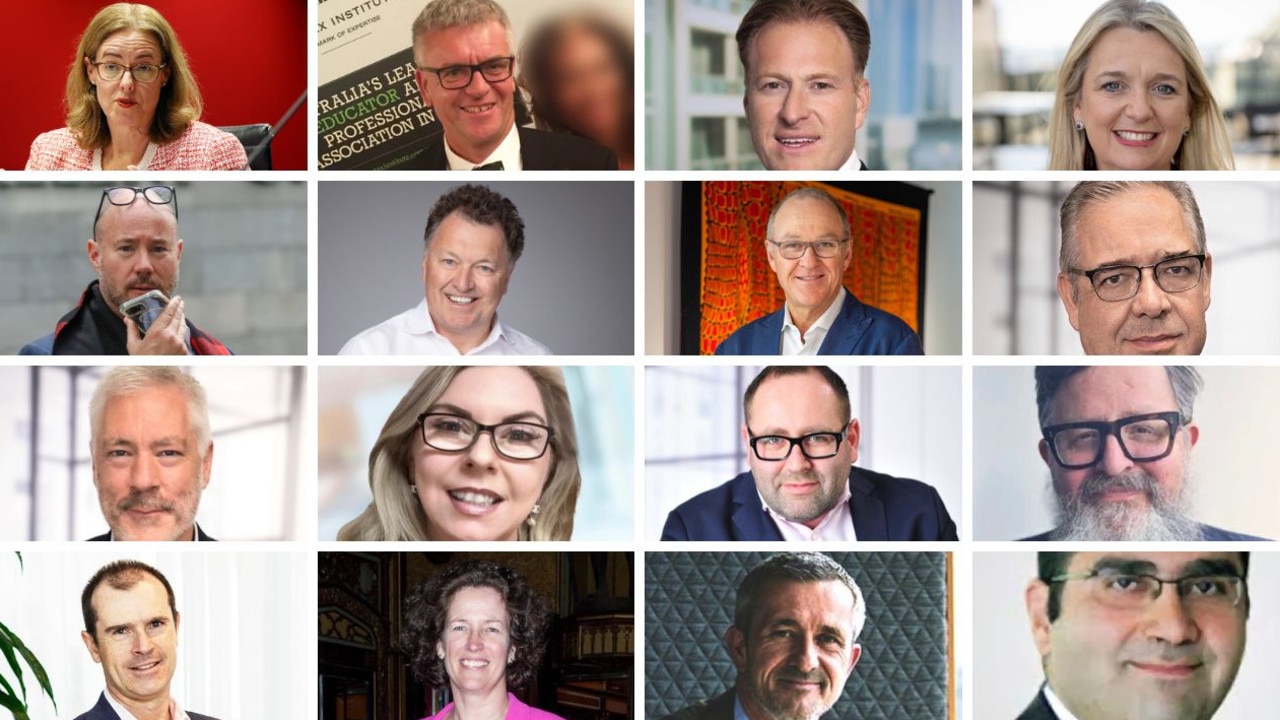

Key players in the PwC Australia tax advice scandal

It’s dominated the headlines for months, with the still-unfolding tax advice scandal at consultancy firm PwC already claiming several big scalps. Here are the key players.

The still-unfolding tax advice scandal at consultancy firm PwC has already claimed several scalps and sparked several investigations.

PwC has faced months of criticism after it was revealed confidential tax briefings were shared with many members of the firm by its former head of international tax, Peter Collins.

PwC used these briefings to sell strategies to clients to attempt to minimise their tax.

A Senate inquiry found PwC engaged in “a calculated breach of trust” and “deliberate strategy over many years to cover up the breach of confidentiality and the plan by PwC personnel to monetise it”.

Here are the key players whose names have been drawn into the scandal or mentioned during the fallout, although only a few have been named by PwC as being involved in the confidentiality breach.

Peter Collins

Former PwC Australia tax partner and its former head of international tax, who is at the centre of the scandal. Mr Collins and PwC have been formally referred to the AFP by Treasury. Mr Collins was one of four former partners that PwC named in June as being involved in the confidentiality breaches. According to the Senate report, Mr Collins received confidential information from Treasury consultations and his engagement with the Board of Taxation from 2013 to 2016 that he shared with PwC partners and others. He left PwC in October 2022.

Michael Bersten

Former PwC Australia tax partner, who was one of four former partners named by PwC in June as being involved in the confidentiality breaches. Mr Bersten denies the allegations. He was a tax and legal partner at PwC from 2004 to 2018.

