‘Cracks start to appear’: Sign Australian economy running out of steam as recession looms

After the largest and fastest rise in mortgage rates in Aussie history, the shine has started to come off the Lucky Country’s fortunes.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

Since the pandemic first began significantly impacting the Australian economy in the early months of 2020, we have witnessed surprise after surprise for the economy and households. Through a commitment of more than half a trillion dollars in stimulus between state and federal governments and pandemic-fuelled demand, the economy has proven to be far more resilient than most expected.

But now, after the largest and fastest relative rise in mortgage rates in Australian history, the shine has started to come off the Lucky Country’s economic fortunes.

Recent months have brought news of an economy that is contracting in per capita terms and of a retail sector that is seeing the volume of actual goods sold declining, despite the most rapid population growth in decades.

But among the gathering storm clouds on the horizon that some economists such as those at the Commonwealth Bank say represent a coin flip’s chance of a recession, there is a silver lining for the nation’s workers.

As early as August last year, there were concerns that the labour market could swiftly deteriorate and that higher interest rates would result in significant job losses.

Fortunately, these concerns proved to be unfounded and Australia’s job market has remained strong.

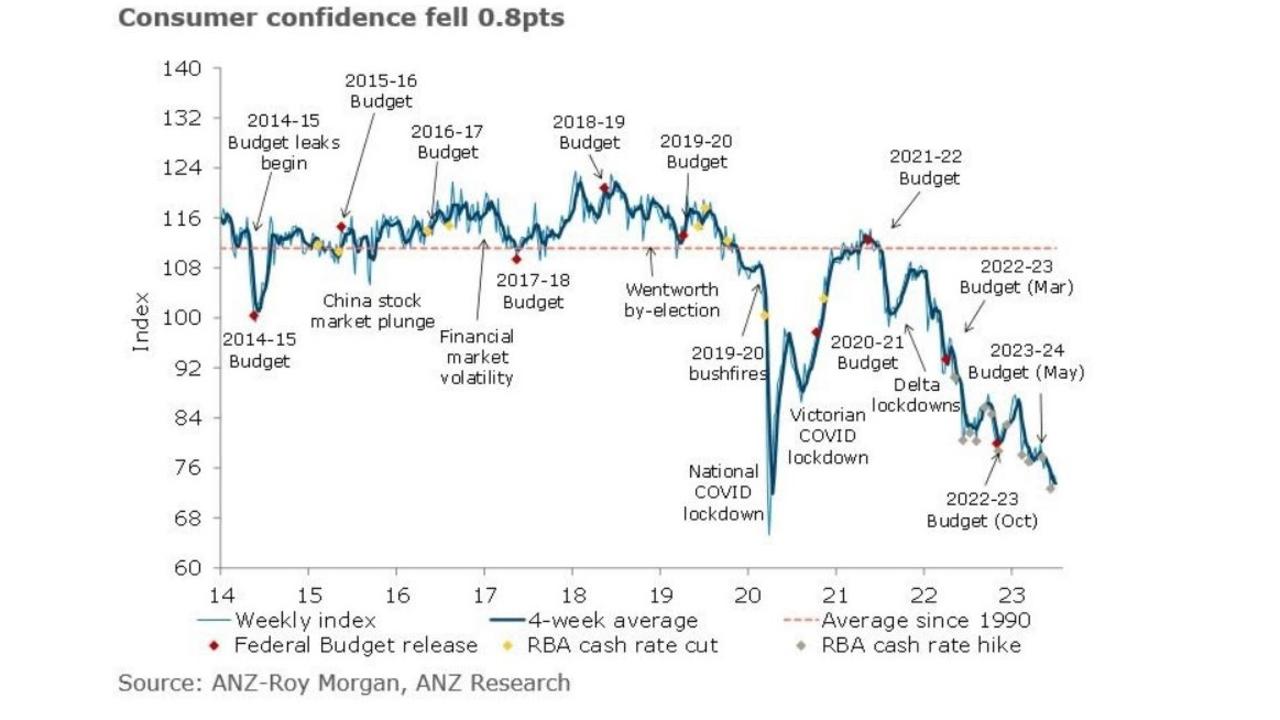

According to the latest figures from the ABS, the economy created 39,800 jobs in May in trend terms and the ranks of the unemployed fell by 14,500. All in all, a remarkably strong labour market considering the broader economic backdrop and the fact that consumer confidence remains at levels last seen in the depths of the 1990-1991 recession.

