The message for big gas in Santos’ landmark Barossa judgement

A legal loss would have bigger implications for the energy industry and the $30bn-plus new LNG projects or expansions underway.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

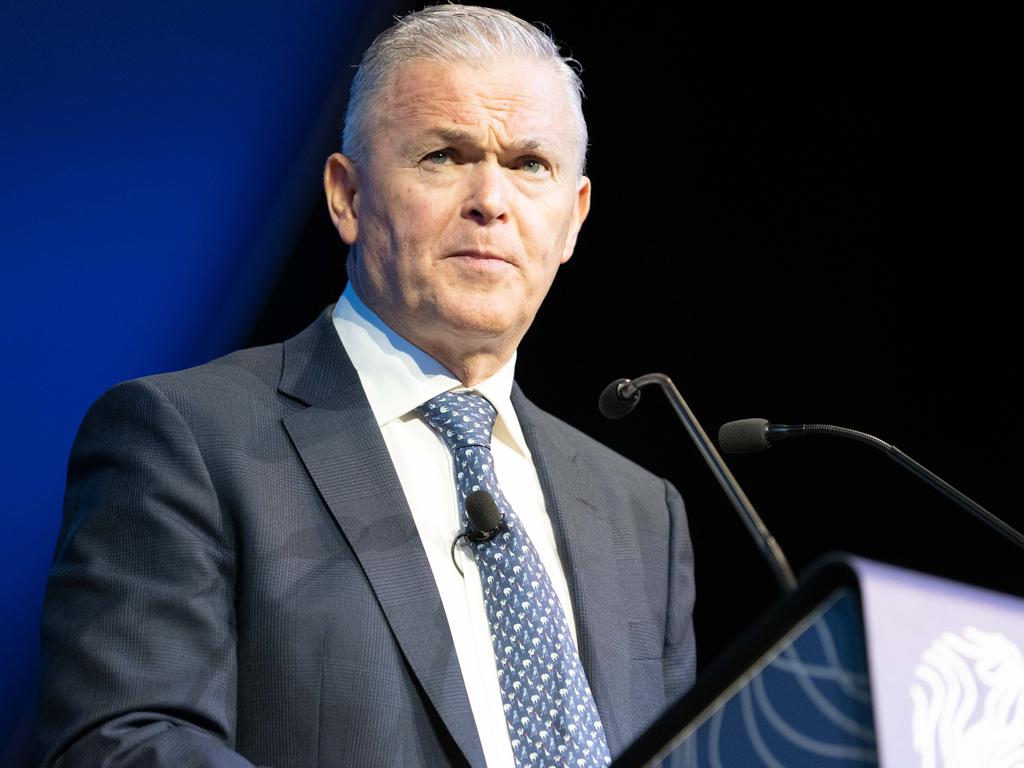

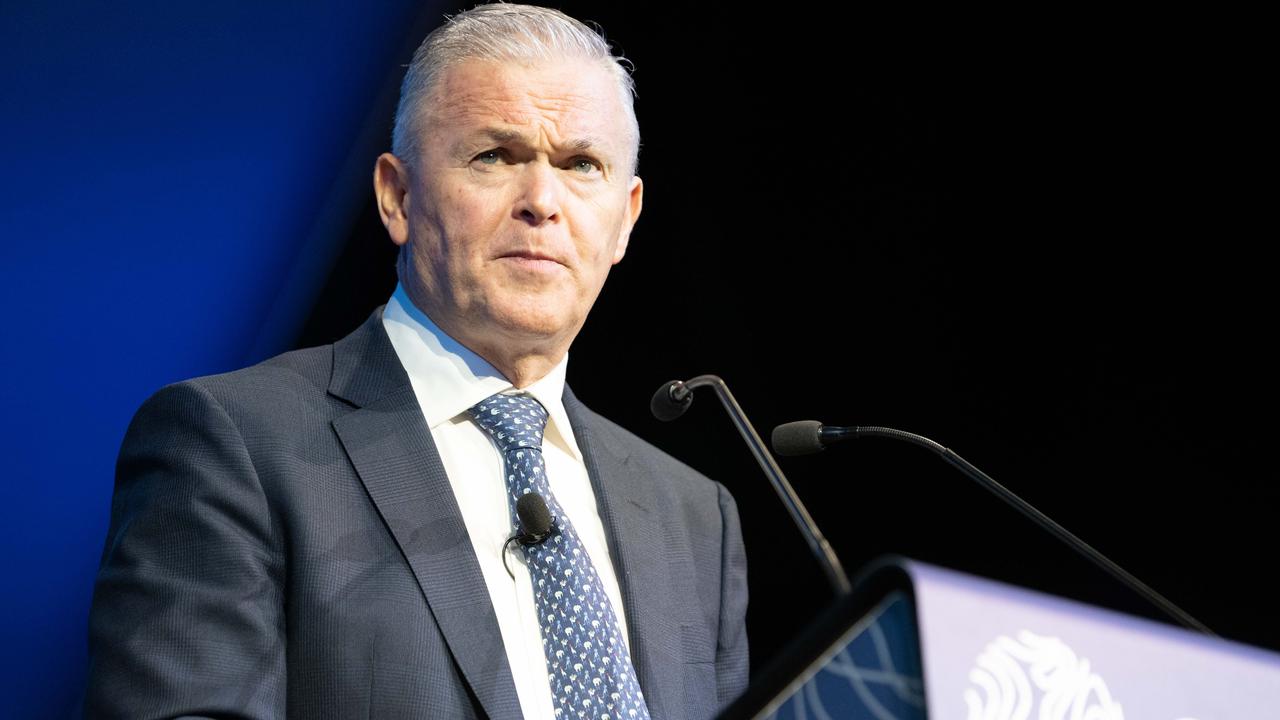

With a lot of going seemingly against Kevin Gallagher lately, the Santos boss will take the very significant win from the Federal Court after it dismissed the injunction that had brought work to a halt on the $5.3bn Barossa LNG project in the Timor Sea.

And for the LNG industry, which has been on edge following the legal delays to Woodside’s $16.5bn Scarborough project, the decision returns some certainty to the way offshore projects are approved. A loss for Santos would have delivered a serious reassessment of the $30bn-plus new LNG projects or brownfield expansions the industry currently has sitting on the drawing board.

In essence, the finding by Federal Court Judge Hillary Charlesworth slightly raises the bar for those seeking to challenge offshore projects in deep waters. It also seeks to deliver certainty around what is “new” activity or risk under existing environment approvals covering projects.

The three applicants from the Tiwi Islands, supported by the Environmental Defenders Office, claimed a new 262km pipeline impacted songlines in the ocean as well an area inhabited by humans some 20,000 years ago before sea levels rose. The arguments were firmly rejected by the court with the evidence presented showing “nothing more than a negligible chance that there may be objects of archaeological value in the area of the pipeline route,” Charlesworth says in her judgment.

