‘A reality check’: Bitcoin slides 21 per cent below its peak

Predictions that Donald Trump’s presidency would make everyone rich are faltering, with another slide putting investors on edge.

Markets

Don't miss out on the headlines from Markets. Followed categories will be added to My News.

The cryptocurrency market is reeling after a sharp sell-off wiped out US$1.56 billion ($2.46 billion) over the past 24 hours.

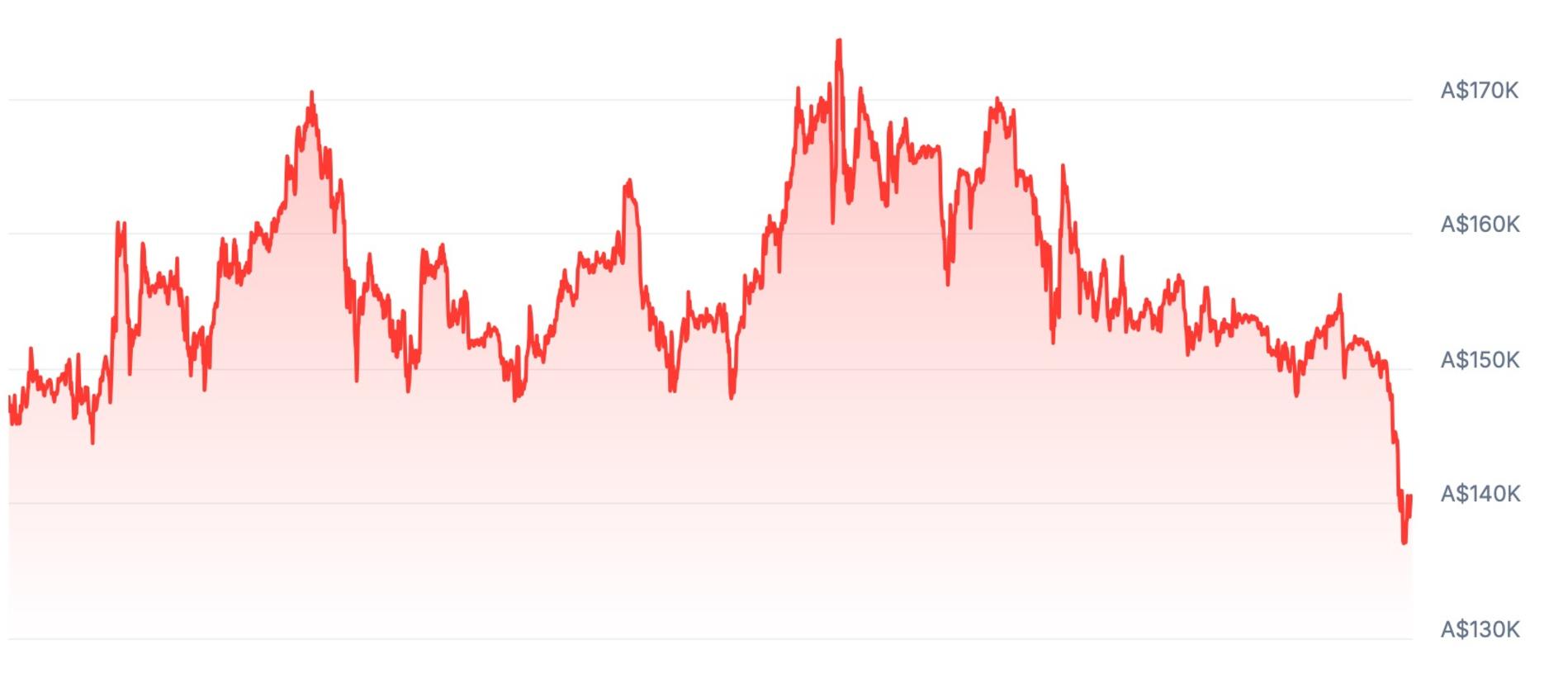

Bitcoin has taken a 7 per cent hit, dropping to US$86,000 (A$135,000) which now marks a 21 per cent slide from its all-time high of US$109,000.

Charlie Sherry, Head of Finance at BTC Markets, says the dip is “a reality check” for those who have jumped on the crypto train after massive successes in the market.

Bitcoin remains the world’s most popular cryptocurrency and is owned by millions of people across several demographics all over the world, meaning the asset is now tied to broader economic shifts similar to any other currency.

It’s been a turbulent week for the world and bitcoin has found itself caught in the tumble-dryer, according to cryptocurrency specialists.

Donald Trump’s win sent the polarising asset soaring, with some analysts claiming his second term could be the game-changing catalyst that propels it to a staggering $1 million.

But it’s suddenly not all going to plan.

Recent tensions over the controversial President’s sweeping tariffs forced a massive 3.16 billion on February 3rd alone with investors warned “we could be seeing the bottom”.

A critical support test for Bitcoin

Bitcoin is currently testing a critical support zone at US$86,000 as the market shakes. Holding this level is vital to maintaining the current market structure, according to Sherry.

“If buyers step in, we could be seeing the bottom, or at least a temporary relief bounce,” he said. “If not, we risk further downside.”

While confidence has been shaken, Sherry believes faith in crypto remains intact.

“Institutions are still buying, and regulatory clarity continues to improve,” he said. However, he cautioned that the market needs a stronger fundamental catalyst to regain its footing.

For now, the market is keeping a close eye on macroeconomic indicators, trade policy developments, and the potential for looser monetary policy as possible triggers for recovery.

‘Momentum faded’

The downturn isn’t isolated to solely crypto.

The broader market is also feeling the pinch, with the S&P 500 closing down 0.47 per cent and the tech-heavy Nasdaq sliding 1.24 per cent.

Sherry attributes the market-wide sell-off to a mix of macroeconomic uncertainty, excessive leverage, and a series of industry-specific setbacks, including high-profile security breaches and meme coin scams.

“Perhaps we ran too far, too fast,” Sherry said in a statement provided to news.com.au.

“Hopes for a pro-crypto Trump administration fuelled Bitcoin’s rally to all-time highs, but with no concrete policy follow-through, momentum faded.”

Wealth analyst’s advice for Aussies

Earlier in February, digital wealth analyst Sydel Sierra warned the 4.5 million Aussie crypto owners against panic selling at a loss.

“Zoom out – literally – is my advice,” the Digital Wealth Group founder said in a statement provided to news.com.au.

“When you zoom in on the charts over a 24 hour period, it’s quite daunting .. but if you zoom out, it’s a lot easier to see the macro cycles at work; as the saying goes: trust the process.

“A face melting bull market is imminent – hold your stance. It’s a pullback not a crash, in my opinion – I’m not worried, and I have a lot invested.”

“Go outside, don’t watch TV, don’t go online, don’t read the newspaper – if you do, you’ll worry yourself sick.”

Originally published as ‘A reality check’: Bitcoin slides 21 per cent below its peak