‘Challenging position’: Can the RBA save Australia as the global economy tanks?

The global economy is struggling and there’s alarming news coming out of China – and it could all spell disaster Down Under.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

When the RBA hands down its decision on interest rates on the first Tuesday of every month (excluding January), it is sometimes perceived as an all-powerful organisation handing down its judgement from on high to the rest of us.

Given the power it holds over the financial fortunes of savers, mortgage holders and other borrowers, it’s understandable why some see it in this way.

But does the RBA truly hold the level of power that it appears to? Can it transform the balance between savers and borrowers on a whim?

The short answer is yes, but like so many things in life, the full reality is quite a bit more complicated than it first appears.

As Australia’s central bank, the RBA can set interest rates at whatever level it believes is necessary in pursuit of its mandate.

The RBA mandate is defined as its duty to “contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people”.

But in setting Australia’s interest rates, the Reserve Bank needs to consider how international forces could impact the pursuit of its goals.

For example, an overly strong Australian dollar stemming from significantly higher than developed world interest rates could be detrimental to the fortunes of Australian exporters.

A strong dollar stemming from the mining boom and relatively high interest rates arguably played a role in the downfall of Australia’s car industry, as higher costs made locally produced cars increasingly uncompetitive in the global market.

At the other end of the spectrum, a weak Australian dollar driven by having low interest rates relative to the benchmark US Federal Funds rate can risk importing inflation.

A historical perspective

Over the past 35 years, the RBA has embarked on five major rate cut cycles where the cash rate was cut by 1.5 per cent or more during a single cycle.

In three out of five of those cycles, the US Federal Reserve either cut interest rates first or was known to be heavily favouring a cut at its next meeting.

In 1990 and 2011, the RBA went it alone and cut interest rates without being given the green light by the Federal Reserve acting first. However, it’s worth noting the underlying conditions under which the RBA felt sufficiently secure to act on its own.

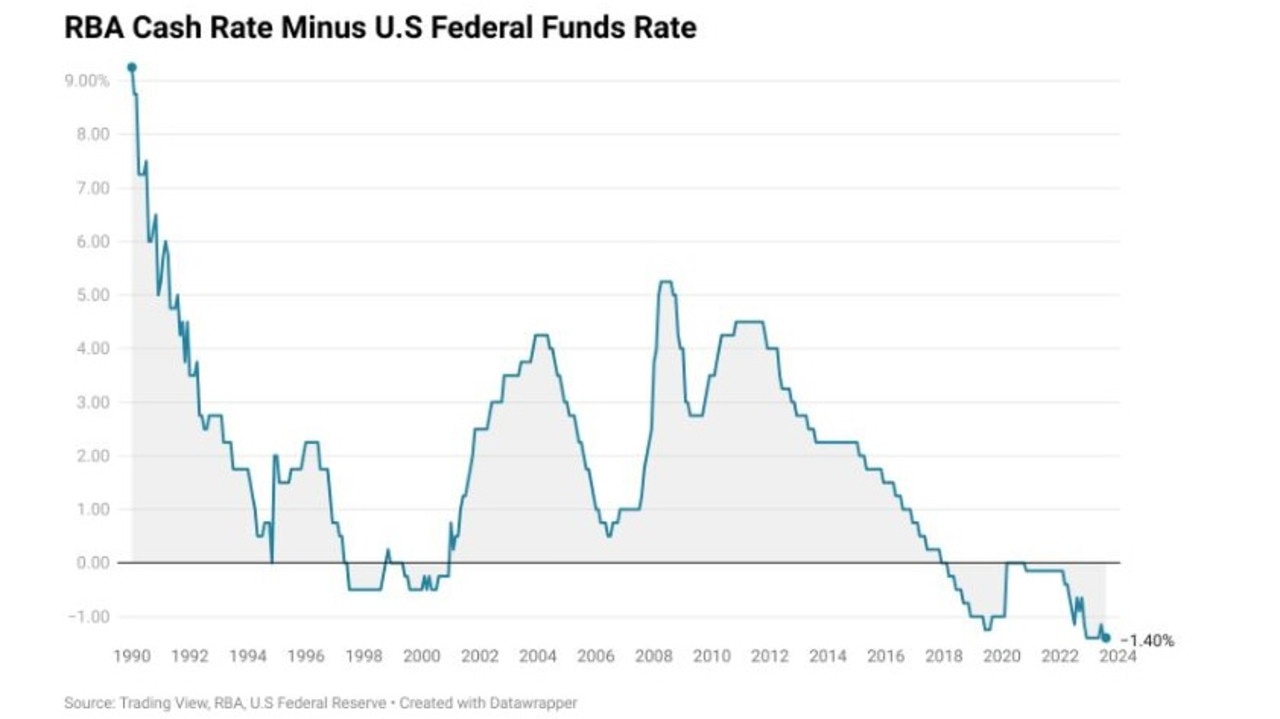

When the RBA started cutting interest rates from the all-time high of 17.5 per cent in January 1990, the RBA cash rate was 9.25 percentage points higher than the US equivalent.

In 2011, when the RBA kicked off its rate cut cycle, the RBA cash rate was 4.5 percentage points higher than the US benchmark rate.

The balance today

For the vast majority of the era that Australia has had a free-floating currency (since 1984), the nation has had significantly higher rates than the United States.

