REDcycle soft-plastics recycling scheme collapsed owing $5 million

The full financial fallout has been revealed after the collapse of a business that raked in $20 million from services provided to Woolworths and Coles.

Retail

Don't miss out on the headlines from Retail. Followed categories will be added to My News.

A company that provided services to both Woolworths and Coles that spectacularly collapsed late last year owes $5 million to creditors, financial records have revealed.

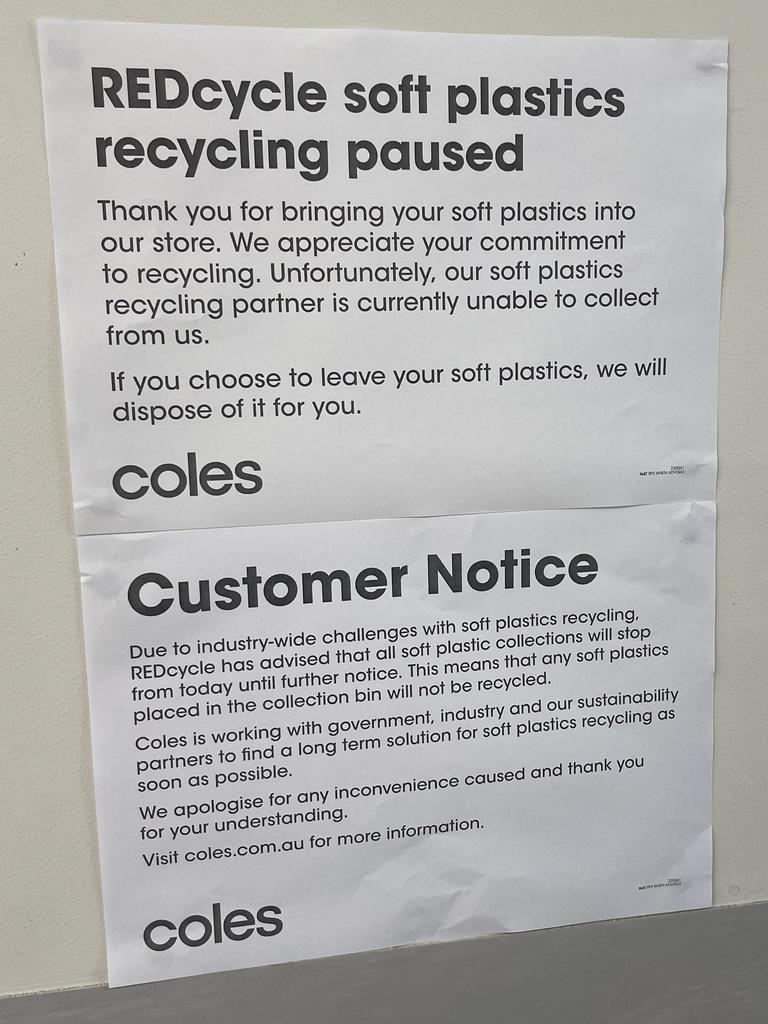

Melbourne-based REDcycle, which offered Australia’s largest soft-plastics recycling program, went under after it was revealed hundreds of millions of bags and other soft plastics were secretly stored in warehouses and not recycled.

Launched in 2011, the company was declared insolvent after it failed to pay storage fees on the thousands of tonnes of plastic, despite earning $20 million from the Coles and Woolworths program that had run for the previous decade.

In February, Woolworths and Coles said they would take on responsibility for tonnes of stockpiled soft plastic being stored in 32 sites – but secret stockpiles of plastic bags continue to be found.

At least a dozen new sites have been located in the past month, including in Tasmania, Queensland and Western Australia.

“To date, we have identified a total of 44 sites where REDcycle had been stockpiling soft plastics without our knowledge,” a spokeswoman for Coles and Woolworths told The Sydney Morning Herald.

“We have contacted the operators of every site to develop an action plan to ensure this material is stored safely.

“With new information continuing to come in, we’re navigating a complex range of sites and challenges, and we know this process will take time.”

With a “limited” soft plastic recycling capacity in Australia and the potential that some material will no longer be suitable for recycling, it’s possible parts of the stockpile could go to landfill.

However, Woolworths and Coles have a year to find a viable mass recycling option after the NSW Environment Protection Authority allowed the temporary storage of the plastics, rather than sending them straight to landfill.

Meanwhile, the full extent of REDcycle’s debts have been revealed.

They included more than $62,000 outstanding in entitlements to former employees and $411,000 in unpaid taxes, while the largest creditor is recycler iQRenew which REDcycle had planned to merge with and is owed $1.6 million.

However, according to a director’s report supplied to the liquidator, at the time of the company’s collapse it was still owed $24,000 from Procter & Gamble, $34,000 from Johnson & Johnson and $27,500 from JB Hi-Fi.

REDcycle ran a program where it charged fees for its branding to be used by companies on their soft plastics packaging and promotional materials.

The company’s demise comes at a torrid time for a range of sectors across Australia, with food and delivery start-ups, retail and construction firms and other businesses collapsing.

Late last month, gourmet food start-up Colab, which offered ready-to-cook meals from more than 150 restaurants, went under after it failed to secure funding.

Also in March, Australian fresh food distribution company In2Food went bust for a second time in less than two years with up to $20 million in debt and 1000 creditors owed money.

One of Australia’s largest home builders Porter Davis Homes collapsed suddenly sending more shockwaves through the problem-plagued construction industry and placing 1700 building projects in jeopardy across Victoria and Queensland.

Beauty and wellness business BWX, which owns Zoe Foster Blake’s Go To skincare company, was also placed into administration after it reported a $100 million loss for the first half of the financial year.

Meanwhile, e-commerce brand EziBuy, which has an online presence across Australia and New Zealand, fell apart in April while popular Sydney music venue HiWay Enmore was forced to shut its doors permanently.

Originally published as REDcycle soft-plastics recycling scheme collapsed owing $5 million