‘Isn’t priced in until June’: Trump win leads to Aussie interest rates news we were dreading

The US President-elect isn’t even running the show yet – but already, countless Aussie households are seriously hurting.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

In recent weeks, as it became clear that Donald Trump would be returning to the office of US President, the tectonic plates underneath global markets and economic expectations began to rapidly move.

Trump’s re-election and the expected seismic shift in American foreign and economic policy swiftly prompted commentary from the Reserve Bank of Australia and the Albanese government on the potential impact on Australia.

During a recent Senate Estimates hearing, RBA Assistant Governor Chris Kent warned that due to the sheer size of the US economy, there would be an “upward effect on interest rates” around the world due to Trump’s agenda.

While addressing the Australian Institute of International Affairs, Treasurer Jim Chalmers warned that Australia has “more at stake than most” if a major trade war were to come to pass.

Dr Chalmers went on to share the findings of a Treasury modelling on different trade and tariff policy scenarios.

“Treasury’s analysis demonstrated that we should expect a small reduction in our output and additional price pressures, particularly in the short term,” Dr Chalmers said.

What are Trump’s policies?

In a recent interview with podcaster Joe Rogan, Mr Trump shared his view that the word “tariff” is the most beautiful word in the dictionary.

“It’s more beautiful than love, more beautiful than anything,” he said.

Mr Trump proposes that all imports into the United States be hit with a tariff of 10 to 20 per cent of the value of the goods. For goods coming from China, the tariff rate would be a significantly higher rate of 60 per cent.

If enacted at the rates currently proposed, tariffs and the inevitable responses from other nations are expected to put upward pressure on inflation and by extension interest rates.

Meanwhile, Mr Trump has also proposed to do a mass deportation of undocumented migrants. The new incoming “Border Tsar” has promised to conduct “the biggest deportation operation this country has ever seen”.

If these mass deportations do come to pass, the US could see a surge in wages growth and inflationary pressures as businesses attempt to fill the positions left by deported undocumented migrants. This could put additional upward pressure on US interest rates, with potential implications of knock-on effects throughout the world.

The US Federal Reserve, among others, has noted that the strong growth in the US labour force in recent years has played a significant role in suppressing wage growth pressures. A sizeable proportion of that growth in the labour force has been driven by the entry of undocumented migrants.

Ties that bind

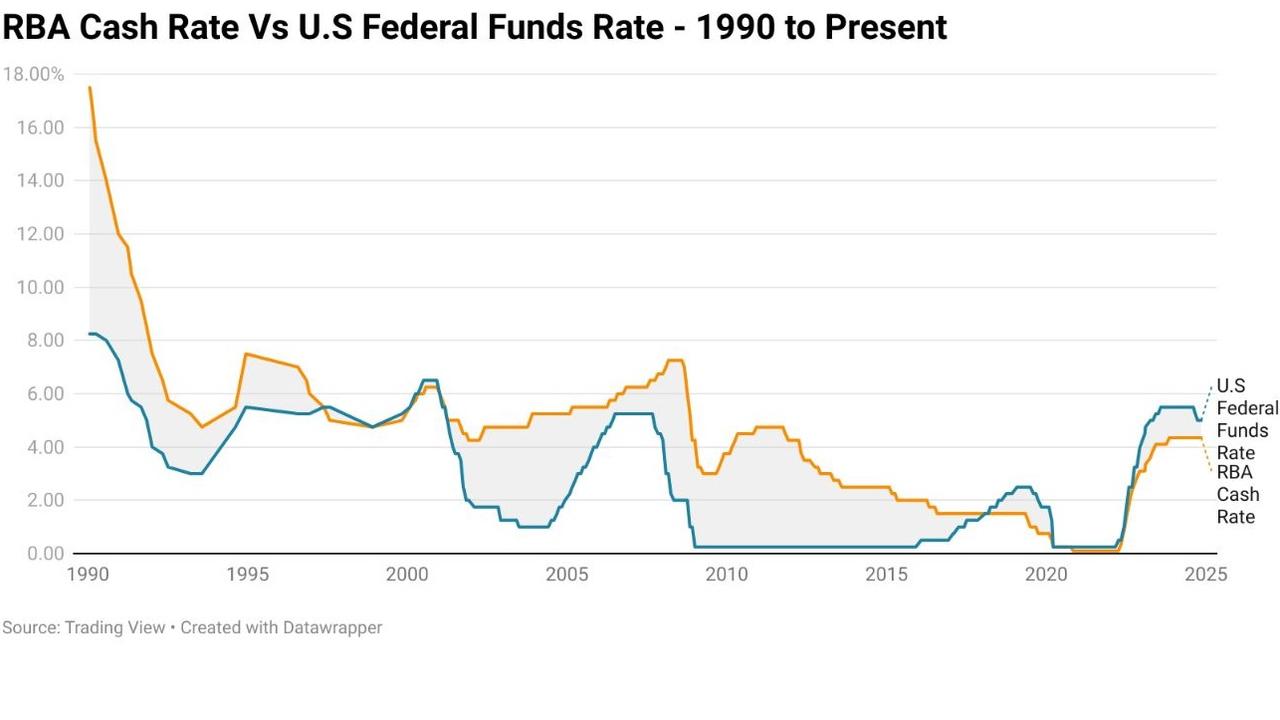

The differential in interest rates between nations can impact the relative strength of their currencies and by extension, inflationary pressures. Historically, Australia has had a significantly higher cash rate than the US equivalent for most of the last 35 years.

