New data shows liquidations are surging, most businesses can’t pay back debts as corporate collapse crisis deepens

New data should put Australia to shame as corporate wrongdoing runs rampant, while victims are left with nothing amid a growing crisis.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

Shocking new statistics show that creditors owed money from a company collapse have no choice but to write off their losses completely in the overwhelming majority of cases.

The Australian Securities and Investments Commission (ASIC) published its annual corporate insolvency statistics earlier this week, revealing that small and medium sized business have “dominated” the external administration sector for 2023.

But shamefully, in 96 per cent of these cases, only between zero and 11 cents is recovered for every dollar owed to out-of-pocket creditors, Australia’s corporate regulator found.

Let me break that down for you. If you are owed, say, $100,000 when a business goes bust, you would be lucky to get back a single cent. Best case scenario would be getting back $11,000.

Indeed, earlier this week, news.com.au reported on failed fitness chain UFC Gym trying to scrape its way out of external administration by offering creditors one cent for every dollar they were owed so they could take back control of the company, an offer that was ultimately rejected.

The gym franchise had debts of $15.6 million. One creditor, Karim Girgis, is owed $1.2 million, and would have recovered a measly $12,000 if he had accepted the proposal.

The construction industry — perhaps unsurprisingly, given how run off my feet I have been this entire year — was named and shamed as the sector facing the largest number of insolvencies, coming in at 28 per cent of the total amount of liquidations, administration and receivership appointments across the nation.

Shabnam Amirbeaggi, president of the Association of Independent Insolvency Practitioners (AIIP) and a registered liquidator at Crouch Amirbeaggi, noted that 92 per cent of collapsed construction firms do not pay any dividend at all to creditors.

Ms Amirbeaggi told news.com.au that “too often” when it came to insolvent small and medium sized companies “there is emotional attachment to the business, and directors wait too long to seek advice”.

“Or when they do seek advice, they look for the ‘too good to be true’ outcome, which is often given by unregulated pre-insolvency advisers,” she added.

Ms Amirbeaggi criticised how Australia’s insolvency and bankruptcy laws applied compared to other nations.

In July this year, the Parliamentary Joint Committee on Corporations and Financial Services, led by Senator Deborah O’Neill, looked into the “effectiveness of Australia’s corporate insolvency laws in protecting and maximising value for the benefit of all interested parties and the economy”.

The Committee found that Australia’s corporate insolvency system is “overly complex, difficult to access, and creates unnecessary cost and confusion for both debtors and creditors”.

Ms Amirbeaggi agreed with this finding.

“Whilst we have the laws available to take action to recover money for creditors, for example for insolvent trading, the costs of litigation and recovery often far outweigh the benefit, and do not always result in a return to the creditors,” she said.

Australia has previously been called a “paradise” for white collar crime by a former ASIC chairman in 2014 when comparing its stance on corporate criminality, in comparison to other developed nations like the UK and the US.

Ms Amirbeaggi said that the vast majority of directors “do act in a responsible manner that avoid creditors losses”.

Data from the Australian Bureau of Statistics (ABS) found that 100,000 businesses shut down every year, and of these, only around 8000 enter liquidation because of their failure to pay their debts to creditors in full.

But once liquidators are appointed due to an outstanding debt, this is where things get trickier.

Around 80 per cent of collapsed companies have been accused of misconduct by liquidators, an analysis from last year found.

That means four out of five directors involved with collapsed companies are accused of doing the wrong thing.

An average of 81.2 per cent of initial statutory liquidator reports submitted to ASIC alleged some form of misconduct in the past 10 years.

