RBA pours cold water on homeowner double interest rate cut hopes

The Reserve Bank of Australia has poured cold water over a major hope for homeowners in the coming months.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

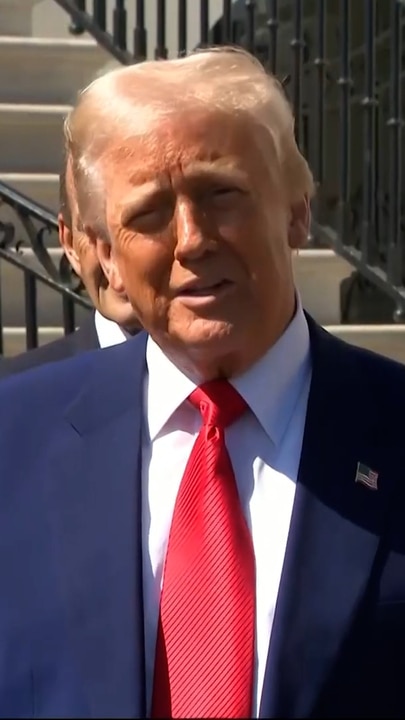

Reserve Bank governor Michele Bullock has poured cold water over predictions of a double interest rate cut next month insisting it’s “too early” to make hard calls on the impact of Donald Trump’s tariff chaos.

Just three days ago there were predictions homeowners could have their mortgage repayments slashed by $6000 a year if a global recession is triggered by Donald Trump’s trade war chaos — including a double rate cut in May alone.

MORE: Aussies to get $5k back amid US tariffs

But as the ASX200 rallied following President Trump’s decision to pause reciprocal tariffs, Ms Bullock altered a prepared speech to warn the path ahead was not yet clear.

In a speech to Chief Executive Women in Melbourne on Thursday evening, she said the bank will take into consideration a range of factors.

MORE: Home loan trap taking years to escape

“We are mindful of not adding to the uncertainty, and to that end, it’s too early for us to determine what the path will be for interest rates. Our focus remains on our dual mandate for price stability and full employment,’’ Ms Bullock said.

“There are a lot of moving parts. We are bringing all this together to form an objective assessment of what it means for the outlook for domestic activity and inflation here at home.

“Inevitably, there will be a period of uncertainty and adjustment as countries respond to the ongoing tariff announcements by the United States administration,’’ she said.

Ms Bullock said it was going to “take some time to see how all of this plays out and the added unpredictability means we need to be patient as we work through how all of this could affect demand and supply globally.”

“Financial market and economic volatility can be expected as this process unfolds. But there are two points I want to make on this. First, we’re not currently seeing the same degree of impact as previous market events like in 2008 for example,’’ she said.

“And second, the Australian financial system is strong and well placed to absorb shocks from abroad.”

As the fallout from the US President’s new trade war engulfs stock markets worldwide, there were fresh predictions this week of a US recession and rapid interest rate cuts.

But Mr Trump then announced a 90-day pause on his announced tariffs.

“’Unpredictable’ is the word,” Shane Oliver, chief economist and head of investment strategy at AMP, told news.com.au.

“By the same token, I’m not surprised. Donald Trump is just so unpredictable that these things are par for the course.”

“I think everyone went into hyper drive a little,” Dr Oliver said. “That was probably a bit far.

“This development pulls back a little bit on those expectations, but I think we’re still going to get at least 25 basis points in May, and there’s maybe a 50 per cent chance we’ll get 50 basis points.

Data from comparison service Canstar shows a standard rate cut next month would slash $76 per month off the repayments on a $500,000 mortgage.

If it was super-sized, that figure would leap to $151 per month, providing some good breathing room for stretched household budgets.

Four rate cuts in next 12 months

Despite fears of a US recession, the economic fallout could have a silver lining for Aussie homeowners slashing up to $400 a month from the average mortgage over the next year.

The ANZ is now forecasting four 0.25 per cent interest rate cuts that could save homeowners with a $600,000 loan around $76 to $156 per month depending on loan size.

A variable rate borrower with a $500,000 home loan could see their monthly repayments drop by around $76, while a borrower with a $1 million loan could see a reduction of $153.

For families with a larger $1 million loan size the savings could be worth $9000 a year.

ANZ chief economist Richard Yetsenga said he was not ruling out a 50 basis point cut – a double rate cut – in May.

“We now expect the RBA to ease in May, July and August – 25 basis points at each meeting,’’ he said.

“This would see the cash rate at 3.35 per cent in August. We do not rule out a 50bp cut in May if sentiment sours and the global growth outlook deteriorates sufficiently.

“The tariffs are disproportionately stiffer for Asia. The impact on mainland China’s economy will be limited. Malaysia, Thailand and Vietnam will be more vulnerable. US tariffs can significantly disrupt India’s exports.

“We expect Asian currencies to bear the brunt of the adjustment to the announced tariffs.”

The Reserve Bank of Australia (RBA) cut the cash rate by 25 basis points in February, saving Australian homeowners with variable interest rate mortgages around $100 to $150 per month, potentially amounting to $1200 or more annually.

Next RBA meeting could deliver a rate cut

In a stunning prediction, Treasurer Jim Chalmers said the dive in the value of the Australian dollar – currently about 60 cents for $US1 – hinted at “around four interest rate cuts in Australia this calendar year”.

And he’s predicted there could be a double rate cut as early as next month.

“The next Reserve Bank interest rate cut in May might be as big as 50 basis points,” he said.

“Forecasting is difficult enough in more stable times, but especially so in uncertain times.

“Clearly a series of decisions are still to be taken around the world when it comes to how countries may or may not retaliate to the decisions taken and announced by President Donald Trump in the last week or so.

“So, there is an element of uncertainty around the modelling and there’s an element of uncertainty on the economic impacts more broadly.”

Releasing Treasury’s third updated forecasts on the impacts of the tariffs, he warned now was not the time to change the government.

“Australia is better placed and better prepared than our peers,” he said. “This would be the worst time to risk a change of government, to a Coalition government, which would make wages lower, taxes higher, and who has secret cuts to pay for nuclear reactors.”

Treasurer Jim Chalmers said he wanted to assure people that in a world of volatility and uncertainty, Australia is better placed and better prepared than our peers.

“Everyone with a super fund, everyone with shares, I think probably every Australian, is seeing what’s happening on global share markets and in our own share market with a degree of trepidation about all of this uncertainty,” he said.

“So yes, we are concerned, and we’ll continue to engage. I’m concerned about the impact in Asia. If you look at the impact of some of the tariffs on Asia, some of them were quite high.”

Originally published as RBA pours cold water on homeowner double interest rate cut hopes