First signs of relief: Mortgage stress eases after RBA February rate cut

Australia’s most indebted households are beginning to feel the effects of monetary easing, as mortgage stress falls to its lowest level in nearly two years - but 1.4m people are still at risk.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Mortgage stress has fallen to its lowest level in nearly two years, offering early signs that the Reserve Bank’s shift toward looser monetary policy is easing pressure on heavily indebted households.

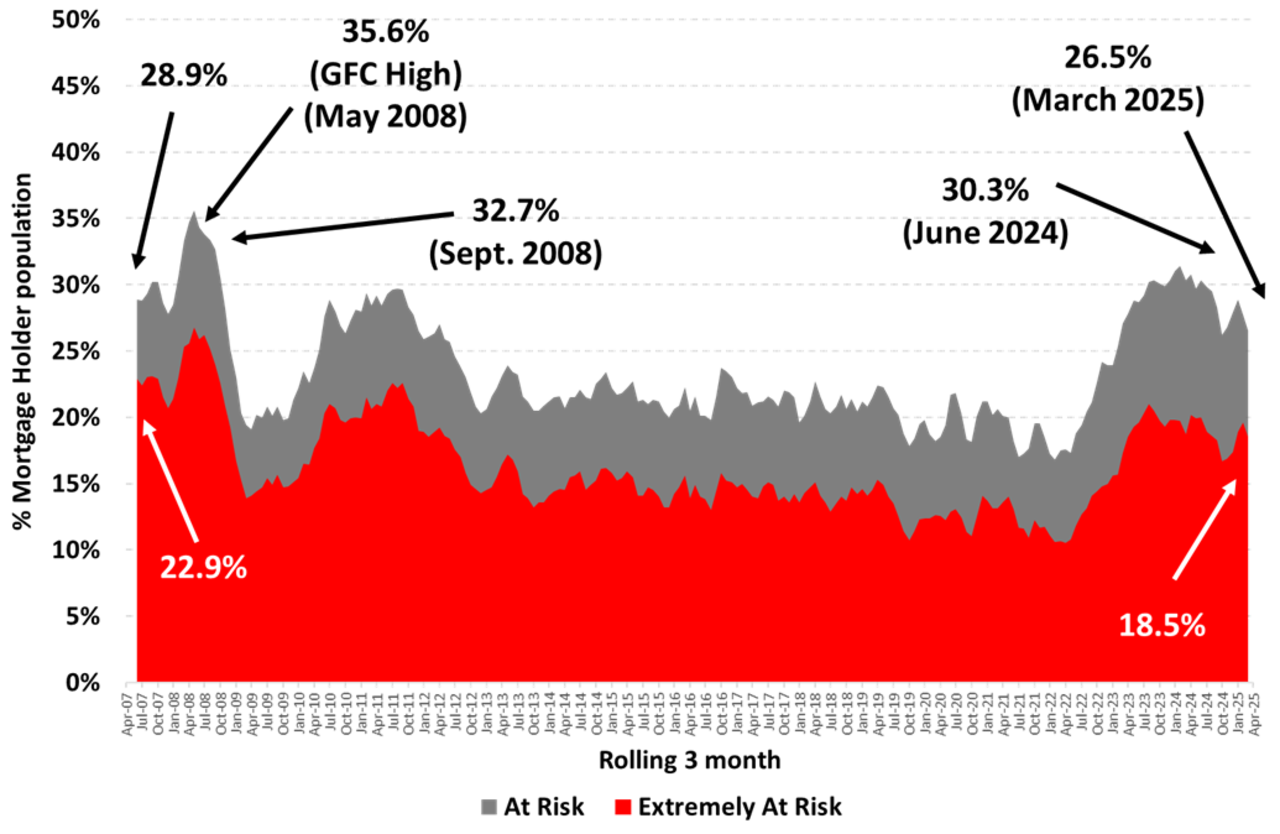

New Roy Morgan data shows 26.5 per cent of mortgage holders were “at risk” in March, down from 27.7 per cent a month earlier.

It is the second consecutive monthly drop in mortgage stress and follows the RBA’s decision to reduce the official cash rate by 25 basis points to 4.1 per cent in February — the first rate cut in more than four years.

“This is the lowest level of mortgage stress we’ve seen since June 2023, and it comes directly off the back of the Reserve Bank’s decision to start easing,” Roy Morgan chief executive Michele Levine said.

“We’re now seeing the first signs of relief flow through to households.”

In March, 1.45 million mortgage holders were considered “at risk,” with 990,000 deemed “extremely at risk” — those for whom even interest-only repayments take up a high share of household income.

While still elevated, Ms Levine said the worst of the pressure may now be behind most borrowers if interest rates continue to ease.

“Our modelling shows that if the RBA cuts rates again in May, the number of people at risk will drop further — potentially down to 1.42 million by June,” she added.

“The key is inflation staying inside that 2–3 per cent band.”

The February cut, driven by a sustained cooling in price growth, marked a critical pivot point for the central bank.

Core inflation, measured by the trimmed mean, has now sat inside the RBA’s target range for three consecutive months and came in at 2.7 per cent in February.

Headline inflation was even lower at 2.4 per cent, although artificially lowered by government spending including on electricity rebates.

Markets are increasingly betting the May board meeting could deliver another rate cut if inflation due next week continues the trend along with ongoing uncertainty in financial markets over US policy settings.

After three consecutive increases in mortgage stress between October and January, the downward shift in borrowing costs has helped ease monthly repayment burdens and stabilise household confidence — particularly for borrowers who entered the housing market during the record-low rate period in 2020 and 2021.

Still, economists caution that interest rates are only part of the picture.

Employment remains the most important driver of household financial resilience, and Roy Morgan estimates more than 3 million Australians — or 19.3 per cent of the workforce — are either unemployed or underemployed.

The number of borrowers considered “extremely at risk” remains above its long-term average of 14.7 per cent, highlighting the ongoing challenges for many.

Since the RBA began raising rates in May 2022, the number of borrowers in mortgage stress has increased by 644,000, many of whom have been forced to roll off ultra-low fixed-rate mortgages onto much higher variable rates.

While the easing of interest rates provides some relief, whether this continues will depend on how quickly the RBA shifts from caution to confidence and whether the economy can absorb lower rates without reigniting inflation.

Markets are currently pricing in three rate cuts by December, with the first potentially coming in May if upcoming inflation and wages data continue to track lower.

Originally published as First signs of relief: Mortgage stress eases after RBA February rate cut