‘Frantic’: Property experts reveal the real impact of interest rates

Landlords have revealed how the property market will become temporarily “frantic” after today’s rates decision.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Landlords have reacted to today’s Reserve Bank decision, insisting that rate changes aren’t the gamechanger most Aussie think they are, and warning that placing too much importance on them is a common trap.

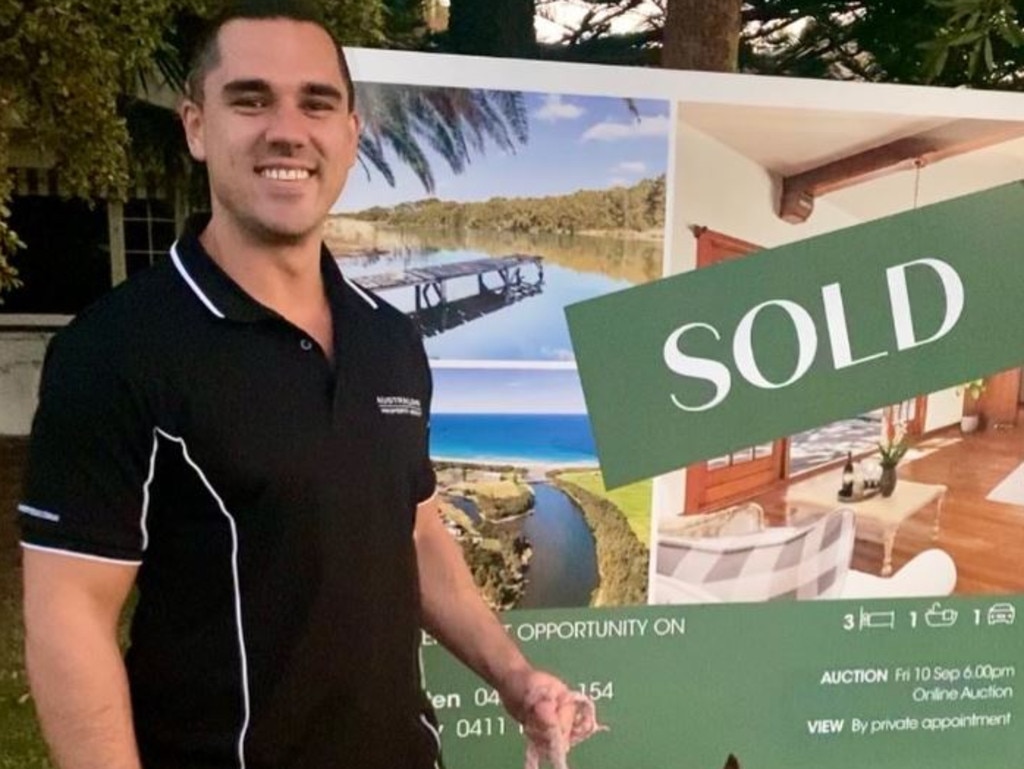

Jack Henderson, 28, owns 15 properties and a buyer’s agency and has amassed over $20 million in debt building his property empire.

Mr Henderson, who believes it is “stupid to pay off your mortgage”, is braced for the property market to become temporarily “frantic” now that rates have dropped but, otherwise, he isn’t too concerned.

Mortgage holders have finally been given much-needed breathing room, with the Reserve Bank announcing inflation has fallen enough for Australia to begin its rate-cutting cycle.

After Tuesday’s meeting, the Reserve Bank cut the official cash rate from 4.35 to 4.10 per cent.

Mr Henderson told news.com.au that rates coming down creates a more “positive market” for buyers and sellers.

“It will give buyers more confidence to act in the marketplace, which is good for my business,” he said.

“People will be more confident with money because the future will look brighter than the past.”

The 28-year-old rents a multimillion-dollar property in Sydney’s affluent eastern suburbs because he believes you should only buy to invest, not for lifestyle.

He owns over a dozen properties and lives and breathes the property market and creating income streams.

MORE: Half of renters experiencing financial difficulties

Mr Henderson explained that it will create a “short-term frantic market” where people are keen to take “advantage” of lower interest rates.

The 28-year-old stressed that it is never enough to change people’s lives, even when interest rates fall in general.

“Life will continue on as normal. That is the reality for most people,” he said.

Mr Henderson said he learned years ago that there’s not much point in living and dying by interest rates.

“The only thing it impacts for me is my current cash flow. I feel poorer now on a monthly basis than I did five years ago,” he said.

“It costs significantly more now to hold a property than it did a few years back. Money that I used to be spent on other sh*t now gets spent on my properties.”

MORE: Man moves into DIY tiny house to avoid paying rent

The financial hit doesn’t worry him because he is more concerned with how his properties are increasing in value over time than with monthly expenses.

That does not mean a rate decrease isn’t a welcome relief.

He runs a property-buying business, and when people are keen to purchase property, he’ll be making more money, but he is more interested in how rates impact the market than his own bottom line.

“It is a great thing for me but it is also a positive thing for the market because it makes banks more competitive,” he said.

Property expert Sam Gordon owns over 100 properties, and has $40 million worth of debt. He shares a similar perspective to Mr Henderson.

Mr Gordon also rents the home he lives in and explained that rates have become less of a concern for him because the “longer you’re in the property game, the less debt you should have” – but that doesn’t mean he dismisses them altogether.

“People get fixated on rate cuts, but it is more of a market thing. It really drives the market,” he said.

“There’s definitely people that have been hesitant and waiting for the signal to buy.”

Mr Gordon said that, while rates may vary and that you certainly shouldn’t invest in property if you can’t afford to service the mortgage, he generally tries to educate people on the “bigger picture” when it comes to interest rates.

“A rate cut is nice, but if you look at markets like Perth and Brisbane, they’ve seen a 20 per cent growth in the last year, so if you missed out in that time frame because of rates, then that was shortsighted,” he said.

“The way I look at it is that rates are the cost of doing business. If you put yourself out of the market for two years how much capital growth did you miss?”

Mr Gordon said that rising or falling interest rates make a difference to him personally and professionally, but you don’t want to fall into the trap of only worrying about rates.

For example, Mr Gordon plans to sell some properties this year, so he is keen to see which way rates continue to trend, because if they keep dropping, the market sentiment will be more positive, but beyond that, he isn’t worried.

The 34-year-old said that rates start to matter more if your property isn’t increasing in value.

“If a property is costing you $10,000 to hold and the market is stagnating and that is when you have to assess if the property is going to keep growing for you,” he said.

“Most people in Australia believe if you buy property you should hold it forever, I don’t agree with that. If you are holding a property when the market is going backwards you can end up $100,000 down.”

Mr Gordon said, ultimately, people should buy when they can afford and advised Aussies not to “obsess” too much over interest rates.

Originally published as ‘Frantic’: Property experts reveal the real impact of interest rates