The brownfield LNG project involves the development of the Barossa gas field in Australian waters offshore from the Northern Territory. Under challenge was the construction of a new pipeline west of the Tiwi Islands to connect the field to the existing Bayu-Undan underwater pipeline already taking gas to the Darwin LNG plant. At its closest point the Barossa pipeline would be 7km west of the Tiwi Islands.

The court decision means Santos can resume building the pipeline as well as drilling, after works around the Tiwi areas were impacted by an injunction granted last November. Drilling on the Barossa field is about to start, with production still slated for the first half of 2025. The project is set to extend the productive life of Santos’ Darwin LNG plant by around another two decades.

The case had been a big uncertainty hanging over Santos, with the markets discounting the prospect that Barossa was likely to get up and running. It comes after Santos’ banker Goldman Sachs cancelled summer plans to work on merger talks with the bigger Woodside. The green light for Santos substantially increases the longer-term value of any deal that could put a $29bn price tag on the energy player. Woodside is being advised by Morgan Stanley.

Santos’ Gallagher has welcomed the decision and in a note to staff highlighted Barossa will be one of the lowest-carbon LNG projects in the world with net-zero reservoir emissions from the start. The project will use a combination of carbon offsets and carbon capture and storage. Gallagher also promised to continue to consult with the Tiwi Islanders as the project continues.

“All of us at Santos deeply respect the cultural heritage of the people of the Tiwi Islands,” he said. He also called out the “courage and conviction” of nearly a dozen Tiwi Islanders who gave evidence to the Federal Court on behalf of Santos around the impact of the Barossa project. No change was given by Gallagher over cost estimates or production timelines.

