‘I don’t think so’: Aussie man slams bank over credit card fee increase

An Australian man has been left gobsmacked after being alerted by his bank that his annual credit card fee had jumped from $0 to $399.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

An Australian man was left gobsmacked after being alerted by his bank that his annual credit card fee had jumped from $0 to $399.

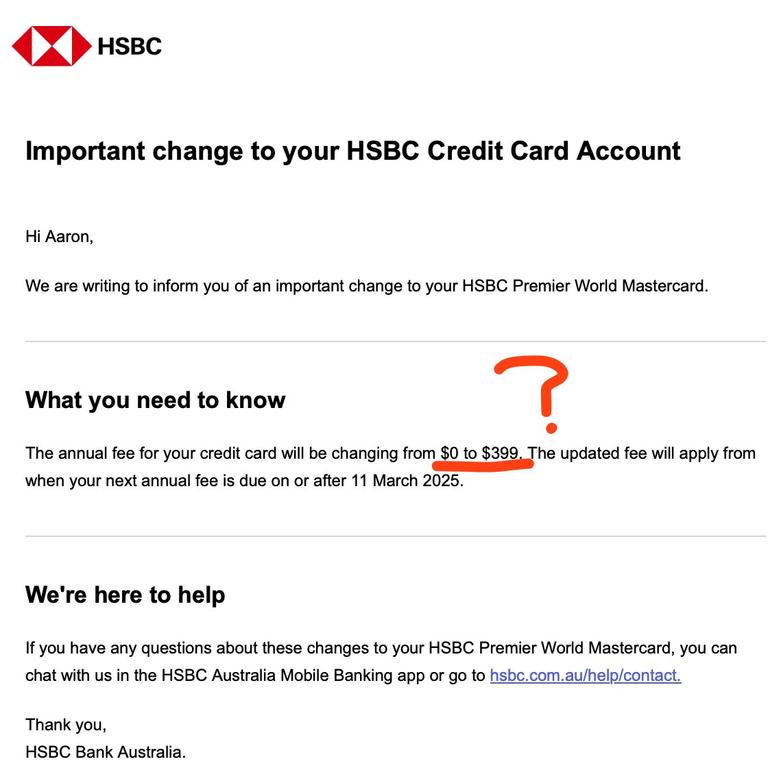

Aaron Smith received a letter this week from HSBC, whose headquarters are in London, informing him of the “important change” to his HSBC Premier World MasterCard.

“The annual fee for your credit card will be changing from $0 to $399,” the message, which Mr Smith shared a screenshot of on X, read.

“The updated fee will apply from when your next annual fee is due on or after 11 March 2025.”

The bank did not clarify in the letter the reason for such a significant fee increase.

“From $0 to $399 per year? I don’t think so @HSBC,” Mr Smith captioned his post, which has been viewed some 35.4k times in the past 48 hours.

Respondents to his tweet were equally floored by the price hike.

“Can’t make this stuff up! Bloody hell,” one woman wrote.

Another said: “That’s wicked. Cancel it and burn the bloody thing. That goes to executive salaries.”

“That would be an automatic cancellation of card,” someone else agreed.

“This seems excessive. This is why I don’t have a credit card,” another user wrote.

Asked for the reason behind the fee increase, a HSBC Australia spokesperson told news.com.au the bank is “committed to providing our customers with high quality credit card products”.

“The recent fee adjustments will ensure we continue to offer competitive rewards,” they said.

Research by financial comparison website RateCity in 2023 found that credit card fees from seven providers had risen by as much as 200 per cent within a three-month period – the vast majority of which were for rewards cards.

RateCity’s Sally Tindall told The Sydney Morning Herald at the time the increases were among the steepest she’d ever seen, urging the hundreds of thousands of people affected to check if they were still getting their value for money.

“What was right for you a few years ago may not be right for you today because of a change in the way you spend, or your financial goals,” she said.

It comes as the Reserve Bank on Thursday revealed in its January bulletin that Australian households paid almost 10 per cent more in bank fees in the 2023/24 financial year, with credit card and personal loan use skyrocketing as a result of the cost of living.

Aussies paid 11 per cent more in credit card fees, which the report’s author, RBA analyst Robert Gao, said reflected a rise in cardholders spending money overseas again.

Personal loan fees, meanwhile, increased by 34 per cent.

“With more households using their Australian credit and debit cards at overseas businesses, banks earned more fees on international transactions and foreign currency conversions,” he said.

Originally published as ‘I don’t think so’: Aussie man slams bank over credit card fee increase