ANZ-Roy Morgan Aus Consumer Confidence fell ahead of the RBA meeting. The 4wk ave was the 2nd worst result in 30yrs. ‘Current’ and ‘future financial conditions’ remain weak as inflation expectations hit their highest 4wk ave for 2023. #ausecon@AdelaideTimbrel@arindam_chkypic.twitter.com/3ZvGGDPLcS

— ANZ_Research (@ANZ_Research) July 3, 2023

Which begs the question, how is the labour market so resilient, and how long can this run of good fortune last until cracks start to appear?

The horse comes before the cart

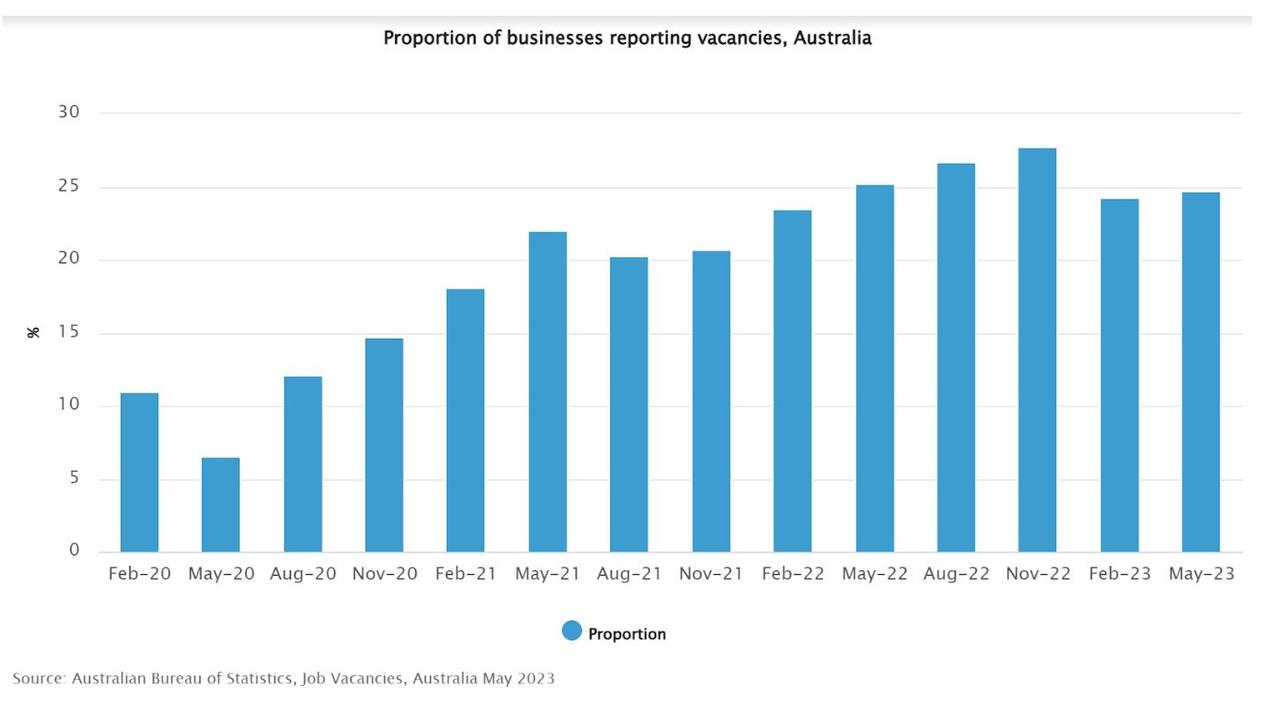

Just prior to the pandemic arriving on Australia’s shores in February of 2020, 11.0 per cent of businesses surveyed by the ABS reported a job vacancy.

Between this point and the peak in this metric in November of last year, the proportion of businesses actively looking for workers more than doubled to 27.7 per cent.

