Fears interest rates could be hiked in 2024

Over a million Aussies are already in mortgage stress and now there are fears there is even more trouble ahead.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

There are fears that interest rates could be hiked again as employment holds strong and inflation remains difficult to contain, despite desperate homeowners – including over a million experiencing mortgage stress – waiting for the cost of living relief.

Australians with mortgages have suffered through the most aggressive rate hikes in decades after it was pushed from a record low of 0.1 per cent to 4.35 per cent in the space of 13 months.

This was the biggest increase to interest rates in the shortest period in 40 years – sending many scrambling to find thousands more to pay their mortgage.

The last time the Reserve Bank of Australia (RBA) was so aggressive, the country ended up in the deepest recession since the 1930s.

While the RBA has spoken about a “narrow path” to a soft landing for the economy and hope this had been achieved – some have raised concerns that instead the country is teetering on the edge of another rate rise.

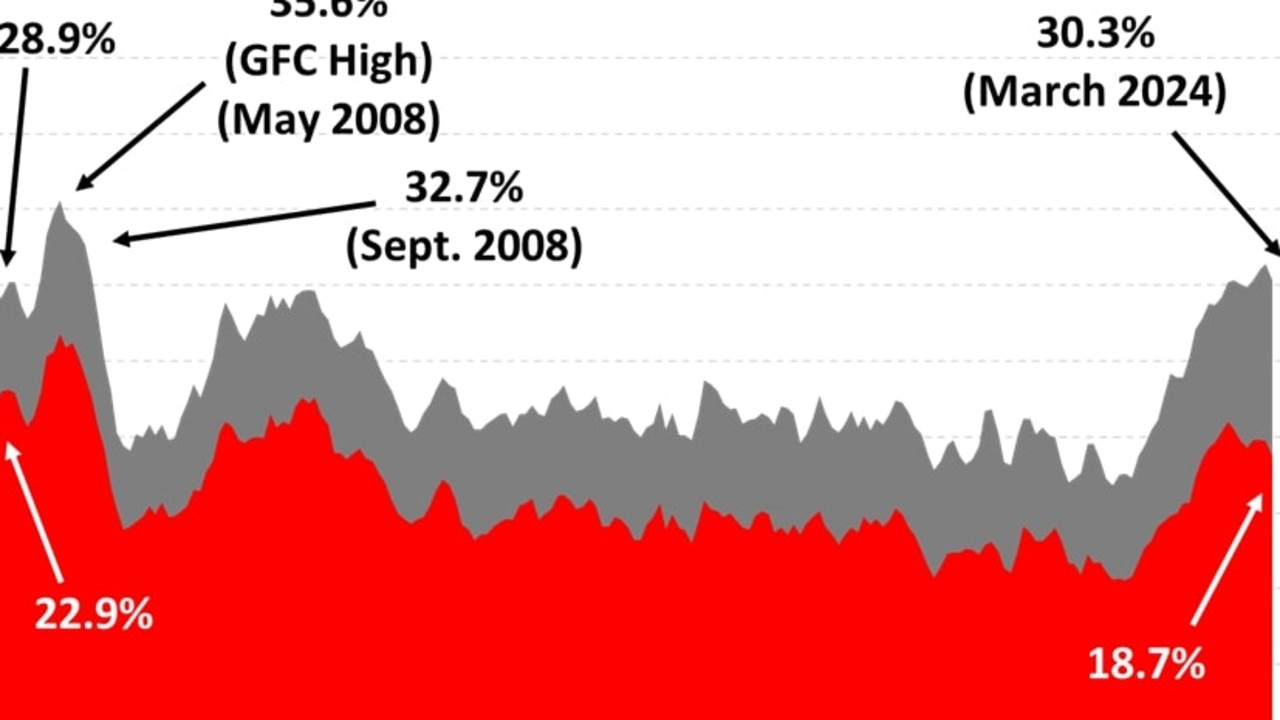

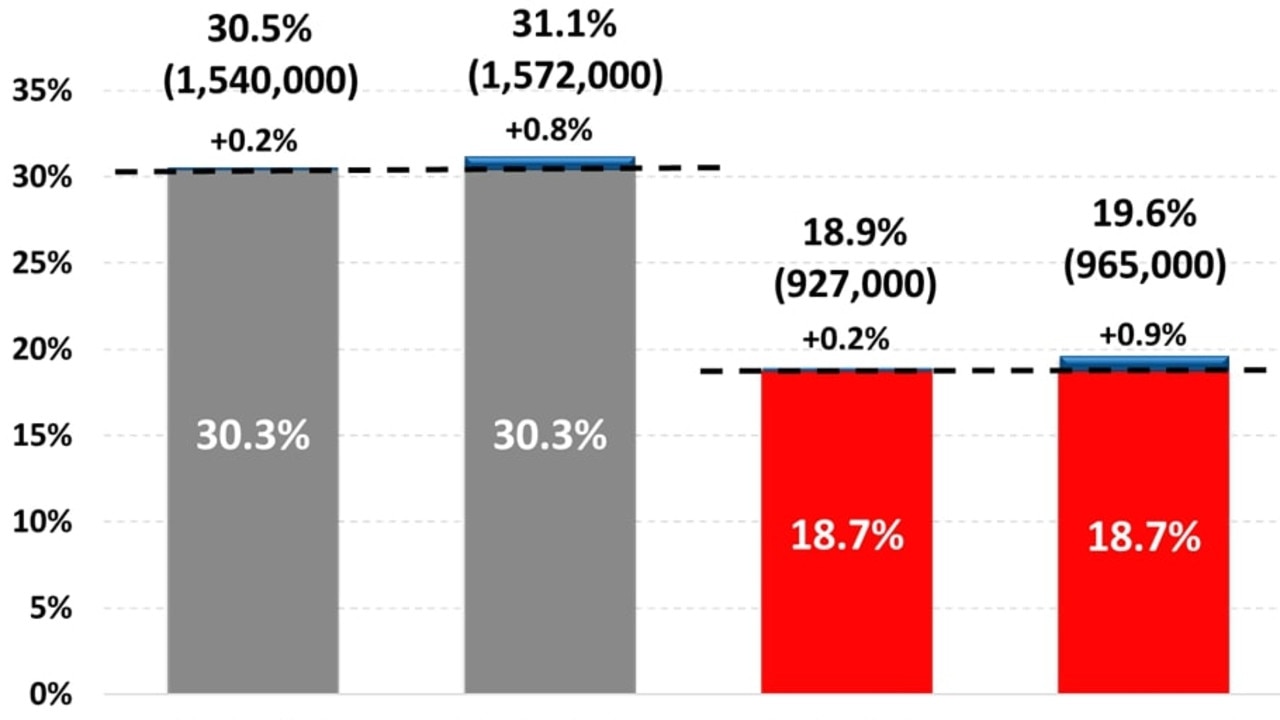

It comes as the latest Roy Morgan data shows 1.53 million mortgage holders were at risk of mortgage stress in March 2024, down 98,000 from February, but virtually unchanged from December 2023.

“Although inflation pressures have clearly eased, the level of inflation remains above the Reserve Bank’s preferred target range of 2-3 per cent and inflation indicators such as petrol prices remain high,” Roy Morgan CEO Michele Levine said.

“For the first time in history average retail petrol prices have been above $1.80 per litre for a record 41 straight weeks – equivalent to 10 months.

