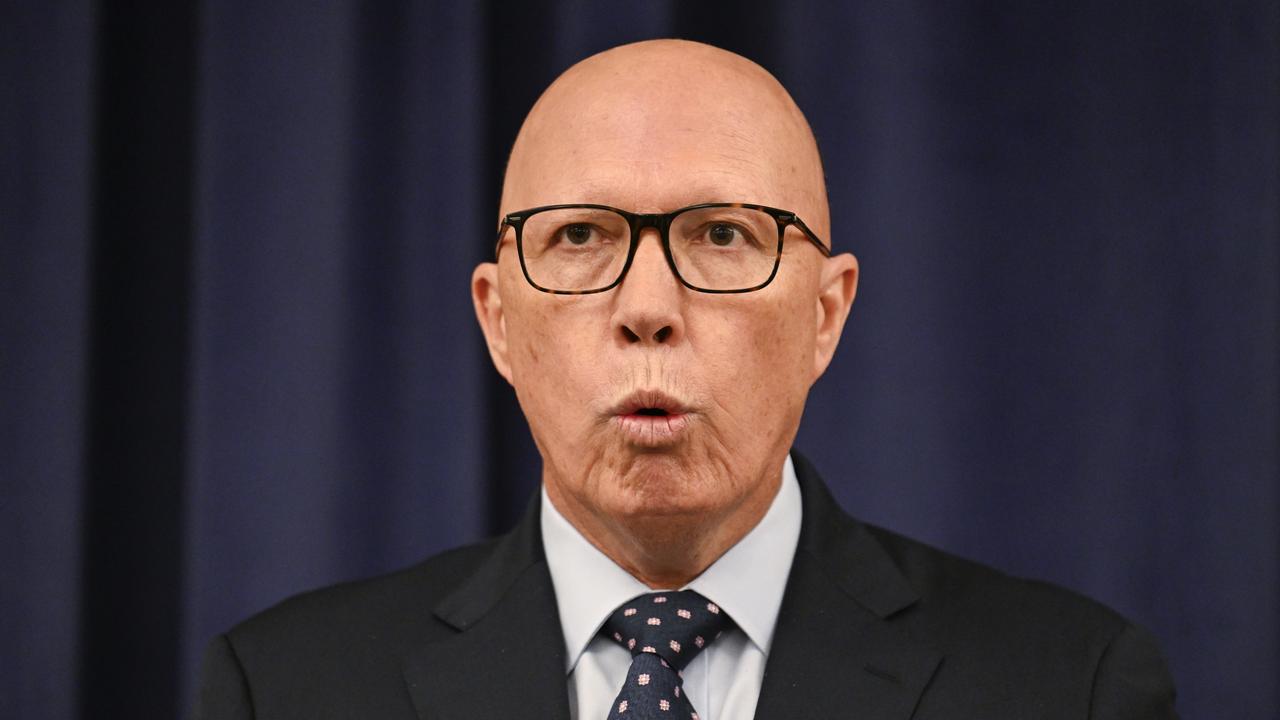

Peter Dutton’s long lunch plan would cost $500 million

New costings have emerged about the Opposition Leader’s proposal to give bosses tax breaks for work lunches.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

EXCLUSIVE

Peter Dutton has been accused of quietly walking back his “sloppy” tax-break plan for long lunches but the Treasurer says it will still cost taxpayers $500 million a year and cut GST revenue if it was meals-only.

The new policy was rolled out last month with the Liberal leader promising to cut red tape for small businesses by introducing a capped tax deduction of $20,000 for business-related meal and entertainment expenses.

Treasury’s costings previously suggested this policy would cost the budget $1.6 billion a year. This becomes more than $10 billion a year if all eligible businesses claimed what they’d be entitled

The Coalition claims the parliamentary budget office says it will cost $250 million – half the Treasury estimate – but won’t release the detailed costings.

“It means the builder with five or six of his or her tradies can go down to a local restaurant, or to a local club or pub at the end of the week to celebrate a week of hard work,” Mr Dutton said.

