Christmas miracle on the way as experts tip RBA to deliver a rate cut in December

Relief could be on the way for mortgage holders across the country as experts tip a rate cut might be on the cards before Christmas.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Relief could be on the way for mortgage holders, with experts predicting a rate cut could arrive “before Christmas”.

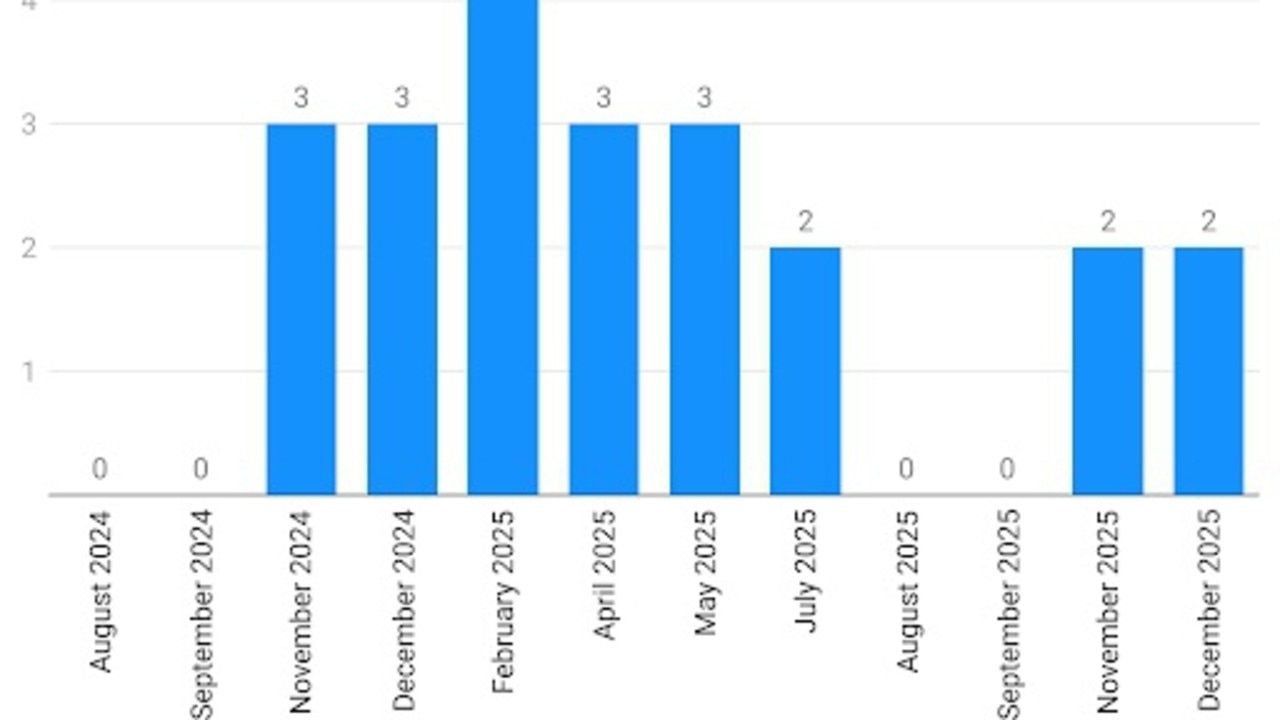

A new Finder survey revealed one in four economists are expecting the first cash rate cut to happen by the time the RBA finishes its December meeting, in what could be a Christmas miracle for homeowners across the country.

More than 80 per cent of the surveyed economists predict the cash rate will be held at 4.35 per cent when the board meets next week.

Finder head of consumer research Graham Cooke said inflation figures released on Wednesday aren't high enough to warrant a rate hike.

“While inflation has been a stubborn thorn in the economy, the June quarter CPI data was in-line with expectations, although still higher than the RBA would like it to be,” he said.

“Australia’s core inflation rate, which excludes the most volatile products such as food and energy, has slowed enough to almost rule out another rate rise.”

Mr Cooke said while the slowing of the country’s core inflation rate doesn’t mean there will be a rate cut in August, there is a chance Australia will receive one by Christmas.

However, University of Sydney economist James Morley is among the 19 per cent of economists predicting an interest rate hike is likely to arrive in August.

“The RBA will raise the cash rate because it will want to demonstrate its primary focus is on bringing inflation back down to the target range,” he explained.

But while Mr Morely is expecting an immediate rate increase, he said rate cuts will begin in December and continue well into the New Year.

“A further weakening of economic conditions and improvements in inflation measures for Q3 will allow the RBA to consider reversing the rate rise in December and continue cutting in the new year to bring the cash rate back towards a neutral level,” Mr Morley said.

The cash rate has been held at 4.35 per cent since the last hike in November and is sitting at its highest level since December 2011.

It comes as 41 per cent of homeowners struggled to pay their mortgage in July, a 7 per cent increase from the previous month, according to Finder’s Consumer Sentiment Tracker.

Mr Cooke said the number of Australian’s who are struggling to afford their mortgage repayments has been steadily increasing since 2021.

“Millions of homeowners are desperate for relief with borrowers anxiously waiting for rates to start dropping,” Mr Cooke said.

Originally published as Christmas miracle on the way as experts tip RBA to deliver a rate cut in December