“For these reasons we have modelled further interest rate increases of 0.25 per cent in May and June 2024. If the RBA raises interest rates by 0.25 per cent in May and June to 4.85 per cent, Roy Morgan forecasts mortgage stress would increase to 1.57 million mortgage holders (31.1 per cent) considered at risk.”

She said the variable that has the largest impact on whether a borrower falls into the at risk category is related to household income – directly related to employment.

“The employment market has been exceptionally strong over the last year, and this has underpinned rising household incomes that have helped to moderate the increases in mortgage stress since mid-2023,” she said.

“However, rising interest rates since May 2022 have caused a large increase in the number of mortgage holders considered at risk.

“If there is a reacceleration in inflation over the months ahead, that results in further interest rate increases in 2024, levels of mortgage stress will begin to increase again later this year.”

‘Even money on rate rise or cut’

Meanwhile, new job figures released this month dimmed hopes the Reserve Bank will cut interest rates this year.

The unemployment rate rose slightly to 3.8 per cent in March, up from 3.7 per cent in February, according to Australian Bureau of Statistics.

The number of full-time positions rose by 27,900 last month, but that increase was offset by the loss of 34,500 part-time positions.

Judo Bank chief economic adviser Warren Hogan is concerned momentum is picking up in the economy with retail spending edging up and employment remaining strong.

“Employment data for March confirms February levels were above right – the Dec and Jan numbers were the noisy outliers,” Mr Hogan said.