-

Worley needs to come clean

Just weeks after being awarded a hefty pay rise, Worley’s Chris Ashton has spent the new year trying to reassure his big investors over a series of stunning revelations centred on corruption findings linked to the company’s behaviour in Ecuador early last decade.

The revelations uncovered by The Australian that relate to a period prior to chief executive Ashton taking charge, have come with a strong denial from the $8bn mining and energy services player there was no corruption, illegality or bad faith.

The reports by my colleagues Ben Butler and Nick Evans came to light following a $700m payment dispute with the Ecuadorean government and raise very serious claims of corrupt behaviour and allegations of the use of insider information by the company as it was bidding for oil and gas contracts early last decade.

The findings were made at a Paris-based arbitration tribunal under an investment treaty between the US and Ecuador. Worley says it disagrees with the decision and is considering legal options. Although it has since acknowledged that senior staff of one of its contractors, Tecnazul, were found to be corrupt by an Ecuadorean court.

Worley says in a statement it did not breach anti-bribery and corruption laws. “Worley takes its responsibilities under such laws extremely seriously,” it adds.

The allegations are being taken very seriously by big investors, with Worley’s shares off nearly 10 per cent since the start of the year.

Ashton in recent days has promised a series of one-on-one meetings in an effort to restore Worley’s reputation.

But on the surface Worley’s position remains opaque and the legal nature of the claims and links to Tecnazul come with a stench. At the very least, Worley’s systems failed to detect corrupt behaviour within a key partner. Remember, this is a company that today operates in more than 45 countries including in Central America and the Middle East. It still has more than $20m tied up in Russia.

More to restore trust

Ashton’s bid to restore the company’s integrity should be around Worley coming clean. Details around the scandal that have so far emerged are through the robust reporting in The Australian, leaving investors to question what else is really out there. Disclosure by the Sydney-based engineering company to the ASX of the tribunal’s findings have fallen short and also deserve scrutiny.

An independent review of the events would go a long way in helping to regain trust. It might be uncomfortable, but there is more is at stake for Worley.

Worley has just been awarded the plum early stage construction contract for BHP’s massive Jansen Potash project in Canada. It works with US LNG exporter Venture Global, and has contracts in place with oil giants Shell, BP and Anglo American. These are big global operators that have a zero tolerance for corruption. Partners include government-owned entities, and Worley has substantial US operations which means it is captured by some of the toughest anti-corruption rules in the world.

Under Ashton, Worley is in the process of its own transformation, with the aim of generating the bulk (75 per cent) of its income from renewable energy and similar projects and away from oil and gas. With 55 per cent of its earnings currently from oil and gas, by standing still, Worley could potentially become stranded as the weight of cash – including funding – goes toward green investing.

This change sees Worley actively looking to chase critical minerals projects, renewables, water and even nuclear projects. Last year it issued a sustainably linked bond and renewed a $US1.2bn bank lending facility.

Ashton, appointed to the top job almost four years ago, has said he has briefed the board about the allegations. But surely it is the board’s role to be asking harder questions about what exactly went on inside the company.

Former chief executive and current chair John Grill was running the company as Worley was finding its feet in Ecuador.

There is no suggestion that Grill was involved, briefed or aware of allegations surrounding problems in Worley’s fledgling Ecuador business.

Grill, a substantial shareholder with more than 6 per cent, retired as chief executive in late 2012 and was appointed chair in March 2013. As a matter of record Worley provided services in Ecuador from 2011 to 2017.

But for a company that has a powerful figure like Grill with more than 10 years as chair, Worley has a surprisingly refreshed board. And this shows the efforts taken in recent years to reinvent itself for a renewables era. The average tenure is a little over five years. Five directors, including former powerful Treasury boss Martin Parkinson, have been appointed since 2019. Former Dow Chemicals boss Andrew Liveris joined in 2018 and is deputy chair to Grill. Other Worley board members include Commonwealth Bank director and former Blackmores chair Anne Templeman-Jones and top former Chevron executive Joe Geagea.

Worley recently commissioned an external board review which included a pathway for chairman succession. Although Grill recently told investors he intends to remain as Worley’s chair for the foreseeable future.

Ashton is scheduled to deliver Worley’s first half results on February 28.

johnstone@theaustralian.com.au

More Coverage

Originally published as The message for big gas in Santos’ landmark Barossa judgement