Banks feature in the average Australian’s ‘perfect main street’ despite mass closures

Academics have figured out what makes Australia’s ‘ideal main street’, but one thing Aussies say is essential is rapidly vanishing from towns nationwide.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

Academics have formulated what makes Australia’s “ideal main street”, but one establishment Aussies say is essential is currently vanishing from towns nationwide.

A recent study by academics from the University of Tasmania canvassed the wants and needs of 655 shoppers from across the country, asking them to rank 45 different stores and services in importance for their ideal main street.

The results showed that pharmacies held the top spot in shoppers’ preferences, consistently ranking as themost crucial element regardless of demographics.

Additionally, four types of stores and services – the post office, bank, department store, and newsagent – made it into the top ten despite being on the decline in main streets across the nation.

Little over a fortnight ago, it was revealed a significant number of bank branches have vanished in the last year.

The Australian Prudential Regulation Authority (APRA) found over a 12-month period ending in June this year, 424 Australian bank branches or 11 per cent of the nation’s overall branches, have disappeared.

It also found that 122 of these branches were situated in regional and remote areas, exacerbating those communities’ banking access issues.

The data collected by APRA also highlighted a rapidly declining trend in the number of ATMs available to the public.

The past year witnessed an 11 per cent reduction in ATMs, with more than 700 cash machines removed.

Since 2017, Australia has seen a staggering 60 per cent decrease in operational ATMs, leaving fewer than 6000 cash machines across the country.

“This continues a trend that has seen branch numbers decline by 34 per cent in regional and remote areas, and 37 per cent overall, since the end of June 2017,” stated APRA.

Author of the study, Dr Louise Grimmer, a retail scholar at UTAS, told news.com.au the findings revealed a “detachment” of Australia’s big banks and the wishes of their customers.

“Despite the excuses being made by banks for why they are closing branches and forcing customers online or to use automatic teller machines, many, many people don’t want this,” she said.

“They want the human connection from being able to speak with a bank teller and receive assistance with their financial matters.

“Similarly, many people won’t or can’t use net banking or teller machines (and) many older Australians find this a real challenge.

“For those who live in country towns or regional areas, the loss of a bank leaves a huge hole in their community.

“It really is time banks balanced their focus on their shareholders with the needs and wants of their customers, but with the huge profits we continue to see this is clearly not the direction the banks are taking.”

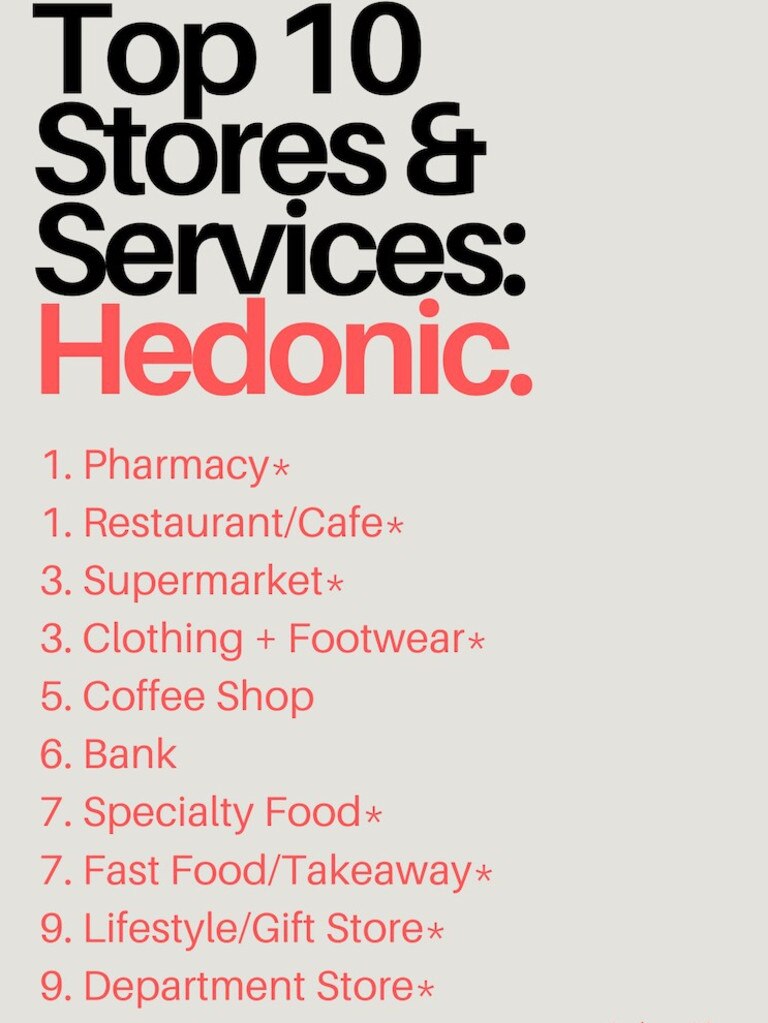

The research also explored the shopping motivations of respondents, dividing them into two categories: “hedonic” and “utilitarian” shoppers.

While their top 10 stores and services lists varied significantly, both hedonic and utilitarian shoppers rated pharmacies as number one and featured banks.

Beyond stores and services, the survey also evaluated the importance of various elements of the main streets.

“Cleanliness” emerged as the top priority, followed closely by “safety and security” and “parking.”

And despite UTAS’ study showing the majority of Australians prefer to have banks present in their ideal main streets, in the cloud of the current senate inquiry, leaders of Australia’s “Big 4” banks have all recently expressed a different perspective, citing changing consumer trends and the increasing reliance on digital banking.

During a recent appearance before the Senate Inquiry, NAB Group CEO Ross McEwan defended the bank branch closures, emphasising that these decisions are made after carefully evaluating customer behaviour, the availability of alternative banking options, and the bank’s ability to attract skilled bankers.

He stated: “The decision to close a branch is done with careful consideration.”

Matt Comyn, CEO of Commonwealth Bank, highlighted the significant role of mobile banking apps in meeting customer needs, with over 8 million users logging in an average of 39 times per month.

“It’s clearly one of the most important features that customers use,” he asserted.

Peter King, CEO of Westpac, underlined the digital shift in banking, noting that 96 per cent of Westpac customer transactions are now digital.

He claimed customers who exclusively use branches make up just three per cent of their 13 million customer base.

Shayne Elliott, CEO of ANZ, acknowledged the importance of digital channels for banking, particularly among customers over 65, but also stressed the continuing significance of physical branches for some customers.

While public sentiment favours retaining bank branches, Australian Banking Association Chief Executive Anna Bligh argued that imposing mandates to keep regional branches operational could divert essential funds away from cybersecurity technology.

More Coverage

Originally published as Banks feature in the average Australian’s ‘perfect main street’ despite mass closures