‘Hollow victory’: Why ‘beating inflation’ won’t fix Australia’s cost of living crisis

Inflation is squeezing Aussie households hard – and it turns out the situation is even more grim than most of us probably realise.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

Here’s the bad news on inflation: even when economists tell us it is finished, it is still going to feel bad. Really, really bad.

Imagine inflation is a tree in your front yard – getting bigger and bigger, casting shadows, making your house dark and dropping leaves everywhere.

When inflation is defeated, the tree doesn’t get cut down. It will still be there, large and looming. It just stops growing so fast.

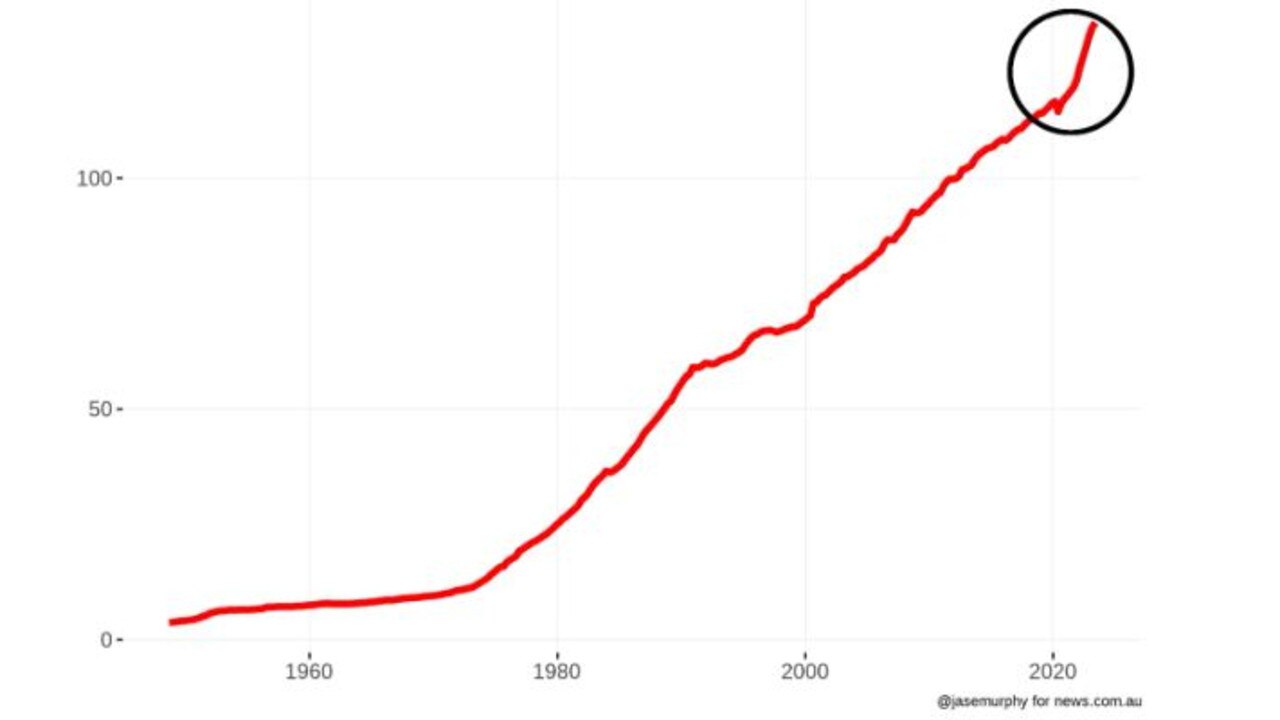

As the next chart shows, our recent bout of inflation has sent prices soaring. But they always rise. Something that cost $4 in 1960 costs $130 now, assuming it has been affected by the average rate of inflation.

That red line isn’t going to fall. Prices aren’t going back to where they were. For example, my favourite yoghurt was $5, now it’s $6.50. It isn’t going back to $5. Probably not ever.

One-dollar-milk is the same. It’s gone.

Thinking about that is about as relevant as reminiscing about how you could once buy a pie for a shilling. The prices we thought we knew are gone forever. This burst of inflation has made them history.

Petrol and bananas will fluctuate, but expect to see $1.40/L petrol less and less often, and $2/L petrol more and more.

Hollow-feeling victory

Inflation doesn’t feel good. And when the economists declare victory, it won’t feel like a victory.

Prices will stay far higher than they were, and they will keep rising. Economists will say inflation is back to 2.5 per cent, but prices will be 20 or 30 per cent higher than they were way back before the trouble began.

Inflation is measured on an annual basis, but our memories go back way longer than a year. So victory will feel like no victory at all.

Check this out:

● Something costs $10. Inflation in this year is 6 per cent.

● It now costs $10.60.

● Inflation in the next year is 9 per cent.

● It now costs $11.55.

● Inflation in the next year is 7.5 per cent.

● It now costs $12.42. That’s 24 per cent more than it started off as.

● Inflation goes back to 2.5 per cent in the next year. Macroeconomic triumph!

● Now the thing costs $12.73. Economists announce inflation is under control but this item costs 27 per cent more than it did before the wave of inflation.