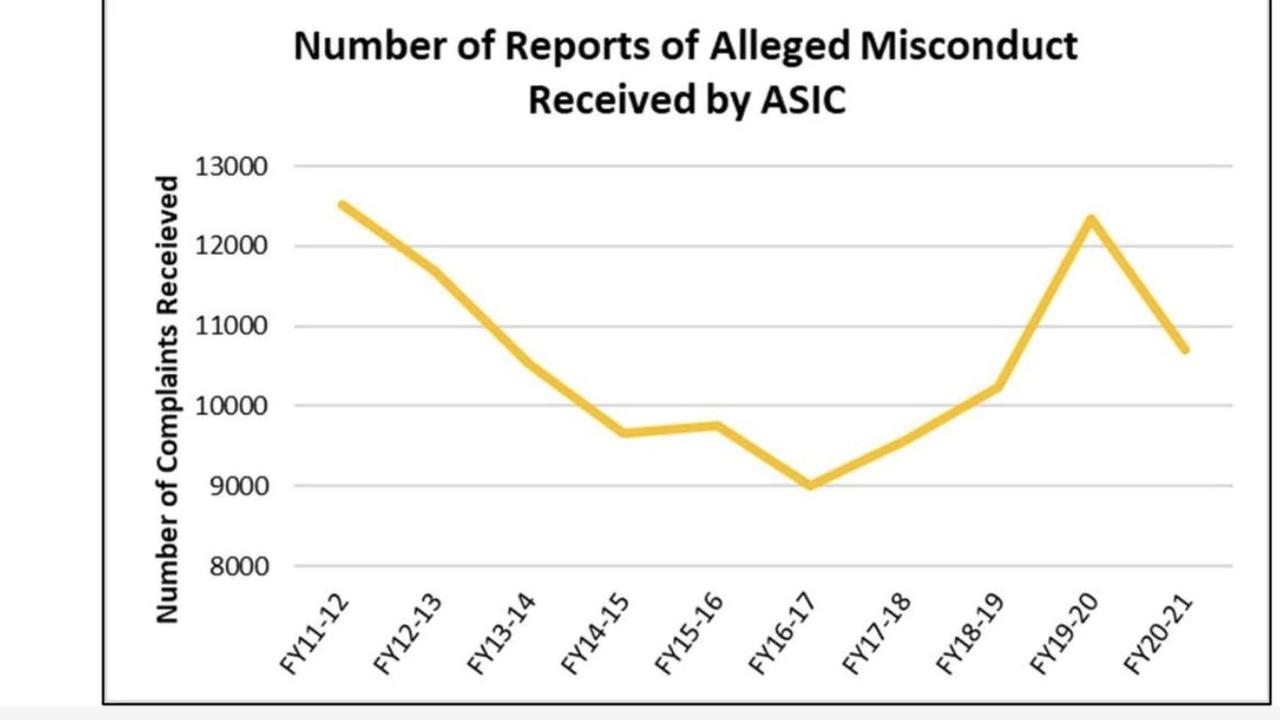

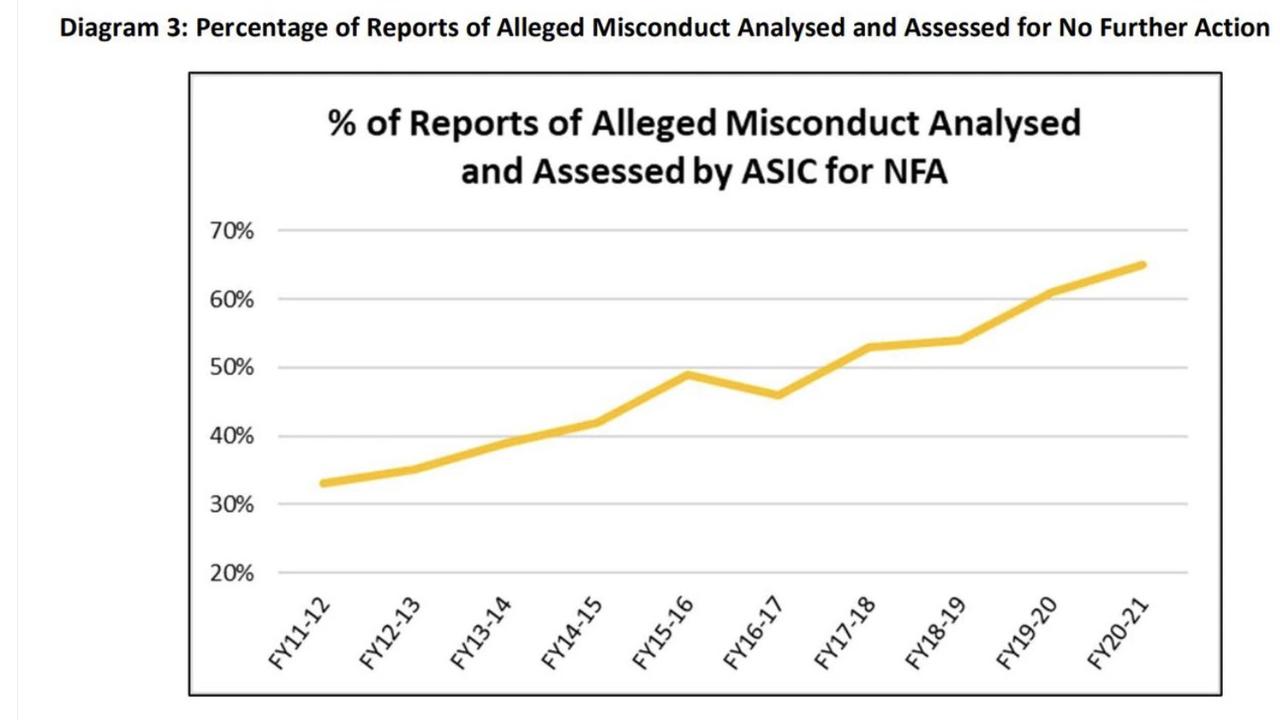

But in a disturbing trend, a decades-long analysis by independent economist John Adams found that the corporate watchdog investigates less than one per cent of tip-offs it receives about suspected corporate misconduct.

Mr Adams found that of the 134,000 reports of alleged misconduct over the last decade, ending in the 2021 financial year, only 1709 progressed to a formal ASIC investigation.

But the latest financial year at the time of his report being released, for the 2020-2021 period, “saw the lowest annual ratio of investigations to the total reports of alleged misconduct in the past 10 years” at just 0.74 per cent.

