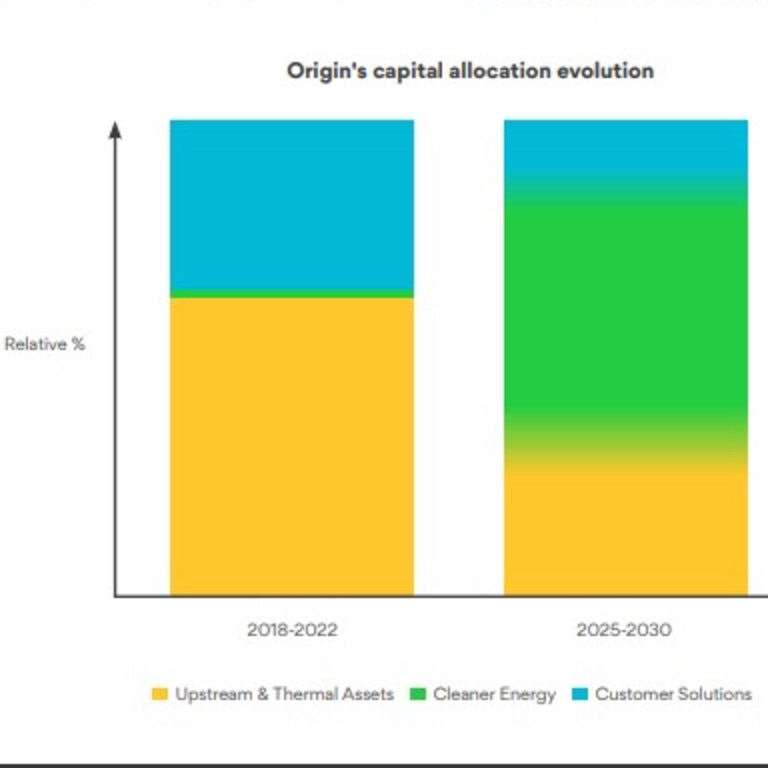

Brookfield’s Australian boss Stewart Upson says publicly listed companies like Origin – not matter how well run – only have limited capacity to spend huge sums of money needed for the renewables transition. At the same time they have limited ability to secure new investment given their legacy carbon emitting businesses such as coal or gas.

“The task in front of Australia in the world right now is so immense, it requires so much capital,” Upson says in an interview. “It’s very difficult for that amount of capital to efficiently come through the public markets, especially when you are a traditional dividend stock...and now you’re embarking on a capital heavy program, where you can’t really pay yield,” he says.

“In our view, these businesses are best in the private in private hands while this transition occurs, to fund it efficiently and then at some point in the future, when things stabilise it may make sense for some to be public,” he says.

To get where Australia needs to be in getting renewables in place to hit its net zero carbon targets will require multiple waves of investment over decades.

However, the immediate challenge for Brookfield which if successful, is to convince Origin’s four million customers as well as politicians it can deliver low cost and reliable electricity in the midst of a global energy crisis. Volatility across Australia’s creaking power grid is only going to be increase, particularly as aging coal-fired power stations are pulled from service.

Upson says what he can bring to the table is making the path to the transition “as smooth as possible”.

“(Origin) will now have the capital it needs to pursue the transition,” he said. “The end state of this transition is a green grid, which should result in the lowest cost power available to the community”.

Green split

The ambitious takeover stands to see the split of Origin between its electricity generation and retail business and its Queensland-based LNG-export operations.

This would see Origin’s massive LNG export exposure hived off to US energy investor MidOcean Energy, which is quickly becoming a key player in the Australian market through stakes in a portfolio of LNG assets including WA-based Gorgon, Ichthys and Pluto as well as Queensland’s Curtis LNG.

The spilt unwinds the integrated structure which for years Origin has insisted provided it with protection from the wild swings in the Australian electricity market.

The caveat is the acquisition still has some way to play out given it remains subject to due diligence and final agreement. The deal could also spur on interest from Australia’s big super funds, which are looking to double down their green energy exposure. Although it is more likely they will want to become co-investors alongside Brookfied in building renewables.

