Why RBA governor Michele Bullock could put a stop to interest rate rises

Veteran finance pundit Alan Kohler has made a bold claim for the next two years in Australia after the government announced a successor to Philip Lowe.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

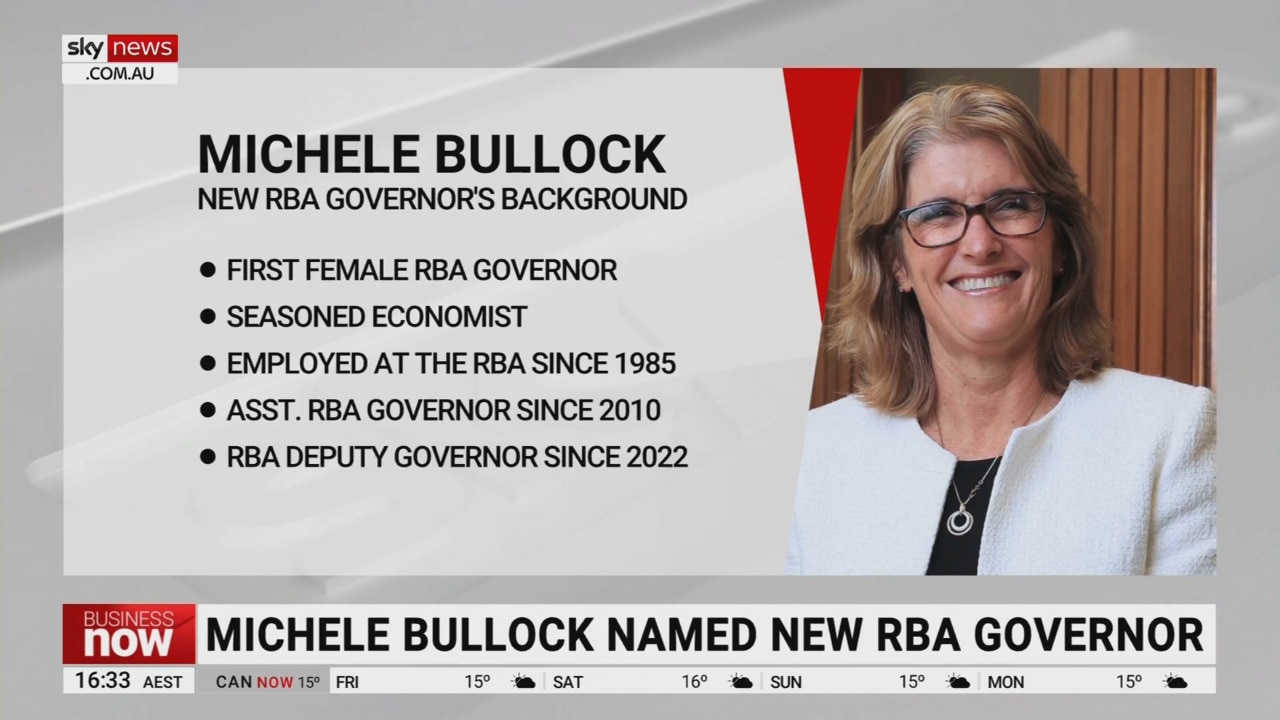

Veteran finance pundit Alan Kohler has made a bold claim for the next two years in Australia after the government announced Michele Bullock as the successor to RBA governor Philip Lowe.

Ms Bullock was appointed RBA deputy governor in 2022, serving also as chief of the bank’s payment systems and executive women boards.

She has now inherited a position that faces ongoing scrutiny amid Australia’s surging inflation and cost of living dilemma.

Kohler said Ms Bullock, who has been at the RBA for 37 years, has arrived at the top job at a critical moment in Australia’s history, but will be more focused on “changing the way the place runs” than bumping up rates.

“It’s very interesting because, in some ways, she is coming into the job with the place at a similar junction as Lowe did,” Kohler told ABC Melbourne on Friday.

“When he was appointed in September 2016, he didn’t do anything with interest rates for 29 months. He went to 29 meetings and didn’t do anything. They left the interest rate at 1.5 per cent.

“My view, and I think it’s going to become the general view fairly quickly, is that interest rates will stay at 4.1 per cent, possibly for the next 29 months.”

“I don’t think Michele Bullock is going to do anything with interest rates for a very long time.

“All of her focus will be on changing the way the place runs.”

It came as Prime Minister Anthony Albanese said Ms Bullock was “eminently qualified” for the top job amid an inflation crisis, which has led to interest rate rises and cost-of-living stress.

Treasurer Jim Chalmers, who joined Mr Albanese in making the announcement, said the decision to oust Dr Lowe was “not an easy call”, claiming Lowe was actually on a shortlist of considered applicants for the role.

Kohler, however, said he didn’t think there was any way Lowe would be returning to his position amid the controversy over the RBA’s decisions in recent months.

Having been the public face of controversial rates rises aimed at tackling inflation, Dr Lowe’s dumping is a big change for homeowners.

Ms Bullock will inherit an RBA in the midst of a review and under fierce criticism when she takes over on September 18.

“It’s the best combination of that experience and expertise but also a fresh leadership,’’ Treasurer Chalmers said.

“One of the things that I have really admired about Michelle Bullock is her contribution to the Reserve Bank review. Michelle has thought deeply about how we take the bank forward into the future.

“She does have a lot of experience. A respected leader, and that’s what we treasure.”

Shadow Treasurer Angus Taylor welcomed Ms Bullock’s appointment.

“Michele Bullock is a highly capable economist, with qualifications from the London School of Economics and University of New England, who has served the Reserve Bank with distinction for 38 years,” Mr Taylor said.

“With inflation at its highest level in three decades, it is essential Australians can have confidence in this crucial economic institution and that we continue to have a credible and capable Reserve Bank.

“Families are feeling the impacts of higher prices and rising interest rates every day. Along with strong economic management, a strong Reserve Bank is essential to addressing the inflation that is driving higher prices.”

Originally published as Why RBA governor Michele Bullock could put a stop to interest rate rises