Falling house prices might be the factor that finally cracks retail sales

More will be at stake than retailing pride as summer sales data starts to come in and we see if consumers really are that resilient.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The next two weeks will mark a make or break moment for ASX-listed retailers – and perhaps the economy – as numbers from the official Christmas and New Years trading window start filtering in.

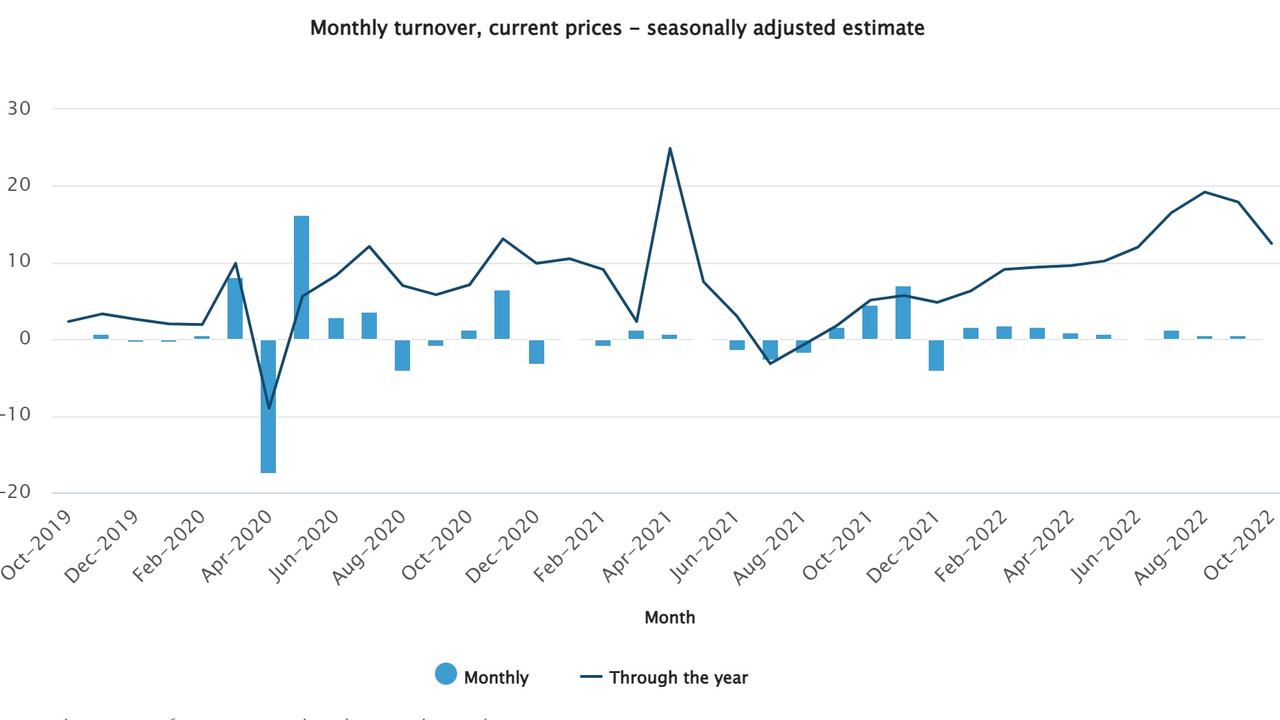

Australian consumers have been a resilient lot, going on a furious shopping spree following the Covid-19 lockdowns. But this sales boost – up 12.5 per cent at the end of October – is clearly starting to run out of steam with a combination of fast rising interest rates, inflation and a shrinking pool of savings are slowly taking their toll.

Sales updates from JB Hi Fi, Michael Hill, Universal Brands and Beacon Lighting, will start flowing from next week, taking in the crucial Christmas and New Year’s sales period. Also coming next week will be Commonwealth Bank’s closely watched credit card sales data, the first comprehensive spending snapshot of the season.

Then all eyes will be on Myer – the big barometer of discretionary spending. Any change to what had been shaping up as a strong sales performance leading into Christmas for the department store will trigger an earnings update toward the end of this month.

Real economy

The retail numbers have a bit more significance this year because the intensity of sales will be a major factor on how Reserve Bank governor Philip Lowe will be thinking about a February rate rise. A string of disappointing updates from retailers will add to ammunition for the RBA to take stock of the pace of its interest rate hikes and see the market start to lower their expectations for peak rates. A stronger-than-expected set of numbers could push the case for the RBA to push through a 50 basis point hike.

