How cryptocurrency in Australia will be impacted by the global collapse

As sceptics warn crypto trading volumes are thin and market manipulation remains rife, experts reveal what can happen for Aussies who own the volatile currency.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

For regulators and sceptics, cryptocurrencies such as bitcoin are a disaster area, devastated by fraud, collapses and fraudulent collapses.

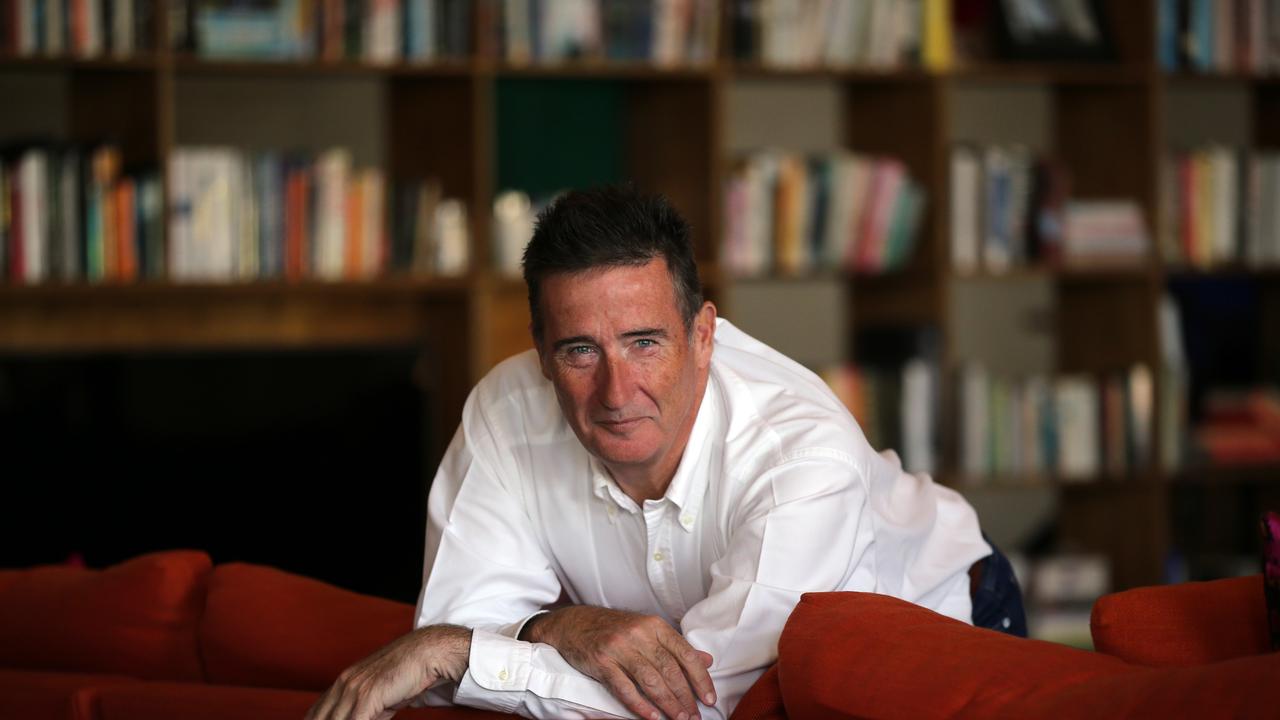

But for Australian fund manager and investor Mark Carnegie, Bitcoin in particular is more like the “honey badger” – a reference to a famous internet meme video featuring the “bad ass” African mammal shrugging off fights, snake bites and bee stings as a camp American narrator, Randall, says: “It really doesn’t give a s**t.”

Carnegie’s not alone. There are still true believers in crypto’s future, despite a collapse last year dubbed “crypto winter”, which saw the price of Bitcoin collapse from a peak of about $87,000 in late 2021 to just $24,600 on December 30 2022, the multi-billion dollar implosion of several key players in the sector and the conviction in the US last month of Sam Bankman-Fried, the founder of exchange FTX, on fraud charges that could see him sentenced to more than 100 years in prison.

