Crypto giant Binance booted off PayID system and banned by Westpac

Binance Australia has been booted off a large Australian payments service and banned by Westpac in a tumultuous day for the exchange.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Binance, the world’s largest crypto exchange, has been booted off a large Australian payments service and banned by Westpac in a bombshell day for the company.

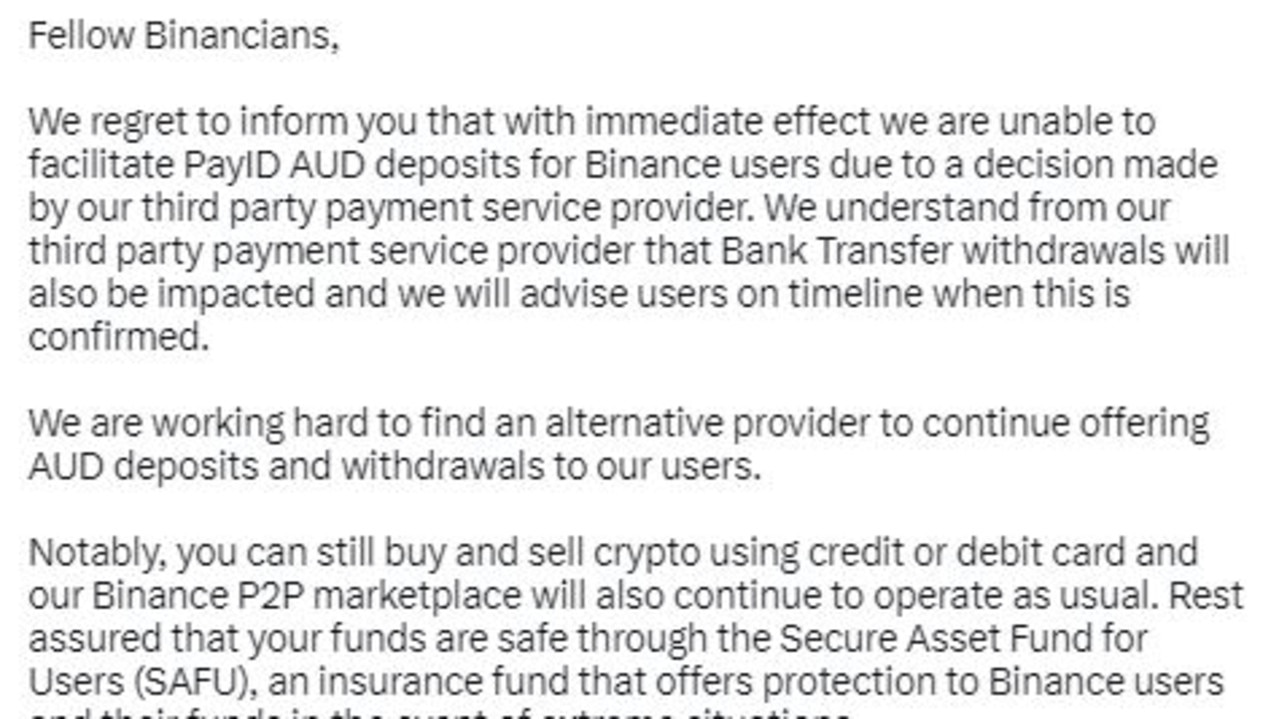

Binance Australia stated on Twitter that it could no longer facilitate PayID deposits for Binance users. It cited a decision made by a third party payment services provider.

The Australian arm of Binance also said that bank transfer withdrawals would also be impacted.

“We are working hard to find an alternative provider to continue offering AUD deposits and withdrawals to our users,” it stated.

The company said its customers could still buy and sell crypto using credit or debit cards and that its Binance P2P marketplace would continue to operate as usual.

It also sought to reassure customers that their funds would be safe through the Secure Asset Fund for Users, an insurance fund that offers protection to Binance users and their funds in the event of extreme situations.

PayID is part of the New Payments Platform that was introduced in Australia in 2018 that enables the fast transfer of payments. PayID transfers can be made in less than a minute compared to bank transfers that can take up to three days.

An email address, phone number or ABN can be used to transfer funds.

The service is offered by hundreds of banks including ANZ, Commonwealth Bank, NAB, Bankwest and Bendigo Bank.

Crypto traders responded to the news, with one writing, “Binance just got de-banked in Australia.”

Another commented, “Binance have officially rugged Australia.”

The use of PayID has been linked to an “increasing number of scams”, NAB warned earlier this year.

Aussies lost about $260,000 to PayID-specific impersonation scams last year, Scamwatch reported, and NAB noted there had been a 38 per cent increase in scams. The total losses to phone and text bank impersonation scams rose to more than $169 million, the Australian Competition and Consumer Commission said.

Westpac effectively bans customers from transacting with Binance

Meanwhile, Westpac announced today that it had started to trial new customer protections for some cryptocurrency payments to reduce scam losses.

“The latest Westpac data shows investment scams account for approximately half of all scam losses and a third of all scam payments are transferred directly to a cryptocurrency exchange,” the bank stated in a press release.

“Digital exchanges have a legitimate role to play in the financial ecosystem. But since the rise of digital currency, we’ve noticed that scammers are increasingly using overseas exchanges,” Westpac Group Executive of Customer Services and Technology, Scott Collary, said.

The Australian Financial Review reported that Westpac had effectively banned customers from transacting with Binance.

Last month the Australian Securities and Investments Commission cancelled the Australian financial services licence held by Oztures Trading Pty Ltd trading as Binance Australia Derivatives (Binance).

The cancellation, which was requested by Binance, means that clients will not be able to increase derivatives positions or open new positions with the crypto exchange.

In March US regulator Commodity Futures Trading Commission sued Canadian businessman Changpeng ‘CZ’ Zhao and the company he co-founded, Binance.

The regulator alleges Binance had attempted to “flout and actively attempt [to] circumvent” CFTC requirements.

The CFTC listed crypto billionaire CZ, former compliance chief Samuel Lim and three Binance companies as defendants in the civil action.

Binance and its entities have been issued with regulatory warnings by a number of overseas regulators including in the UK, Japan, Italy, Singapore, Netherlands, Canada and Thailand.

Statement from Binance

A spokesman for Binance issued a statement to news.com.au stating: “AUD deposits by bank transfers are no longer available to Binance users in Australia due to a decision made by our third party service provider. The suspension of this service is with immediate effect. Bank transfer withdrawals will also be impacted and we will advise users on timeline when this is confirmed. We are working hard to find an alternative provider to continue offering AUD deposits and withdrawals to our users.

“Customers can still buy and sell crypto using credit or debit card and our Binance P2P marketplace will also continue to operate as usual. Customers should rest assured their funds are safe through the Secure Asset Fund for Users, an insurance fund that offers protection to Binance users and their funds in the event of extreme situations.

“We can confirm that Cuscal, our payment processor’s partner bank, has made the decision to end AUD deposit services. However, our users can continue to withdraw AUD and we will update any further changes on timing as we know more. Users are still able to buy and sell crypto via debit and credit card and rest assured their funds are safe through the Secure Asset Fund for Users, an insurance fund that offers protection to Binance users and their funds in the event of extreme situations.”

Originally published as Crypto giant Binance booted off PayID system and banned by Westpac