The point is, the end of inflation is a technical thing that won’t feel much like relief. To feel chilled, we need to somehow accept our new normal.

Deflation

To send prices back to where they were, we would need deflation. And the central bank is not aiming for deflation for good reason.

When prices fall, spending money is dumb. You can wait a bit and things will get cheaper. Deflation causes the economy to grind to a halt, as people buy only what is essential. The central bank – the RBA – will instead aim to get inflation back into the range of 2 per cent to 3 per cent. That’s considered to be the sweet spot.

So even when we declare victory against inflation, prices will still be rising, on average.

A pack of biscuits that costs $5 on 1 January will cost $5.15 on December 31 if we cop 3 per cent inflation. And the RBA is forecasting 3 per cent inflation in the next two financial years. We need wages growth to go up faster than 3 per cent, or we will be getting worse off collectively.

Some things will get cheaper

It’s important to remember inflation is an average. Some things rise in price by more, some by less.

I’d expect phones, computers and data will fall in price or at least get expensive more slowly than inflation. Clothes too. When I was a kid, a T-shirt cost $30, but now you can buy one for $8. That’s likely to stay the case. Of course, rent was $150 a week when I was a kid, and now it’s more like $500.

It is only on average that prices rise at a steady rate. Even in the last couple of years, as prices have gone crazy, there’s a couple of things that have got cheaper – women’s clothing is actually cheaper now than in 2020.

However …

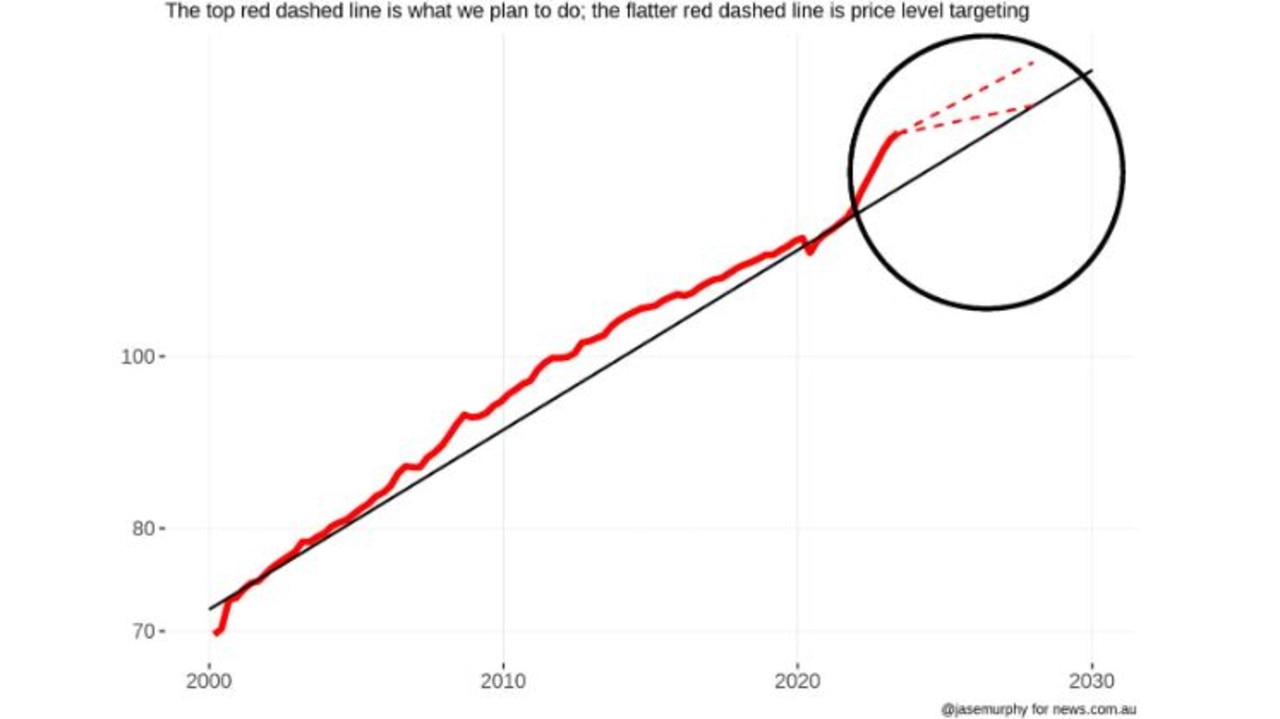

There is a school of thought in economics that we *should* try to go back to where we were; they call this price-level targeting. But in Australia we don’t do price level targeting. Instead, we do inflation targeting.

Price-level targeting doesn’t mean we send prices backwards to where they were. But it does mean that if we have a period of time here where we experience high inflation, we get a period of very low inflation afterwards. The next graph shows what that looks like. We drop the rate of inflation so prices increase slowly and eventually end up where they would have been if the higher rate of inflation hadn’t happened.

Note that the solid red line is the same as in the first chart, just limited to data since 2000 and on a log scale.

Price level targeting is not on the agenda in Australia, despite being raised in the recent review of the RBA. They said there was “insufficient evidence” it would make us better off.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.

Originally published as ‘Hollow victory’: Why ‘beating inflation’ won’t fix Australia’s cost of living crisis