“ASIC has done just a poor job,” Mr Adams told news.com.au at the time.

In the wake of the report, ASIC denied that its enforcement was dire, saying that 15 per cent of the 10,000 misconduct reports it receives are “referred for action”. Of that, a smaller number turns into an official investigation.

An ASIC spokesman added to news.com.au: “Every year ASIC receives more than 10,000 separate reports of misconduct and possible breaches” (per year).

So why are so many companies collapsing?

More than 8000 businesses entered liquidation this year.

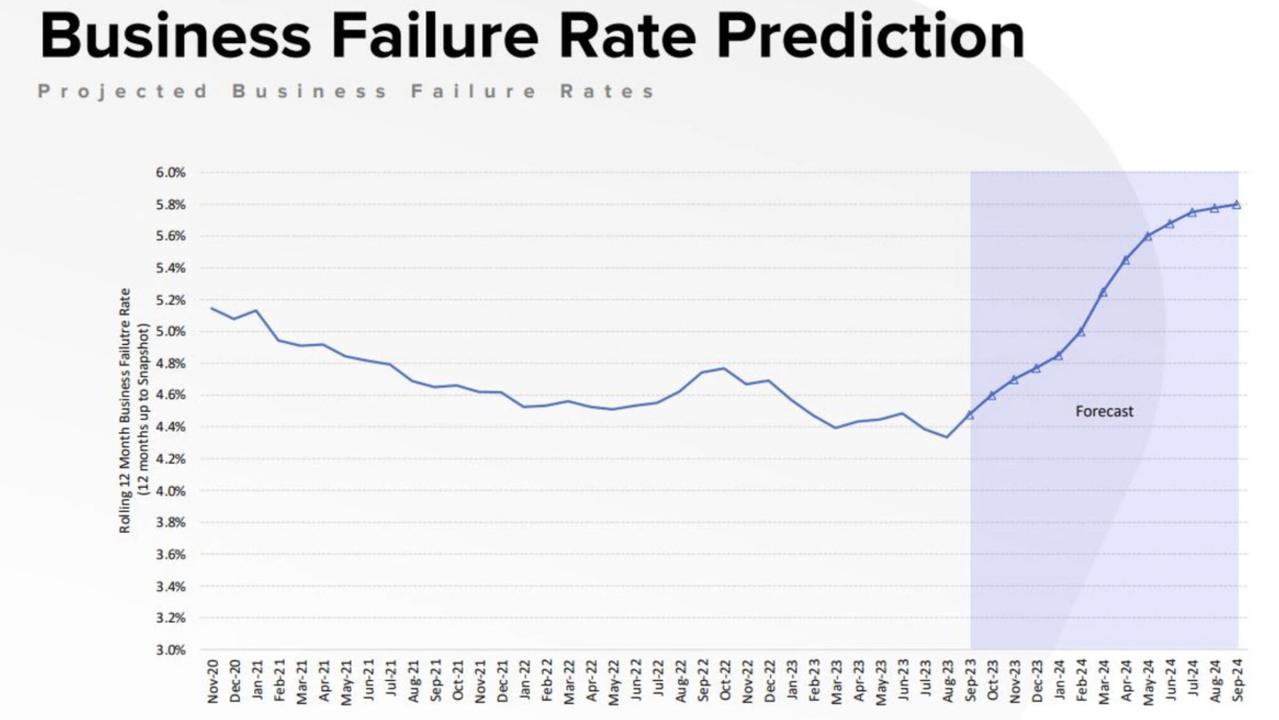

News.com.au earlier reported that the number of business insolvencies surged to its highest level since 2015 in the three months to September 30, with construction industry collapses leading the way.

In the last reported quarter, 2486 businesses hit the wall.

Mass collapses of construction companies are usually the first signs of a struggling economy caught in the throes of inflation, as they run on tight margins and rely on supply chain prices staying the same.

High interest rates has also led to the surge in corporate collapses. The accommodation and food services industry came in as the second most impacted industry in the wake of the corporate collapse crisis Australia is facing.

ASIC’s latest data concluded that 19 per cent of collapsing firms blamed the flow-on effects of Covid-19 for their failure, citing it as a disruption to their business.

Many of these businesses had no assets to speak of. Of the small and medium businesses in Australia that failed in the past 12 months, 83 per cent had assets of $100,000 or less and had fewer than 20 employees.

CEO of credit reporting agency CreditorWatch, Patrick Coghlan, previously told news.com.au that construction industry insolvencies had now surged above pre-Covid levels.

Mr Coghlan said that builders had been “hammered from multiple fronts” including supply chain issues and inflation affecting the cost and availability of materials, labour shortages affecting the cost and availability of labour and high interest rates affecting demand for construction projects.

CreditorWatch’s monthly Business Risk Index forecasts that business failures are likely to continue to rise over the next 12 months, from the current rate of 4.5 per cent to 5.8 per cent.

— With Michelle Bowes

alex.turner-cohen@news.com.au

Originally published as New data shows liquidations are surging, most businesses can’t pay back debts as corporate collapse crisis deepens