As of August, 23 per cent of adult Australians owned crypto, according to a survey run for crypto exchange Swyftx, up two per cent from last year.

Those who held on to their coins – “hodlers”, in crypto slang, have pared their losses, with the Bitcoin price rising from a low of to hit $55,000 this week.

But sceptics warn trading volumes are thin and market manipulation by some remains rife.

And regulators who previously washed their hands of the wild west sector have started cracking down after becoming alarmed by ballooning consumer losses and crypto’s role, in some cases, as a payment system for scammers and crooks.

The Albanese government is also taking action, putting forward laws last month that would force crypto exchanges to hold a licence just like regular financial services companies do.

Carnegie, runs two funds that invest in crypto and the crypto ecosystem, says the crackdown was inevitable.

“There’s still a couple of shoes to drop in terms of wringing the bad parts of crypto out,” he says.

“Crypto, we made common cause with a whole series of bad actors. And therefore the regulation that comes or the obfuscation or everything, we deserve.”

He also wonders if two of the big international forces in crypto, exchange Binance and Tether, a so-called “stablecoin” whose price is fixed to the US dollar, can survive the new world in their current forms.

Binance, which has up to 280,000 Australian customers, and its boss, Changpeng “CZ” Zhao, this week pleaded guilty in the US to deliberately breaking laws designed to curb money laundering and terrorism finance – including by playing down possible Hamas transactions – and agreed to pay more than US$4bn ($6bn) in fines and forfeiture of profit.

Meanwhile, for more than five years, Tether has repeatedly failed to deliver on repeated promises to provide a full audit of the assets that are supposed to back up its US$1-a-coin price.

As for bitcoin?

“Bitcoin is basically a religious cult,” Carnegie says.

“But what we don’t know is whether it’s the Mormons, right, and they’re going to end up building Utah and Salt Lake City, or it’s the Branch Davidians and it dies in a hail of bullets in Waco, Texas.”

He’s also interested in Ethereum, which he says has the potential to replace the international bank payments system, Swift, and what he calls the “teenage libertarian” in him likes “everything else” in crypto as a potential antidote to banks pushing “their ESG liberal bullshit agenda across the world” and refusing to service people like Right wing UK politician Nigel Farage.

Other believers in Australia include the co-founder of comparison website Finder, Fred Schebesta and Liberal Senator Andrew Bragg, who did a podcast series with Schebesta last year and took a Binance-funded trip to San Francisco.

But others in the finance sector are doubtful.

“The level of crypto interest has very noticeably dissipated since the incredible crypto collapses of 2022,” says Todd Sarris, the managing partner of Sydney-based business advisory group Spartan Partners.

“I presume many liquidated their positions in full and redirected their capital to more traditional and stable investment options.”

He says he doesn’t think any democratic government will ever support crypto over its own sovereign currencies, and points out crypto is banned in China, taxed at the highest possible rate in India, and out of reach of the world’s poor.

“Pseudo anonymous decentralised unbacked crypto currencies – i.e. as a direct competitor to the sovereign Australian dollar – respectfully is not a valid investment,” he says.

And long-time sceptics remain completely unconvinced.

David Gerard, the author of two books on cryptocurrencies, says the market is thin, allowing the price to be manipulated on the cheap by bad actors.

“Bitcoin doesn’t do anything – all you can do is try to dump it on the next sucker,” he says.

And he thinks the venture capital caravan of hype that helped fuel the crypto boom has moved on to the next hot thing: artificial intelligence.

“Literally the same VCs who were dumping money into incredibly vague ‘Web3’ schemes that never produced a product are now dumping money into ‘AI’ on the same basis,” he says.

“It’s the same guys with some very similar buzzwords.”

More Coverage

Originally published as How cryptocurrency in Australia will be impacted by the global collapse