Kevin Burrowes

PwC Australia’s new CEO. The accounting veteran was previously based in Singapore as PwC Network’s global clients and industries leader. He moved to Australia in July to take up the CEO position.

Pete Calleja

Former PwC Australia partner in its financial advisory business who was removed in July. PwC said Mr Calleja and Sean Gregory failed to “adequately exercise their leadership or governance responsibilities to prevent these actions or to address the deficiencies in culture at the firm or hold others accountable for their behaviours”.

Paddy Carney

PwC Australia governance board risk chairman who stepped down from the role in May.

Neil Fuller

Former PwC Australia tax partner, who was one of the four former partners that PwC in June said were involved in the confidentiality breaches.

Richard Gregg

PwC Australia partner who is suing the firm to stop his removal as a partner. PwC in July named him one of eight partners to be removed. PwC said he was being removed for “similar reasons” as for partners Eddy Moussa and Peter Kondaris, who the firm claimed “failed to meet their professional responsibilities”. Eligible former PwC partners are reportedly paid on average about $140,000 in annual partner retirement benefits.

Sean Gregory

Former PwC Australia partner in its deals and private equity business who was removed in July. PwC said Mr Gregory and Pete Calleja failed to “adequately exercise their leadership or governance responsibilities to prevent these actions or to address the deficiencies in culture at the firm or hold others accountable for their behaviours”.

Tracey Kennair

PwC Australia chair, who stepped down from the role in May. She became the first female chair of the board of partners in July 2022.

Anthony Klein

Retired from PwC Australia in 2021. The former PwC partner resigned from the Board of Taxation in July.

Peter Konidaris

Former PwC Australia partner who was removed as a partner in July. PwC said Mr Konidaris and Eddy Moussa’s actions “failed to meet their professional responsibilities”. He was most recently the managing partner in charge of PwC’s government, health, infrastructure and defence business.

Paul McNab

Former PwC Australia partner who was also named by PwC as being involved in the confidentiality breaches. Mr McNab denied he breached confidentiality and said he was not involved in any Treasury consultations where confidential information was discussed.

Bob Moritz

Global chairman of PwC. Mr Moritz intervened in the scandal involving PwC’s Australian arm in June, saying PwC Australia’s “past actions are not representative of the work and behaviours of PwC around the world”.

Eddy Moussa

Former PwC Australia tax partner who was removed as a partner in July. PwC said Mr Moussa and Peter Konidaris’ actions “failed to meet their professional responsibilities”.

Tracey Murray

A former PwC Australia director who established the firm’s transfer pricing practice at its Brisbane office. She told the Senate’s PwC inquiry that “the highest-earning partners were almost bulletproof” at PwC.

Wayne Plummer

Former PwC Australia corporate tax partner who was one of the eight partners removed following PwC’s internal investigation. PwC said he was being removed as partner for “similar reasons” to partners Pete Calleja and Sean Gregory, who the firm claimed failed to adequately exercise their leadership or governance responsibilities.

Luke Sayers

Former PwC Australia CEO who was in the top job at the time of the scandal. Mr Sayers denied being aware of the confidentiality issues within PwC’s international tax practice. He was CEO for eight years, from 2012 to 2020.

Tom Seymour

PwC Australia’s former chief executive was pushed out of the company in early July after a 21-year career at the firm. Mr Seymour was head of tax at the time of the leaks. He stood down as CEO in May after three years in the position, and had planned to retire in September. PwC said he was being removed as partner for “similar reasons” to partners Pete Calleja and Sean Gregory, who the firm claimed failed to adequately exercise their leadership or governance responsibilities. Evidence at a Senate inquiry into consultancy firms showed Mr Seymour was the highest paid chief executive in the sector, taking home more than $4.6m in the 2021-22 financial year.

Kristin Stubbins

Former PwC Australia acting CEO. Ms Stubbins, PwC’s assurance leader, became acting CEO after Tom Seymour stepped down from the position in May. She will remain as acting CEO until new CEO Kevin Burrowes relocates to Australia.

Peter van Dongen

Former PwC Australia chairman and partner, who was one of the eight partners removed following PwC’s internal investigation. PwC said he was being removed as partner for “similar reasons” to partners Pete Calleja and Sean Gregory, who the firm claimed failed to adequately exercise their leadership or governance responsibilities. Mr van Dongen was chair of PwC from July 2018 until 2022.

Originally published as Key players in the PwC Australia tax advice scandal