ATO reveals Australia’s top 100 self-managed super funds and what they are worth

The Albanese government is coming for the piggy-banks of the super rich that hold a staggering $12bn in savings. See the full list of the top 100 funds.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

Australia’s top 100 super funds have exploded in value to collectively hold more than $12bn, new data released to News Corp by the Australian Taxation Office reveals.

The data, obtained under Freedom of Information laws, shows that as of July 2021 the top five self-managed super funds had average assets of $379m while the smallest fund among the top 100 held a still substantial $65m.

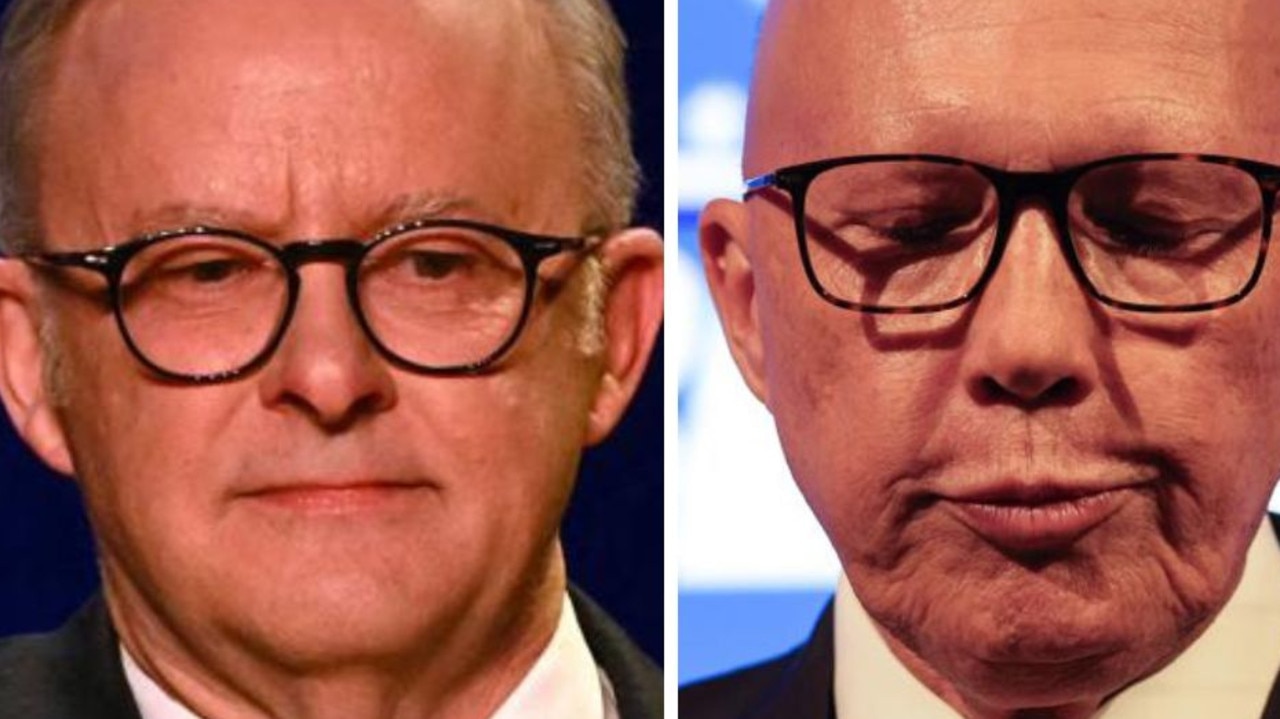

Swollen balances could make the top 100 funds, which are controlled by wealthy families or individuals, rich pickings for the Albanese government’s new tax slug on income earned by people who hold more than $3m in super.

Super expert Brendan Coates, from the Grattan Institute, said he estimated the top 100 funds were currently enjoying tax breaks worth about $250m a year.

Based on there being an average of two people in each top 100 fund, he estimated the potential extra tax take under the controversial new rules, which come into force on July 1, was about $100m a year.

The data shows that 11 funds have more than $200m in assets in them, while 46 contain more than $100m.

Assets owned by the top 100 funds soared from $9.7bn in 2020 to $12bn in 2021.

Super experts said the bulk of the money in the top 100 funds was probably tipped in before 2007, when the government capped contributions to funds.

SMSFs are allowed to have at most six members, meaning the average balance of every member of a top 100 fund is above the $3m threshold.

In a move bitterly opposed by the SMSF industry, Treasurer Jim Chalmers in February announced that the tax on income earned for super balances above the threshold will increase from 15 per cent to 30 per cent.

Mr Coates said the funds were “just the latest sign that superannuation is becoming a taxpayer funded inheritance scheme”.

“When you’re talking about balances of many millions of dollars, it’s very unlikely that much of that money actually gets spent down retirement,” he said.

“Instead it is much more likely to be passed on to the next generation. This data confirms why the government did need to crack down on the tax breaks they offered to those very large super balances.”

SMSF Association chief executive Peter Burgess said his organisation agreed that “the objective of super shouldn’t be to provide tax concessions to people with very large balances”.

But he argued that the new tax slug wasn’t necessary because there were already caps on how much money can be put into super and how much can be taken out.

“This is a legacy issue that the current system is designed to overcome,” he said.

“What we’re about to do by introducing more caps is make the system more complex and costly to run, just to fix a problem that will be solved over time.”

He said he did not expect any further big changes to super in the Budget to be handed down by Mr Chalmers next month.

In previous years, the ATO has released the balances of each of the top five SMSFs, but it refused to do so this year because the extra information could be used to work out the identity of the funds’ owners.

Previous sets of data have prompted speculation that the biggest fund recorded in 2019, of $544m, belonged to mining magnate Gina Rinehart.

However, Mrs Rinehart denied this last month.

The ATO said data from 2022 was not yet available because not all SMSF tax returns have been filed.

More Coverage

Originally published as ATO reveals Australia’s top 100 self-managed super funds and what they are worth