At the peak in January 1990, the RBA cash rate was 9.25 percentage points higher than equivalent federal funds rate. With the exception of a brief period between 1997 and 2001, the RBA cash rate spent the rest of the 28 years between 1990 and 2018 at a level higher than its US equivalent.

In the other direction, the largest gap in favour of US interest rates occurred in February 2023, at which time the federal funds rate was 1.65 percentage points higher than the RBA cash rate.

There is scope for the RBA to pursue lower interest rates than the United States, but depending on the broader circumstances, that can carry potential risks of higher inflation and the bond market diverging from the RBA and pursuing a different path.

The impact so far

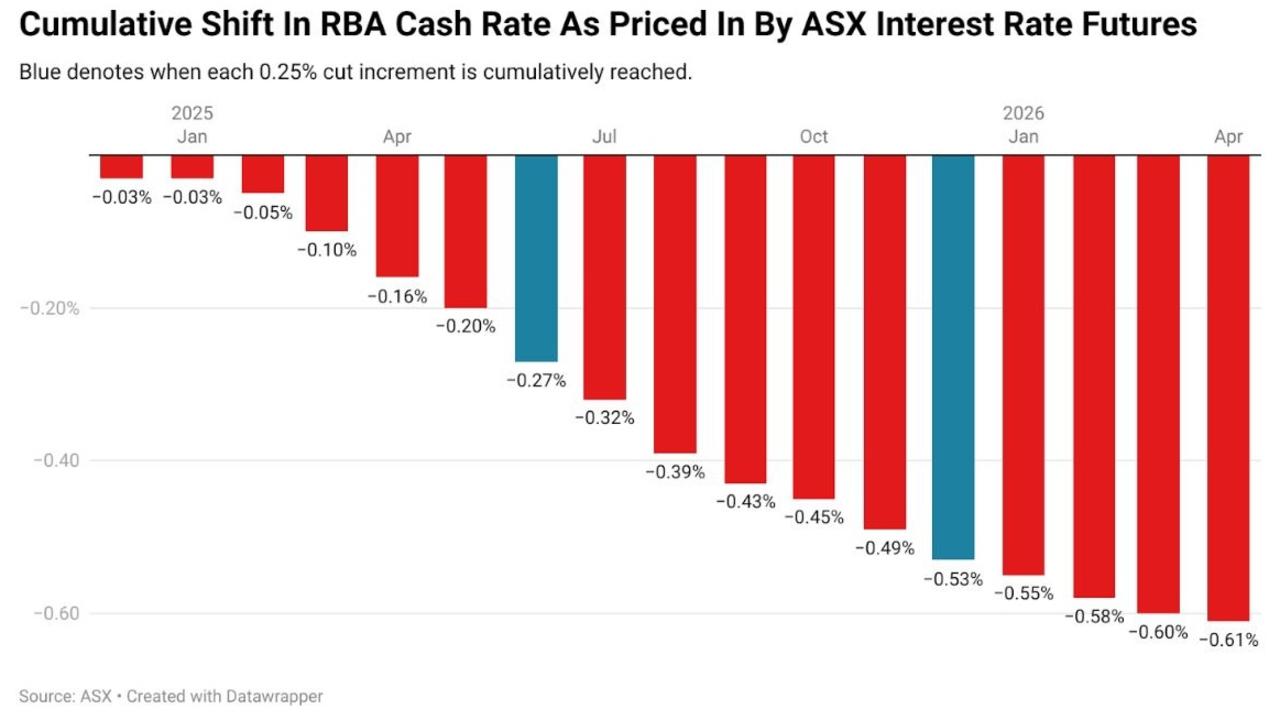

Just a few short weeks ago, the consensus of the Big Four banks was that a rate cut would be coming in February. As of the latest market close, a rate cut isn’t priced in until June.

At one stage, the market had pushed the first fully priced in 0.25 per cent rate cut all the way out to August.

Further volatility in the market pricing on the path of interest rates going forward is arguably highly likely, as the market continues to process the implications of Mr Trump’s proposals and the likelihood of those policies being enacted in their current form.

The somewhat ironic thing is President Trump doesn’t actually take office for another two months, so it will be some time before it is entirely clear what Mr Trump will prioritise in reality, and how it will be pursued by his newly-minted cabinet and admiration.

A problem for mortgage holders and Labor?

To what degree the concerns about inflation and higher borrowing costs will be realised in the long-term is something of an open question. President Trump can be an unpredictable figure, and there is likely to be a great deal of push back from American businesses against his plans.

On the domestic front, the recent RBA Minutes reveal a central bank comfortable with interest rates exactly where they are and deeply aware of the upside risks to inflation.

Beyond our shores, the fortunes of Australian mortgage holders and perhaps those of the Albanese government may be heavily influenced by the global bond market. The course of global bond yields is far from set in stone and there may be further volatility in both directions in the months to come, as the market attempts to digest what may lay ahead.

Ultimately, the election of President Trump and the impact of his proposed policies are just one of several major hurdles that stand between the Australian economy and rate cuts.

In a vacuum, the impact of Mr Trump’s policies alone may not have been enough to potentially keep interest rates at the high end of recent history, but when combined with still-simmering domestic inflationary pressures, it is entirely possible they may have a major role in that scenario.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Isn’t priced in until June’: Trump win leads to Aussie interest rates news we were dreading