ASIC investigates global crypto giant Binance and its billions

Australia’s corporate cop is investigating the world’s biggest cryptocurrency exchange. See what it means for its customers.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

Australia’s corporate cop is investigating the world’s biggest cryptocurrency exchange and its customers for suspected breaches of financial services laws.

The Australian Securities and Investments Commission has been using its special investigative powers to force Binance to hand over details of customers the regulator is investigating.

It is also investigating Binance itself after questioning whether the company is fit to hold a financial services licence.

Binance held a licence from January 2022 until April 6 this year, when it handed it in rather than face the prospect of ASIC revoking it.

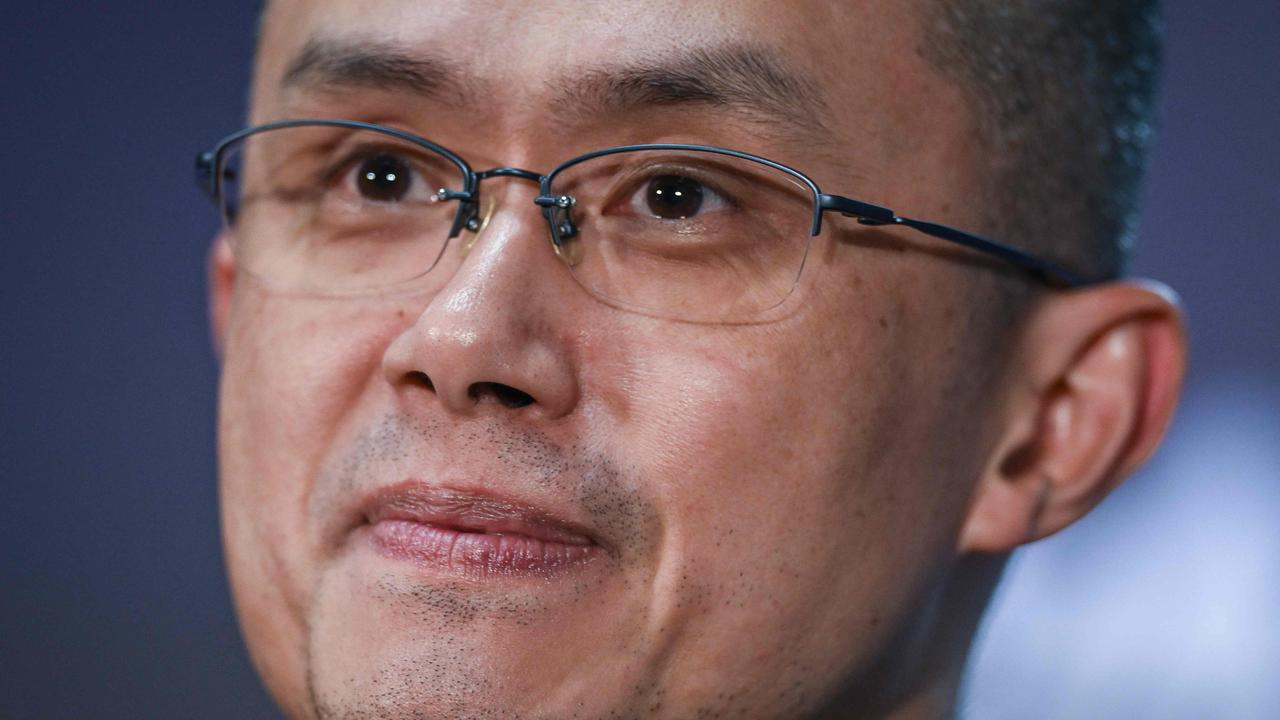

Overseas regulators are also investigating Binance, which is worth billions of dollars and has at least 280,000 Australian customers, with the powerful US Securities and Exchange Commission this week launching legal action against the company and its jetsetting chief executive, Changpeng Zhao.

In court documents, the SEC accuses Binance and Mr Zhao of breaking securities laws and allowing a company owned by Mr Zhao to engage in wash trading, a form of market manipulation in which companies effectively sell to themselves.

The US Commodity Futures Trading Commission has also taken action against Binance in the courts, accusing it of helping customers evade anti-money laundering rules in a March lawsuit.

Binance denies both sets of allegations.

In Australia, ASIC has issued a dozen formal notices to Binance since April 29, 2021, demanding the company co-operate with its investigations. It is believed these demands largely relate to the affairs of Binance customers.

Failure to comply with ASIC’s demands can be a criminal offence punishable by up to two years in jail. There is no suggestion Binance has failed to comply.

Binance’s woes have also thrust into the spotlight events at Byron Bay-based fintech Zepto, which until recently provided Binance with its access to the Australian banking system.

Banking is becoming harder for crypto exchanges in Australia, with the Commonwealth Bank this week restricting transfers to them.

The move came after pressure from big bank Westpac saw Zepto cut Binance off from its main access to the Australian banking system, PayID, last week.

Westpac, which was concerned with a large amount of fraud-related transfers involving the Binance platform, believed to total more than $2m a month, has also banned customer transactions with the exchange and another big operator, crypto.com.

A Zepto spokesperson said the company was told to “offboard” Binance by its banking partner, Cuscal.

“We are not aware of any investigation into Zepto,” the spokesperson said.

The move leaves credit cards Visa and MasterCard as the only way Australian clients can directly transfer money into their Binance accounts.

After a Freedom of Information request ASIC has provided News Corp with a list of demand letters it has sent to Binance, but refused access to the documents themselves.

ASIC has sent Binance 10 demands for documents, including in a nine-page letter sent just last month.

It has also twice demanded “reasonable assistance” from Binance – a power it can invoke only after beginning a formal, full-scale investigation.

“Examples of reasonable assistance include requiring you to sign a power of attorney, provide passwords for access to computer files, or provide a key to a locked safe,” ASIC says in a guide published on its website.

In addition, ASIC twice demanded information related to whether Binance or its executives are fit and proper people to hold a financial services licence.

At the time Binance surrendered its licence, ASIC said it was conducting a “targeted review” of whether the group had correctly classified customers as wholesale, a category that means they receive fewer legal protections than retail customers.

“These notices are an important method used as part of ASIC’s compulsory information-gathering powers to find out whether or not there is evidence that a contravention of the financial services laws has occurred,” an ASIC lawyer said in a letter to News Corp on Monday.

In an earlier letter, the same lawyer said: “ASIC has engaged in various ways with Binance as part of enquiries where Binance is not the subject of ASIC’s interest or investigation (for example, where a person of interest holds an account with Binance).”

An ASIC spokesman said: “ASIC does not generally confirm or deny whether it is undertaking any investigation, much less provide comment on one.”

A Binance spokesperson did not respond to questions about ASIC’s investigation.

Originally published as ASIC investigates global crypto giant Binance and its billions