‘Freaking out’: Texts reveal Aussie’s nightmare with bank account scammer

An Aussie woman was left terrified when her phone kept ringing and text messages wouldn’t stop – and the reason was chilling.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A Brisbane woman was bombarded with 25 calls in just over half an hour as a scammer who had already stolen thousands from her bank accounts became increasingly desperate to keep her on the hook.

The life savings of Tanya Owens were gone, while $12,000 was also spent on her credit card.

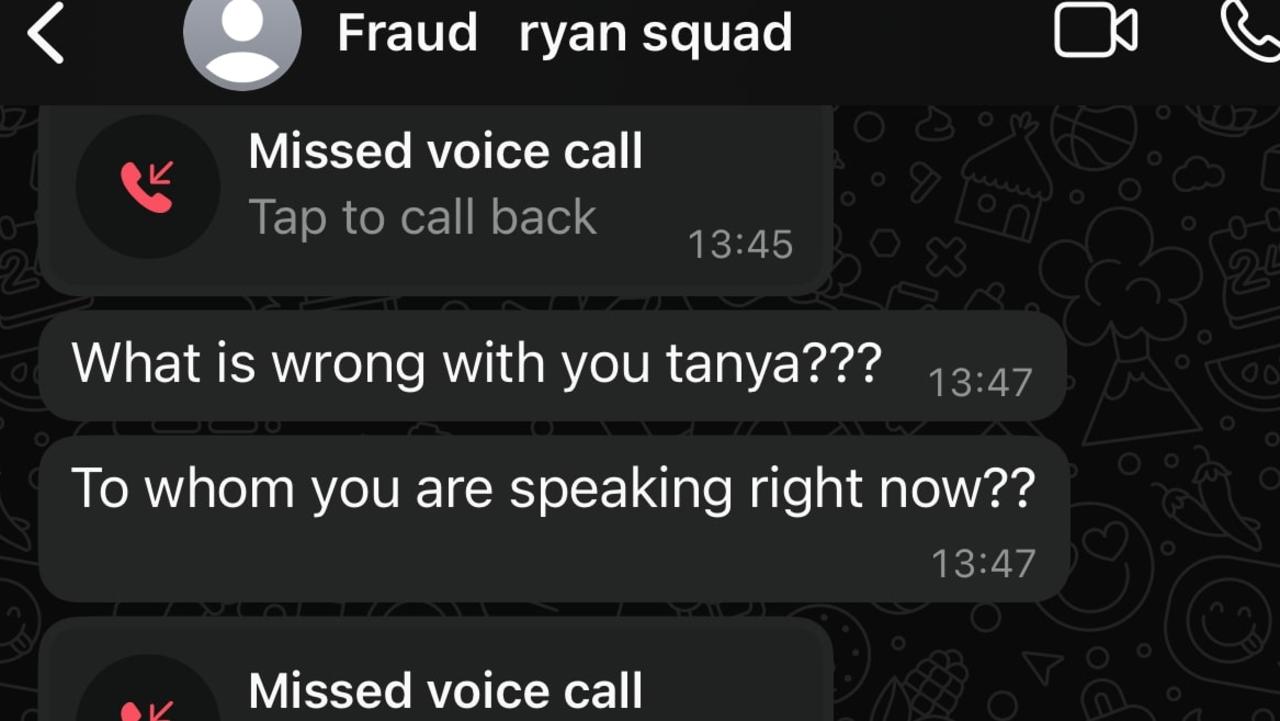

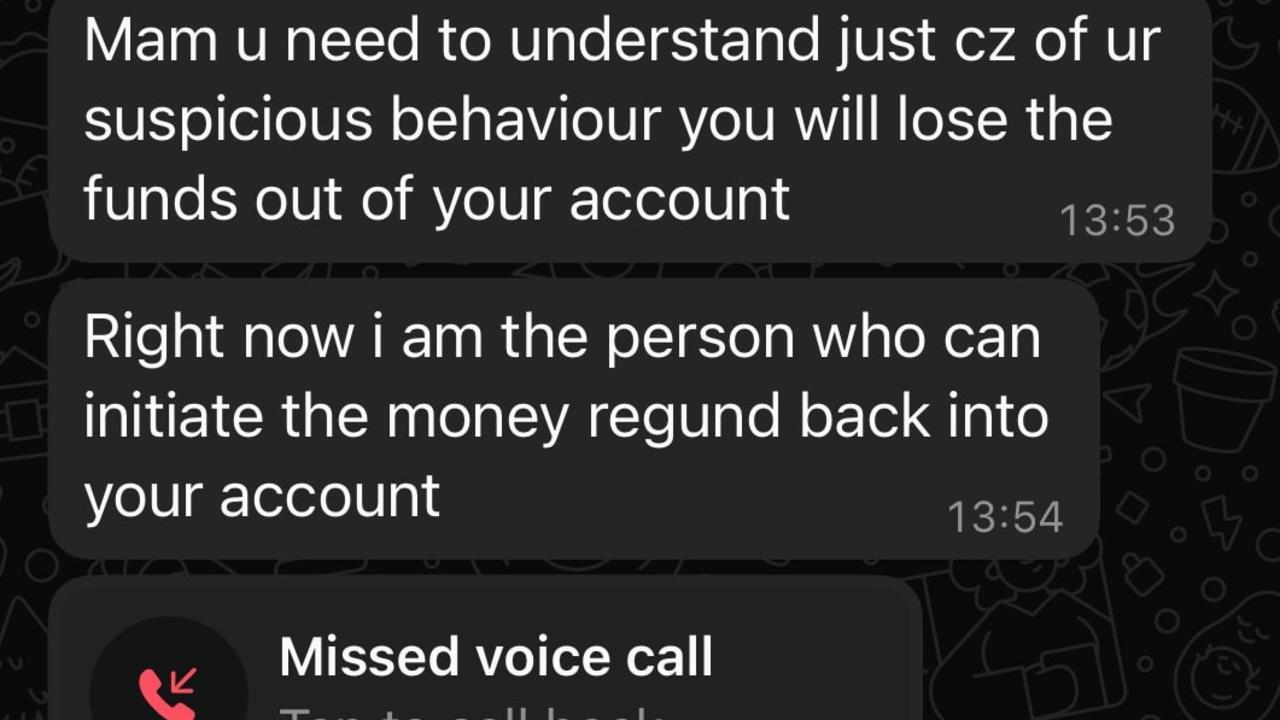

“What is wrong with you tanya??? To whom are you speaking right now,” the man demanded in text messages.

He placed another two phone calls and then sent more frantic messages.

“Mam u need to understand just cz (sic) of ur (sic) suspicious behaviour you will lose the funds out of your account. Right now I am the person who can initiate the money regund (sic) back into your account,” he wrote.

