More green hydrogen projects set to fall by wayside as economic realities bite

Australia’s high hopes of becoming a world leader in the field of renewable hydrogen and ammonia production face an acid test over the next 12 months.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

An industry insider has predicted many more of Australia’s renewable hydrogen and ammonia projects will fall away in 2025 as economic and technology realities take a heavy toll.

Charles Whitfield, chairman of industry minnow NH3 Clean Energy, said Australia’s high hopes to become a world leader in the field faced an acid test across the next 12 months.

The past year was marked by a long list of projects shutting and companies withdrawing from hydrogen and ammonia ventures.

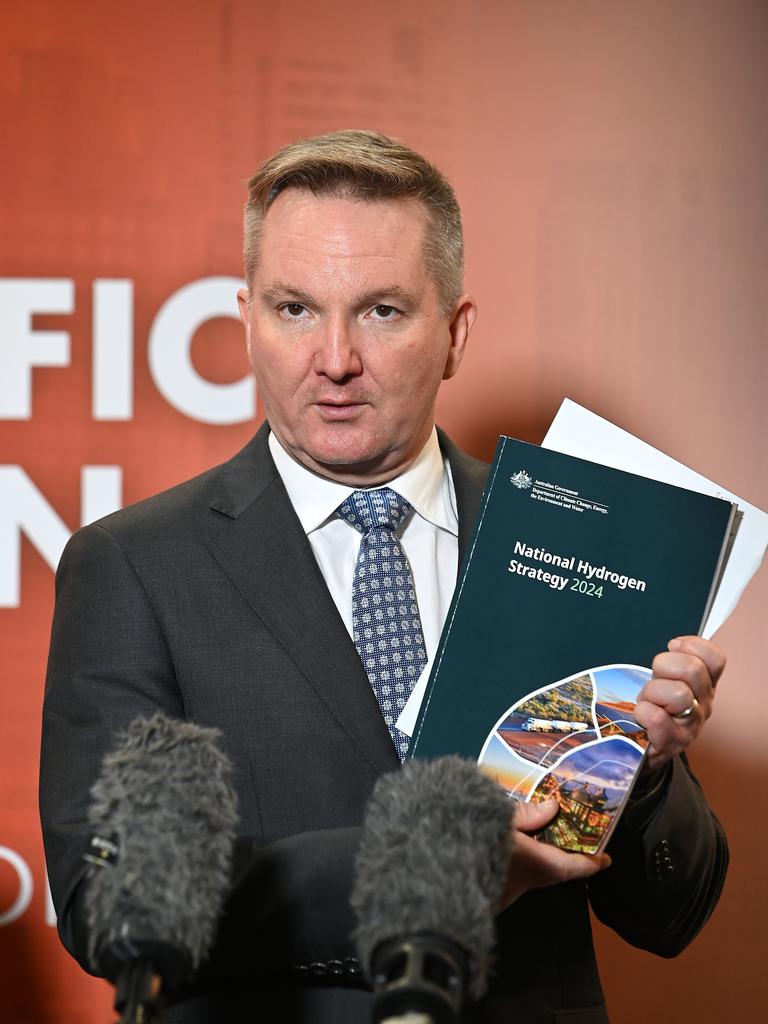

The exits came despite the Albanese government legislating a production tax incentive worth $2 per kilogram of renewable hydrogen produced from mid-2027 to mid-2040, and Climate Change and Energy Minister Chris Bowen’s heavy promotion of the industry.

In a reality check, Mr Whitfield said two years ago there were about 140 hydrogen projects being touted in Australia.

“In 2024, that number slashed with some of the highest profile projects falling foul of the brutal reality of economics and competitiveness,” he said. “No doubt the new year will see even more announcements as companies have to start to face the realities of the shortcomings of their project design.”

Many projects are labelled hydrogen by backers even though they aim to make ammonia, which is hydrogen and nitrogen.

Ammonia is easier to handle, store and transport, and often is what customers want for power generation and transport applications. Two pathways – the green and the blue – have emerged in ammonia production with debate raging over their economics and carbon reduction merits.

The electrolysis-based green method takes water and splits the hydrogen and oxygen. It is a winner on carbon emissions but consumes a lot of water and energy, and that makes it expensive.

The other method is to use natural gas to split the hydrogen, then capture the carbon and sequester it. It is considered cheaper and more scalable but not popular with those opposed to the use of fossil fuels.

The government did not prescribe which hydrogen production pathways would be eligible for tax credits but by setting the threshold to qualify of 0.6kg of carbon dioxide equivalent made clear it expected most production to come through electrolysis. A further eligibility requirement is that each production facility must have a minimum capacity equivalent to a 10 megawatt electrolyser.

The trouble is many projects that fell over or were shelved or delayed in 2024 were based on producing green ammonia/hydrogen.

The most notable setback came in July when Andrew Forrest-led Fortescue moved to shed 700 jobs across its emerging energy business and pulled back on the Gibson Island project in Queensland.

September claimed a string of victims, including Province Resources putting its HyEnergy green hydrogen and ammonia gas production facility near Carnarvon in Western Australia on “indefinite hold”.

Woodside Energy shelved two green hydrogen projects in Australia and New Zealand citing inadequate renewable energy generation capacity, revised environmental demands and challenging economics.

Origin withdrew from its electrolysis-based Hunter Valley Hydrogen Hub venture in October and soon afterwards Kansai Electric Power Co backed out of the C2-HQ green hydrogen project in Queensland citing high costs of production.

And in early December Kawasaki Heavy Industries withdrew from the Latrobe hydrogen project because of cost concerns.

Fortescue maintains it is committed to green hydrogen in Australia although the price of renewable energy remains a big hurdle, a situation it blames in part on subsidies for fossil fuels.

UBS estimated Fortescue needed to source electricity at $20 to $30 a megawatt hour – way below the prices being offered by solar and wind farm operators – to make the Gibson Island ammonia project viable.

Mr Whitfield, who worked at Citigroup and Deutsche Bank before becoming principal investment officer at Drumrock Capital, said the hydrogen and ammonia industry did have a bright future in Australia but for now it was probably blue and not green.

“The federal government seems to be walking a tightrope between backing economically viable low-emission blue projects and placating the uneconomic but renewable backed green projects,” he said.

NH3, led by former Woodside executive Stephen Hall, has pinned its hopes on blue and an ammonia project based near major oil and gas infrastructure in WA’s northwest.

It sees Japanese and South Korean power companies mandated by their governments to use ammonia as a substitute for coal in power stations as the most predictable markets.

More Coverage

Originally published as More green hydrogen projects set to fall by wayside as economic realities bite