The central bank doesn’t meet in January but its December minutes revealed it was a lineball between hiking by 50 basis points and 25 basis points that it ended up doing. The case for a pause still seems a little off with the RBA noting in December that even with a significant increase in cash rates over 2022, inflation was expected to take several years to return to its target. Tellingly it noted no other central bank had yet started to pause which shows it doesn’t want to be the global leader. With the cash rate at 3.1 per cent, economists are currently tipping the cash rate to peak at 3.6 per cent, although futures markets are more bearish and pricing in a number closer to 4 per cent.

Warning signs

Fashion and accessories retailer City Chic set the tone shortly before Christmas, warning trading conditions through December had been “below expectations”. Much of the downturn was due to a drop off in the US where rates have been hiked more aggressively. However it said trading this financial year across Australia has been flat with online sales also falling away.

This prompted a return to what retailers call “promotional” activity – better known as discounting – to help boost sales. Other retailers in recent days have quietly admitted to discounting particularly in the period after Christmas to spur on sales. Some larger retailers such as Myer and JB Hi-Fi have their discounts jointly funded by suppliers.

Elsewhere online focused underwear retailer Step One said trading conditions in the first quarter September quarter were more challenging than expected.

The past six weeks is the most important period for retailers, with some recording as much as 60 per cent of profit through this period.

It hasn’t all been bad news. A month out from Christmas Myer chief executive John King said the retailer had “good momentum”, with record sales since the start of the financial year and into Spring. King has previously told The Australian he plans to use every lever available from the popular Myer One customer loyalty program to drive sales through the first half of this calendar year.

Another headache for retailers is inventory levels, the amount of stock they are sitting on. This is a major balancing act, Retailers get market down for too much stock, given this ultimately becomes old or seasonal inventory that needs to be moved by discounting.

Through Covid when supply chains were constantly tight or closed it was prudent for retailers to hold higher levels of inventory. But the reopening of some supply chains has changed the equation. Wesfarmers, the owner of Bunnings, Kmart and Officeworks was sitting on more than $6bn worth of inventory, the highest levels seen since it spun out its Coles supermarkets business.

Housing puzzle

A recent deep dive into the Australian consumer Morgan Stanley analysts said discretionary spending such as fashion and electronics is likely to be hit hard going into 2023.

Indeed it’s going to be a cocktail of headwinds for consumers going into this year with inflation still pushing higher, savings rates falling and nervousness about the outlook for the coming year.

The December reading of consumer confidence by Westpac-Melbourne Institute is comparable to the low points seen during the Covid pandemic and the global financial crisis. Inflation is the number one concern of households, though ‘budget and taxation’, ‘economic conditions’ and ‘interest rates’ were also prominent. At the same time higher household energy bills are starting to be felt.

But the biggest crack to consumer behaviour is set to come from housing. The negative wealth effect from falling house prices is set to weigh on consumption trends, particularly on big ticket house items such as TVs, furniture and top-end appliances. As house prices rise consumers “feel” wealthier, the opposite is also true for falling house prices – even for those with no intention to sell their home.

CoreLogic and REA-backed PropTrack show mid-single digit falls for house prices with falls accelerating as interest rates bite.

Average national home prices are now down by 8 per cent from their April high and dropped 5.3 per cent in 2022 – marking their worst calendar year decline since 2008. The two big capital cities Melbourne and Sydney are feeling steeper falls which will be felt more acutely by consumers and therefore retailers in those cities.

Savings hit

Economists expect a 15 per cent to 20 per cent top to bottom fall in home prices out to the September quarter, as the full impact of rate hikes flows through and as economic conditions slow sharply this year resulting in rising unemployment. To put this in perspective a fall of 20 per cent would be the largest decline on record in Australia and all but eliminate the gains from the past two years.

The savings rate accelerated during Covid-19 pandemic to a high of around 25 per cent, helped by government stimulus programs and lockdowns limiting spending options. As the economy has reopened, the savings rate has fallen to 6.9 per cent during the September quarter while interest repayments to income at 6 per cent have drifted to the highest level since 2019.

The big mortgage reset is looming with some $500bn worth of loans on a fixed-rate mortgage set to reset to a higher variable rate over the next two years, with a majority of these rolling off in 2023.

Consumers have had a lot thrown at them in the past two years. Just how resilient they are will soon become clear.

johnstone@theaustralian.com.au

More Coverage

Originally published as Falling house prices might be the factor that finally cracks retail sales