Is the national energy market ready for Dan Andrews 3.0?

The Victorian premier will use his third term to play a bigger role than ever in shaping national energy policy.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Beyond the political implications of Dan Andrews’ Labor government being swept back into power in Victoria, get ready for another bumpy ride for the nation’s energy market as the state accelerates its green push.

The Victorian premier and his government will play a bigger role than ever in shaping the national electricity market which will be felt beyond their borders. It could see other states wanting to reassert more control over their own energy infrastructure in response.

Indeed, the campaign slogan from the Andrews team was “doing what matters – for Victoria”.

This will further test the ability for national regulators including AEMO to steer the ageing grid through to 2030 interim net zero targets and beyond which is already going to make for a tough transition for power markets.

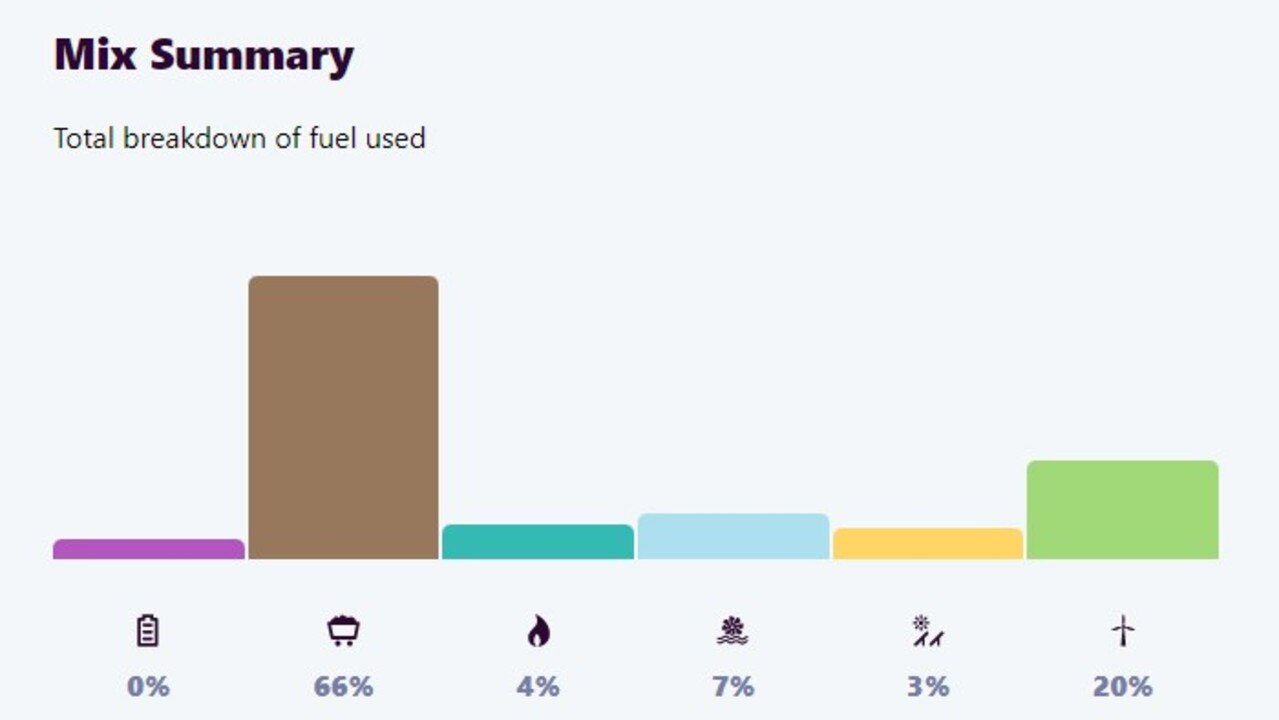

During the campaign Andrews promised to legislate Victoria will essentially exit coal by 2035, with the grid to be 95 per cent powered by renewables and battery back-up. That happens to be the same year that AGL independently committed to bring forward the closure of its massive brown coal-fired Loy Yang A plant in Victoria’s Latrobe Valley. Even so, it’s an ambitious plan given that two-thirds of the state’s energy output currently comes from coal.

Much of this will be built around Andrews’ centrepiece $1bn policy to re-establish the State Electricity Commission of Victoria, or SEC, to design and build new renewable energy generation projects from the ground up. Andrews promised to add a legislative break to prevent the rebooted SEC from being sold.

This will seek minority co-investors, expected to be industry funds, or state backed investment funds, to develop and own energy generation assets. All this in a little over a decade. This comes as players such as AGL are already moving in that space. AGL is seeking to invest billions in renewables, while Origin Energy suitor Brookfield has committed a $20bn spend although expect the bulk of this in NSW. Victoria has historically been a net exporter of electricity, but this will be reversed if the state can’t get enough replacement on-stream, this will reverse the trend adding to demand on the grid.

