Financial experts reveals how to save $8500 a year in tax

A financial expert has revealed a genius way to save $8500 a year in tax by making some simple changes.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

When most people think about what they can do to save tax, they typically think about getting more deductions or finding the latest hack to get a little bit more back in their tax return.

But the reality is that there is a limit to how many deductions you can get, and there is a much bigger opportunity to save a lot more tax.

If you want to be a successful investor, by definition over time your aim is to replace your employment salary with investment income. This means your aim is to build tens or even hundreds of thousands of dollars of investment income every year.

At this level, doing even just a little bit better with your tax means a big dollar difference to your bottom line.

But when you invest, you don’t have to personally own all of your investments. You can own investments in your name, joint names with a partner, or under a trust, company, bond, or even your super fund. The ownership structure or tax structuring you choose will dictate how much tax you pay on your investment income.

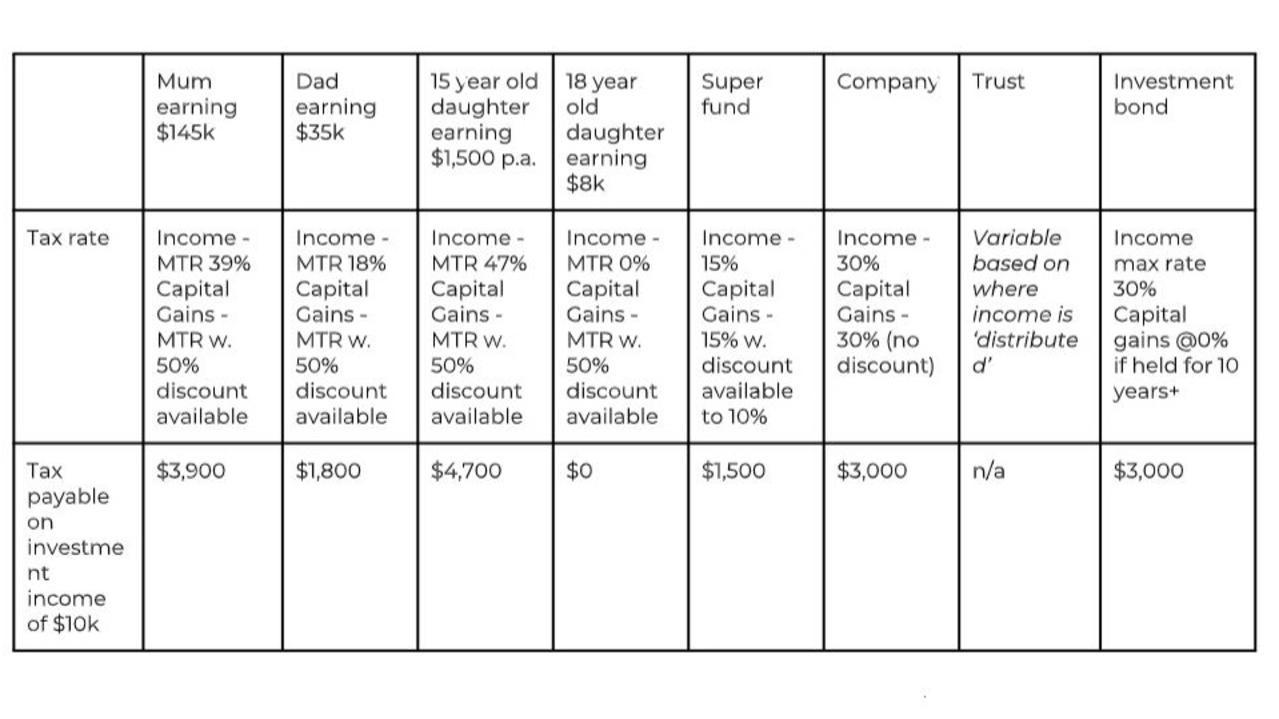

In the example below, I’ve shown how $10,000 of investment income would be taxed based on the different tax structures available to a family group.

You can see from this table that the highest tax rate is 47 per cent, or $4700 in tax, compared to the lowest tax rate of 0 per cent - this reflects a potential $4700 annual tax saving that would give you more money to reinvest and get ahead.

