Myer will buy Just Jeans, Jay Jays, Portmans, Dotti and Jacqui E

Myer has launched its ambitious growth plans by buying a portfolio of fashion brands from Solomon Lew, with the former Coles Myer chairman and billionaire to return as a director of Myer upon the deal being done.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Myer will emerge as a new heavyweight in the fashion and apparel sector with annual sales of more than $4bn and more than 700 stores after agreeing to a deal to buy five fashion brands from Premier Investments for $864m, and that will also see billionaire Solomon Lew return to the board as a Myer director.

The 124-year old Myer, under the leadership of newly appointed executive chairman and former Qantas loyalty boss Olivia Wirth, has unveiled its bold and ambitious new strategy to broaden the traditional department store’s reach after negotiating with Mr Lew’s Premier Investments to buy Just Jeans, Jay Jays, Portmans, Dotti and Jacqui E.

The purchase of the Apparel Brands division owned by Premier Investments also comes as Mr Lew seeks to restructure his investment portfolio that will also see its high growth sleepwear fashion chain Peter Alexander demerged next year and listed as a standalone company.

Under a possible deal first revealed in June - and within weeks of Ms Wirth arriving at Myer - Myer will issue 890.5m new shares in itself to Mr Lew’s Premier Investments worth $863.78m based on Monday’s closing share price to pay for the five brands that sit within Premier’s retail apparel brands business unit. There will also be an $82m cash contribution from Premier Investments to Myer for the deal.

In addition, the Myer board will declare before completion a fully franked dividend of 2.5c per share to existing Myer shareholders, provided all conditions to the transaction have been satisfied.