With another four years worth of political runway ahead of him, Andrews will use his third and likely final — term as premier – to exert influence on energy policy on the national stage.

In his first interview following Saturday’s election win, Andrews seized on the politics of energy, putting pressure on his national Labor colleagues to reserve gas for the use of Australians over exporters. He avoided the issue of Victoria’s own constitutional ban on onshore unconventional gas exploration, and lack of proven or probable onshore gas reserves.

Most of the gas from the ageing Gippsland Basin Joint Venture is used to supply the south eastern Australian market, with gas from fracking across Queensland sent to LNG export markets.

Andrews says he has been talking with Prime Minister Anthony Albanese on a gas reservation policy or some other pricing mechanism. Andrews said he would like a state-based reservation program if he could but is constitutionally prevented from doing so.

“Our gas for our businesses and our households,” Andrews told ABC’s Insiders, saying energy companies were forcing Australians to pay “terrible” European prices. “What we don’t need is to export that to the world to get the best price you can”.

He added the Albanese government has a coherent energy policy around renewables after nine years of multiple coalition governments.

By the time Victoria’s Labor government faces the electorate again in 2026 – with or without Andrews as leader – the path to the state’s rapid green energy shift will be even steeper.

Green arms race

Three Australian-listed companies last month received nearly $760m in grants from Washington to help fund hi-tech processing of raw materials.

The funding boost is likely to be the first round in a series of the hundreds of billions starting to flow in America’s massive green energy program aimed at slashing carbon emissions.

The funds went to Piedmont Lithium ($210m); Trevor St Baker’s batteries minerals play Novonix ($222m); and Syrah Resources ($325m) as each look to advance a processing or manufacturing of minerals in the US which will underpin the surge in renewable energy. Even the world’s biggest miner, BHP, is eyeing the evolving opportunities that Washington’s green subsidies program will bring.

Joe Biden’s $US369bn ($546bn) Inflation Reduction Act is now creating an intense pull for investors, resources and even talent. Which means countries such as Australia face being left behind — simply digging up raw materials and potentially losing out on valuable downstream processing opportunities to capture the broader economic benefits from the green energy boom. There is growing anxiety in Europe about missing out on investment in green technology as momentum gathers in the US.

Biden’s centrepiece program is designed to slash carbon emissions as it deploys billions in tax credits, cheap loans and grants designed to spur on businesses making hi-tech parts for electric vehicles and wind turbines and even develop green hydrogen.

BHP and Rio Tinto are eyeing a boost that could at least see the program help to fast track the giant Resolution Copper mine they are hoping to develop deep below the surface of Arizona. The project, which could supply as much a quarter of US copper demand, has stalled on environmental concerns. But BHP is banking on Biden’s Inflation Reduction Act helping to unlock parts of the mega critical minerals project.

Ampol chief executive Matt Haliday is one of the 48 members of the Australian Climate Leaders Coalition, and points out any biofuel feedstock produced in Australia today will leave the country largely because of the generous subsidies available in the US.

“That critical resource that means bio fuels can’t be manufactured domestically at the moment. On top of the existing California support for biofuels, the Inflation Reduction Act sits on top and it makes it a highly attractive market for that feedstock,” he said in an interview.

“Biofuels for aviation or heavy transport are a really important part of the decarbonisation solution, but without policy support Australia is not going to get many projects up”.

NSW Treasurer Matt Kean told The Australian’s and PWC’s Critical Minerals Summit the Inflation Reduction Act has been a game changer for investment flows.

“There is a global arms race underway to attract investment and we don’t have policies in place that give investors confidence when it comes to climate change, for example, that capital will go elsewhere,” he says.

Federal Treasurer Jim Chalmers told the same conference economic and strategic opportunities of critical minerals was front of mind and work was underway to develop a national strategy for the sector. He sees more than 50,000 jobs out to 2050, before we capitalise on the downstream opportunities.

Canberra and state governments won’t win the subsidies arms race against the US or Europe, but they can certainly use their strategic influence to help companies win critical contracts and set good policy while having the conditions around, including training skills and flexible labour.

Wesfarmers for one is taking the risk, going all in with a nearly $1bn bet as part of the Mt Holland lithium venture. It hopes to have a long life mine, concentrator and refinery ready to produce high grade lithium hydroxide all based in Western Australia by 2024. The lithium will be used in EV battery production and the venture has already signed up Tesla for an offtake agreement.

Wesfarmers and its partner SQM are already reviewing an expansion of the mine and concentrator, based on elevated demand even before the original mine has come onstream. The venture is even eyeing a move into EV battery production in Australia.

johnstone@theaustralian.com.au

Originally published as Is the national energy market ready for Dan Andrews 3.0?