Aussie shares dip in wait for US open

The Australian share market drifted lower in quiet trading on Friday as investors stepped cautiously before Wall St’s big Friday.

The Australian share market drifted lower in quiet trading on Friday as investors stepped cautiously before Wall St’s big Friday.

A fire at a major coalmine has caused hundreds of workers to be sent home and their futures are uncertain.

The Australian sharemarket notched a powerful rebound rally on Tuesday on the back of iron ore and oil price rises and a surge in banking behemoth Commonwealth Bank.

Finance behemoth Commonwealth Bank has released its latest economic health check on the nation and there is one state blowing everyone else away.

Losses in health and consumer stocks were offset by gains from miners and energy producers to send the benchmark higher on Tuesday.

The world’s biggest miners are spending billions of dollars as they square up to the next big energy hurdle: switching off diesel.

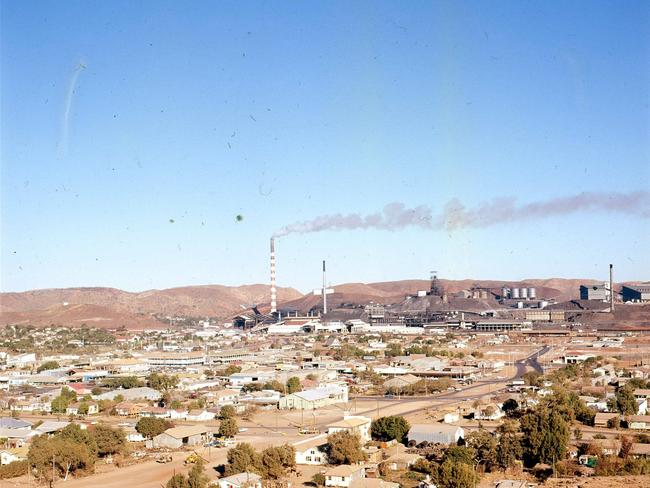

An Aussie city is furious and devastated after a crushing blow that means more than 1200 jobs up in the air.

Fears of an escalation of the Israel-Hamas has shaved 1.2 per cent off the Australian share benchmark on Friday.

The sharemarket has cheered the news of a mega mine deal, but environmentalists say it’s a catastrophe for the climate crisis.

An international mining giant has revealed it will close a 60-year-old mine, casting doubt on more than 1000 jobs.

Resources companies are unloading mountains of cash on to investors through high dividends. Can it continue?

There was cautious trading to kick off the week as investors monitor news of the ongoing Israel-Gaza war.

Despite a stronger lead from Wall St overnight, the share market was flat on Thursday, dragged lower by health stocks.

Following the shock incursion by Hamas into Israel, the ASX edged higher on Monday buoyed by surging energy and gold stocks.

Original URL: https://www.thechronicle.com.au/business/companies/mining/page/35