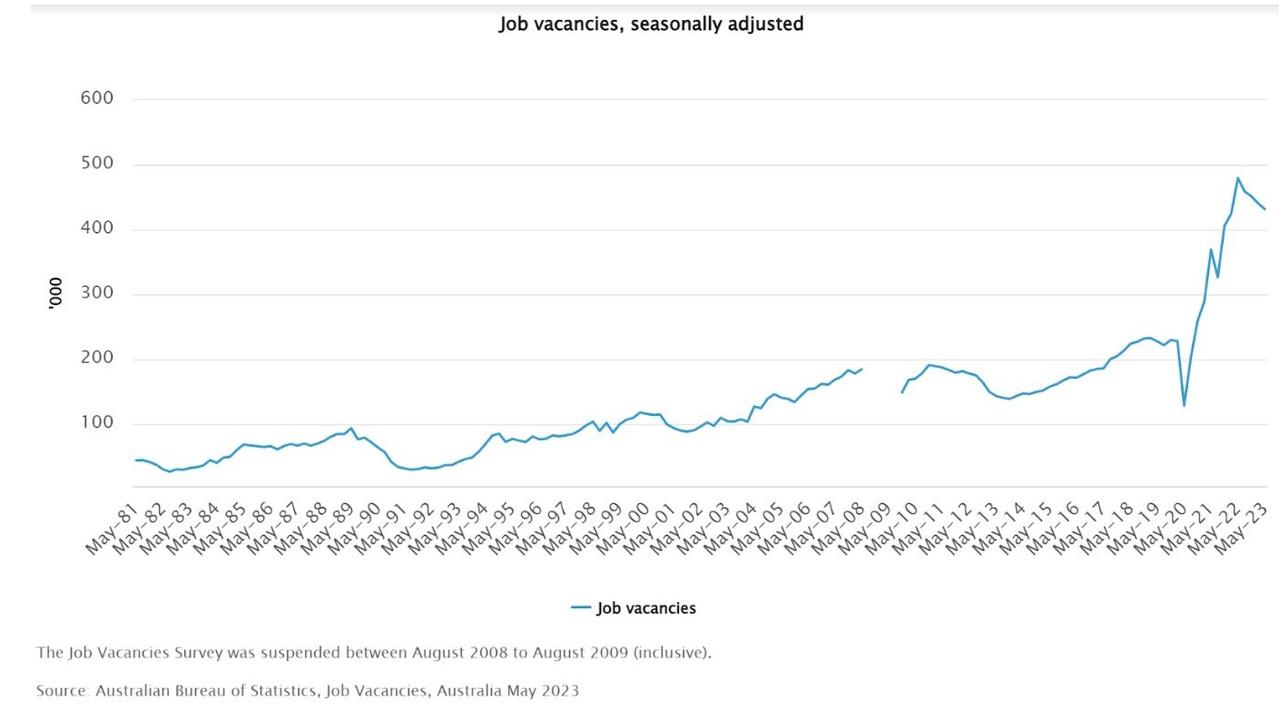

It was a similar story for job vacancies overall, with the number of total jobs on offer rising by 110.3 per cent between February 2020 and May 2022.

Historically, a significant rise in unemployment is generally proceeded by a fall in the number of job vacancies, as employers gradually shift from a stance of aggregate hiring to letting employees go.

For example, 13 months prior to the last pre-Covid recession in 1989, the ABS job vacancy index recorded an 18.2 per cent drop in the number of jobs on offer. Five months after this large fall in job vacancies, it resulted in a rise in the headline unemployment rate.

In the current economic cycle, we haven’t seen a similar swift deterioration in job vacancies – instead, there has been a slow grind down in the numbers since they peaked in May of last year.

Currently, overall job vacancies sit 89.3 per cent above the last reading recorded prior to the pandemic.

While the slow decline in job vacancies is a matter for a degree of concern, they are currently falling at such a slow rate that pre-Covid levels won’t be reached until the latter half of 2030.

Unexpected levels of strength

Despite recessionary levels of consumer confidence, the most rapid relative rise in interest rates in Australian history and falls in inflation adjusted retail sales, businesses are so far generally reticent to let go of staff.

In fact, the proportion of employers reporting they have a job vacancy is actually higher today than it was before the nation’s international borders reopened in February of last year.

At that point, 23.5 per cent of employers were reporting a job vacancy to the ABS, and as of the latest data which covers up to May, the figure is 24.7 per cent.

After spending years attempting to get enough staff to meet demand, it’s understandable that businesses would be keen to hold on to their employees.

But there is arguably another factor that may be at work.

Over the past 30 years, Australia hasn’t had what could be termed a normal recession, during which there was a significant contraction in headline economic output and a large rise in unemployment, at least outside of the pandemic.

Instead, every threat to economic growth prior to Covid-19 was addressed with either stimulus from the government or the RBA, or just flat out lady luck coming to the economy’s aid. This has created a high degree of confidence for many businesses that the Australian economy can deal with whatever is thrown at it in relatively short order without too much trouble.

Based on historical precedent in the adult lives of the vast majority of Australians, this is a perfectly normal perspective.

However, the scale of the rise in interest rates and falls in inflation adjusted have been anything but normal over the past 18 months.

For now, various job ad and employment vacancy indices seem to be pointing to continued labour market resilience in the immediate future.

But on a longer-term time horizon, the confidence held in the economy’s ability to weather a storm may be well and truly tested, as the domestic economy slows and the possibility of recessions in some of the world’s largest economies looms on the horizon.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Cracks start to appear’: Sign Australian economy running out of steam as recession looms