“Employment and hours work solid in 2024. The economy is wandering off the RBA’s ‘narrow path’. Even money now the direction of the next move in rates.”

Data from the Judo Bank also showed improvement for manufacturing and the service sector output rose to its highest level in two years.

“It looks like the economy is wandering off the RBA’s ‘narrow path’ which is great news for business, jobs and economic growth but brings into question whether inflation remains on track to get back below 3 per cent on a sustainable basis,” he added.

Rabobank senior strategist Ben Picton also believes a further rate hike can't be ruled out and has questioned calls for cuts, particularly considering the “pretty strong result that does nothing for the “rate cuts now” case”.

Mr Picton wasn’t convinced it was the time for rate cuts noting that job ads were still 59 per cent above pre-Covid levels, retail sales were above 2009-2019 trend and credit growth is accelerating.

“We also have tax cuts on the way and Albo/Jim indicating more spending in the budget. ASX making new all-time highs,” he added.

Slam the door shut

After Iran launched an attack on Israel unlike anything the world has seen with more than 300 munitions fired, Betashares chief economist David Bassanese warned global inflation and interest rates in Australia could be impacted.

“The good near-term news is that tensions between Israel and Iran appear to be moderating, with neither side keen to escalate their tit-for- tat exchanges,” Mr Bassanese told news.com.au.

“If so, there’s a good chance we may have seen the peak in oil prices and hence upward pressure on inflation from fuel prices.

“The interest rate outlook, however, remains critically dependant on the strength in economic activity and lingering service sector inflation.”

Although local consumer spending remains weak, employment growth and the labour market remains tight, he warned.

“The RBA will also be aware that inflation pressure in the United States of late has surprised on the upside. All up, these factors have reduced the pressure for local interest rate cuts any time soon,” he said.

“Tomorrow’s CPI report will be important. Confirmation of continued declines in inflation will still keep the door open for rate cuts later this year, while a high number could slam the door shut. On balance, I’m still anticipating at least one RBA rate cut this year but likely not before November or December.”

Canstar’s group manager of research, ratings and product data Josh Sale agreed all eyes will be on the March inflation data for further insight into how soon borrowers may be able to expect the first cash rate cut.

“Stronger than anticipated inflation numbers out of the US last week may put the Reserve Bank of Australia on notice so as not to commence reducing rates here before the inflation dragon has been slayed,” Mr Sale said.

More waiting

Meanwhile, Deloitte Access Economics partner Stephen Smith, believes there is still the case for rate cuts as inflation is slowly and steadily receding, but a thorn in the RBA’s side is the official data suggests the labour market is yet to deteriorate.

“So the second half of 2024 will bring the revamped Stage 3 tax cuts and gradual improvements in real wages, much to the relief of households,” Mr Smith explained.

“At the same time, the outlook for growth is clouded by fading business investment, a housing construction sector spinning its wheels, and a global environment that’s uncertain at best.

“The case for lower interest rates is growing, but there is significant debate about the timing and extent of rate cuts.

“Our forecasts now include a first rate cut in November this year, based on an acknowledgment that a cautious RBA will likely want to see the September quarter inflation data, released in late October, before pulling the trigger.”

The global situation

But it could also hinge on the US, with the Fed the world’s most powerful central bank, which often leads global rate cutting agenda.

In the US rates are currently sitting at 5.37 per cent – the highest in 23 years – and now some economists have dropped their predictions of cuts by June. Instead experts are warning there will be no relief before Christmas after March inflation in the US accelerated from 3.2 per cent to 3.5 per cent.

HSBC senior economist Chris Hare and US economist Ryan Wang US economist said markets point to an increased risk of delayed rate cuts, particularly in the US, but in Europe, where demand is weaker and cost pressures are easing, loosening is still broadly on track.

However, the economists have forecast the Fed, the European Central Bank (ECB) and Bank of England (BOE) will slash rates by 0.25 per cent in June.

“These forecasts for rate cuts have two key features. First, the cuts are gradual by historical standards. This is because we see some further inflation stickiness, mostly due to strong growth in the US, mostly due to high labour costs (due to weak productivity) in Europe,” they wrote.

“Second, while our forecasts are similar for all three central banks, our conviction for rate cuts varies – lowest for the Fed, highest for the ECB, with the B) E in between.

“For the Fed, stalling disinflation risks are pushing rate cuts past June And if above-trend growth continues, that poses an upside risk over the medium term.”

Originally published as Fears interest rates could be hiked in 2024