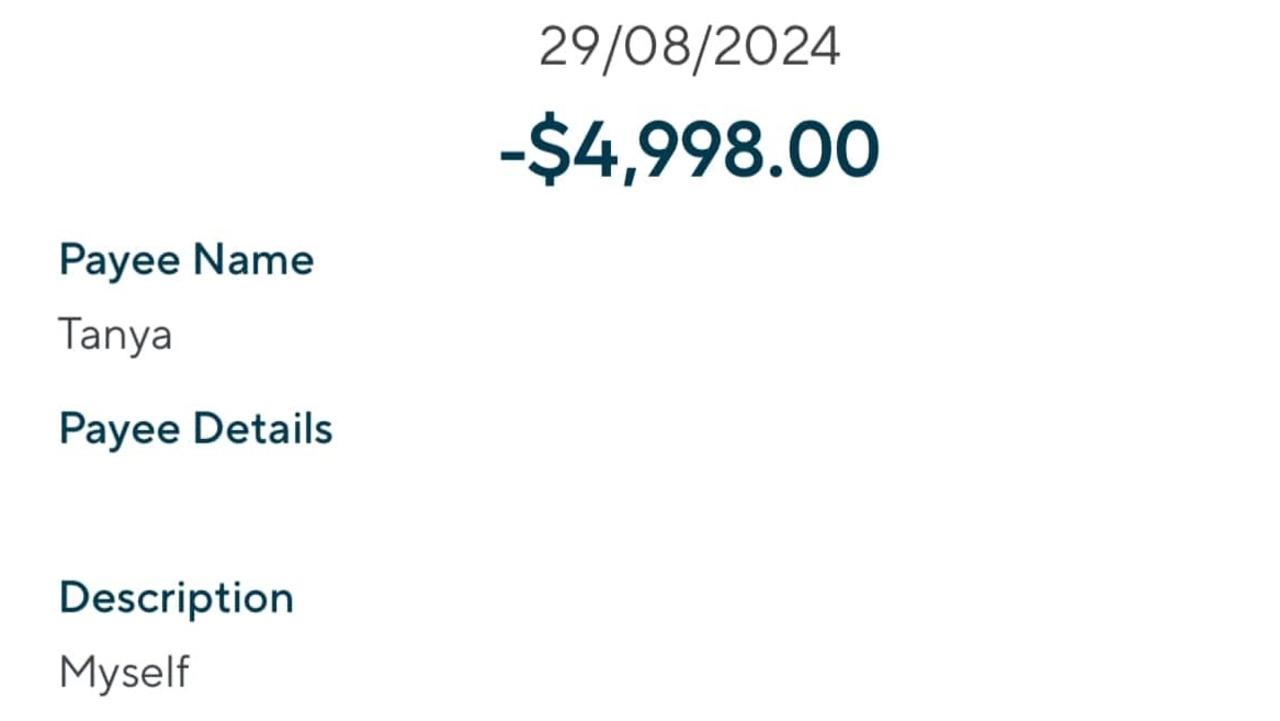

Her $6500 in life savings had been transferred out by her from her Great Southern Bank to People’s Choice bank using her name as the receiving account — yet she had never banked with the institution.

Account name matching is a basic anti-scam measure that has blocked many fraudulent transactions in other countries and despite a $100 million pledge for Australian banks to roll out the technology — it still isn’t place.

Ms Owens is lending her support to news.com.au’s campaign People Before Profit, calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK.

In October last year, the UK introduced world leading legislation making compensation mandatory for scam victims within five business days unless in cases of gross negligence.

IT’S TIME BANKS PUT PEOPLE BEFORE PROFIT. SIGN THE PETITION

In July 2022, the Australian Competition and Consumer Commission called on the banking sector to establish an industry-wide account name checking system.

Only in late 2023, did the Australian Banking Association announce a $100 million investment by banks to block customers from transferring money if a name does not match the details of the recipient.

But rollout is not complete and has come too late for Ms Owens who was scammed in August last year.

She lost her life savings despite the transfer details not matching up with the scammer’s account name.

“That alone should have stopped the transfer or held the money in limbo land as the account name obviously didn’t match … the fraudulent account holder at People’s Choice,” Ms Owens said.

“I was always under the impression that you had to make sure the spelling of the account holder name or at least the account name had to also match the account details that money is transferred or sent to.”

It all began when the 44-year-old received a phone call from a man called Ryan who claimed he was from the fraud department of government agency Scamwatch.

He told her there was an active hack occurring on her phone right that minute.

Chillingly, Ryan also knew her address, date of birth and that she banked with Great Southern and Citibank and also had Afterpay and Zip accounts, lulling her into a false sense of security.

The scammers directed her to download remote access software called Zoho Assist claiming it would help stop her money disappearing.

“I had no idea what damage this app was doing to my phone at the time,” she said. “It had literally mirrored my phone and they had changed the operating system and did all kinds of stuff in the background.

“I was effectively held hostage. I couldn’t make a move they didn’t realise.”