“It means that money is spent in those small businesses.”

Liberals accused of Les Paterson inspo

But Labor piled on the plan after the Coalition refused to release the costings, suggesting it was dreamt up over a Les Paterson-style lunch where the Liberals had dim sim stains down their suits.

“He wants workers to pay for bosses’ lunches and he will smash the budget in the process,” Mr Chalmers said.

“Now, this is the only kind of policy that could have been agreed at the tailend of a very long lunch.

“You can imagine them sitting around with the blue teeth and soy sauce on the tie, coming up with the big ideas.”

Has the Coalition walked it back?

But in a speech this week, opposition treasury spokesman Angus Taylor says it’s now for meals only – describing it as a “meal tax deduction” and not mentioning entertainment.

This is in line with Mr Dutton’s remarks on January 24 where he also clarified it was it was for food only.

That was around five days after the policy initially mentioned meals and entertainment.

Treasury says meals only is $500 million

In response, the Treasurer has told news.com.au that Treasury was also asked to model that scenario and it shows that even if you take a substantially narrowed interpretation of the Coalition’s taxpayer-funded lunches policy, it would still blow a hole in the budget.

“Even if you take a much narrower interpretation, it would blow a half a billion dollar a year hole in the Commonwealth Budget,” the Treasurer told News.com.au.

“They’re making it up as they go along but the exorbitant cost is constant.

“It’s been more than four weeks since Peter Dutton announced his taxpayer funded long lunches policy and he still won’t release his costings.

“He needs to come clean with taxpayers about exactly what this policy includes and exactly how much he thinks it will cost.”

No strippers, no golf rule

The Coalition previously clarified the tax deduction couldn’t be use to spend up on strippers or golf to entertain prospective clients.

It also can’t be used for booze, although presumably the boss could buy a few beers to go with the tax deduction schnitzel.

Shadow treasurer Mr Taylor rejected the costings but won’t realise his own.

“We have a long standing custom in this country of not politicising the public service, but it is very clear today the treasurer is intent on doing exactly that,” he said.

“He has worked with Treasury to come up with figures that we think and know are absolute nonsense.”

He said he has been working with the Parliamentary Budget Office, and that it would cost just $250 million a year.

What ATO says is entertainment

According to the ATO, entertainment includes amusement, sport and similar leisure activities, such as: a game of golf a gym membership of a sporting club theatre or movie tickets a joy flight or harbour cruise accommodation and travel in connection with entertaining clients or employees over a weekend at a tourist resort.

Treasury’s costing of $500 million per year for meal expenses alone has assumed that not every business claims the maximum $20,000.

Even if the policy is narrowed to meals only, it could cost more than $10 billion a year if all eligible businesses claimed what they’d be entitled to.

Treasury’s costings predict that actively trading businesses would claim a deduction of $2,500 on average per year.

According to Treasury advice there are also significant upside risks. For example if take up and average claims are higher than expected, or if businesses rort the system by illegitimately claiming food and entertainment that is personal, not for business.

Treasury has also advised that the proposal will be difficult to police. If take-up increased by 30%, the meal and entertainment expenses proposal would cost $2 billion per year.

The meal expenses proposal would cost $650 million per year If take-up increased by 50%, the meal and entertainment expenses proposal would cost $2.4 billion per year.

GST fears

According to the Treasurer, Treasury costings show the Coalition’s taxpayer-funded long lunches policy would cut GST revenue by $169 million per year, even if it only covered meals.

That’s because the allowance of an income tax deduction for these expenses will allow businesses to claim GST input tax credits where they can’t currently.

This policy would eat into state and territory budgets in a big way,” the Treasurer said.

“States and territories will pay the price for Peter Dutton’s policy for taxpayer-funded long lunches and entertainment.

“That’s why he won’t come clean on costings or cuts. It will mean less money for Medicare if Dutton is elected and less funding for all of the frontline services delivered by state governments.”

Mr Taylor’s office was contacted for comment.

Originally published as Peter Dutton’s long lunch plan would cost $500 million