Location tracking company Life360 IPOs at $US27 per share seeking more ‘recognition’

Millennial parents are part of the driving force behind the location tracking app’s recent growth.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

One of the world’s next big commodities is location.

At least, that’s the view of Life360 chief executive Chris Hull, who is building an empire based on services and subscriptions tied to the real-time locations of its customers.

The business is beginning to boom, with its products, including location tracking devices, now boasting 66.4 million active users – and, more importantly for investors, 1.9 million of them who pay.

Last year, Life360 brought in $US220.8m from subscription revenue, up about 44 per cent year on year.

“Well, it’s just so practical,” Mr Hull tells The Weekend Australian when asked why he believed location services were growing so fast.

“We’re running a live feed of your family and so all these things that used to require effort or produced anxiety are just gone with Life360,” he said.

The San Francisco-based Life360 had managed to capitalise on the growing trend of tracking your belongings, once limited to third-party tracking devices but now being built into consumer electronics from ear buds to smartphones, laptops, wallets, vehicles, electric scooters and eBikes.

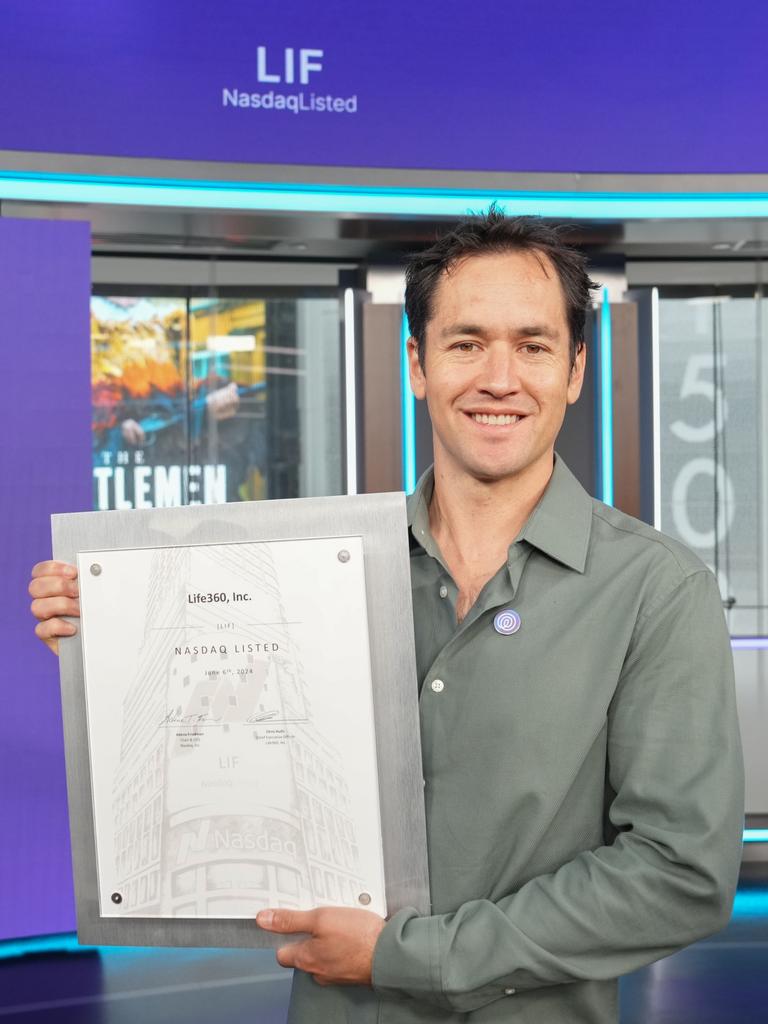

Now it is banking on a new cohort of investors to help the company grow. On Thursday (Friday local time), it completed a dual listing, going live on the NASDAQ with an IPO price of $US27 ($40.49) a share.

The listing arrives five years after Life360 became a publicly traded company in Australia, where its local share price sank near 7 per cent on Friday to $13.68.

