Inheritance planning has never been more important

Creating your inheritance no longer depends solely on a will. Super and family trusts must also be considered along with getting it right — otherwise a legal goldmine awaits.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

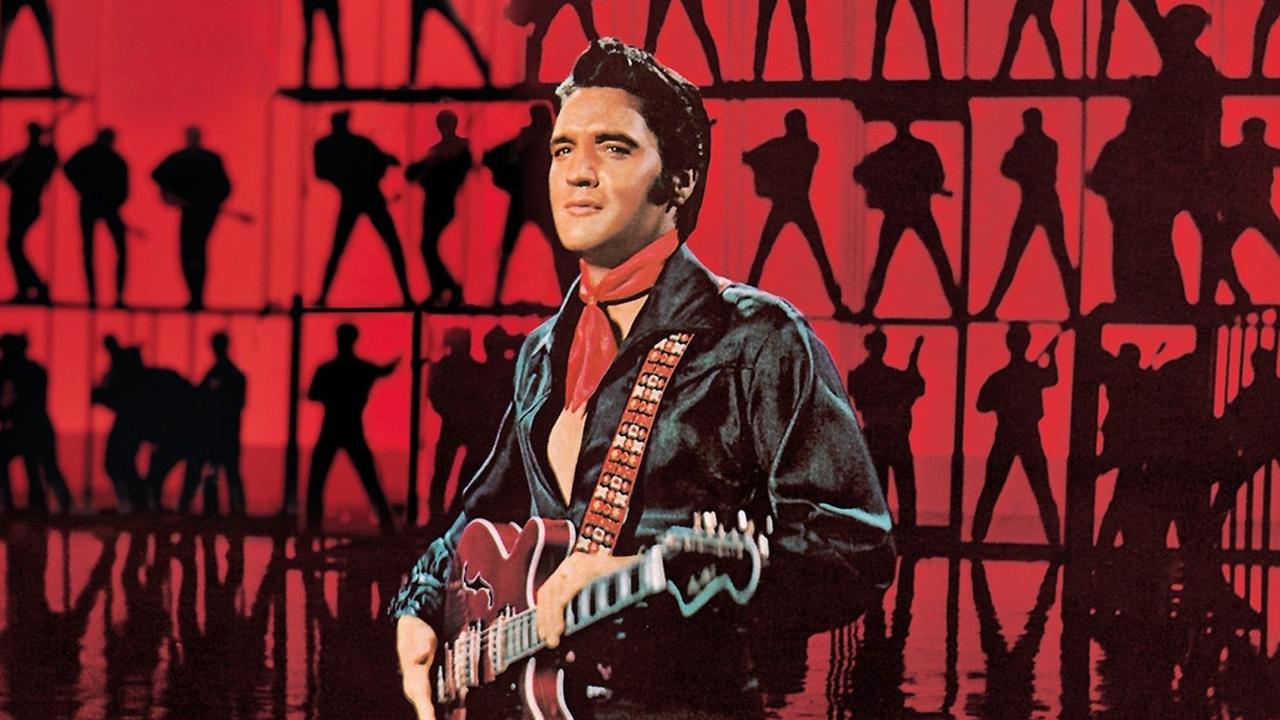

Elvis Presley’s 13.8 acre Graceland estate in Memphis, Tennessee as well as a 15 per cent stake in Elvis Presley Enterprises is at the centre of a legal dispute following the death of Elvis’s only child, Lisa Marie Presley in January this year.

The King of Rock and Roll’s assets were inherited by Lisa Marie and his father Vernon and grandmother Minnie Mae.

More recently, Lisa Marie became the sole beneficiary of the estate. Held in a trust known as the Promenade Trust, these assets were managed by Lisa Marie’s mother Priscilla Presley.

The bone of contention is a 2016 trust amendment that removes Priscilla as the trustee and appoints Lisa Marie’s two eldest children, Riley Keough and Benjamin Keough as the new trustee. Benjamin passed away in 2020 leaving Riley as the sole trustee to the Promenade Trust, something that Priscilla is now challenging in court.

The validity of the trust amendment is being challenged on the basis that Priscilla’s name was misspelt in the trust amendment, her signature appears inconsistent with her usual signature, the amendment was not witnessed and contrary to the original trust terms, the original trustee, Priscilla, was not notified of the amendment.

If celebrities who have deep pockets for expensive lawyers cannot get it right, what hope does the everyday person have in sorting out their Will and estate plans?

In Australia, there are four main pathways to leave assets after you die. The first and the most obvious is via a Will. Unfortunately only 50 per cent of Australians have a Will. The next is to use a family trust, which allows the smooth succession of assets after passing. But operating a family trust can be expensive and time consuming and as such, it is not widely used to pass assets to the next generation. It is more of an estate planning tool for the rich. The third is to hold property in an ownership structure known as ‘joint tenancy’. After death, ownership of the property automatically passes to the surviving owner and is not considered an estate asset.

The fourth pathway is to leave money via superannuation. Although not watertight, an advantage of using superannuation as an estate planning tool is that there is a strong likelihood that your super money will go to who you want it to go to.

In other words, if you leave your super assets via a death benefit nomination, it is probably going to be paid to whoever you nominated, and less likely to get caught up in a bitter estate challenge. That said, in NSW there are ‘‘notional estate’ rules which means that a court can claw back superannuation funds and add them to a deceased estate family under a provisions act challenge.

Whether it be through a SMSF, retail fund or industry fund, super beneficiary nominations work the same way. They can either be binding or non-binding. Most people choose binding over non-binding as there is no discretion for the super trustee to decide who should receive the super benefit, it must be paid to whoever the member nominated under binding.

There is a prescribed list of who can be nominated as a super beneficiary including your spouse, partner, children, people financially dependent on you and another group known as inderdependents.

Making a death benefit nomination in super also allows older Australians to retain their deceased spouse‘s super funds inside super, which otherwise might have attracted tax if the super fund had to be sold and distributed personally to the surviving spouse and then invested.

Leaving your assets via a Will, although having the increased risk of being contested, can cater for a wider range of assets with more specific gifting instructions. Adam Lubofsky, Founder and CEO of Safewill says: “We have seen some very specific gifts from artwork through to a set of fishing rods being gifted via our Will platform.”

Safewill, which offers online Wills, is a level up from the old post office standardised Will kit and has helped over 80,000 people since launching in 2019. They use technology to guide users through an online Will creation process which is then reviewed by a lawyer.

Accredited specialist in Wills and estates Angela Brischetto from law firm Aubrey Brown Lawyers says: “A low cost web based Will creation service cannot compare with obtaining tailored and comprehensive legal services from a traditional law firm. The web based Will is only as good as the information which is used to create it. A real life lawyer will ask questions, check information, provide advice and recommend options so that the willmaker’s wishes and intentions can be given effect to.”

With that in mind, an online Will may not be for everyone, but still likely to be appropriate for some.

Lubofsky says: “On the Safewill platform, 20 per cent of all Will writers leave a gift to charity. This is 5 times higher than the national average. We have over 200 of Australia’s largest not for profits using Safewill to supercharge the bequest efforts. To date, over $500M has been left to charities from our Wills.”

James Gerrard is principal

and director of Sydney

financial planning firm www.financialadvisor.com.au

Originally published as Inheritance planning has never been more important