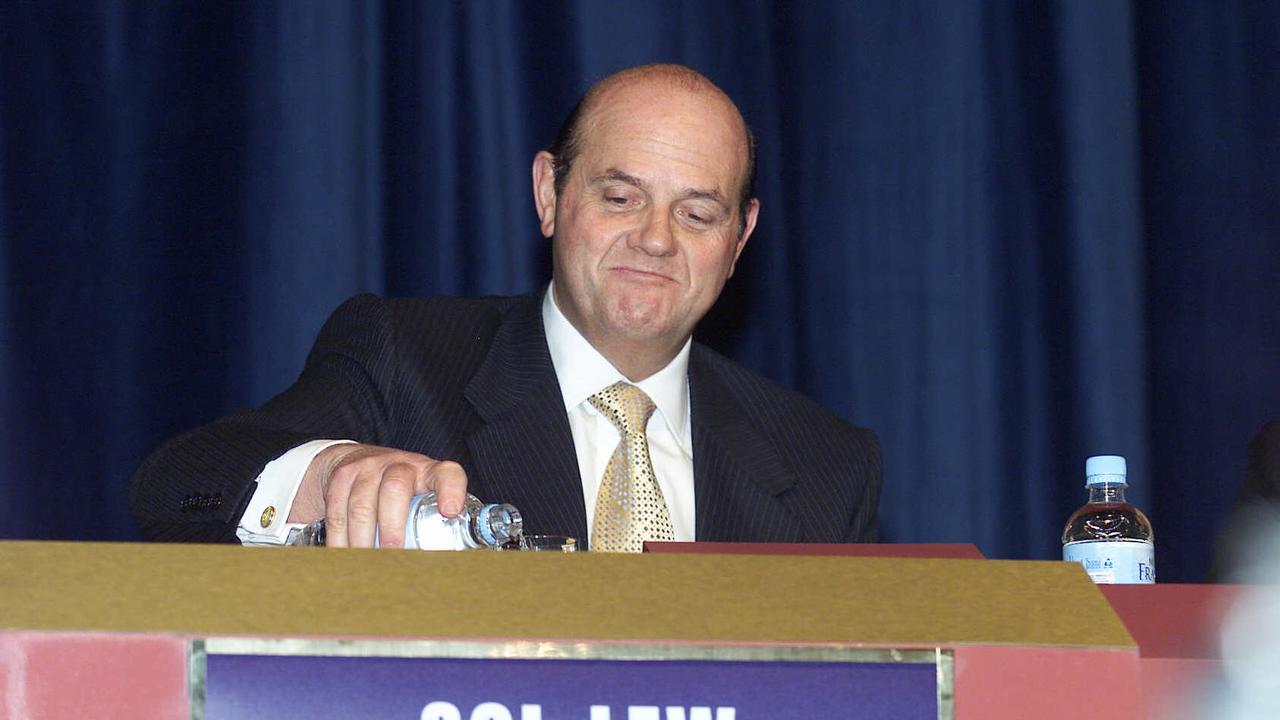

Realising a long held dream for Mr Lew, who is a former chairman of the old Coles Myer conglomerate, following the deal Premier Investments will distribute the Myer scrip to its shareholders - the largest of which is Mr Lew’s Century Plaza private company.

This will see Mr Lew emerge as Myer’s largest shareholder - replacing Premier Investments which currently is Myer’s largest investor - with the retail billionaire to have a 26.8 per cent personal stake in Myer and be invited to join the board.

He will sit alongside long-time business associate and friend Gary Weiss who is Myer’s deputy chairman and a former director of Premier Investments. Another Myer director, Terry McCartney, is also a former Premier Investments director.

Shares in both retailers surged on the news, with Premier Investments jumping 18 per cent to a record high of $36.20 in opening trade. Myer lifted 8 per cent to a seven-month high of $1.05.

Ms Wirth has been negotiating with Mr Lew’s Premier Investments since at least June to pull off the deal to buy its five fashion brands - Just Jeans, Jay Jays, Portmans, Dotti and Jacqui E - as part of her new strategy for the department store to grow beyond its traditional base and sink its teeth into other standalone fashion and apparel brands.

The acquisition will accelerate Myer’s key strategic priorities to create a leading Australian retail platform leveraging respective and complementary strengths of Myer and apparel brands, the company said on Tuesday. It is expected to deliver combination benefits of at least $30m earnings per annum on a run-rate basis over the short to medium term and deliver significant earnings per share accretion on a pro forma 2024 basis. The transaction is unanimously recommended by the Myer directors.

The deal will see Myer, which currently has 56 stores, expand to take in the 719 stores operated by the five Premier Investments fashion brands and lift its annual sales from $3.266bn to $4.057bn. Of the brands Myer is buying, Just Jeans is the largest with $294m in annual sales, Jay Jays has $164m in sales, Portmans sales of $145m, Dotti has sales of $112m and Jacqui E annual sales of $76m.

“The combination of Myer and Apparel Brands is transformational for our business,” Ms Wirth said on Tuesday.

“If approved by shareholders, it will create a leading retail group with more than 780 stores across Australia and New Zealand, with a large and highly engaged customer base and capital to fund future investment and growth.

“Myer and Apparel Brands have highly complementary store footprints and customers who will benefit from an expanded omni-channel ecosystem that enables them to engage with the Group’s loved brands when and how they want.”

Ms Wirth said the combination would also create significant opportunities to supercharge its leading Myer One loyalty program through greater reach, enriched data, enhanced cross-shop opportunities and increased personalisation to drive incremental sales growth. “The combined business will also be well positioned to take advantage of capabilities in product development, design, sourcing and distribution to realise the full potential of Myer’s Exclusive Brands and private label portfolio and deliver improved margins for the group.”

The deal is subject to a number of customary conditions, including Myer and Premier shareholders voting in favour of the transaction, Myer and Premier each obtaining the requisite ASIC and ASX confirmations and executed ancillary agreements. Subject to the satisfaction of these conditions, the transaction is expected to complete by early calendar 2025.

Myer shareholders will vote at an extraordinary general meeting in late January, as will Premier Investments shareholders, with the deal to be completed in early 2025.

Originally published as Myer will buy Just Jeans, Jay Jays, Portmans, Dotti and Jacqui E