Meanwhile, Ryan ratcheted up the pressure telling Ms Owens withdrawals of both big and small amounts were disappearing from her accounts. He told her to transfer money out to a holding account to keep it safe.

“Come Friday morning I had no sleep overnight, I hadn’t eaten or drunk, I was just f**king freaking out,” she said.

But her suspicions were also aroused. She attempted to call Citibank, yet with the software controlling the phone, the scammers cut the call just before she was set to talk to the fraud department.

The scammers called her back and put her on the phone with someone with a foreign accent they claimed was from Citibank.

Ms Owens told the scammers things sounded “wrong” and hung up the phone again, calling Great Southern bank this time.

“As I was talking to someone the phone disconnects and magically rings,” she said.

“It was the scammer getting huffy. He said ‘we have been helping you, why do you think we are scamming you? We have been on the phone for the last 24 hours’. I said ‘don’t get huffy, I haven’t verified who are you, I need to talk to someone at the bank’ and hung up.”

In fortunate timing a colleague managed to call and she “burst into tears”. Her work mate briefly reassured her what was happening wasn’t right.

“My phone was ringing and ringing. This Ryan character was ringing. First he rings from his number and then my phone was effectively spoofing me, like Tanya was calling Tanya. I freaked out. I knew that this was not right, something was really bad here, and phone is ringing incessantly,” she said.

She then uncovered that her phone was on do not disturb.

“I clicked on my deleted inbox for some reason and saw two text messages from the bank of the one time passwords sitting in there,” she added.

Ms Owens contacted her banks, putting blocks on her Citibank and Latitude credit cards. Seven weeks later, Citibank returned the $12,000 spent, while Latitude and Afterpay also refunded purchases.

But Great Southern is the only bank that has refused to refund the scam victim – blaming her for the loss of the money.

She said the situation was “messed up”.

“I am working a second job now. I had savings and I’m now in debt,” she said.

“I went from having $6500 of savings to having to play severe catch up to get my rent paid, bills paid and I rang Telstra and my health insurance to tell them I’m going to be late.”

Ms Owens said she was “really embarrassed” to be caught out by the scam

“I answered a phone call and as they ID checked me … I thought they were legitimate,” she said.

“They were super patient and supportive. They said they were here for me and looking after things and don’t stress. They had time and played the game, they weren’t in a rush.”

She said she went to a “dark place” for a little while after the scam.

“It messes with your head. You think you deserved this, you should have known better, you are an idiot as you fell for it,” she added.

“I swear they have a psychology department … It was such a well thought out script – they had an answer for any question or pre-empted concerns.”

After being a customer of Great Southern for 25 years, she said she was “sorely disappointed” by their response to her being scammed.

“Great Southern said effectively I gave access to my accounts, so it’s on you. If I actually gave the scammers the one time password verbally that might be the case but I didn’t actually give it to them. But sadly I gave them access to my phone and they were deleting text messages that I had no idea they got,” she said.

Ms Owens is currently going through the complaints process with the Australian Financial Complaints Authority (AFCA).

News.com.au understands that Ms Owens has now been reimbursed the $6500 that was stolen from her bank account.

“It’s a scary world we are living in. Our data is out there and information is at someone’s fingertips before you know about,” she added. “The stories they can spin are crazy believable.”

A spokesperson for Great Southern Bank said they can’t comment on individual cases due to privacy, but claimed they are actively working with relevant parties to assist the customer in this case to recover their funds.

“We understand the distressing impact of scams and are deeply sorry to hear this customer has been impacted by scam activity. Great Southern Bank is focused on both preventing scams and supporting customers when incidents occur,” they said.

News.com.au understands the confirmation of payee system is not due to be implemented by all Australian banks until the end of 2025.

A spokesperson for the Australian Banking Association said implementing an industry-wide confirmation of payee system requires a significant build and investment.

sarah.sharples@news.com.au

More Coverage

Originally published as ‘Freaking out’: Texts reveal Aussie’s nightmare with bank account scammer