KPMG warns disaster ripples in reinsurance market will fuel double-digit price rises next year

The nation’s insurers are expected to continue slugging customers with large premium rises despite more than a year of breakneck increases.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The nation’s insurers are expected to continue slugging customers with double-digit premium rises despite more than a year of breakneck increases as continued losses in key categories blight balance sheets.

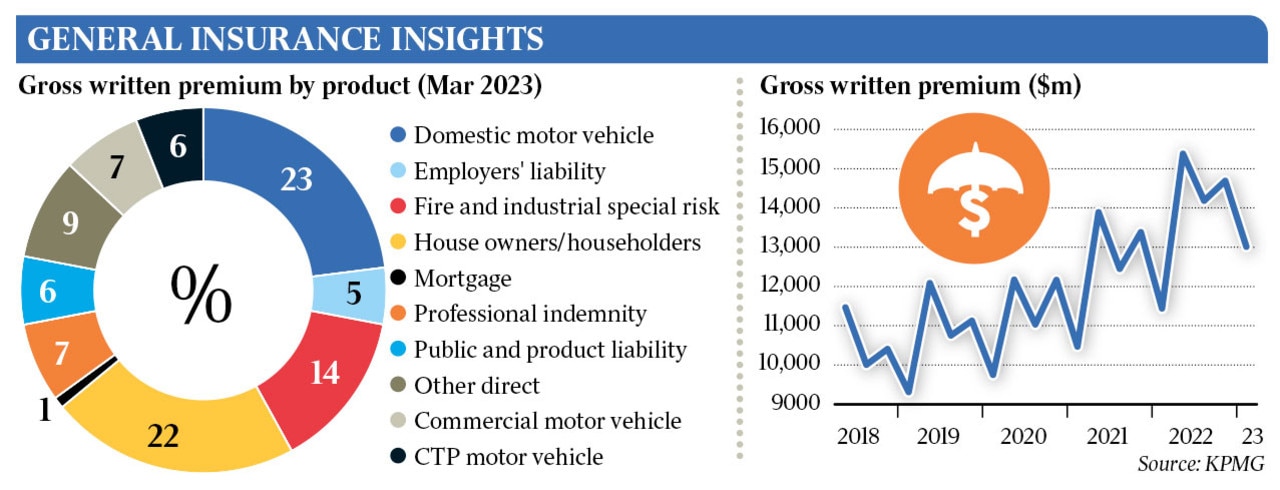

The latest quarterly update on the insurance sector by KPMG has revealed gross written premium surged 10.2 per cent in the 12 months to March.

Underwriting profits also rose in the period, up 12.4 per cent to $5.3bn, according to KPMG’s analysis.

But this was offset by net claims costs, which topped $9.17bn for the March quarter, 20.4 per cent higher than December quarter and 36.5 per cent higher than March last year.

KPMG insurance partner Scott Guse said premiums were likely to continue to rise, warning customers faced at least 10 per cent premium increases in the coming year.

“I can’t see any change in premium increases – the current trend will only continue,” he said.

KPMG found premiums in commercial lines, particularly in property and motor, were up by an overall 11.5 per cent.

But commercial profitability was supported by a sugar hit from the unwinding of pandemic provisions.

Fire and industrial special risks returns jumped from $359m last year to $1.95bn in the year to March.

“This increase in underwriting profit has primarily been due to the release of reserves for business interruption by insurers following recent court decisions on policy wordings for pandemic exclusions, and also as a result of premium increases,” KPMG said.

Mr Guse said despite the overall rosy profitability numbers, key sections of the insurance market remained challenged, with motor and home losses ballooning.

Insurers made a $321m loss on homeowner policies and a $275m loss on household insurance in the year to March. Motor profitability sagged to $408m in the year to March, down from $688m in the previous year.

“Home and motor are not doing well,” Mr Guse said.

He said insurers wrote around $12bn in home policies and a $321m loss was “not sustainable”.

“Insurers have been passing on at least 10 per cent increases and still making losses. That means there’s a lot of cost increases out there in the market, “ he said.

“You’re seeing a huge inflationary increase coming through. You’re also seeing significant increases in reinsurance costs.”

Reinsurance is purchased by major insurers to cover losses in excess of certain amounts for major disasters and to protect balance sheets. Mr Guse said reinsurers had historically underpriced cover offered to insurers but recent market movements showed this was shifting, leading to much higher costs for insurers and customers.

IAG, which operates brands RACV, NRMA and CGU, announced on Friday it had secured aggregate and third and fourth event reinsurance cover, but the insurer will have to wear more costs before its cover kicks in.

IAG’s excess has been dialled up to $600m, from a previous $500m limit. Its update only adds cover capped at $200m, after first suffering $50m in losses per event.

Suncorp last week also signed new reinsurance arrangements, increasing its maximum retention to $350m from $250m last year.

Retention on events in Australia was also upped to $150m from the $100m limit last year.

Mr Guse said reinsurance was raising costs for insurers but this was being passed on to customers.

“The good thing is the industry is passing on pricing increases,” he said. “Customers will complain but they’re paying them, they’re not chopping and changing their insurers.”

UBS analyst Scott Russell said Suncorp was facing a higher frequency of small natural catastrophes, but it was moving to reprice its policies to meet a 10-12 per cent margin on its insurance cover.

In a note to investors, Macquarie said QBE was likely to see a 10.6 per cent increase in gross written premium in the second quarter, with growth running at 9.4 per cent for the year.

Mr Guse said although customers were showing a willingness to take up insurance, there was a risk in how much pain the market could take.

“Insurers are saying it’s a no-win situation if we continue down this path,” he said.

“The biggest focus for insurers in the long term is obviously climate change. The biggest thing they can do is push the government hard on disaster resilience.”

Federal and state governments have set aside $400m to bankroll disaster prevention and resilience measures through a Disaster Ready Fund, aiming to fund projects to reduce the impact of extreme weather.

The 2022 floods that trashed the NSW Northern Rivers region and southeast Queensland cost insurers $5.65bn, with much of that passed on to reinsurers.

Insurance Council of Australia chief executive Andrew Hall said the string of disasters was increasingly challenging for insurers.

He said Australia had historically benefited from several decades of good reinsurance markets, but the country was now faced with a worsening insurance environment, both at home and overseas.

Losses from natural disasters have ballooned in Europe and North America.

“We’ve got to present a better risk story,” he said.

Mr Hall said “the ICA tries not to hold a crystal ball” to future insurance pricing, but warned unless more was done to improve mitigation and resilience pricing risked worsening.

“The issue globally is real when you combine the loses we’ve had here with the hurricanes and wildfires, it has lessened the appetite globally to put capital into reinsurers and that’s making insurance more expensive,” he said.

More Coverage

Originally published as KPMG warns disaster ripples in reinsurance market will fuel double-digit price rises next year