The RBA keeps interest rates on hold at 4.1%

The RBA has kept interest rates on hold at 4.1% today but a major bank is forecasting more pain to come.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

BREAKING

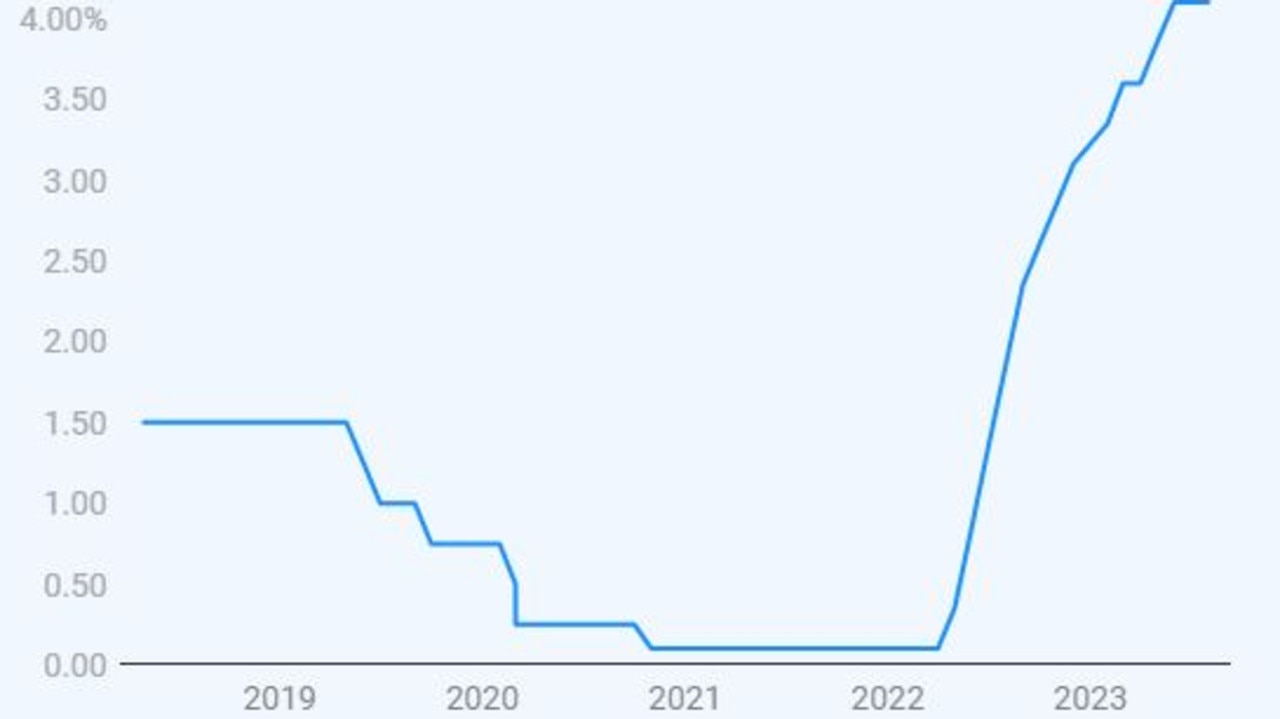

The Reserve Bank of Australia (RBA) has kept the cash rate on hold at 4.1 per cent on Tuesday afternoon for a third consecutive month, but said that “significant uncertainties around the outlook” remain.

The decision was widely expected, with 97 per cent of economists in the Finder cash rate survey forecasting that rates would stay on hold.

The last interest rate hike occurred in June, ending 12 rate rises since last May and providing relief to overextended borrowers struggling to keep up with home loan repayments.

But the good news may not last with at least one ‘big four’ bank forecasting Aussie homeowners will be hit with one more interest rate rise before Christmas.

Gareth Spence, NAB senior economist, told news.com.au that as economic “risks are still tilted to the upside”, NAB is predicting Australia’s central bank will increase rates by another 0.25 per cent to 4.35 per cent on November 7.

Although, Mr Spence said, the rise could come as early as the next RBA board meeting on October 3.

He said the RBA was “very data dependent” and based on upcoming economic data “they may have to do a little more tweaking” to interest rates.

In announcing the decision, the RBA said: “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks.”

While inflation associated with the consumption of goods is slowing, as seen in the recent monthly Consumer Price Index (CPI) figures, third quarter CPI data, to be released on October 25, will provide a better picture of inflation in the services sector, Mr Spence said.

RBA governor Dr Philip Lowe acknowledged that services inflation was a risk.

“Inflation in Australia has passed its peak and the monthly CPI indicator for July showed a further decline. But inflation is still too high and will remain so for some time yet. While goods price inflation has eased, the prices of many services are rising briskly,” Dr Lowe said.

“We all know the brakes are on but the longer inflation is above target the more ingrained it becomes in price setting,” Mr Spence said. “We’re not completely out of the woods yet.”

It is a view echoed by the RBA: “If high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later, involving even higher interest rates and a larger rise in unemployment.”

NAB was also “still worried about the potential for wage increases due to labour market risks,” which would be inflationary if they materialised, Mr Spence added.

Making the announcement the RBA said: “Given that the economy and employment are forecast to grow below trend, the unemployment rate is expected to rise gradually to around 4.5 per cent late next year. Wages growth has picked up over the past year but is still consistent with the inflation target, provided that productivity growth picks up.”

AMP chief economist Dr Shane Oliver said in a note that “stronger than expected wages growth” and “a further drop in unemployment” were both risk factors that could lead to another interest rate rise.

However, unlike NAB, Dr Oliver agrees with two-thirds of economists in the Finder cash rate survey who believe interest rates have hit their peak.

Views on when interest rates will begin to fall – and Aussie households will get real relief – are more mixed, with economists’ predictions ranging from March 2024 to late 2024.

Mr Spence said NAB is forecasting the first interest rate cut in August 2024, with rates returning to three per cent by 2025, depending on “how much things do slow”.

Tuesday’s decision to keep interest rates on hold was one of Dr Lowe’s last acts in the position.

Future interest rate decisions will come under the purview of new RBA governor, Michele Bullock, who takes over in the top job from Dr Lowe on September 18.

The government opted not to reappoint Dr Lowe for a further term as RBA governor after he provided incorrect guidance to Australians that interest rates were likely to remain low until at least 2024.

Originally published as The RBA keeps interest rates on hold at 4.1%