Stockmarket to edge higher but investors nervously await inflation data

The ASX is poised to open marginally higher when trading resumes on Tuesday, though investors remain wary as they await data expected to shape Australia’s monetary policy.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The ASX is poised to open marginally higher when trading resumes on Tuesday, though investors remain wary as they await data expected to shape Australia’s monetary policy.

Global equity markets have rallied in recent days as US President Donald Trump moves quickly to stimulate the economy, underpinning ASX gains.

That momentum is set to continue in early trading, though investors said the market ultimately would be swayed by the next inflation read. The Bureau of Statistics will release inflation for the three months to December 31 on Thursday.

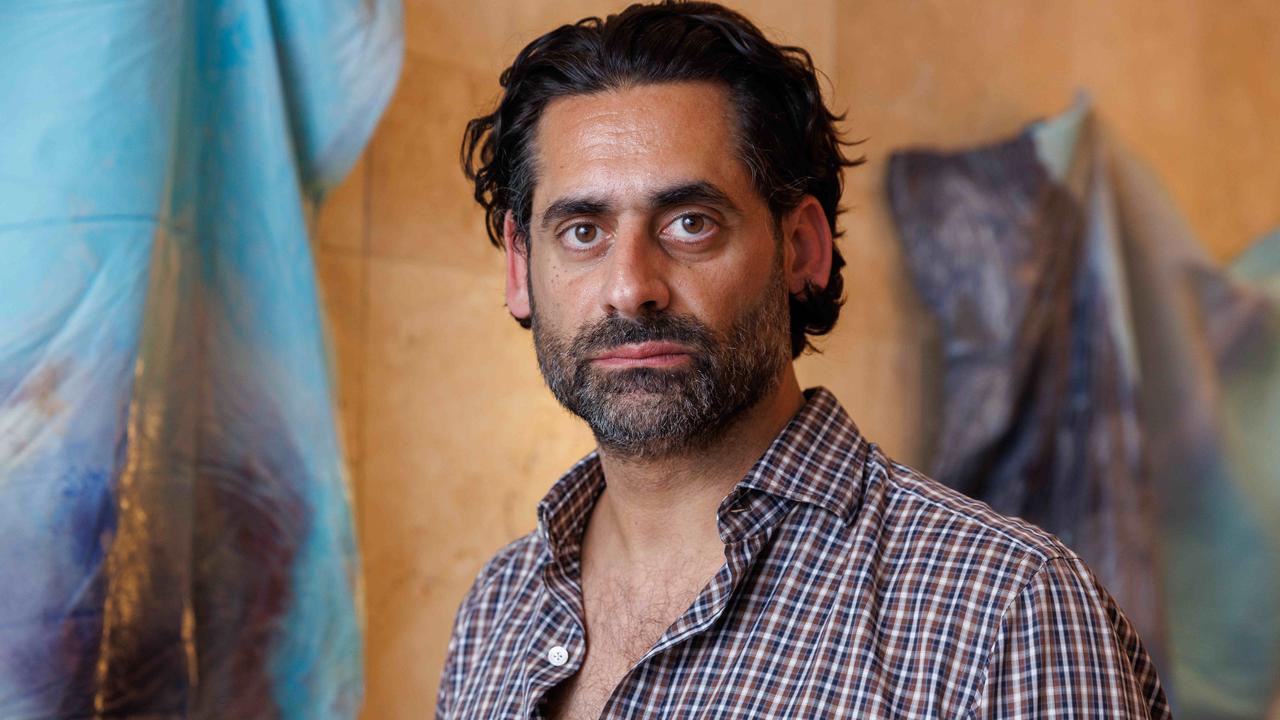

Shane Oliver, head of investment strategy and chief economist at AMP, said the reading would probably determine whether the Reserve Bank begins its own easing cycle.

“Our view remains that if trimmed mean inflation comes in at 0.6 per cent quarter on quarter or less, as we expect, against implied RBA expectations for a 0.7 per cent quarter-on-quarter rise, it will be very hard for the RBA not to cut in February, and the softer Australian dollar and still strong jobs market should not be barriers,” Dr Oliver said.

The Australian bond market has prescribed a more than 60 per cent chance of a rate cut next month, though other investors insist the central bank could and perhaps should wait.

Should the inflation rate overshoot market expectations, the ASX is likely to fall, while the dollar will rise as traders rapidly move to reposition for later interest rate cuts.

The RBA is under pressure to cut interest rates as consumer spending wanes, though proponents of waiting for easing monetary policy insist cutting rates when unemployment remains historically low risks stoking inflation.

But with inflation expected to be confirmed back in the target band, the RBA will struggle to convince voters that it will be prudent to wait. A critical justification highlighted by the RBA is what it deems an artificial fall in inflation. It cites government moves to offer electricity rebates to households as a temporary measure that once removed will see inflation lift again.

The government is widely expected to extend the electricity rebate scheme for a further year, a policy that would probably give little cover for the RBA to justify tight monetary policy.

Australia is also under pressure to join the global monetary policy easing cycle, with peers such as the US, Canada and the UK all well under way in reducing interest rates.

Market sentiment about further interest rate cuts globally was bolstered last week when data showed slowing inflation in Canada and New Zealand – though both have taken a much harder line in raising interest rates to more restrictive levels.

The buoyant mood across global markets is expected to continue as Mr Trump implements his plan to lower inflation and ease cost-of-living pressures.

But analysts have noted the threat of a global trade war as a potential headwind for markets.

Meanwhile, the US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation.

The Fed cut its key lending rate by a full percentage point in the last four months of 2024 and indicated it would move more cautiously amid an uptick in inflation away from its long-term target of 2 per cent.

“I think they will do nothing, and I think they should do nothing,” said Jim Bullard, the long-serving former president of the St Louis Fed. “I think the committee’s in very good shape.”

Additional reporting: AFP

More Coverage

Originally published as Stockmarket to edge higher but investors nervously await inflation data