But in recent years that has changed dramatically.

Since November 2017, the RBA cash rate has been at or below the level of the benchmark US equivalent.

Today, the US Federal Funds Rate sits 1.4 per cent above the RBA cash rate, an all-time record high spread in favour of the US benchmark.

With the Australian dollar at the low end of its historical average trading range, this puts the RBA in a challenging position.

Amid growing concerns over the slowing global economy and a Chinese economy that is struggling to refire following its reopening from the pandemic, the RBA going it alone and cutting interest rates may put an unwanted degree of downward pressure on the value of the Australian dollar.

The dollar downside

Historically, the RBA hasn’t been too concerned about a weaker Australian dollar, if it occurred over a relatively short period of time like during the pandemic or following a global economic shock such as the Global Financial Crisis.

The much more concerning scenario is where the US economy performs robustly and the Aussie dollar is weaker over a protracted period, putting upward pressure on import costs.

Despite its perceived power and image of acting from on high, the RBA have to consider this factor among legions of others before it chooses to eventually loosen monetary policy.

In some ways, the RBA is captive to the tides of the global economy in a way that isn’t all that far removed from the relationship mortgage holders have with the RBA.

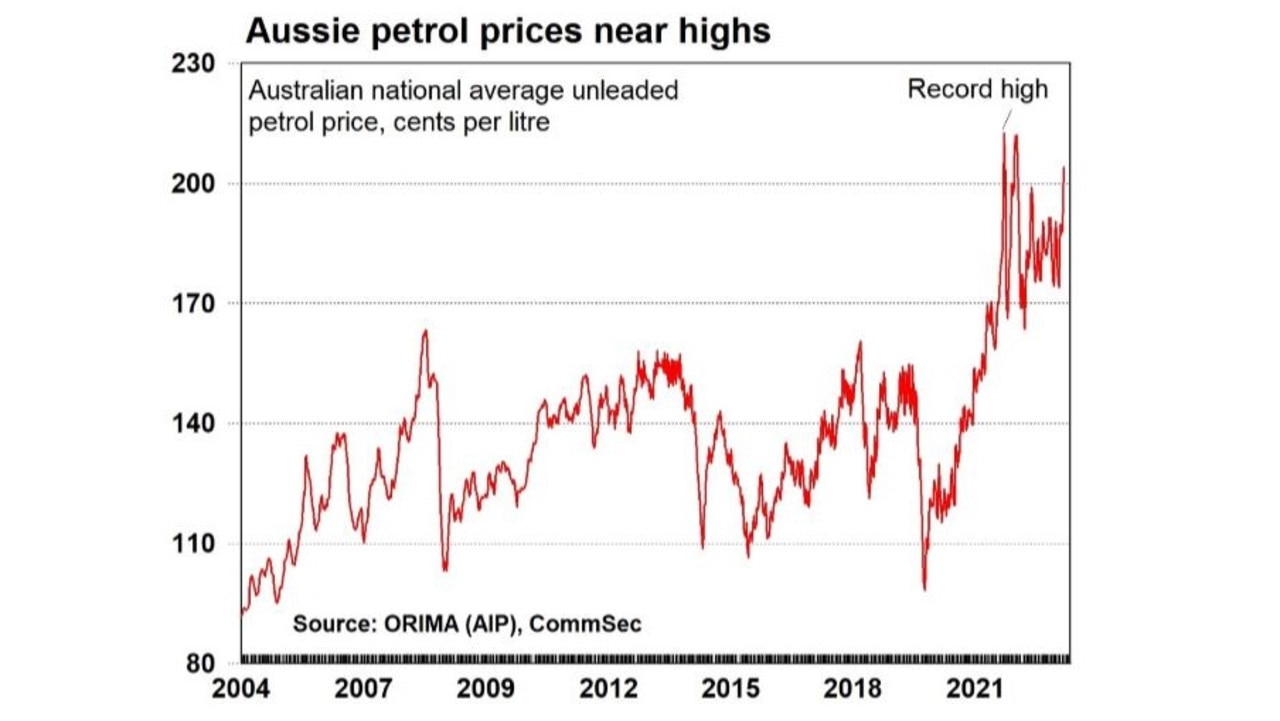

While the impact of a weaker currency generally takes quite some time to be felt in products like consumer goods, where it is felt with relative immediacy is in our collective trips to the fuel bowser.

Last week, average national fuel prices hit $2.03 per litre (91 octane unleaded), the highest level in more than a year. Amid higher oil prices and a weaker Australian dollar, households are set to see their bills at the service station potentially return to the uncomfortably high levels seen in March last year, following the Russian invasion of Ukraine.

Ultimately, a very different economic cycle is currently playing out compared with those of the past.

The US economy remains robust, helping to drive the Federal Reserve’s stance of higher rates for longer, while on the other side of the coin, the reopening of the Chinese economy has seen strong positivity contained to a limited number of sectors, while the industries the Australian economy is most exposed to, such as property, have continued to perform poorly.

In the case of a more traditional US-led downturn such as the Global Financial Crisis or the Dotcom Bubble recession, the RBA would have more scope to cut rates if deemed necessary. But in this new and very different world, its options are more limited and while it can act unilaterally, that comes with potential costs.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Challenging position’: Can the RBA save Australia as the global economy tanks?