Aussie shares leap higher in rebound rally

The Australian sharemarket notched a powerful rebound rally on Tuesday on the back of iron ore and oil price rises and a surge in banking behemoth Commonwealth Bank.

The Australian sharemarket notched a powerful rebound rally on Tuesday on the back of iron ore and oil price rises and a surge in banking behemoth Commonwealth Bank.

The Australian sharemarket fell sharply in a ‘punchy session’ to start the week, dragged down by a selloff in the energy and materials sectors.

Jim Chalmers has amped up his tax cut sell, revealing the group of Aussies expected to pocket an average of $3000 amid renewed concerns on the inflation fight.

For the average household things have scarcely been worse since records began in the 1970s, as the economy enters a dangerous and familiar phase.

The true cost of some Aussie supermarket classics have been laid bare in a hearing into price-gouging.

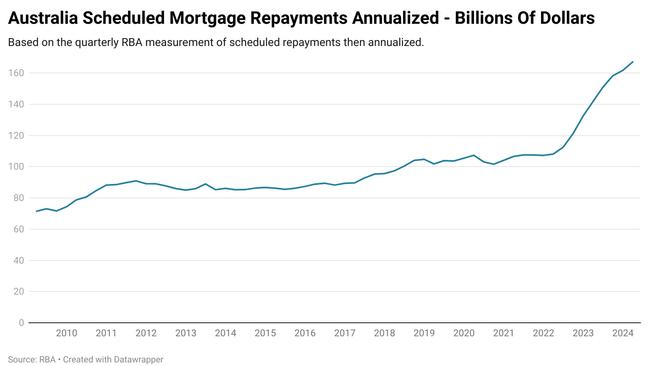

‘Do what is necessary’: Aussies may not be in the clear when it comes to interest rate increases as a key expense threatens to derail inflation.

A spillover from China’s weak economy and surging petrol prices pose significant challenge to taming inflation, the RBA has cautioned.

All 11 sectors finished in the red on Monday, with the local benchmark dragged down by a sell off in tech stocks.

The share market soared on Friday as strong leads from Wall St and Europe and better-than-expected data from China lifted traders’ confidence about the global economic outlook.

The number of Aussies in work has hit a new high as fresh figures show more people are picking up part-time jobs.

Household spending growth has collapsed in the last 12 months as persistent price pressures and an aggressive round of rate rises forces families to tighten their belts.

One of Australia’s biggest banks has announced a shock move for its interest rates.

The combined value of Australia’s housing stock has soared, with the average house price in one state rising by a whopping $3200 every week.

Philip Lowe will depart the Reserve Bank this week after a controversial tenure. But what does he plan to do next?

Original URL: https://www.thechronicle.com.au/business/economy/interest-rates/page/72