Huge group of Aussies abandoned by budget

The budget is set to see struggling Aussies left behind, with little immediate relief for millions buckling under one particular bill.

The budget is set to see struggling Aussies left behind, with little immediate relief for millions buckling under one particular bill.

Despite forecasting a second consecutive surplus, Tuesday’s budget will show the nation’s finances falling further into the red from next financial year.

A former Labor strategist has warned the federal government that without a bold policy vision in the budget voters could ditch the major parties.

Australian shares were flat on Monday before important inflation data is released midweek.

Bring up today’s cash rate and Boomers will inevitably gripe about the 17 per cent rate of the 1980s. But they’re forgetting one major thing.

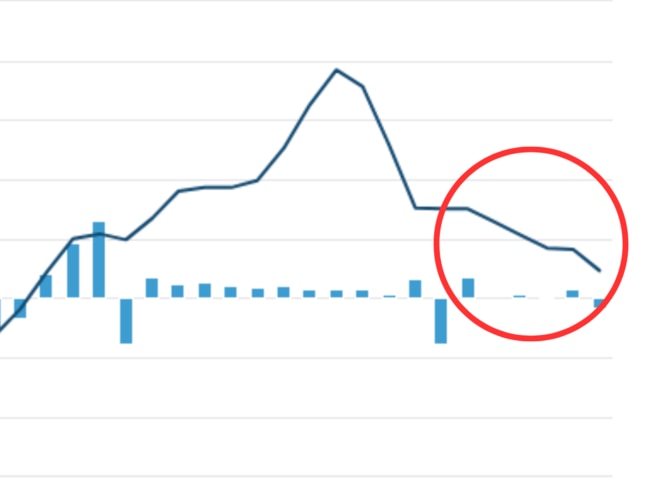

A grim forecast has been issued for Aussies struggling to pay their mortgages, as thousands of borrowers brace for an inevitable repayment shock.

Economists predict Australians will cop it in the coming months whether the RBA increases rates or not on Tuesday.

The Australian share market has had its two-day boost come to an end with Friday finishing off the week on a low note.

For the second week in a row, one major bank has announced it will hike interest rates for some unlucky customers.

Mid-year sales have failed to get Australians spending as the cost-of-living crisis continues and people are cautious with their money.

It’s been a ripper day on the Australian share market with the majority of stocks increasing, but there’s two outliers.

A financial nightmare is now unfolding – and money expert Mark Bouris says it will be “disastrous for hundreds of thousands of families”.

It’s obvious that the Chinese economy is now seriously struggling – and it’s bad news for Australia too for one major reason.

A major Australian bank has forecasted rates to rise once more next week, despite positive inflation news.

Original URL: https://www.thechronicle.com.au/business/economy/page/199