With more than $1 trillion in investments around the world, Brookfield is firmly aligned with Origin over a renewables transition including the planned closure of NSW’s Eraring power station.

Origin chief executive Frank Calabria has already done much of the heavy lifting for Brookfield when in February outlined plans to shut down Eraring, Australia’s biggest coal-fired power plant, by 2025.

This move got a cool reception in Canberra just as the then Morrison government was about to go to the polls, but Calabria was able to deftly prevent his company from being subject of an election battle.

Calabria is also nearing sign-off on a 700MW mega-battery storage project and has 1,600MW of renewable energy development projects planned. Of interest to Brookfield is Origin’s existing transmission connections directly into Australia’s backbone power grid at Eraring, which like slots at a busy airport are the biggest hurdle in getting green power to market.

And unlike the attempt on AGL, Brookfield is not buying Origin is not a beaten down business. Under Calabria it has a stable management team while a clean-up of the business including a selldown of some of its LNG exposure and Beetaloo Basin gas exploration holdings has won investor support.

Origin’s board led by Scott Perkins has quietly led talks in the background for three months and in the process has secured two sweeteners in the offer price to settle on $9 a share.

Sweetener

The structure departs from the usual private equity takeover pantomime where an indicative approach is rejected, leading to a drawn out public battle. There will be some questions why the talks weren’t disclosed by Origin, particularly as the pricing moved higher, but no doubt it came down to the confidential nature needed to secure a substantial headline offer price.

At $9.00 a share this takes pricing back to mid-2018 levels and compares to Origin’s shares closing at $5.81 on Wednesday. It is a 56 per cent premium to the three-month average share price when talks were taking place. Origin shares ended up 35 per cent at $7.83. The pricing gap highlights the regulatory uncertainty.

The low-profile talks of recent months are more suited to Brookfield’s style of keeping out of the spotlight until a deal is done. The intense scrutiny Brookfield drew when it joined forces with Cannon-Brookes in his since abandoned bid for AGL sat uncomfortably with the Canadian investment giant.

The takeover also introduces a new concept into Australian markets – a tick agreement. Widely used in the US, this sees the bidders hit with a financial penalty of 3 cents a share per month if they don’t get the deal done by the May 15 scheduled completion date. This puts the pressure on Brookfield to fast-track its own transition to Origin.

Lew’s Myer win

Myer’s boardroom led by JoAnne Stephenson will now have a decidedly different feel with Solomon Lew’s nominee securing a directors’ seat.

It was always going to come down to the wire but at Thursday’s annual meeting, former retail executive Terry McCartney secured a thumping win with 61 per cent support. Stephenson herself was up for re-election and got 56 per cent.

Going into the vote Myer’s board made no public recommendation on McCartney but influential proxy firms ISS and CGI Glass Lewis were recommending a vote against the former retail executive joining the board.

In the background Myer had been using a proxy solicitation firm urging every investor to vote which would have at least lengthened the odds of McCartney getting the required 50.1 per cent support needed.

Now with McCartney on board, Lew and Myer will play nice in the near term as they seek to build on the retail turnaround underway at the department store.

And by rejecting the unnecessary standstill conditions that Myer’s board had initially tried to place on Lew for a board seat, the billionaire is now free to add up to 3 per cent of Myer shares to his current holding every six months.

The boardroom addition of an experienced retail executive can only support shareholder returns. McCartney is a former general manager of Myer-Grace Bros who worked his way up from the shop floor. He has the backing of the nation’s most astute retailer Lew who has been a driving force behind Breville and his main retailing vehicle Premier Investments. Lew has serious skin in the game with a near 23 per cent holding in Myer and he will want to see that investment grow. But that stake also comes with responsibility, particularly when it comes to voting on so-called shareholder strikes.

McCartney, the former Myer-Grace Bros general manager, made the right noises about his reasons for wanting to join the board. In his speech to the annual meeting he outlined his retail credentials and wanted to work constructively with the current board. Nor does he want to change the rebuild strategy underway by Myer chief executive John King.

“I look forward to contributing alongside my fellow Myer directors to deliver value for all shareholders,” McCartney said on Thursday night.

johnstone@theaustralian.com.au

Originally published as No turning back as Origin Energy deal puts green energy in play