Using different tax entities and investment structures is the most powerful and effective way to save tax into the future. It’s not the immediate sugar hit you get from finding a new tax deduction, but the amount of money you can make (or save) from getting this right into the years ahead is (at least) well into the hundreds of thousands of dollars.

Using the right tax entities at the right time is exactly how you can optimise your tax position and save a boatload of tax in the years ahead.

So below I’ve outlined the most common (and most useful) tax entities and how to use them to your advantage.

Investment bonds

An investment bond is an investment account you can use to buy shares, ETFs and investment funds that are subject to some special rules and tax rates.

These accounts work sort of like superannuation funds, but you can access the money at any time.

The big benefit of investment bonds is their tax efficiencies, and there are two main tax benefits that come from using investment bonds.

Firstly, when you hold the investment for 10 years or longer, capital gains tax doesn’t apply. As a result, growth on your investments over the long term is received entirely tax free, rather than being subject to marginal tax rates of up to 47 per cent.

The second benefit is that income like dividends and interest from investment bonds doesn’t get included on your tax return, and instead is taxed “internally” by the fund. The maximum tax rate that applies is 30 per cent, which is lower than marginal tax rates if it’s for income earned above $135,000.

If your aim is to build an investment income of tens of thousands of dollars into the future, this lower tax rate on your investment income will deliver serious dollars in tax savings.

Family or discretionary trusts

A trust is another tax entity or structure that can lead to some serious tax savings.

To invest through a trust, you generally get the help of an accountant or lawyer to set up the trust and register it to get a tax file number.

From there, you can open up investment accounts, bank accounts, buy properties and even take out a mortgage.

Any investments you acquire will be owned by your trust, and then all future income and capital gains are also “owned” by the trust and subject to the trust tax treatment and rules.

The main rule with trusts is that you need to distribute any taxable income your trust receives to another taxpayer, commonly a person in your family, but this can also include a private investment company (more on this below).

The big benefit of investing with a trust is that you can change who you distribute taxable income to each year, based on where the lowest amount of tax will be paid.

For example, if you had a trust with $100,000 of taxable income, in one year where your income was low, you might distribute the money to yourself, and in another year if the income was higher, you might instead distribute the money to a partner or other family member.

The flexibility to change who or where you distribute money to year-on-year delivers the ability to make some serious tax savings.

Private investment companies

Most people are at least broadly familiar with operating companies, but you can also set up a private company solely for the purpose of investing.

Similar to using a trust, when you set up a private investment company, you register the company and get a new tax file number, and from there you can start investing in the name of the company.

The big benefit of doing this is that a company has a flat tax rate of 30 per cent, which is much lower than personal marginal tax rates of up to 47 per cent.

For example, if you were to earn $50,000 of investment income under a company, you would pay total tax on this investment income of $15,000.

If this same $100,000 income was earned in your personal name and taxed at the top marginal tax rate, your tax would be $47,000.

You can see that in this case, investing through a company would save you a whopping $8500 of tax every year.

The wrap

Using different tax entities has the potential to create significant tax savings, increase your after-tax investment return and give you more money that you can reinvest to get ahead faster.

But there are a number of different options, each with their own advantages and downsides. The rules are complicated and can be confusing, and if you’re going down this path and you don’t get things right from the start, it will be expensive to change things down the line.

If you’re considering using different tax structures to invest, you should only ever do this with the support of some good professionals in your corner.

The tax savings on offer mean that good help will easily pay for itself, often many times over, so don’t go down this path alone.

Disclaimer: The information contained in this article is general in nature and does

not take into account your personal objectives, financial situation or needs.

Therefore, you should consider whether the information is appropriate to your

circumstances before acting on it, and where appropriate, seek professional advice

from a finance professional.

Ben Nash is a finance expert commentator, podcaster, financial adviser and founder of Pivot Wealth, and the author of soon-to-be-released Virgin Millionaire. He runs regular free online money education event which you can book here

More Coverage

Originally published as Financial experts reveals how to save $8500 a year in tax