Life360, which has a market capitalisation of $US2.1bn ($3.2bn), is looking to raise at least $US100m from its IPO offering as it looks to move 5.75 million shares. The company also has a provision for 862,500 shares, known as a greenshoe, that can be sold for up to for 30 days after the IPO.

The US listing was a natural step as the company looks to gain credibility , Mr Hull said. “What I am hoping is that we start getting a lot of recognition that is warranted for our scale.”

“A lot of the reason that we wanted to come back to the US was that we are a very ambitious company. We want to hire the best and the brightest,” he said.

Many of Australia’s most successful tech companies have chosen a US listing when they decide to become publicly traded. That was the case for Atlassian, with design giant Canva expected to list in the US from 2025.

“A lot of what we’re trying to do is get more hiring in and get more recognition and have more credibility with partners and being on a US exchange is very helpful for that,” Mr Hull said.

The company also wanted to demonstrate that its initial listing in Australia wasn’t a growth limiter. “We’re trying to demonstrate there’s no strings attached to Life360. We often have to explain away the ASX listing … people get it when we do,” he said.

While Life360s rise to fame is very much recent, the company was founded 16 years ago on the back of a natural disaster. Its first prototype was a connectivity app built for Android devices to reconnect families after Hurricane Katrina hit in 2008. “It was very niche at the time and when we built the prototype, there were no third-party apps on iPhone,” Mr Hull said.

“Our one and only pivot was in those early days (when we thought) maybe this was the way to bring family’s digital in the same way Facebook brought friends digital and LinkedIn brought professionals digital … we can be the hub for the family.

“A kind of flash went off. Like, hey we think we’re onto something a whole lot bigger here because we just saw the power of knowing where someone is … that actually had real value. We also quickly realised that with your safety when you’re out of sight, you’re out of your mind you need and people need that ongoing engagement,” he said

Millennials are part of the driving force behind its recent growth, as are Gen Z, whose upbringing in a largely online world means they view privacy differently.

“We were not an overnight success, and a lot of it was to do with the A) the tech just wasn’t ready and B) attitudes toward location sharing,” Mr Hull said.

“It’s really millennial families driving our growth because it’s the first generation where you don’t have to explain to them why they should use Life360, and then even younger Generations just don’t mind sharing location.”

The company is also placing a big bet on pets, much like one of its competitors Samsung which has a designated pet mode for its SmartTag.

“We are going to have a dedicated pet tracker that’s going to come out a year from now,” Mr Hull said. The company was also making its Tiles programable and developing an SOS button which integrates with other subscription services including one that acts as a middleman between a user and emergency services.

Pet tracking devices are part of a shift in the location tracing market, with people often having little to no concern about companies being able to see the live or recent location of their pets.

Life360 shares have grown significantly on the ASX over the past few months after the company reported a 33 per cent jump in revenue, reaching $US305m in the 12 months to December 31 last year. Despite this, it still recorded a $US28.2m loss.

Speaking to The Weekend Australian after Life360’s first day of trading in the US, Mr Hull said he hadn’t kept an eye on the share price at all. “We were watching the price up until the listing because that’s when it actually mattered … I honestly don’t even know where we’re closed, to be honest,” he said.

Thursday was more of a celebration for Life360, Mr Hull said. “Today’s the easy day. The deal got done essentially yesterday but it’s been a month-long slog of going through the process so today was more of a celebration.”

Its shares opened at $US26, reached a high of $US27.50 and later closed at $US27.

In Australia the company has a little over 2 million users, with the Life360 app the 15th most popular in the Apple app store.

The total global addressable market of tracking devices is worth some $75 billion. Other opportunities lay within the insurance sector, care for the elderly and advertising.

Life360’s FY24 guidance expects revenue in the range of $US365m-$US375m and adjusted earnings of $US30m-$US35m.

Goldman Sachs, Evercore ISI and UBS are act as joint book running managers for the IPO.

Originally published as Location tracking company Life360 IPOs at $US27 per share seeking more ‘recognition’